Commodities Outlook: A Balancing Act

Global oil demand is expected to be modest, with weak consumption in the U.S. and China, while India will support demand in 2026 and 2027. Non-OPEC supply is expected to expand moderately in 2026, whereas OPEC’s policy will respond to demand but remains puzzling. Supply trends in 2027 are likely to mirror 2026, with cautious producer behavior and OPEC group-wide cuts persisting. WTI is forecast at USD 53 by end-2026 and USD 60 by end-2027. Downside risks include weaker demand, OPEC’s production policy and faster Russian or Venezuelan oil supply growth.

Copper markets in 2026 and 2027 will remain shaped by tariffs, mine disruptions and China’s uneven demand, while growing consumption from electrification, clean energy and especially data centers add structural support. U.S. inventory behavior and the potential 15% tariff create near term uncertainty, while recurrent mine disruptions amplify market tightness. We forecast prices at USD 12,000 by end of 2026 and USD 13,000 by end of 2027, with upside risks from sustained demand or stronger-than-expected supply disruptions.

Gold has been one of the best performing assets of 2025, supported by strong central bank purchases, renewed ETF inflows and geopolitical tensions. Central banks continue to provide durable structural support. Retail and institutional investors have also driven demand, though behavioral motives introduce potential vulnerability to a correction. Supply remains largely stable, with limited growth in mining or recycling. We forecast gold at USD 4,500 by end-2026 and USD 4,600 by end-2027. Main risks include slower central bank demand and retail liquidation.

Oil: Supply as a Function of Demand

According to OPEC’s estimates for 2025, the U.S. accounts for 19.7% of global oil demand, China for 16.0%, and India for 5.4%, indicating that shifts in economic activity in these countries will continue having a significant impact on crude’s price. A closer look at the economic and sector specific drivers in each country reveals the potential direction of oil consumption over the coming years.

As discussed in our U.S. Outlook chapter, consumer spending is expected to remain moderate due to a weak labor market, which will limit growth in oil demand. While private consumption is likely to be modest, residential and business investment, particularly in artificial intelligence, will provide some support to overall activity. Nevertheless, these factors are unlikely to drive a sustained increase in oil demand beyond a marginal rise in fuel consumption for transportation. Meanwhile, China faces a similarly subdued demand outlook on the consumer side, as household wealth continues to be constrained by the ongoing property sector crisis and a soft labor market. Even so, oil demand for petrochemicals is becoming more important and will offer some support. This could be complemented by a continuation in the inventory buildup observed in 2025, which has contributed to the relative stability of oil prices in 2025. By contrast, India stands out as one of the most dynamic sources of new demand. The U.S. Energy Information Administration projects the country’s oil consumption to grow 2.9% in 2026, compared with 1.8% in China and a 0.1% decline in the U.S., driven by expanding manufacturing activity and a sustained increase in demand for transportation.

Non-OPEC producers are expected to contribute moderately to supply growth in 2026, led by the U.S., Brazil and Guyana. Output from OPEC members, however, remains less predictable. The cartel’s production policy was inconsistent throughout 2025, often diverging from earlier guidance, and a similar dynamic is expected next year as members frequently reassess output in response to global demand, limiting the usefulness of forward guidance. Our baseline scenario anticipates that the group of eight OPEC countries (that cut 1.65 mb/d and partially reversed these cuts in October 2025, with a pause scheduled for the first quarter of 2026), will maintain the pause through the first half of 2026. Thereafter we see OPEC gradually resuming output increases in the second half, potentially extending into early 2027, assuming global demand remains moderate. There is also the possibility that the pause lasts longer if demand weakens and prices fall toward the low USD 50s per barrel, placing financial pressure on OPEC members and potentially making U.S. shale production unprofitable. A less likely but still possible scenario is that OPEC implements new production cuts if prices drop into the low USD 40s, although this would reverse the production build back effort undertaken over the past year.

Geopolitical developments could influence the outlook, though their effects would likely materialize with a lag and would be more of a 2027 story. A potential peace agreement involving Russia by end-2026 would not immediately translate into higher Russian exports, as sanctions relief and logistical normalization would take time. The timing and extent of the lifting of sanctions over Russia will be of importance. Venezuela faces a similar constraint. Even if there is a significant shift in the domestic political environment, the country’s outdated infrastructure, years of underinvestment, and its fragile logistical chain suggest that additional barrels would return to the market only gradually. We forecast WTI at USD 53 by the end of 2026.

Looking ahead to 2027, global oil demand is expected to remain moderate. In the U.S., the effects of the monetary easing cycle, expected to conclude in 2026, are likely to provide more support to oil consumption, while a weaker USD could provide an additional tailwind for global demand. In China, private consumption is projected to remain subdued, although there is still some potential upside from petrochemical manufacturing. In contrast, India is likely to continue experiencing strong growth in oil demand, consistent with its status as a rapidly growing emerging economy.

On the supply side, we believe uncertainty will persist. Saudi Arabia’s evolving strategy and the rollout of OPEC’s new capacity assessment mechanism will be central in shaping the 2027 outlook. Riyadh has indicated that it can tolerate a period of lower prices, prioritizing output, market share, and long-term investment rather than strict production cuts. This reflects a pragmatic fiscal approach that accepts temporary deficits to advance Vision 2030 while recognizing that some recalibration will be necessary. Moreover, the OPEC mechanism will introduce externally audited production baselines that are expected to be more credible and binding, likely granting higher quotas to well-funded producers such as Saudi Arabia while constraining members with structural limitations, thereby concentrating supply influence among the Gulf producers. Against this backdrop, supply trends are expected to resemble those of 2026, with group-wide cuts that were initially expected to be unwound by the end of 2026 now likely to remain in place through 2027. The result is a market entering 2027 with improved demand expectations but supply still shaped by cautious producer behavior. Under these conditions, we expect WTI to recover and end 2027 at USD 60.

The balance of risks over the next two years is skewed to the downside. A weaker global macroeconomic environment, whether due to a deeper U.S. slowdown or a sharper deterioration in China, would weigh heavily on consumption and increase downward pressure on prices. On the supply side, risks are also tilted toward the downside. Prices could fall into the USD 40s if OPEC continues prioritizing market share over price support, a possibility reinforced by Saudi Arabia’s willingness to tolerate a period of lower prices. Additional downside could come from faster increases in Russian or Venezuelan supply if geopolitical or domestic conditions shift.

Copper: Tariffs, Mine Disruptions and New Demand

Copper has spent the past year at the center of a complex interplay between politics, supply shocks and China’s shifting economic landscape. These forces not only shaped prices in 2025 but are likely to remain the decisive factors in 2026. Through all the noise, three drivers stand out: the prospect of U.S. tariffs, a series of supply disruptions across major producing mines and China’s uneven but still relevant demand.

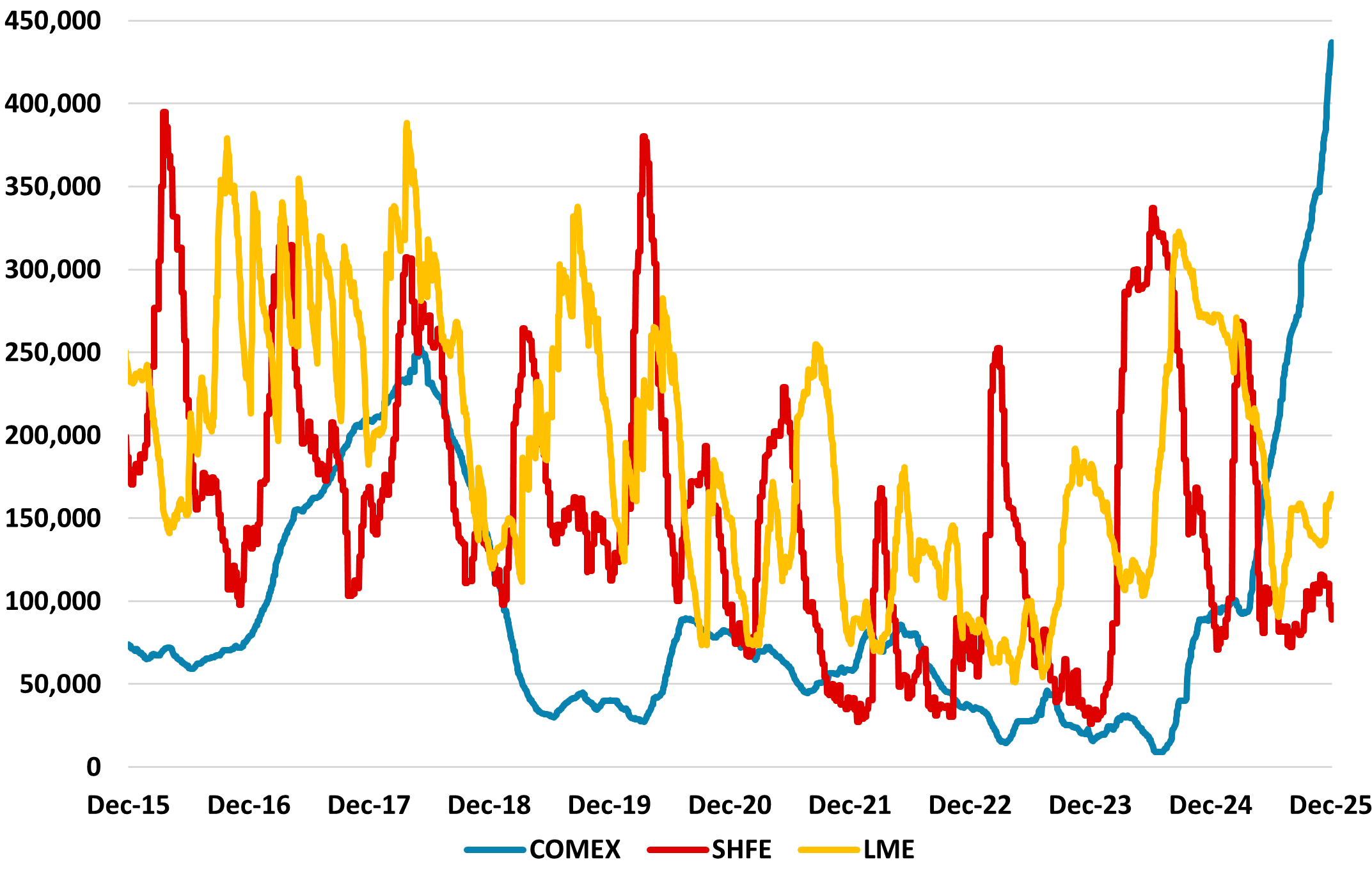

Market behavior has been especially sensitive to policy signals from Washington. In the run up to President Trump’s decision on copper tariffs, inventories rose sharply as traders and manufacturers positioned for the risk of broad restrictions on refined imports. The eventual measures were narrower than expected but uncertainty persists. The administration announced that a decision on whether to impose a 15% tariff on refined copper will be revisited by mid-2026. This has kept U.S. inventories rising even as stocks in London and Shanghai have drawn down (Figure 1). Inventory divergence is now one of the most relevant features in the copper market.

H1 2026 is likely to bring more of the same. In anticipation of the June decision, the U.S. is expected to continue stockpiling copper, adding upward pressure to prices. It remains unclear whether Trump will introduce tariffs on refined copper. With his popularity declining, the cost of living rising, and uncertainty stemming from the Supreme Court’s pending decision on tariffs, the probability appears roughly even, with no clear indication of whether extra copper tariffs will be imposed. Regardless of the outcome, we expect a similar market reaction during H2 2026. If tariffs are imposed, the decision is unlikely to surprise the market which has already built inventories, although sentiment would likely turn bearish as attention shifts to the drag on demand from higher costs. If tariffs are not imposed, the market could be surprised, but not bullishly so. The inventory cushion built on tariff expectations would need to unwind, and significant volumes of U.S. stockpiles could flow back into the global market, weighing on prices. Outside the U.S., stocks remain relatively low, so any release of U.S. material would add further pressure.

Supply conditions have offered little stability, with recurrent disruptions across Chile, Indonesia, Peru and the Democratic Republic of Congo. For example, Benchmark Minerals, a market intelligence firm, reported that eighteen of the twenty-five largest copper miners recorded quarter-on-quarter declines in output by Q3 2025. Codelco and Freeport-McMoRan posted reductions of 10.2% and 5.3%, respectively. Such interruptions are a familiar feature of the sector, but their impact is amplified by the tightness of the global balance. Copper prices remain highly sensitive to marginal supply losses, and given the frequency of such disruptions, they are expected to continue in 2026.

Figure 1. Copper Inventories (tons)

Source: Continuum Economics / Datastream

Demand from China has meanwhile delivered a mixed signal. The weakness of the property sector in 2025 has raised concerns about demand in the country. However, beyond the property sector, the picture has been more encouraging. Grid investment has remained strong and the electrification push has continued, supported by renewable power deployment and the expansion of electric vehicles and battery materials. These forces anchor medium term demand even as the property sector drags. The structural story is difficult to ignore. As China and the rest of the world accelerate investment in clean energy and digital infrastructure, the copper intensity of economic activity rises. Data centers supporting artificial intelligence and cloud services have emerged as a new and growing source of consumption.

We forecast copper at USD 12,000 by the end of 2026 and risks are skewed to the upside. For instance, in the event where tariffs are imposed on copper but demand is still strong enough to offset the effect of tariffs, coupled with weak inventories outside the U.S. means copper price could rise beyond the expected. Likewise, if large mine disruptions persist or increase while demand surpasses output, creating a larger market deficit, prices could rise further.

The 2027 outlook remains constructive, with the dual engines of the energy transition and data center expansion reasserting themselves. Structural demand growth outpacing supply additions is set to tighten the market and push prices higher. In our central scenario, we forecast copper at USD 13,000 by end-2027 as the metal reaffirms its status as a critical input for the decarbonized and digitized economy of the next decade.

Gold: Room to Grow, but Risks Ahead

Gold has been one of the best performing assets of 2025, rising by roughly 60% from January through early December. This performance reflects a combination of structural and cyclical forces. The most influential drivers have been strong central bank purchases and renewed inflows into gold ETFs. The rally has also been supported by a more accommodative monetary stance in the U.S., a weaker USD, and a macroeconomic environment that remains fragile. Persistent geopolitical tensions, from trade frictions to the conflict between Russia and Ukraine, have added an additional layer of defensive buying that is likely to carry into next year.

Data from the World Gold Council (WGC) indicates that central bank demand decreased 12.5% during the first nine months of 2025 versus the same period of 2024; the deceleration is notable but hardly discouraging. Purchases remain well above pre 2022 as central banks continue to diversify reserves and hedge political risk. The People’s Bank of China was among the most important contributors in 2023 and 2024 but its officially reported additions have slowed. Persistent reports that China may be significantly under reporting its purchases suggest that official data understate the trend (here), reinforcing the view that gold remains an important element of Beijing’s long-term strategy. Beyond this, China has signaled an ambition to become a custodian of other countries’ bullion as part of a broader effort to build a financial architecture less anchored to the USD. Its agreement with Cambodia to store newly acquired bullion is a small but telling indication of its intent. Custodial status enhances influence but also suggests confidence in the long run value of gold within China’s reserve strategy.

As of the end of October, the largest net buyers this year have included Poland, Kazakhstan and Azerbaijan through its sovereign wealth fund. Survey evidence from the 2025 WGC report shows that 43% of central banks plan to increase their gold holdings, which is showcased by statements from Poland, South Korea, Rwanda, Serbia, Czechia, Namibia, Madagascar and Uganda that support this forward sentiment and point to a durable structural bid.

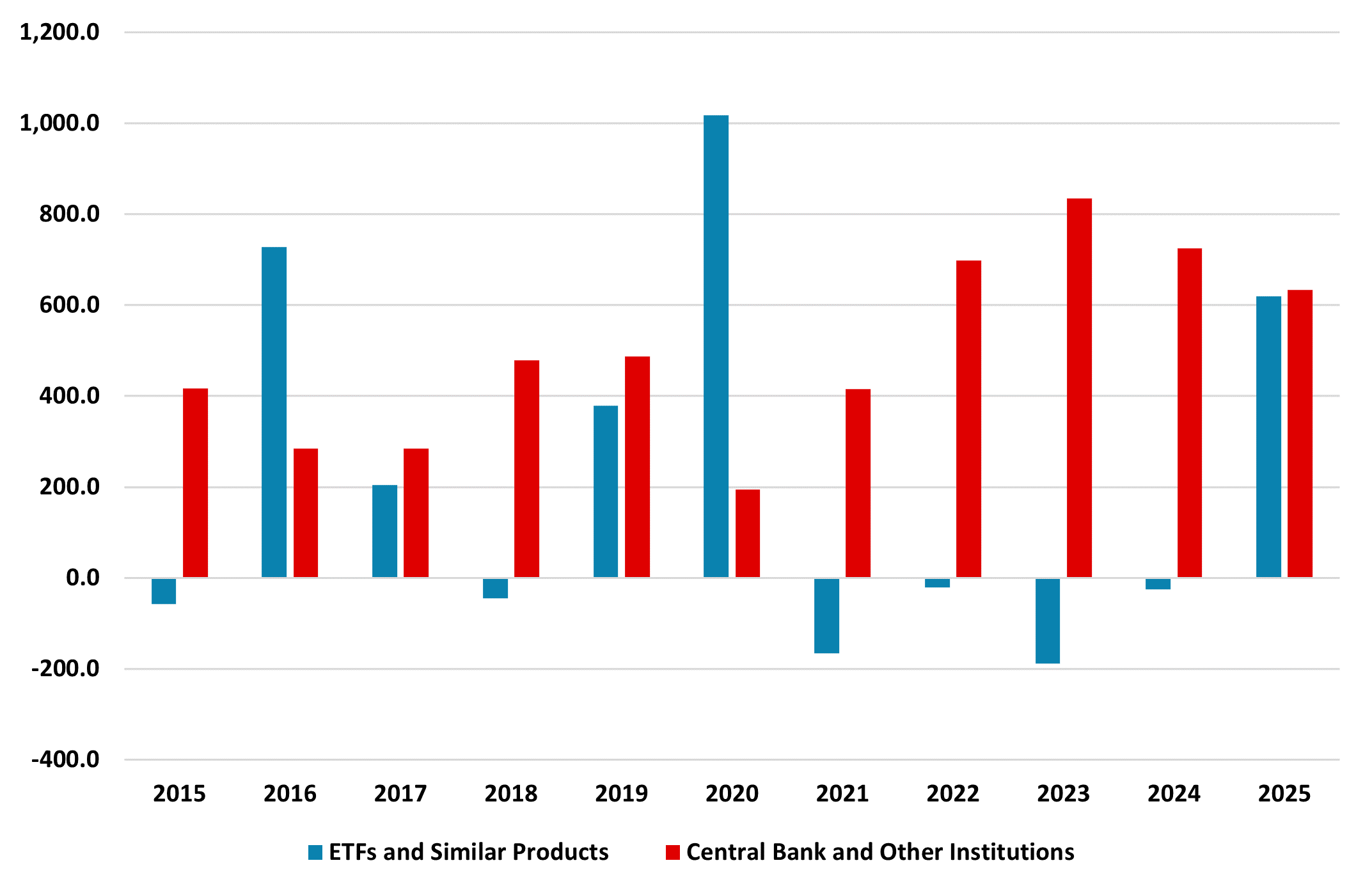

Investment demand has reawakened through gold ETFs and has been instrumental in the metal’s rally. Lower interest rates have reduced the opportunity cost of holding gold, helping to revive flows (Figure 2). Institutional participation, but especially retail investors, account for a significant portion of this year’s buying, according to an article from the Bank for International Settlements (here). Their participation appears driven not only by macro hedging motives but also by a fear of missing out. This behavioral element introduces a potential vulnerability since retail investments are more prone to profit taking possibly leading to a sharp correction.

The gold outlook is supported by several factors. We think a continuation of the U.S. easing cycle would weaken the USD and maintain a favorable environment for gold by lowering costs for foreign buyers. This sustains both central bank accumulation and ETF inflows. Nevertheless, from a geopolitical perspective, a possible peace deal by end of 2026 between Russia and Ukraine would remove much of the geopolitical risk premium. On the supply side, mine output has been effectively flat and only modest relief is expected from recycling. With supply largely fixed in the near term, the price has been dictated by shifts in demand. We forecast gold at USD 4,500 by year end 2026.

Looking into 2027, we forecast the Fed to keep the Federal Funds Rate unchanged, which would likely be a less favorable scenario for ETF inflows. Likewise, we expect central bank demand to continue normalizing and not returning to the rapid growth observed between 2021 and 2023. From a geopolitical perspective, a stabilization of global conflicts and a more predictable trade environment could limit upside for gold prices. We project gold at USD 4,600 by the end of 2027.

Risks to our outlook come from multiple streams; for instance, a sharp price correction could follow if retail investors begin taking profits collectively. An unexpected slowdown in central bank demand or a meaningful improvement in geopolitical stability globally could remove pillars of support. A broad sell off in global equity markets could also lead investors to liquidate gold to cover losses elsewhere. Upside risks lie primarily in the opposite direction. A renewed surge in central bank buying or a deterioration in geopolitical relations could push prices higher still.

Figure 2. Central Bank Demand and ETF Inflows (First 3 Quarters of the Year, tons)

Source: Continuum Economics / WGC