Bessent: New Fed Inflation Range and Dropping Dots?

U.S. Treasury Secretary Bessent over the Christmas period suggested that the Fed should shift to targeting an inflation range and drop the quarterly dots. What impact would this have? Such a change would give the Fed more flexibility on the margin, but not significant. This could make communications less clear, but would likely not change voting. With all the district Fed presidents having been reappointed December 11 until 2031 , it is now difficult for Trump’s new Fed chair to change voting substantively.

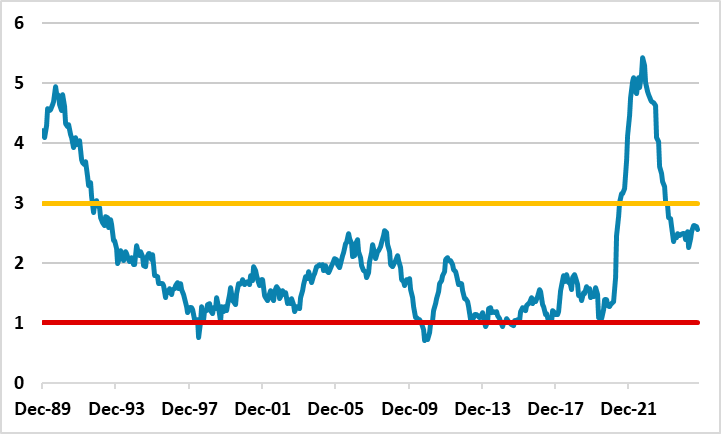

Figure 1: U.S. Core PCE Inflation and a 1-3% Range (%)

Source: Datastream/Continuum Economics

U.S. Treasury secretary reported suggestions (here) that the Fed should move to target an inflation range rather than a pin point 2% and also drop the quarterly dots. What impact would this have if actually implemented?

• Range inflation objective. The idea of an inflation range is followed by some other central banks. For example, the BOE has a range of 1-3%, but this supplements its central 2% inflation objective. If the Fed adopted a range then it would probably still have a central 2% core PCE objective. The key benefit of an inflation range is to soften policy action, if only a modest deviation is seen away from the inflation target and potentially put more weight on employment. However, most central banks that have an inflation range also follow a forward looking inflation target, rather than current inflation. This is supplemented by a central bank monetary policy report that includes inflation projections, where forecast accuracy has varied across central banks. It is unlikely that Bessent is thinking about a forward looking inflation target, as this adds extra complexity. If the Fed has say a 1-3% range around a 2% core PCE inflation target, then it could allow some more flexibility on rate setting but this would likely only be marginal versus the current dots that suggest neutral policy rates will be reached by end 2026 (here).

• Scrapping the Dots. The idea of scrapping the dots is that it diminishes the voice of the FOMC relative to the incoming Fed chair and means that the new Fed chair has more weight in communications. However, this would mean that the market then has less broad guidance on overall FOMC thinking on economy, inflation and Fed Funds. The new dovish chair could communicate his view, which is out of step with the FOMC majority and then this led to disappoint as easing is not actually delivered at the pace or scale suggested by a new Fed chair. December 11 saw an announcement that all district Fed presidents will be reappointed in Feb 2026 for 5 years, which means that the bulk of the FOMC voters will likely follow objective economics rather than Trump’s desires. District Fed presidents and Fed governors could also cause extra uncertainty in the market through speeches that differ from the Fedspeak by the new Fed chair! This could create extra uncertainty that could led to a steep U.S. Treasury curve.

• Scrapping neutral policy rate estimates. If the Fed scrap the dots then it could also mean that the quarterly estimate of long-term neutral rate disappear. Hassett or Warsh could then argue that the neutral policy rate should be 2.0-2.5% due to the AI boom boosting productivity and subduing inflation. The problem is that Hassett/Warsh could be like Miran, with radically different views on neutral policy rates from the rest of FOMC voters and thus a maverick. Split voting could easily become the norm and the new Fed chair communicating messages that are not representative of the FOMC consensus and increasing uncertainty and confusion.