U.S. Corporate Bonds Into 2026

· Though U.S. corporate bond spreads are tight, absolute yield levels are reasonable due to higher U.S. Treasury yields than most of the post GFC period. The main risk remains of a U.S. recession, though economic data is more consistent with a soft landing and we have reduced the probability of a U.S. recession to 20% in the next 12 months. 2nd tier tech companies with high loss rates (e.g. Open AI) could find they need yield premium at times or resort to private markets. This is more a company specify story, rather than even a sector or the market as a whole.

Figure 1: 10yr Investment Grade and High Yield Spread to Treasuries (%)

Source: Bloomberg/Continuum Economics.

U.S. investment grade and high yield spreads remain tight compared to the average of the last 15 years (Figure 1), which has raised some questions about the risk of wider bond spreads. Some focus has been on the surge in bond issuance from AI and Tech companies in recent months. However, most of the big tech companies have conservative balance sheets and are likely to meet most of their 2026 AI investment out of cash flow. Corporate bond market estimates are for net issuance of around USD100bln from tech companies in 2026. 2nd tier tech companies’ with high loss rates (e.g. Open AI) could find they need yield premium at times or resort to private markets. This is company specify story, rather than even a sector or the market as a whole. Overall, investment grade corporate bond spread could widen slight to modestly against the issuance backdrop, but this is not a big reset.

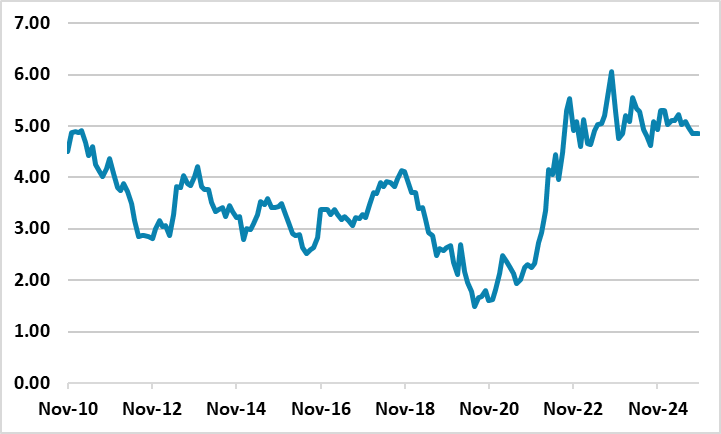

For corporate bond yields, the narrow spread for investment grade needs to be seen alongside absolute yields (Figure 2) that are reasonable compared to the last 15 years, due to higher Treasury yields than most of the post GFC period. Additionally, the broad corporate profit and financial outlook is reasonable, with the latest Fed financial stability review very comfortable with the corporate sector (here ch2).

Figure 2: Investment Grade Yield (%)

Source: Continuum Economics

A selloff in risk assets e.g. driven by U.S. equities could spillover into U.S. corporate bonds, but this should be regarded as a correction rather than anything worse. The main risk remains of a U.S. recession, which would cause a deterioration in corporate profitability and increase in default rate. The IMF GSFR is also concerned that the high yield bond market ownership is high among investment funds and exchange traded funds (Figure 3), which could amplify spread movements in the face of any major shock. However, recent economic data is consistent with a soft landing from the adverse effects of the U.S. tariff increases and we have reduced the probability of a U.S. recession to 20% in the next 12 months. IG corporate bonds are unlikely at this juncture to produce any major fireworks in 2026, though high yield are too tight if any further slowdown is seen short of a recession.

Figure 3: Ownership Shares of Open-Ended Investment Funds and Exchange-Traded Funds (%)

Source: IMF GFSR October 2025