Norges Bank Review: Still Far Too Cautious Despite Clear Output Gap

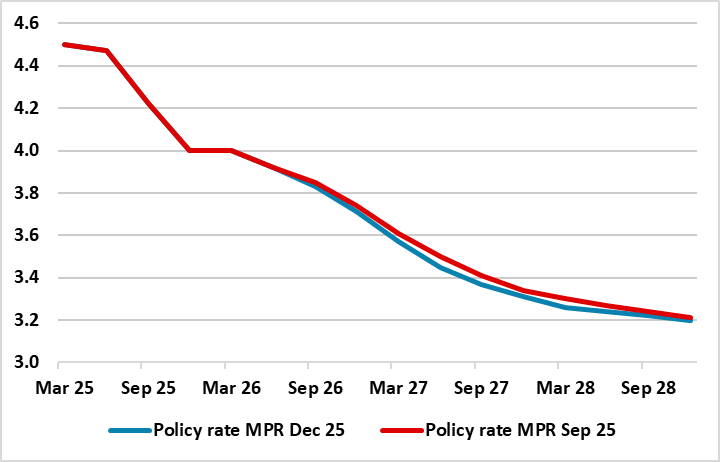

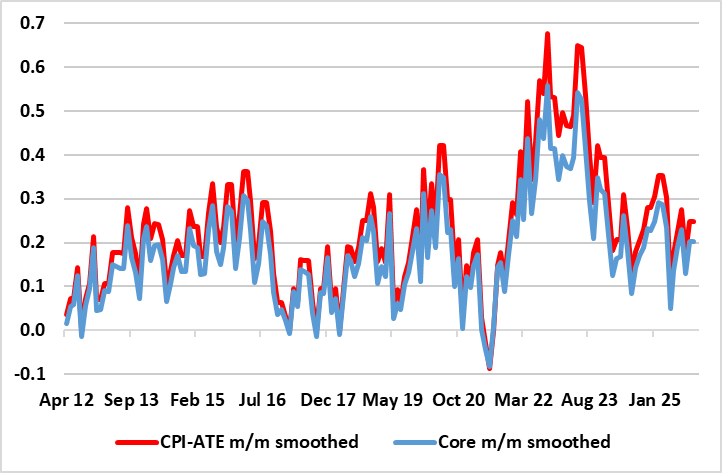

As expected, no change in policy and little shift in rhetoric and/or outlook was the message from the Norges Bank’s latest verdict. After two 25 bp cuts this year (to 4.0%), this month saw a second successive unchanged verdict with the policy outlook also retained (Figure 1). This was consistent with the Board’s repeated assertion that ‘the policy rate will be reduced further in the course of the coming year’. This December meeting came with both new forecasts and data, not least inflation and lending numbers, the latter possibly becoming a worry given the fresh slowing in corporate credit growth and weaker GDP backdrop. But with underlying inflation dynamics being friendly (Figure 2), we still think that the Norges Bank is being far too cautious as it plans to keep policy very restrictive through the projected timeframe out to 2028; we wonder why the Board therefore only sees inflation a little higher and only just approaching the 2% target by the end of that period.

Figure 1: Norges Bank Policy Outlook

Source: Norges Bank Monetary Policy Report

Excessive inflation worries continue to dominate Norges Bank thinking. It sees 1-2 rate cuts next year and a further reduction to somewhat above 3% towards the end of 2028. Given this intransigence, we are a little less confident about the extent of easing into 2026 but envisage further 25 bp cuts every quarter through next year and then similarly into H1 2027. At 2.5%, that would still leave the policy rate still within the neutral rate range estimated by the Norges Bank. In other words, the Norges Bank will be merely taking its foot of the brake, rather than pressing on the accelerator. As for the inflation worries, running at a circa-3% rate, thereby still a full ppt above target, targeted (CPI-ATE) inflation is being boosted by stubborn services inflation. But this is largely offset by softer goods and imported inflation. Regardless, taking food out of the CPI-ATE, thus mirroring the core rate measure used by other central banks (ie ex food and energy), actually shows inflation running just above the 2% target (Figure 2).

This being similar to the core inflation backdrop seen in EZ, where the ECB has responded with 200 bp of rate cuts, this surely in an indictment of the Norges Bank’s excessive caution and focus on the exchange rate despite the latter lack of correlation with imported inflation. But real economy issues are also adding to the arguments for rate cutting. GDP hardly rose in Q3, this undershooting Board expectations and where m/m falls in the last two months of Q3 hardly provide much momentum for the current quarter, let alone the Board’s 0.4% q/q projection. This is occurring as company credit growth is slowing, actually falling in apparent real terms and where the Norges Bank’s recent bank lending survey noted that banks report a slight decline in non-financial corporate credit demand in the last quarter.

Figure 2: CPI Dynamics More Friendly in Adjusted and Ex Food Perspective

Source: Stats Norway, CE, smoothed is 3 mth mov avg, core = CPI-ATE ex food

Reflecting these factors, the Board pared back its recently upgraded 2.0% 2025 GDP projection and now sees circa 1.5 growth out to 2028. In fact, we would contend that an emerging and earlier output gap is partly responsible for the fall in inflation seen of late – admittedly unwinding the overshoot of the early part of 2025. Why, against a backdrop of excess supply, a restrictive policy stance and where current inflation dynamics are far friendlier than the Board cares to acknowledges, it sees targeted inflation staying above target (and a little more so) is a continued puzzle to us.

I,Andrew Wroblewski, the Senior Economist Western Europe declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.