Swiss SNB Review: Preserving Ammunition

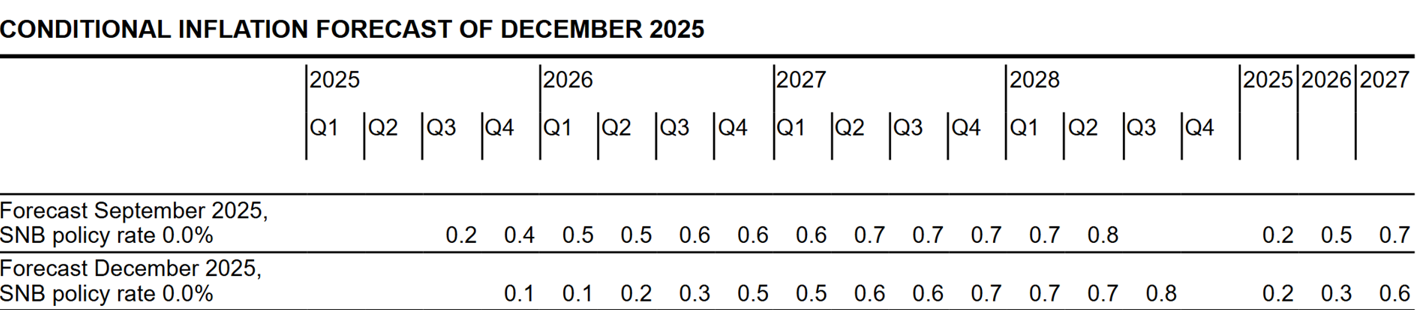

Although the tone of the economic outlook was a little perkier, the latest SNB analysis saw no real change. Policy was unchanged, as widely expected, with little shift in the forecast fir either growth or inflation. Overall it sees medium-term inflation at 0.6% (Figure 1), this despite a gloomy 2026 activity picture with projected GDP growth of around 1% masking the fact that the underlying picture is more sobering given the circa-0.25 ppt boost sports events will provide next year. But with inflation forecast to be within the confines of its target range of less than 2%, this was and will be enough to justify stable policy. We still see policy remaining on hold until at least mid-2027, with only a slight possibility of a return to sub-zero rates given the high(er) bar seen by the SNB for this to occur.

Figure 1: SNB Inflation Outlook Little Changed

Source: SNB

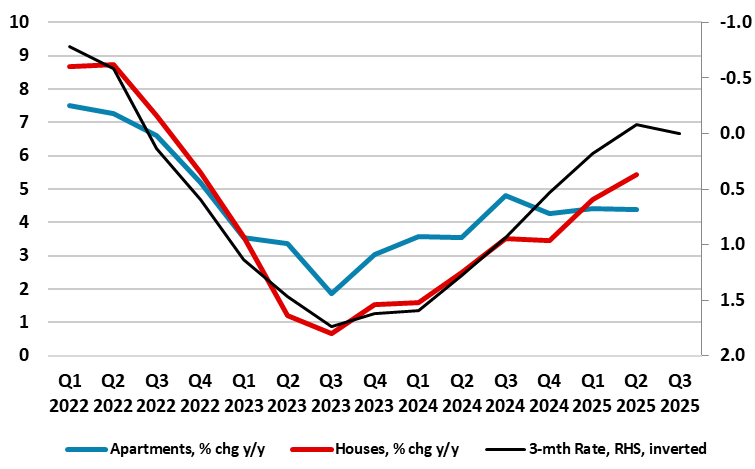

However, in the Q&A, explicit was a retained not so much an easing bias but an acknowledgement that the policy rate could go negative again, but with it likely that a high, if not higher, bar exists in which to make this occur. Indeed, although not formally mentioned in the press conference, financial stability issues may have featured more in the Board’s discussions as the summary of this month’s discussion (due Jan 8) may subsequently highlight. Notably real estate prices are very much on a recovery track, if not clearly rising, all very much correlated with the low SNB policy rate (Figure 2).

Notably, with the U.S. threat of 39% tariffs have been pared back to the 15% most other countries, this has made the SNB a little more upbeat, this largely including pharmaceuticals which account for 40% of exports. Admittedly, probably related to tariff uncertainty, Swiss GDP contracted by a surprise 0.5% q/q in Q3 but this does not seem to have alarmed the SNB and, indeed, the official forecast is little changed for this year seeing growth just under 1.5%. But it will be weaker in 2026 albeit where overall GDP growth of around 1%, meaning that sports adjusted GDP growth next year may be below 1% and thus some 0.5 ppt below potential. However, this unchanged growth outlook explains why the inflation outlook was not being altered materially, even with recent undershoots of expectation and which show clearer signs of domestic price pressures receding.

The strong Franc, more recently against the USD, is also unlikely to have had any policy impact. While still pointing to possible FX intervention and a continued willingness to adjust policy accordingly, the SNB was keen to suggest its currency aspirations and actions are not designed to boost Swiss competitiveness. But this seems more talk than action as any overt attempt to weaken the current via intervention or lower/negative rates may be shunned by the SNB for fear it would court U.S criticism and possibly fresh retaliation.

Figure 2: Property Price Recovery Linked to SNB Easing?

Source: SNB

I,Andrew Wroblewski, the Senior Economist Western Europe declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.