Japan Outlook: Putting One Foot in Front

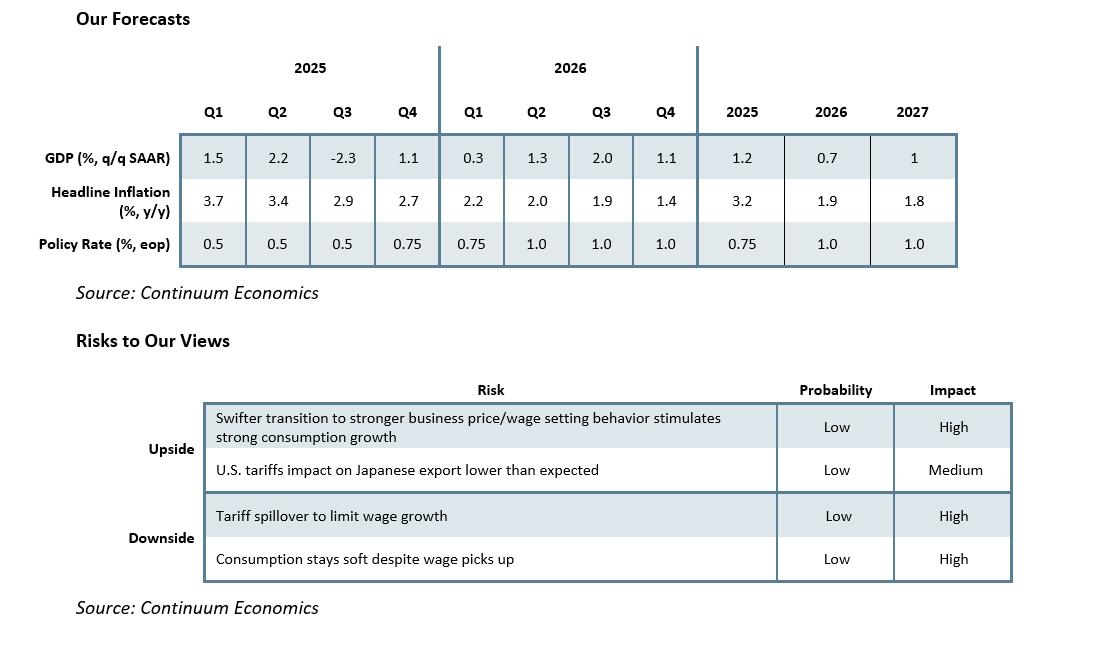

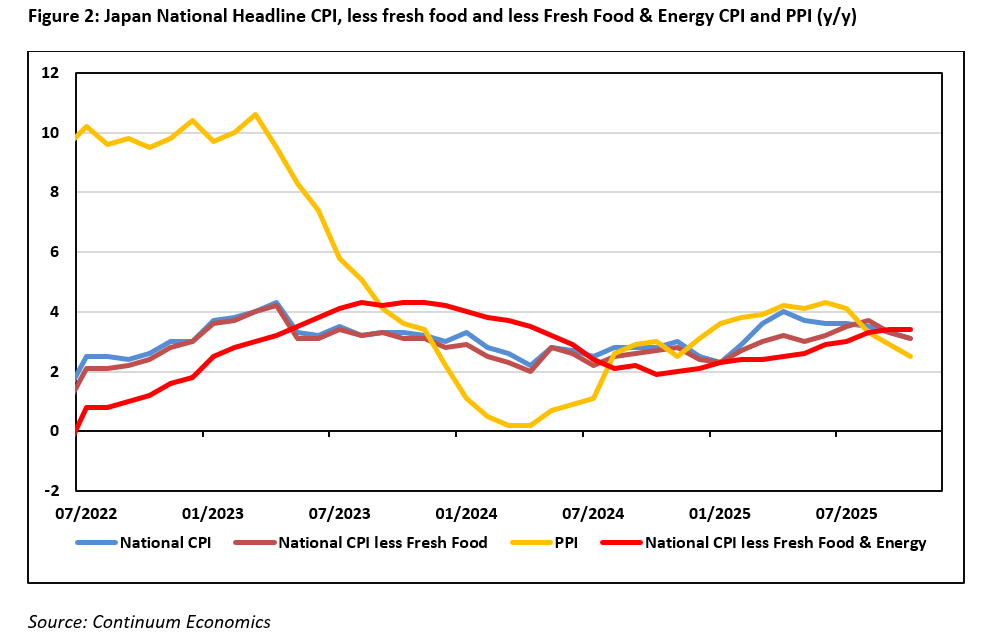

· Private consumption growth is hindered by negative real wage in Q3 2025 yet Japan continues to demonstrate the structural change in both higher business price/wage setting and consumer behavior. Early signs for 2026 spring wage negotiation are upbeat and should see wage growth at similar magnitude. We continue to see 2025 GDP at +1.2% and 2026 GDP at +0.7%. We expect 2025 CPI to be 3.2%, 2026 at 1.9% and 2027 at 1.8%, which indicates the sustainable inflation target is going to be roughly reached.

· PM Takaichi has introduced a JPY21.3 trillion stimulus package, targeting living cost relief and strategic investment. Energy rebates will be introduced in Q1 2026 while other cost relief measures are to be dispersed throughout the next fiscal year. The Japanese government is also establishing a 10yr fund for shipbuilding and other critical areas like A.I. & chips. This should help growth in 2026 and into 2027, where we look for 1.0% GDP growth.

· The BoJ has hiked by 25bps in the December meeting. The current inflationary picture should support the BoJ to hike rates to 1% in H1 2026, but we then see the BOJ going on hold. BOJ QT will likely cause 10yr yields to spike and cause the BOJ to partially reverse QT by increasing rather than reducing bond auction size.

Forecast changes: 2025 CPI forecast has been revised higher to 3.2% from +3%, so is 2026 CPI to +1.9% from +1.8%.

Macroeconomic and Policy Dynamics

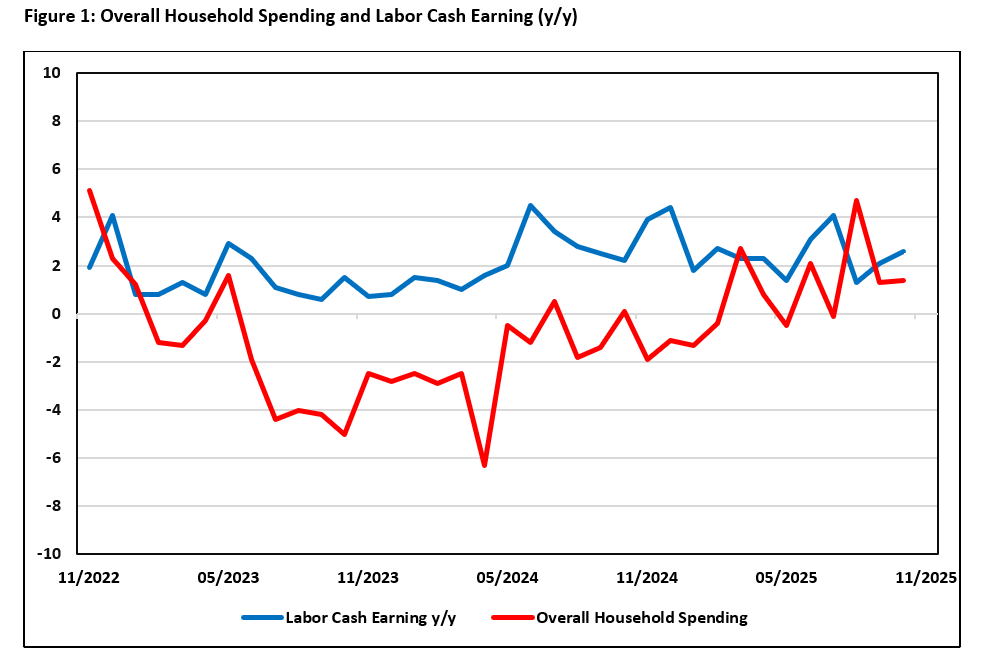

As per our September outlook, the choppy real wage situation has taken its toll in consumption growth. Fortunately, enough momentum has been built in the higher business price/wage setting behavior that allows the steady evolvement of consumer behavior. Real wage should improve in 2026 after the initial shock of U.S. trade tariff, along with optimistic early signs of the coming spring wage negotiation and thus support private consumption growth.

Meanwhile, PM Takaichi’s JPY21.3 trillion stimulus plan is targeting short term cost relief and long term strategic investment. One time measures included energy subsidies (JPY7,000 per household and no tax for gasoline), parental cash handout (JPY20,000 per child) and rice coupons (JPY3,000 per person). It also includes a ten year strategic investment in fields of A.I. and chips to increase Japan’s competitiveness in the area.

The new government under PM Takaichi is pro-spending and have seen Ishiba era budget cut shelved. The stimulus package is larger than previous year but not on the same level of COVID-era stimulus. It does not only show Takaichi to an extent is showing fiscal discipline, but also the transition in business wage/price setting behavior has gained traction and does not require Abe era massive stimulus. With Takaichi repetitively suggest her pro-spending stance comes with restrain to secure market participants’ confidence, it is likely we will see around 0.9% increase in government spending.

The U.S. tariffs have negatively affected the Japanese trade balance. However, the impact was partially cushioned by increasing export to Asia (+9.2% in October) and EU (+5.8% in October). Japanese exports are still benefitting from the weak JPY and could remain attractive unless there is a sharp turn in JPY. The net export will moderate in 2026/27 with domestic demand driving import higher.

Our forecast for 2025 GDP is unchanged at +1.2% as the transition in business price/wage setting continues and consumer adapts to higher prices. We see 2026 GDP at +0.7% on balanced economic growth with competiting forces from adverse U.S. tariff and Japan stimulus boost. Private consumption is expected to grow at a modest pace, driven by improving real wage and adaptive consumer behavior. Headline labor cash earning has risen above 2% in September (2.1%) and October (2.6%) after a surprising dip in August. So far in 2025, the average labor cash earning is +2.3% y/y, a number that in BoJ’s eyes sufficient to drive inflation sustainably towards target rate. Early voices from unions are calling for 5% wage hike in 2026 and the market seems to be optimistic of the potential outcome.

Even National CPI y/y retreated from the high print in early 2025, all three items of National CPI remain at or above 3% in October 2025. The price of food, especially rice, has stabilized yet still contributing to inflationary pressure. More importantly, less fresh food & energy CPI has shown underlying inflation being persistent. We have revised 2025 CPI higher to 3.2% from +3% and 2026 CPI to +1.9% from +1.8%, supported by stronger average household spending (1.5% y/y) in the first three quarters of 2025 and latest round of stimulus. Household spending maybe choppy on a month-to-month basis but in a medium run we are forecasting solid growth from more positive real wage (as CPI inflation slows in 2026 and nominal wages remain elevated compared to pre COVID times).

Growth in 2027 is forecasted to be roughly at a similar pace of 2026. We expect GDP growth to be at +1% with private consumption remain the corner stone of Japanese economy. The BoJ feel sustainable inflation target will be achieved by year end 2026 and we are holding a similar view. The continual transition in business price/wage setting behavior should see 2027 CPI to be +1.8%.

Policy Outlook

The BoJ’s rhetoric on more tightening if economic forecast align with a 2% sustained inflation trajectory has not changed. With a supportive inflationary picture, we see the BoJ to further hike rates by 25bps to 1% in H1 2026. Political headwinds, will only stall, but are unlikely to force the BoJ to go on hold as long as wage/inflation figure aligns with their forecast. For the BoJ to move further from 1%, we will need to see swift adaption of higher price/wage from both Japanese consumers and SMEs owners, which is not in our central forecast’s scenario.

The BoJ has kept their eyes on the bond market’s yield curve dynamics and could see their original plan to further reduce bond purchase after April 2026 derailed on rising yields. JGB yields have been on a one way traffic since PM Takaichi took place, citing fiscal concern. The BoJ will mostly allow yields to gradually grind higher yet intervention risk cannot be ruled out if yields shooting too high and too fast (10yr JGB yields to 2.5%). Monthly BOJ bond purchases are also set to scale down to Yen2.1trn by Q1 2027 that means heavy QT with maturing bonds and pushed yields higher -- QT will be nearly 6% of GDP in 2026 (here). This could cause the BOJ to slow the QT ramp up still further and likely see a partial U turn to higher monthly bond purchases! The BOJ could also be cautious about policy rate hikes in H2 2026 and 2027. Our forecast is for no change in the BOJ policy rate in 2027.