Venezuela: Oil and Geopolitics

· Venezuela’s oil production will likely take years to increase substantively due to poor infrastructure, the need for substantive investment, and a lack of democratic political stability. In terms of geopolitics, operations in Venezuela reinforce the Trump administration’s pivot in its national security strategy toward the Americas, which could lead to political instability in Cuba. Moreover, the Russia-Ukraine war can continue with EU funding replacing the U.S. and we see the current peace negotiations failing before a deal eventually occurring in late 2026. President Xi, after Venezuela, could ask Trump to accept eventual Taiwan reunification for a trade deal, but Trump could find this difficult to concede. Our baseline remans against invasion of Taiwan by China in 2026/27.

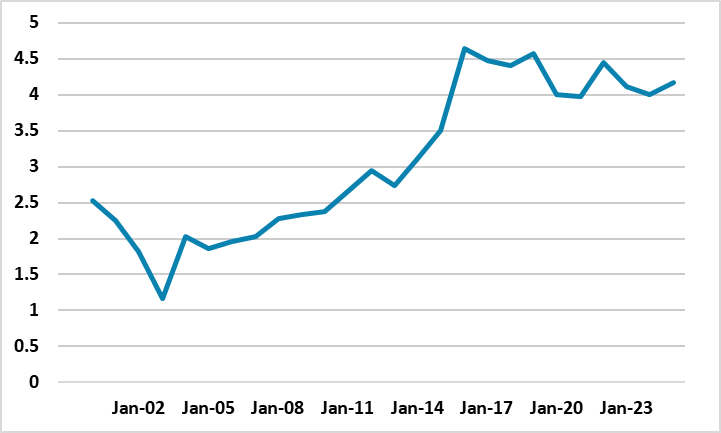

Figure 1: Iraq Oil Production (Mln B/D)

Source: IMF

Events in Venezuela over the weekend have raised questions about the spillover consequences for oil and geopolitics.

A lot of uncertainty still exists over how the U.S. will be involved with Venezuela and the spillover globally, but our early thoughts are.

· U.S. works with the new President. The U.S. has stopped short of regime change, with the vice president sworn in and having support of the military. President Trump and U.S. Secretary of state Rubio have had differing views on the U.S. relationship with Venezuela, with Trump going for the headline grabbing “we now run Venezuela” to Rubio’s more nuanced “we dictate to Venezuela”. Trump’s loathing for ground wars suggests that Rubio’s guidance is likely and the U.S. wants the Venezuela regime to crack down on drug gangs and open up to U.S. oil investment. Despite volatility in the coming days, this is the most likely scenario that the new President will follow rather than have a war with the U.S.

· Oil. The U.S. is keeping pressure on the Venezuelan oil industry via sanctions and intermittent blockades, which could see the new Venezuelan president conceding ground. However, Iraq experience after 2003 is illustrative of the challenges that Venezuela faces with decaying infrastructure that needs large scale investment to boost oil output back to the 3-4mln barrels per day of Venezuela glory days. Additionally, sources close to U.S. oil companies have already expressed a precondition of stable politics including new parliamentary elections. Iraq took until 2010 for production to really take off (Figure 1), which suggests that Venezuela oil really ramp up could be beyond the 2026-27 period – though some rebound is feasible from current depressed levels and would be another worry for oil prices (our Commodity Outlook is here).

· Cuba/Colombia/Ukraine. Trump’s Venezuela campaign shows that he believes in the Monroe Doctrine of a pivot in U.S. policy toward the Americas. This was clearly highlighted in the November National Security Strategy (here). Though Trump, on Sunday, lashed out at Colombia and Greenland, Cuba is the real prize for Trump and Rubio and a vote winner among Latino voters. U.S. action will likely be to squeeze Cuba regime rather than direct military action at this stage, as Cuba is heavily dependent on discounted Venezuelan oil. Outside the Americas, actions on Venezuela will increase nerves about a Trump administration focused on the Americas. Trump could lose patience with the Russian/Ukraine peace discussions that appear deadlocked and we see failing before an eventual peace deal in late 2026 (here). However, European leaders know they cannot depend on Trump, which is leading to a surge in military spending in some European countries.

· Asia and Taiwan. Asia is different, as dependency on the U.S. is great, with Japan and S Korea military spending less than European countries. The biggest focus is on Taiwan. President Xi could ask Trump not to intervene in any future reunification of Taiwan in exchange for a trade deal. This raises the stakes around Trump’s proposed visit to China in April. However, Xi is cautious, and the Trump administration has rejected ideas to shift from the Taiwan strategic ambiguity policy. Thus, our baseline remains for ongoing grey warfare around Taiwan, with a 10% probability of invasion or blockade (here) and a 20% risk of a temporary and partial quarantine.