New Dovish Fed Chair and U.S. Yield Curve

· The initial knee jerk reaction if NEC Hassett is nominated as Fed chair would be for further yield curve steepening in the 10-2yr area. Even so, the dynamics of FOMC voting could mean that Hassett as Fed chair in itself does not deliver more Fed easing. This is already evident with Miran who has taken an uber dovish view, but has not convinced other FOMC members to follow. If the district Fed presidents are reappointed in Feb 2026, then the majority of the Fed will likely remain objectively focus on the economics in their decisions.

Reports suggest that NEC Hassett is the front runner to be nominated as Fed chair. What would be the U.S. Treasury market reaction?

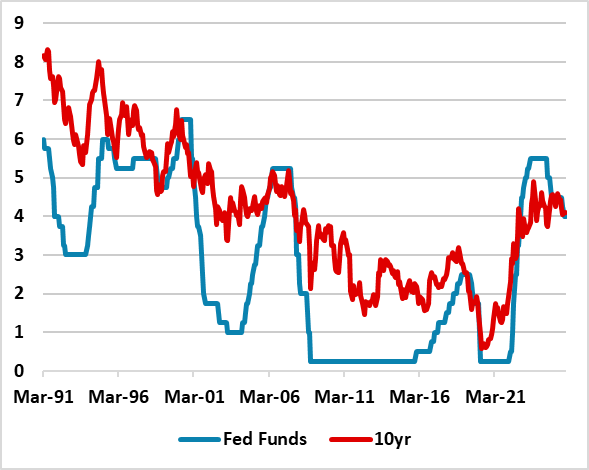

Figure 1: 10-2yr Yield and Inverted Fed Funds Rate (%)

Source: Datastream/Continuum Economics.

Reports over the weekend suggest that the Trump administration is trying to name the new Fed chair before Christmas to start in May 2026. The reported shortlist includes current Fed Governors Waller and Bowman; NEC Director Hassett; former Fed Governor Warsh and BlackRock CEO Rieder (here). Bloomberg reported that Hassett was viewed as the front-runner by the White House. Most of the other candidates ex Rieder and Hassett are seen to be conventional in nature and would not materially impact expectations of Fed policy. However, Hassett is seen to be dovish on rates and seen to a close ally of President Trump. What would be the U.S. Treasury market reaction if he is nominated?

The initial knee jerk reaction would be for further yield curve steepening in the 10-2yr area on the basis that such a Fed chair could deliver rate cuts somewhat faster and also potentially below the FOMC median neutral rate of 3.00-3.25%. It is worth noting that the 10-2yr U.S. Treasury curve is not particularly steep by historical trends or if the Fed Funds were to go below 3% (Figure 1).

Even so, the dynamics of FOMC voting could mean that Hassett as Fed chair in itself does not deliver more Fed easing. This is already evident with Miran who has taken an uber dovish view, but has not convinced other FOMC members to follow. Certainly Waller and Bowman has been more proactive in recent months in arguing for easing, but this is measured (e.g. 25bps); based on reasonable uncertainty about the labor market and does not appear to have seen them lower their neutral rate estimates (looking at the September dot plot). Additionally, the NY Fed president and four rotating district presidents, plus remaining traditional three Fed governors, could out vote a new Fed chair, Miran, Bowman and Waller! One option for the Trump administration is to push the Fed governors to block reappointment in February 2026 for all the Fed district presidents, but Trump is unlikely to have a majority on Fed governors to be able to do this. The next chance would be February 2031.

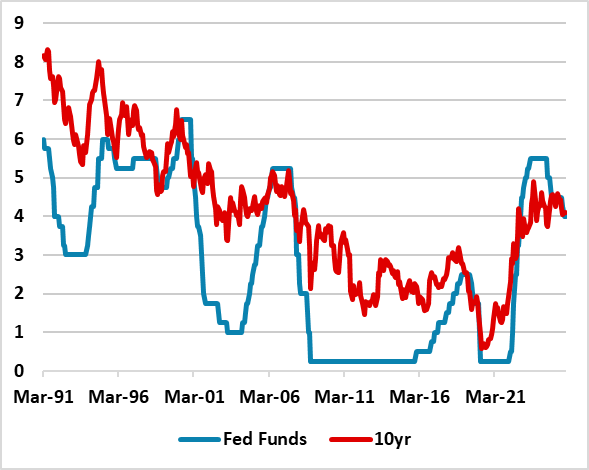

Our baseline remains that some further yield curve steepening would be the initial reaction if Hassett were nominated as Fed chair, but the lasting reaction could be modest as Fed action would be out of line with the new Fed chair’s views and communications. Though volatile communications could also steepen the 10-2yr yield curve, we would avoid forecasting higher 10yr yields. 10yr real yields are fair value at 2%. Additionally, it is not clear that more Fed easing if it were delivered would actually mean higher 10yr yields. Though it would mean more 10-2yr yield curve steepening, 10yr yields can be dragged lower by an outsized decline in the Fed Funds rate (Figure 2).

The biggest swing factor for Fed policy actually remains soft versus hard landing for the economy. Our baseline is soft landing and easing to 3.00-3.25% Fed Funds in 2026, but a hard landing would likely see the Fed easing to 2.0-2.5% Fed Funds rate. We attach a 20% probability to this alternative scenario of a hard landing.

Figure 2: 10yr Treasury yield and Fed Funds (%)

Source: Datastream/Continuum Economics.