Fed: Slower 2026 Easing

Powell in the press conference made clear that the Fed is now in a wait and see mood, with policy rates entering a broad measure of neutral policy rates. This means further weakening in labor demand and then consumption would be required to prompt an early 2026 cut. We are less upbeat than the Fed on 2026 GDP growth and we see two 25bps cuts in 2026 (June and September preferred), rather than the dot plot one 25bps cut. After that policy rates will be at 3.00-3.25% and we see the Fed going on hold and then throughout 2027.

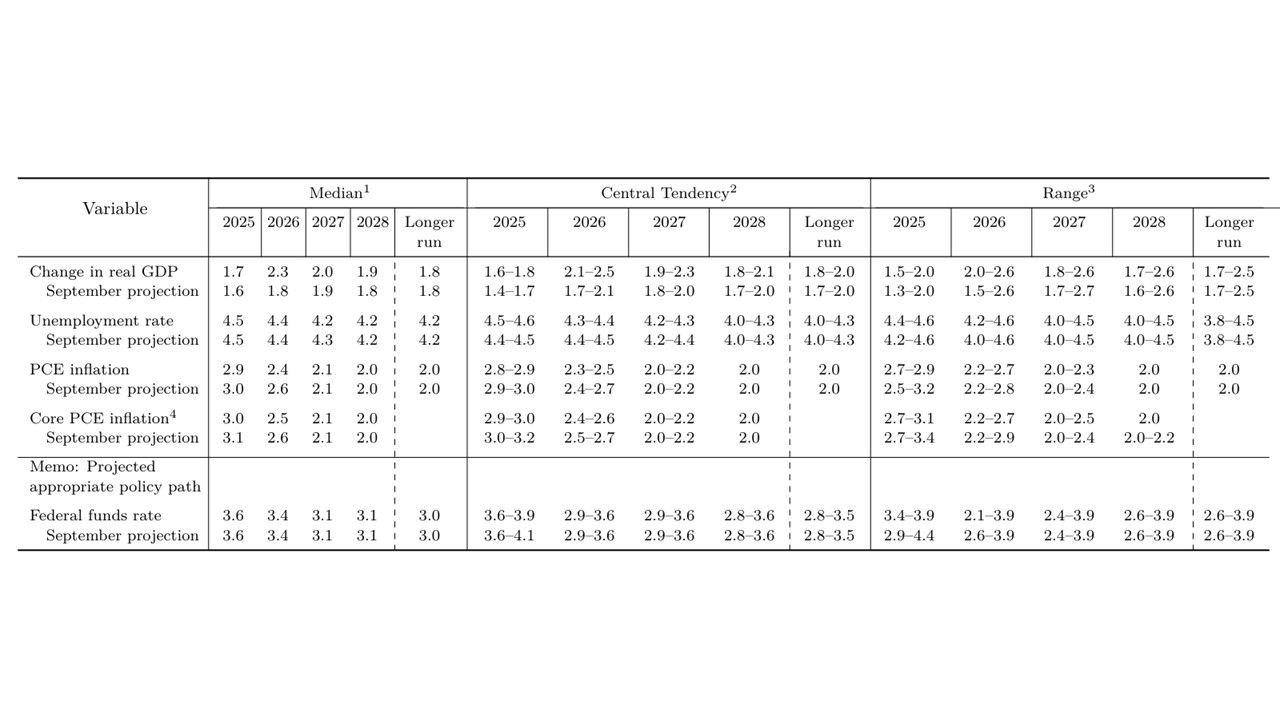

Figure 1: Fed December Summary of Economic Projections (SEP)

Source: Fed (December SEP)

The December FOMC statement and Fed Chair Powell Q/A provide a number of clues on prospective policy. Key points include

· Inflation and growth uncertainties. The medians for 2026 changed with GDP now at 2.3% versus 1.8% in September and PCE and core PCE inflation lower – the latter at 2.5% versus 2.6% previously (Figure 1). The GDP revision is surprisingly strong and Powell acknowledged that in part could reflect the AI Capex investment that is expected to be strong still in 2026 (though he noted that 0.2% was also due to the shutdown shifting activity from 2025). Otherwise the FOMC statement did not really change with the Fed watchful on both employment and inflation. During the Q/A Fed chair Powell noted that consumption is solid alongside investment, but that layoffs and hiring remains low in the labor market. Powell also noted a good part of the slowing likely reflects lower immigration and other supply factors, but that labor demand has also softened (Powell noted that AI could be having a slight impact). Powell also noted that NFP is overestimating current employment trends and that they will be revised lower during 2026.

· Rates guidance. The three way split in FOMC voting was widely expected, with the majority going for a 25bps cut; maverick Miran for a 50bps cut and Goolsbee and Schmid for no change. The December DOT median is for one 25bps cut in 2026 and 2027. However, though the median is for one 25bps cut in 2026, this is all 19 FOMC members rather than the voters. Could it be skewed upwards on the margin by district presidents? We would say yes, as 6 of the 19 FOMC had no cut in the Fed Funds rate today meaning 4 non-voting members did not want a December rate cut. Also only 4 Fed district boards asked for a cut in the discount rate as well. Powell in the Q/A provided better guidance, noting three times at the start of press conference that the Fed Funds rate is now within a broad range of neutral after 75bps of cuts since September. Additionally, he noted at one stage that the Fed was now in a wait and see approach, but the FOMC statement and Powell still left the door open depending on the data. Powell did caution that CPI and the household employment data could be distorted for October and November, which argues for a hold in January. Meanwhile, Powell also clarified that the decline in reserve balance meant T bills would be purchased for technical reasons to keep the Fed Funds rate controlled and initially starting at a USD40bln pm pace.

· Trump administration changes. President Trump has been guiding that he will announce his appointment for the new Fed chair in early 2026, with the desire that they will immediately get on with cutting interest rates after May. Kevin Hassett is widely expected to be the candidate and should get through the Senate confirmation. He certainly sounds like an uber dove already that would tolerate circa 2.5% inflation if is needed to achieve higher growth beyond 2% trend growth. The problem is that Hassett could be like Miran, with radically different views on current, prospective and neutral policy rates from the rest of FOMC voters and thus a maverick. The December FOMC dot plot shows an outlier (likely to be Miran) forecasting Fed Funds at 2.1% end 2026 and neutral rates at 2.6% -- Miran could also be the outlier that forecast 2.5% long-term GDP growth! Though the Fed chair has more weight than Miran, split voting could easily become the norm and the new Fed chair communicating messages that are not representative of the FOMC consensus. This will likely make life more difficult. However, the Supreme Court are not expected to rule on the Cook case before end February 2026, which means the majority of the board of governors will likely want to confirm the 5 year appointment of the 13 district Fed presidents until Feb 2031. Though U.S. Treasury Secretary Bessant (here) is keen on district presidents having resided in the district for 3 years prior to appointment, this may be best practice going forward rather than retroactive to try to appoint Trump supporting district Fed presidents in 2026. Overall, we see the Trump administration making the Fed slightly more dovish, but not radically changing policy rates against a backdrop of a soft landing or the FOMC dot consensus of neutral rates around 3.0%.

· 2026 and 2027 rate prospects. Our view remains that the Fed will now go on hold and wait for the data. Fiscal policy easing will kick in with Q1, with income tax rebates and the Fed will want to see the impact. Additionally, the U.S. economy is not slowing down quickly enough to warrant concern of a hard landing. Powell did note that FOMC views were that inflation pick up would be temporary and that the Fed has difference of views between an extended pause and further cut or cuts in 2026. However, we are below the Fed consensus on 2026 GDP growth. Slower employment growth may not mean a higher unemployment rate with less immigration, but it is a headwind to total wage growth for the economy and hence consumption. We thus prefer two 25bps cuts in 2026 and have penciled in June and September. If any risks exist to this then it could be later, if the economy sees a soft landing. After 50bps on extra cumulative cuts, we then see the Fed going on hold throughout 2027.