U.S. Outlook: Consumers Vulnerable, but Recession Unlikely

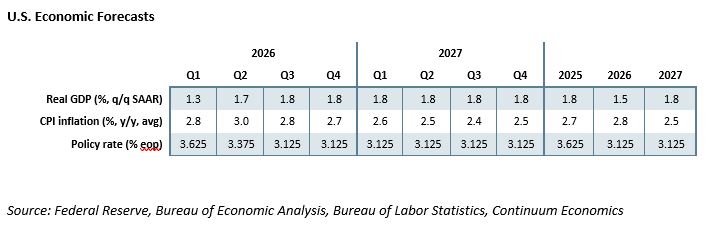

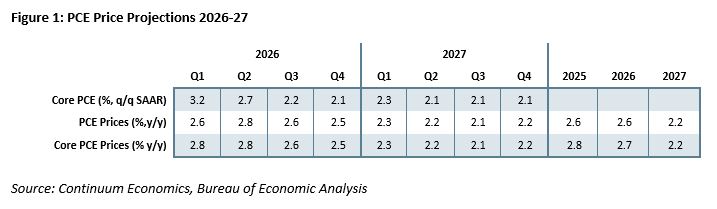

• US GDP growth is likely to look solid in Q3 2025 supported by resilient consumer spending, but with slowing employment growth and resilient inflation weighing on real disposable income that will be difficult to sustain. However, while consumers look vulnerable, business investment looks healthy led by AI, the housing market appears to responding to Fed easing, and inventories, inflated ahead of the tariffs, are now acceptably lean. While growth will look subdued entering 2026, we expect inflation to fall in the second half of 2026 as the lift from tariffs fades, and growth to settle near potential at 1.8% in the second half of 2026 and through 2027. We however expect inflation to stabilize marginally above the Fed’s 2.0% target, with core PCE prices ending 2027 at 2.2%, with CPI at 2.5%. In 2026 we expect GDP to average 1.5% and core PCE prices to average 2.7%.

• Even with subdued growth, resilient inflation is likely to see the FOMC pausing in early 2026, though we expect 25bps easings in June and September to take the Fed Funds rate down to 3.0% to 3.25%, marginally above the 3.0% that the Fed currently sees as neutral. We expect rates to stabilize there through 2027. This would mean Fed policy marginally more dovish than would be appropriate given that we expect inflation to remain marginally above the Fed’s target, with Kevin Hassett the favorite to replace Jerome Powell as Chairman. He would take office in May 2026. Signs of slowing inflation are likely to emerge soon after.

Forecast changes: We now see 2025 GDP at 1.8% rather than the 1.7% we saw in September while we now expect a 1.5% rise in 2026 GDP rather than 1.4%. We have revised 2025 CPI down to 2.7% from 2.8% and 2026 CPI down to 2.8% from 3.0%. In September we expected core PCE prices to rise by 2.9% in both 2025 and 2026. We now expect a rise of 2.8% in 2025 and 2.7% in 2026 before a slowing to 2.2% in 2027. Our Fed Funds forecast for 25bps easings in Q2 and Q3 of 2026, taking the target range down to 3.0-3.25%, is unrevised.

Slowing Labor Market to Hit Consumers, but Investment Holding Up

The U.S. economic picture is less clear than it should be given the delay of releases due to the government shutdown, but a healthy Q3 2025 is expected to be confirmed (our forecast is 2.3% annualized) late in December but a subdued (we expect unchanged) Q4 is likely to follow. Part of the Q4 slowing will be due to the government shutdown, but we also believe that resilience in consumer spending in Q3 is unlikely to persist, given that it is running ahead of real disposable income, which is being restrained by twin headwinds of a slowing labor market and resilient inflation. While layoffs remain modest, employment growth is likely to remain weak well into 2026, restrained by both weakness in labor demand and supply. While some are looking for an acceleration in GDP growth in Q1 2026 given the end of the government shutdown, we expect that a loss of consumer momentum will keep growth subdued, though above the unchanged outcome we expect in Q4 2025.

With employment growth likely to remain moderate at best, for consumers to regain momentum needs inflation to fall to lift real disposable income growth. To date inflation has seen less of a boost than expected from the tariffs, but tariffs are being passed on only slowly. Recent years have tended to see above trend quarters from inflation in Q1 as new year pricing decisions are made, and this is likely to be the case in early 2026. Clear signs of a slowing in inflation may not appear until the second half of 2026, and even in 2027 we expect that progress will stall marginally above the Fed’s 2.0% target (Figure 1).

Outside of consumer spending the picture is more positive, making a move into recession looking a fairly low probability, we estimate at 20%. The start of Fed easing has is already delivering signs of a stabilizing in what had been a negative trend in housing demand, which is likely to deliver moderate growth in residential investment by Q2 2026, while business investment is looking healthy albeit highly dependent on AI. While a correction in equities from overoptimistic views on AI is likely, it is unlikely to be sufficiently severe to significantly undermine the positive investment picture. Inventories, despite seeing a pre-tariff lift, are now looking lean relative to sales limiting downside risk. Government, with the aggressive DOGE cuts in the past, is likely to see modest growth, with Federal spending supported by defense and state and local spending seeing modest growth. Trump’s attempts to permanently improve the net exports picture through tariffs are unlikely to be successful, but we expect only a moderately negative contribution from net exports to GDP through 2027.

Our Forecasts For GDP, Inflation and Fed Funds

After a subdued start to 2026, we expect GDP to return to potential at 1.8% in the second half of 2026 and through 2027, with annual GDP growth at 1.5% in 2026 and 1.8% in 2027. Consumer spending, which at 2.5% in 2025 is likely to significantly outperform GDP growth of 1.8%, looks set to slow to a pace of 1.5% in both 2026 and 2027. We expect core PCE prices to see annualized growth accelerate to 3.2% in Q1 2026, before slowing to 2.7% in Q2. The subsequent six quarters we expect to be close to, but marginally above the Fed’s 2.0% target, with core PCE prices averaging 2.7% in 2026 and 2.2% in 2027. For overall PCE prices we expect a 2.6% rise in 2026 and 2027 also at 2.2%. CPI is likely to be slightly firmer than PCE prices, at 2.8% in 2026 and 2.5% in 2027.

Growth returning to near potential and inflation returning to near target is likely to see the Fed moving rates close to neutral, with risk that the Fed might be a little more dovish than appropriate, adding to the risk of inflation stabilizing slightly above the 2% target. A modest inflation scare in Q1 2026 may see the Fed pausing, though we expect 25bps easings in June and September, once it becomes clear that tariffs have not delivered a sustained acceleration in inflation, which would take the Fed Funds target range down to 3.0%-3.25%. We expect the rate to remain there through 2027 as long as growth remains near potential and inflation remains near target.

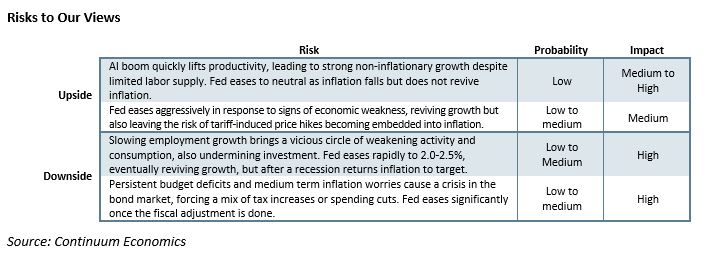

Major Risks to Watch For

Two key uncertainties are likely to be resolved by early 2026, though there are no scheduled dates for when the Supreme Court delivers its verdict on President Trump’s reciprocal tariffs, and President Trump nominates a successor to Jerome Powell as Fed Chair. Supreme Court hearings generated expectations that they will rule against at least some of the tariffs, while the favorite for the Fed nomination is the Director of the National Economic Council, Kevin Hassett. A Supreme Court ruling against the tariffs would reduce upside inflationary risk, with several probably still considering how far they will pass on cost increases, but the economic benefits may prove limited. Loss of tariff revenues could lift the budget deficit to a worrying 6.5% of GDP rather than 6.0%, though Trump would almost certainly attempt to find alternative means of raising tariffs, and that will generate uncertainty. Trump has a variety of options, including extending tariffs on sectors deemed important for national security, though others, including those justified by balance of payments concerns, would require the support of Congress. A Hassett nomination for Fed Chair would be likely to gain Senate approval, but would raise concerns in the markets of a reduction in Fed independence. Still, even with Hassett approved Trump would be unable to count on a majority of FOMC voters to back his wishes. Policy would probably be only marginally more dovish under Hassett, though the spectacle of the Fed Chair being outvoted on policy would be an awkward one. Markets would prefer a nomination of a Fed insider, with current Governor Christopher Waller probably the most credible of the current shortlist.

November 2026 sees mid-term elections for Congress, with Democrats looking likely to regain control of the House where they need only a small swing to do so. We doubt that any attempts by Trump to manipulate the election results would be successful, though political risk will be high surrounding the vote. The Democrats look less likely to take control of the Senate, needing a net gain of four seats, while Republicans are defending only two swing states. A recession would probably be needed to put other states into contention.

As we outlined above, the economy appears to have enough underlying strength to make a recession a relatively modest risk, around 20%, but such a scenario cannot be ruled out if a near flat labor market gives way to one in which significant layoffs are seen, particularly if this delivers a steep slide in equities. That would undermine consumption at the upper end of the income scale, which has been leading recent strength in spending, as well as putting the positive investment picture at risk. Should the economy enter recession, the Fed Funds rate would likely be lowered to around 2.0-2.25% as the Fed in the past have eased below neutral policy rates in such situations .

Risks do lean to the downside on employment, but to the upside on inflation, particularly if the economy proves resilient and the Supreme Court approves the reciprocal tariffs. Our expectation is that inflation will stabilize marginally above the Fed’s 2.0% target, and then easing to 3.0-3.25% would still be credible. Stabilization at 2.5% would be more problematic, but might be tolerated by a Hassett-led Fed. Should inflation remain near 3.0% though 2027 however, tightening would be necessary, even if probably facing resistance from Trump.