Macro Strategy

View:

January 06, 2026

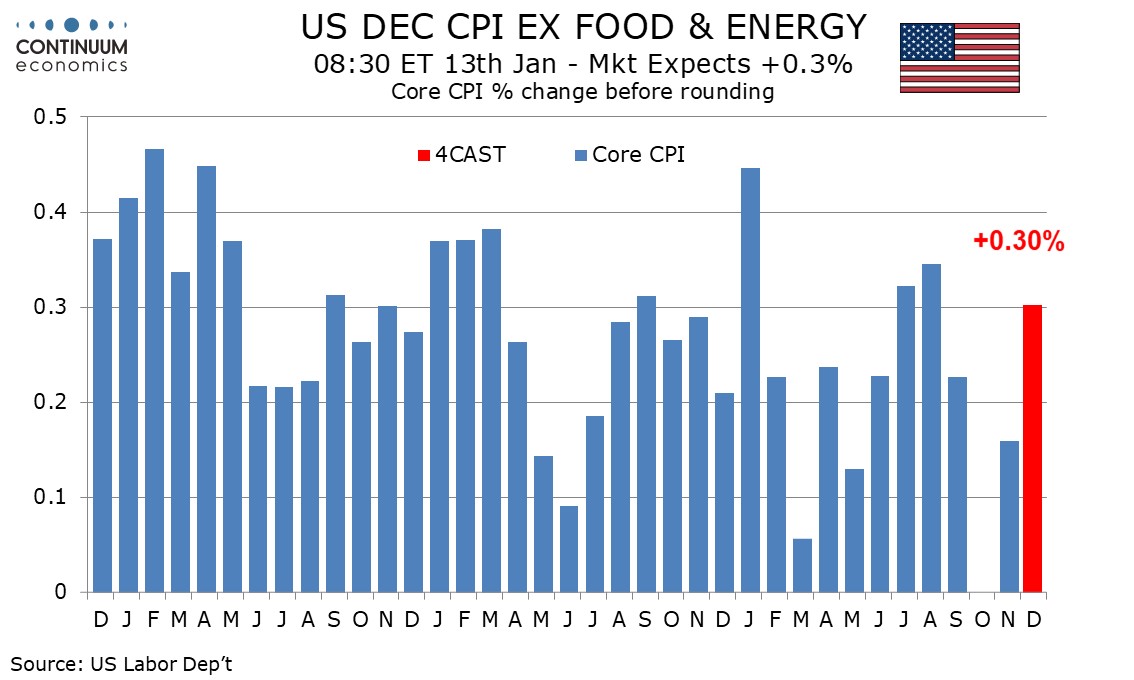

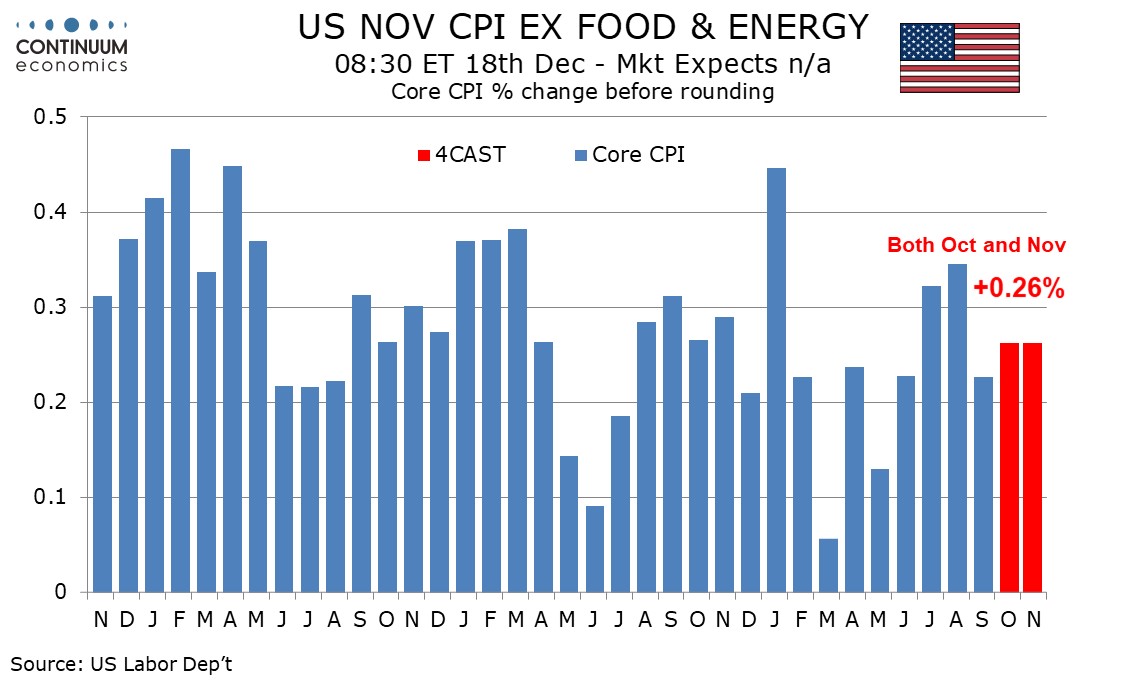

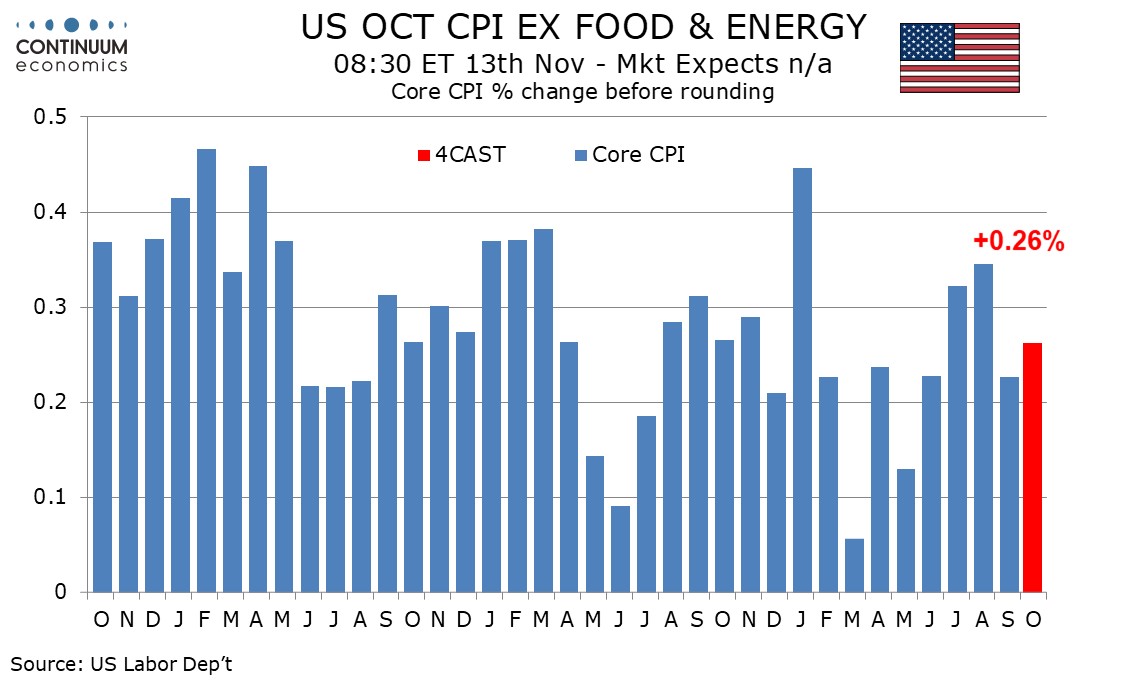

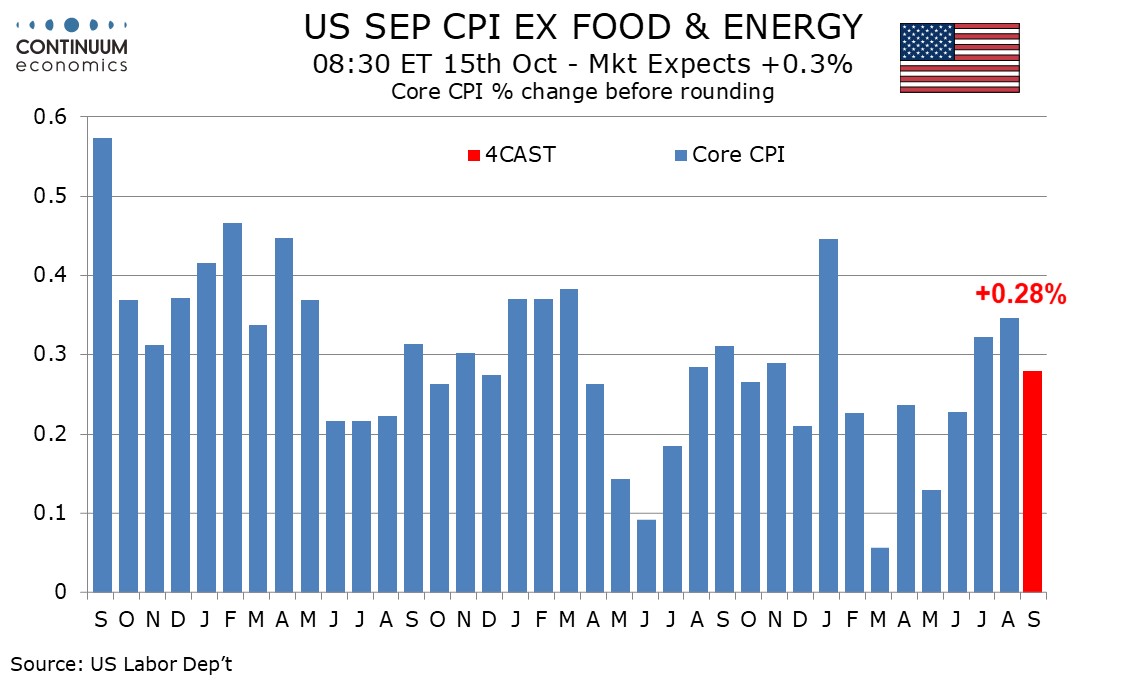

Preview: Due January 13 - U.S. December CPI - Soft November probably understates true picture

January 6, 2026 2:17 PM UTC

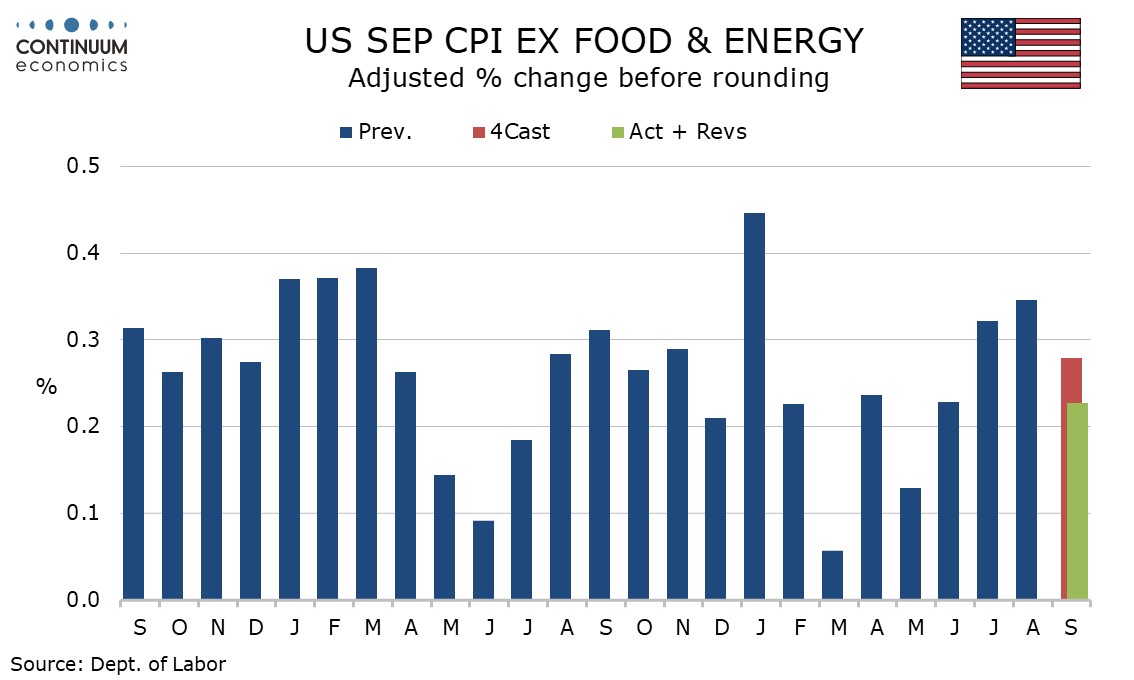

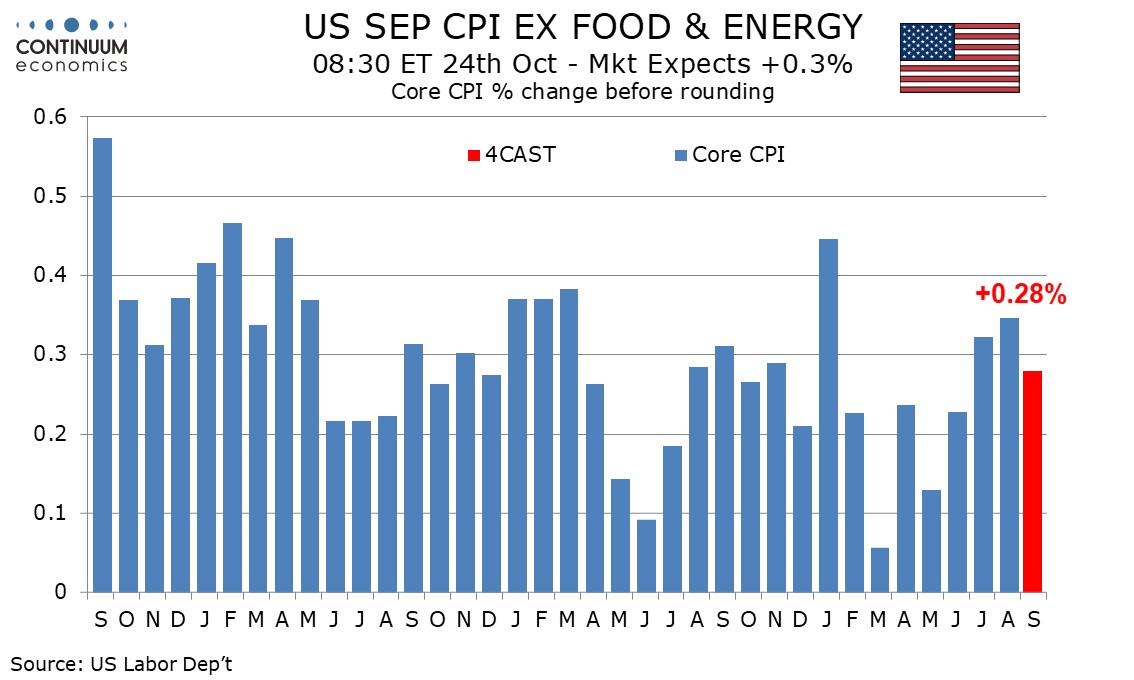

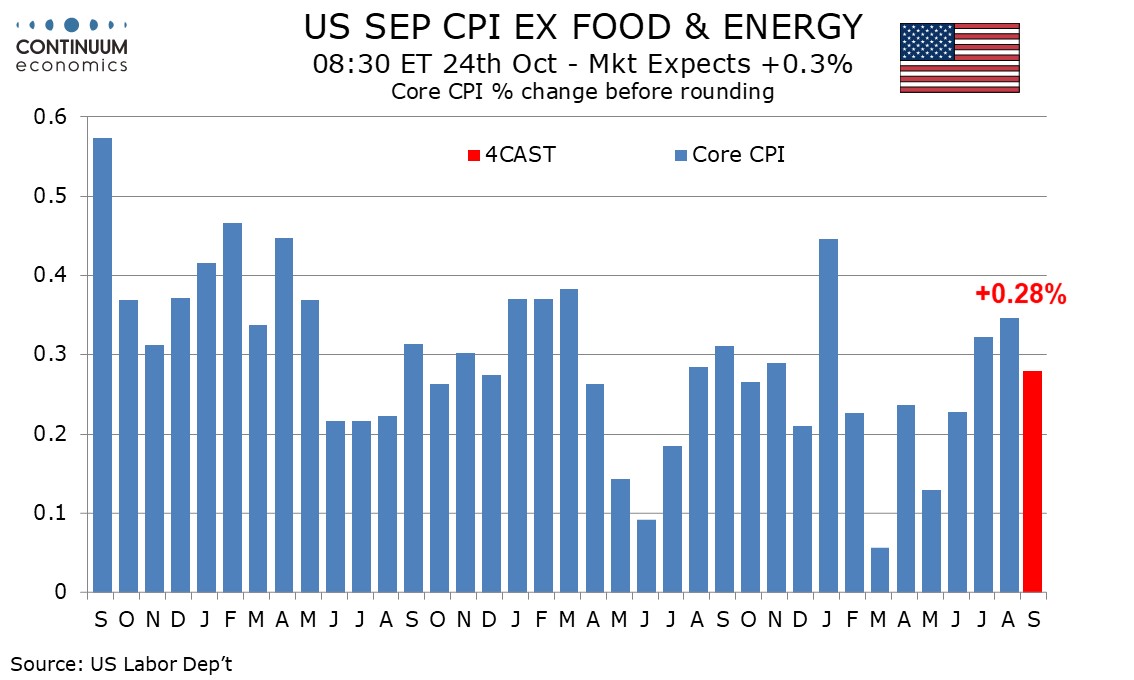

We expect gains of 0.3% in both December overall and ex food and energy CPI, with the gains being close to 0.3% even before rounding. There is extra uncertainty over this release as it is unclear whether the surprisingly soft data for November, after a missing October, represented a slowing in trend

Markets 2026

January 6, 2026 9:58 AM UTC

• For financial markets, the muddle through for global economics and policy provides support for risk assets, combined with solid earnings prospects from some of the magnificent 7. However, U.S. equities are once again significantly overvalued and we look for a 5-10% correction in 2026, b

January 05, 2026

AI and U.S. Productivity

January 5, 2026 8:04 AM UTC

· Structural labor and overall productivity will be boosted if current AI adoption is sustained at a pace quicker than the adoption of the internet. However, not all areas of the U.S. economy are exposed to AI benefits, as manual work can only be replaced by humanoid robots with maj

January 02, 2026

December 23, 2025

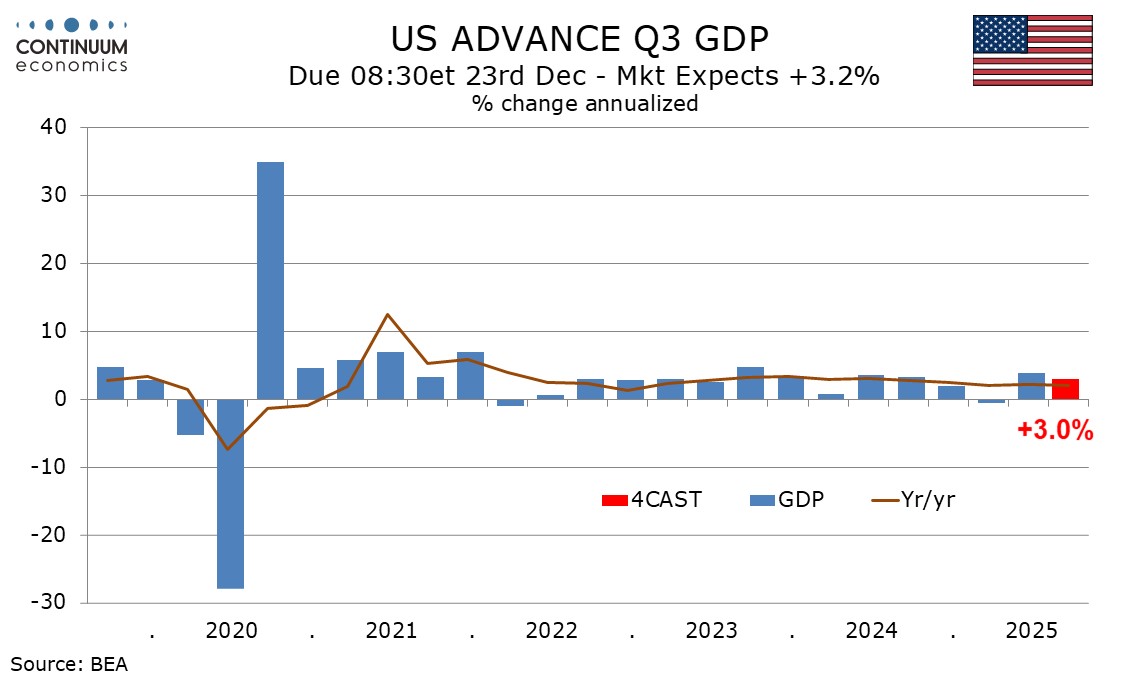

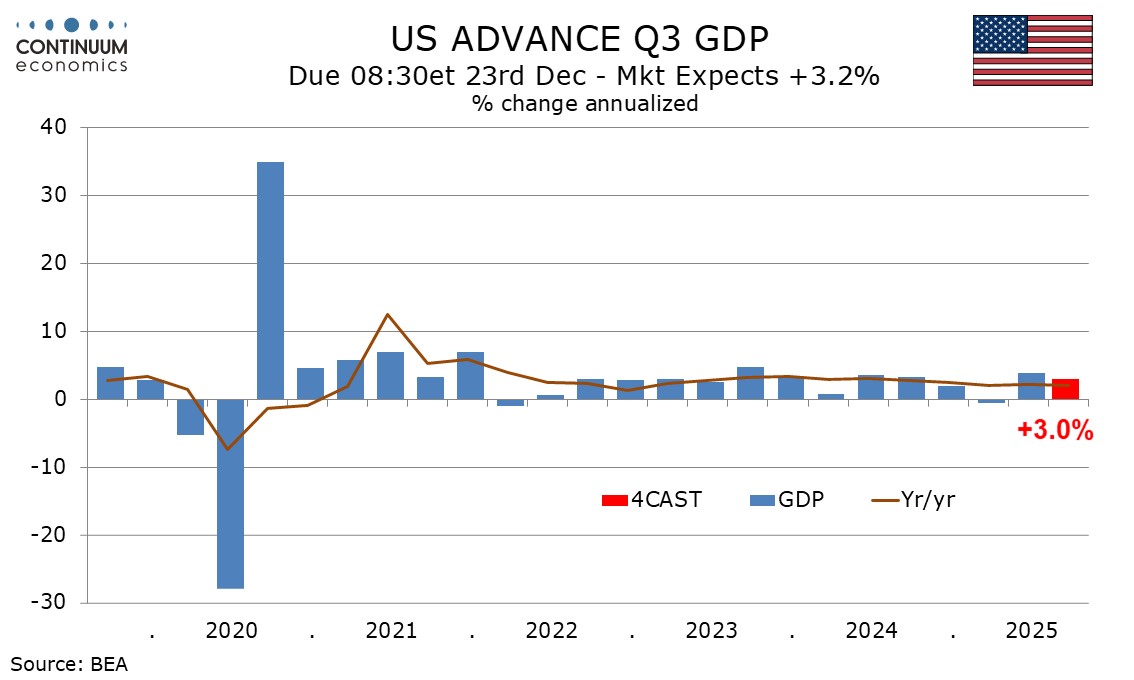

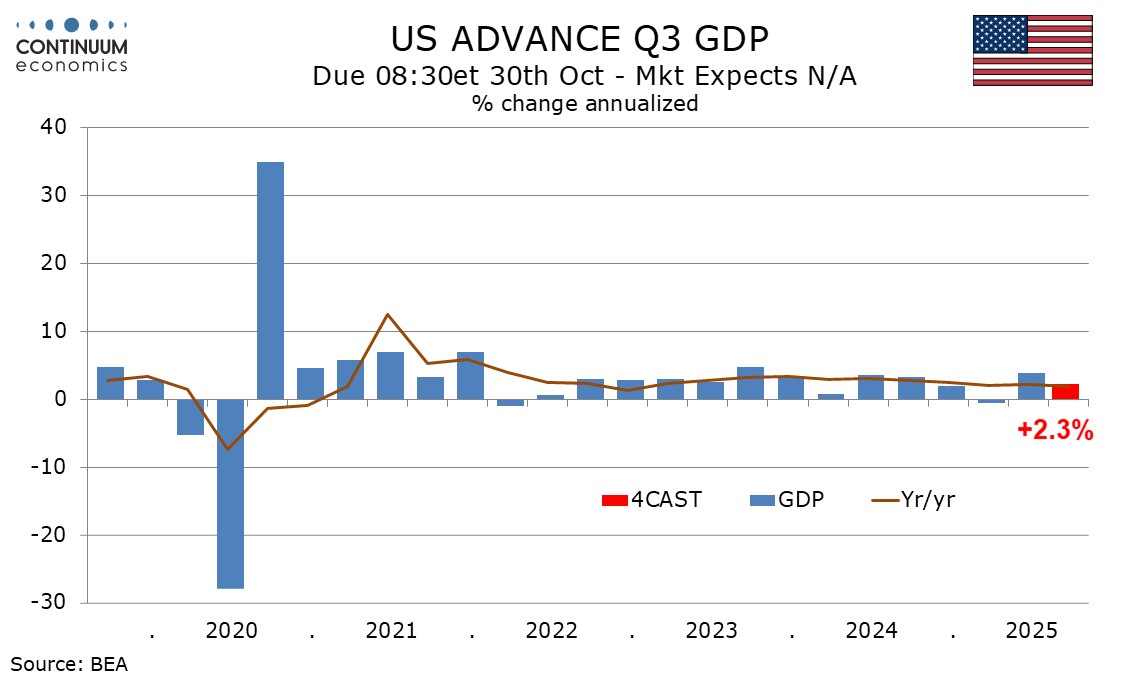

U.S. Q3 GDP: Better Than Expected, But

December 23, 2025 1:54 PM UTC

Q3 GDP came in better than expected due to a big net export contribution to growth. Gross domestic purchases at 2.7% were more in line with expectations, with mixed performance in key expenditure sectors. We see growth slowing in Q4, with net exports unlikely to repeat the Q3 outcome and consume

December 22, 2025

Preview: Due December 23 - U.S. Q3 GDP - A second straight solid quarter though Q4 is likely to be slower

December 22, 2025 2:42 PM UTC

We now look for a 3.0% annualized increase in the delayed Q3 GDP release, lifted by some recent data. This would be a second straight solid quarter to follow a weak Q1, though Q4 is likely to be weaker, in part due to the government shutdown that persisted through October and much of November.

December 18, 2025

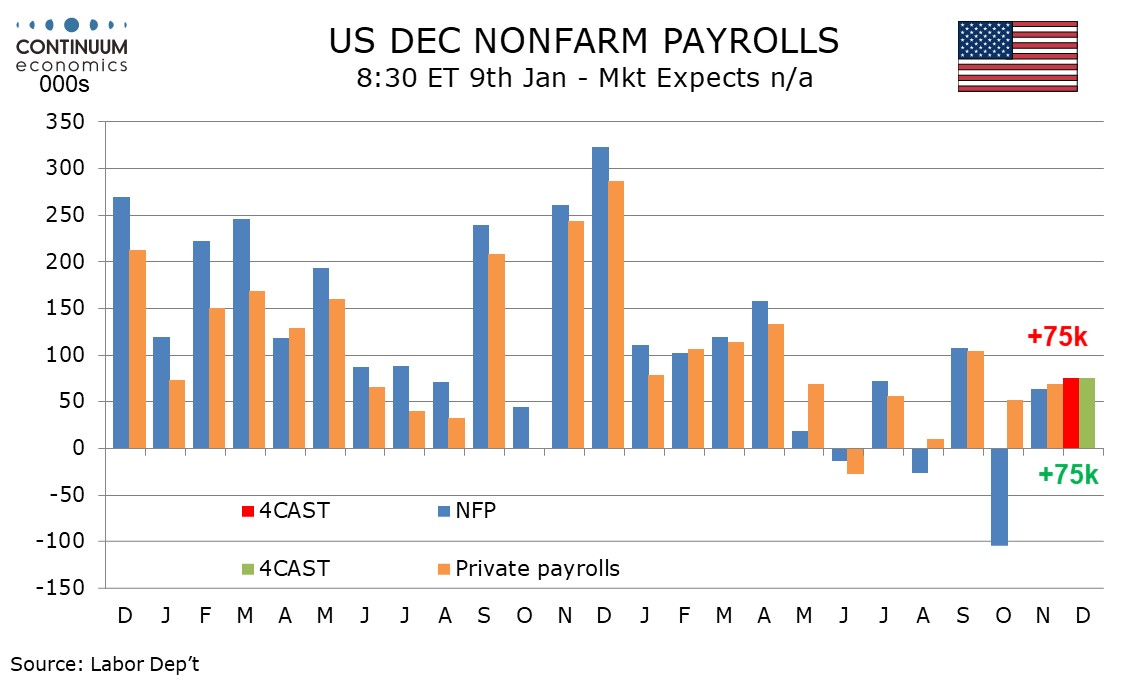

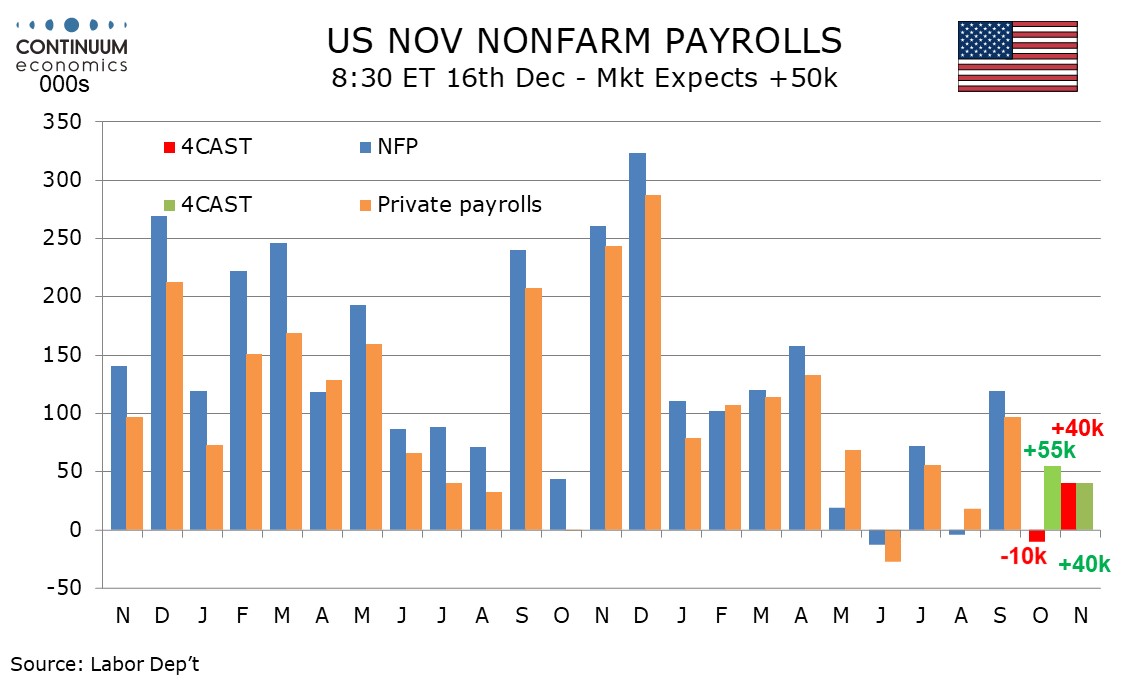

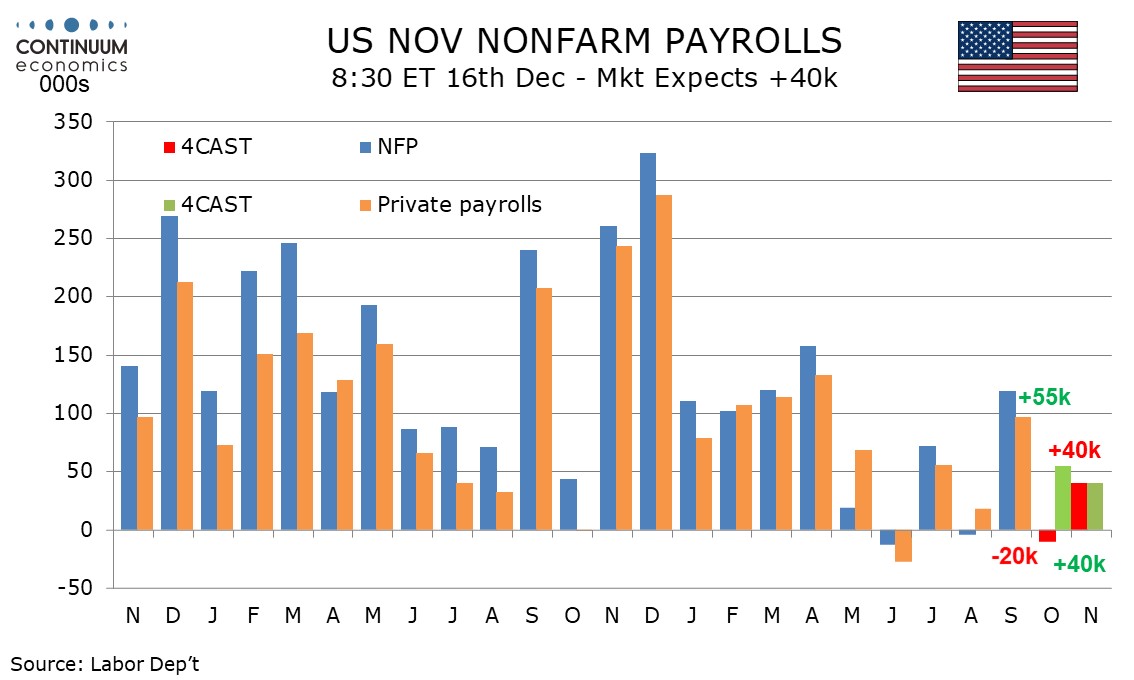

Preview: Due January 9 - U.S. December Employment (Non-Farm Payrolls) - Slightly firmer with unchanged unemployment

December 18, 2025 8:46 PM UTC

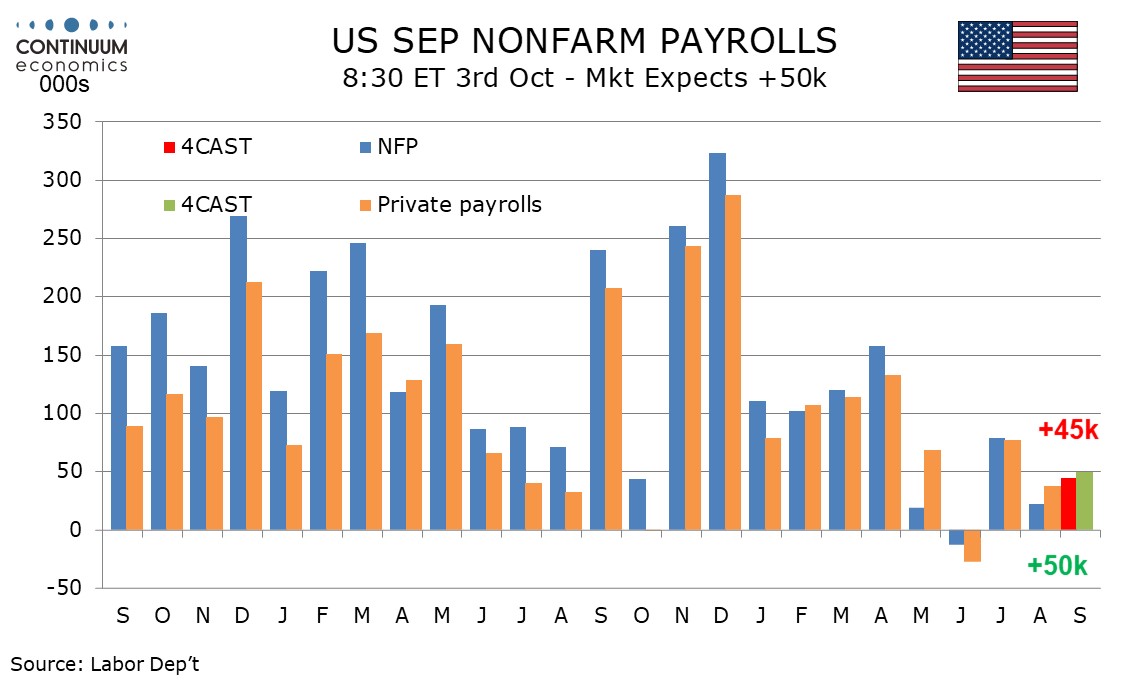

We expect December’s non-farm payroll to rise by 75k both overall and in the private sector, up from 64k and 69k respectively in November. We expect unemployment to be unchanged at 4.6% and a modest 0.3% increase in average hourly earnings.

DM FX Outlook: Scope for USD decline against JPY, AUD and NOK

December 18, 2025 2:31 PM UTC

· Bottom Line: We expect some modest USD losses across the board over the next couple of years, but there is much more scope for losses against the JPY, AUD and NOK than the other G10 currencies, as yield spreads have moved dramatically in favour of these currencies, and the currencies

U.S. November CPI - Is the tariff impact fading?

December 18, 2025 2:10 PM UTC

November’s CPI is significantly lower than expected, at 2.7% yr/yr, 2.6% ex food and energy, compared with 3.0% for both series in September (October data will not be released). November’s core CPI index is up only 0.16% from September’s, implying an average rise of less than 0.1% per month ov

EM FX Outlook: High Real Yields Still Help

December 18, 2025 12:14 PM UTC

• EM currency 2026 prospects come against a backdrop of a further but slower USD depreciation against DM currencies, but inflation differentials, domestic central bank policy and politics also matter. We forecast the Mexican Peso (MXN) will likely be more volatile, as President Donald Tru

December 17, 2025

Preview: Due December 18 - U.S. November CPI - A two month change with October canceled

December 17, 2025 1:41 PM UTC

The labor market will not publish monthly changes for each month so it is the two monthly change that will be published, we expect 0.49% for overall CPI, assuming October at 0.16% and November at 0.33%, and the core rate up by 0.53% over the two months. Gasoline prices are likely to dip in October b

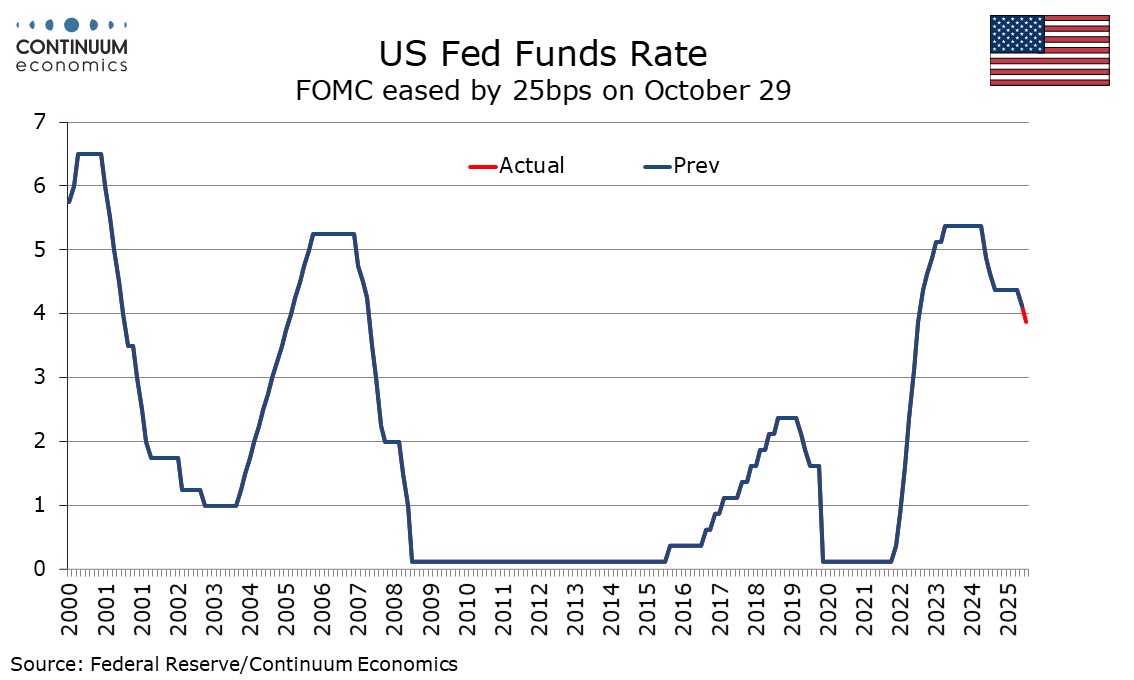

DM Rates Outlook: 2026 Yield Curve Steepening Before 2027 Flattening

December 17, 2025 9:21 AM UTC

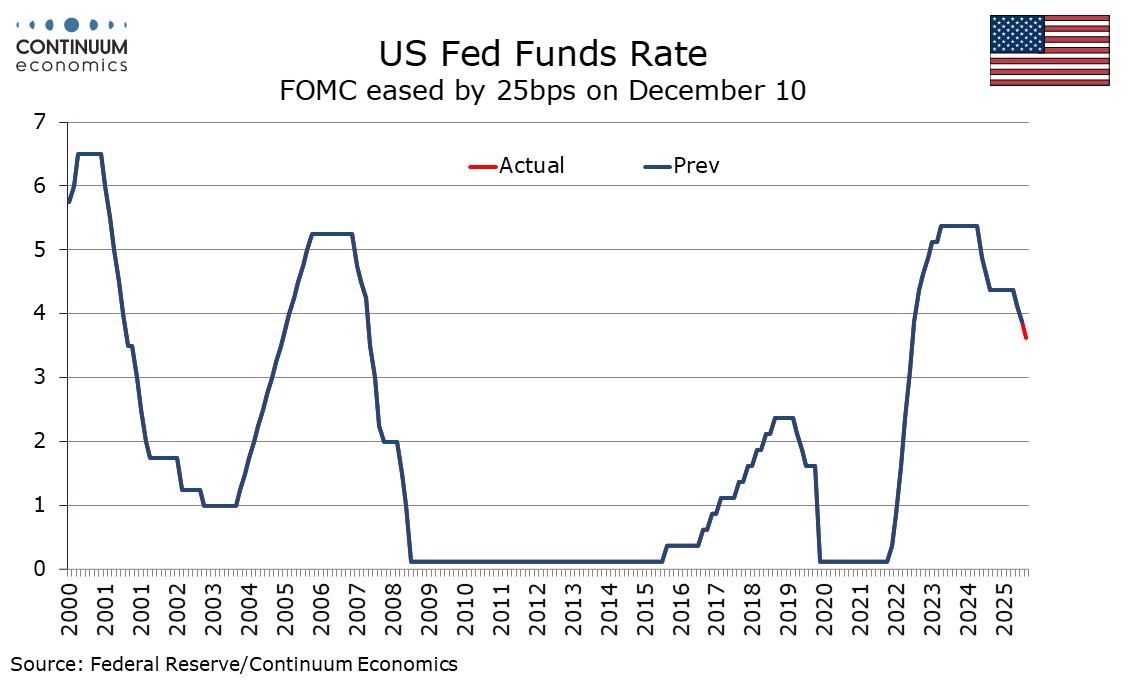

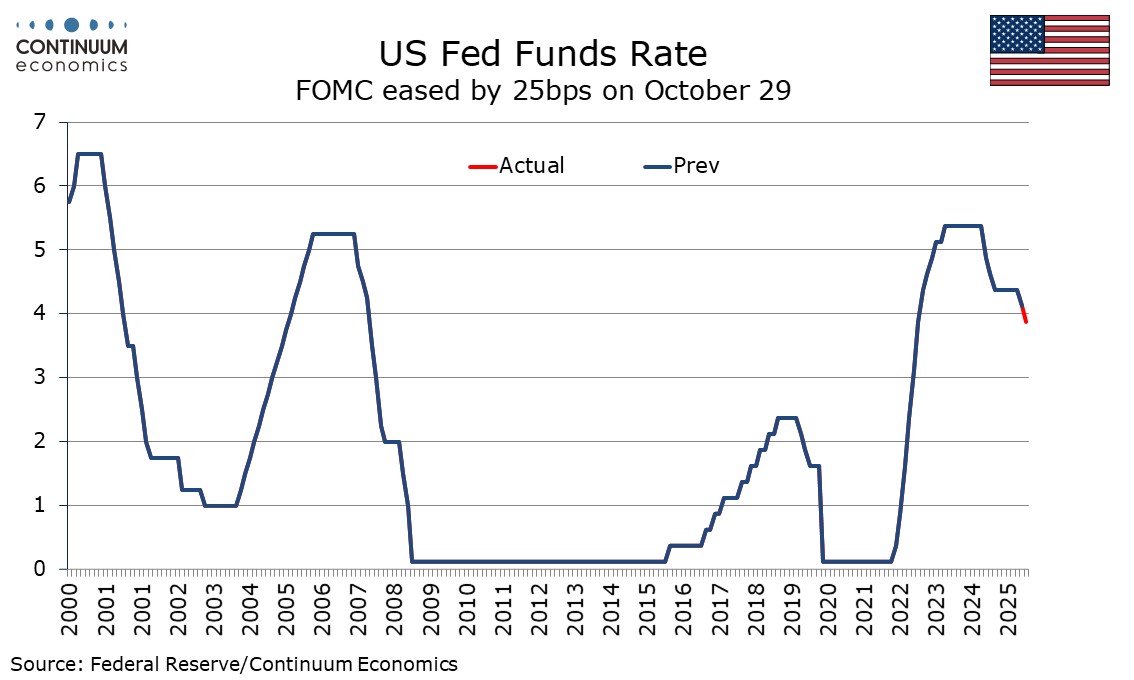

· Multi quarter, we still look for 50bps of further Fed easing by end 2026, which will likely initially bring 2yr yields down to 3.35%. However, once the Fed Funds rate get closer to 3.0-3.25% and the assumed slowdown turns into a soft landing, the 2yr will likely move to a premium ve

Outlook Overview: Turbulent Times

December 17, 2025 7:44 AM UTC

· The U.S. slowdown remains in focus as the lagged effects of President Trump’s tariff increases continues to feedthrough, though our baseline is for a 2026 soft-landing. The Supreme court will likely rule against part of Trump’s reciprocal tariffs, which will create short-term

December 16, 2025

Preview: Due December 23 - U.S. Q3 GDP - A second straight solid quarter though Q4 is likely to be slower

December 16, 2025 4:25 PM UTC

We now look for a 3.0% annualized increase in the delayed Q3 GDP release, lifted by some recent data. This would be a second straight solid quarter to follow a weak Q1, though Q4 is likely to be weaker, in part due to the government shutdown that persisted through October and much of November.

Asia/Pacific (ex-China/Japan) Outlook: Managing Slower Growth Without Losing the Cycle

December 16, 2025 2:43 PM UTC

· Asia’s 2026 growth is normalizing, not weakening, though the growth outlook reflects resilience under mounting strain rather than acceleration. Larger investment-led economies such as India and Malaysia are sustaining momentum through public capex, infrastructure pipelines, and indu

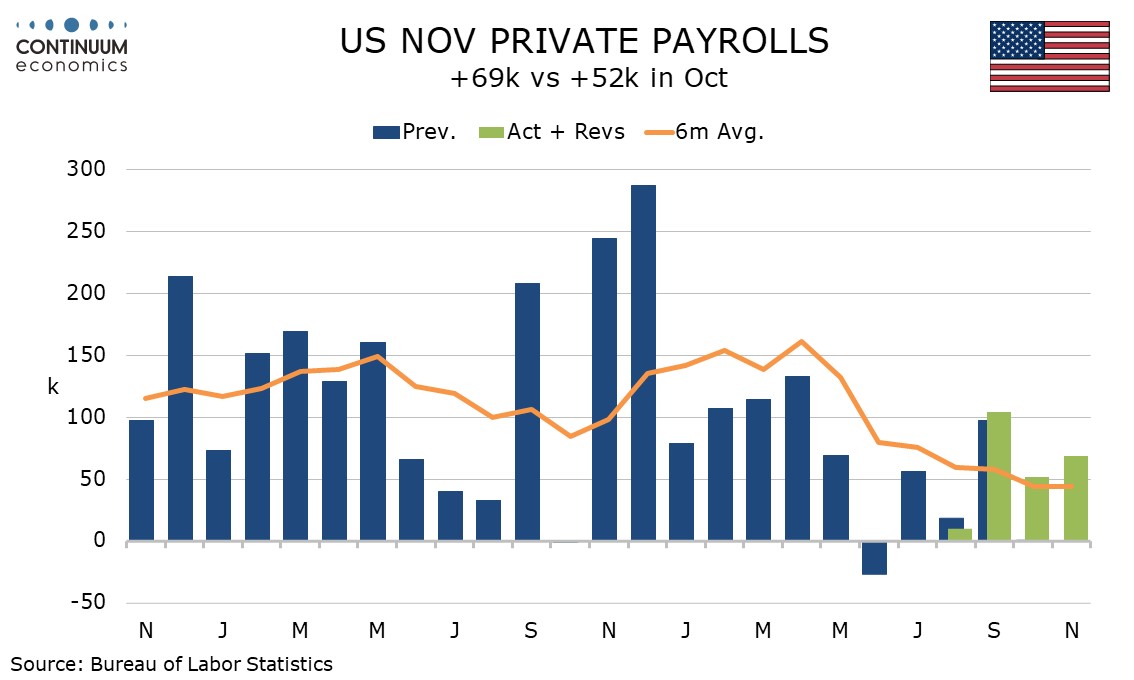

U.S. October and November Employment - Unemployment rising but economy maintains some momentum

December 16, 2025 2:22 PM UTC

November’s non-non-farm payroll at 64k does not fully erase a 105k decline in October but private payrolls at 69k in November and 52k in October maintain moderate growth, though unemployment at 4.6% in November is the highest since September 2021, and average hourly earnings growth is slowing. Oct

Commodities Outlook: A Balancing Act

December 16, 2025 10:15 AM UTC

Global oil demand is expected to be modest, with weak consumption in the U.S. and China, while India will support demand in 2026 and 2027. Non-OPEC supply is expected to expand moderately in 2026, whereas OPEC’s policy will respond to demand but remains puzzling. Supply trends in 2027 are likely t

December 15, 2025

Preview: Due December 16 - U.S. October/November Employment (Non-Farm Payrolls) - Slow but still positive in the private sector

December 15, 2025 3:25 PM UTC

The Labor Department will release October and November non-farm payroll data on December 16. We expect November to see gains of 40k both overall and in the private sector. However we expect October to see a decline of 10k overall but a 55k increase in the private sector.

December 12, 2025

U.S. Outlook: Consumers Vulnerable, but Recession Unlikely

December 12, 2025 4:38 PM UTC

• US GDP growth is likely to look solid in Q3 2025 supported by resilient consumer spending, but with slowing employment growth and resilient inflation weighing on real disposable income that will be difficult to sustain. However, while consumers look vulnerable, business investment looks h

Equities Outlook: Choppy Up For 2026 and Down for 2027?

December 12, 2025 8:05 AM UTC

· The U.S. equity market is underpinned by the bullish AI/tech story and a soft economic landing into 2026. However, overvaluation is clear and this leaves the market vulnerable to a 5-10% correction on moderate bad news e.g. economic data. We see the S&P500 having a choppy year a

December 10, 2025

FOMC eases by 25bps, dots unchanged from September

December 10, 2025 7:21 PM UTC

The FOMC has eased by 25bps as expected to a 3.50-3.75% Fed Funds target range, with two hawkish dissents for no change from Schmid (who dissented in October) and Goolsbee, while Miran again dissented for a steeper 50bps ease. The dots are unchanged from September, implying one 25bps ease in both 20

December 09, 2025

Preview: Due December 16 - U.S. October/November Employment (Non-Farm Payrolls) - Slow but still positive in the private sector

December 9, 2025 5:01 PM UTC

The Labor Department will release October and November non-farm payroll data on December 16. We expect November to see gains of 40k both overall and in the private sector. However we expect October to see a decline of 10k overall but a 55k increase in the private sector.

Americas First: New National Security Strategy

December 9, 2025 8:40 AM UTC

· The new NSS at one level reads like a Trump/MAGA current list of topics and desires, that may not translate into policy or a major shift of military assets. Trump has blown hot and cold on Europe and China over the past 12 months and could shift again. Nevertheless, the NSS does r

December 08, 2025

Preview: Due December 18 - U.S. November CPI - A two month change with October canceled

December 8, 2025 2:00 PM UTC

The labor market will not publish monthly changes for each month so it is the two monthly change that will be published, we expect 0.49% for overall CPI, assuming October at 0.16% and November at 0.33%, and the core rate up by 0.53% over the two months. Gasoline prices are likely to dip in October b

AI and U.S. Equities

December 8, 2025 8:50 AM UTC

· The AI story has driven broad momentum in the U.S. equity market, but will likely become narrower driver in 2026 and 2027, as not all big AI/tech companies will generate clear explosive revenue from areas outside cloud computing and semiconductor chips. Companies that are also depende

December 04, 2025

China/Japan: The Australia Playbook or Grey Warfare

December 4, 2025 10:05 AM UTC

China will likely escalate pressure on Japan to back down over it less pacifist stance on self-defense, as it wants to drive a wedge between Japan and the U.S. One option is to repeat the 2020 copybook when China banned coal imports from Australia for 3 years. A 2nd alternative is grey warfare a

November 26, 2025

U.S. Corporate Bonds Into 2026

November 26, 2025 10:15 AM UTC

· Though U.S. corporate bond spreads are tight, absolute yield levels are reasonable due to higher U.S. Treasury yields than most of the post GFC period. The main risk remains of a U.S. recession, though economic data is more consistent with a soft landing and we have reduced the prob

November 24, 2025

Japan Aging: Consumption Lessons for Eurozone/China?

November 24, 2025 10:55 AM UTC

· China will likely suffer slowing consumption from population aging in the coming years, as consumption per head falls for over 55’s and large scale immigration is not a likelihood. China’s household wealth is also heavily concentrated in falling illiquid residential property. Chin

November 21, 2025

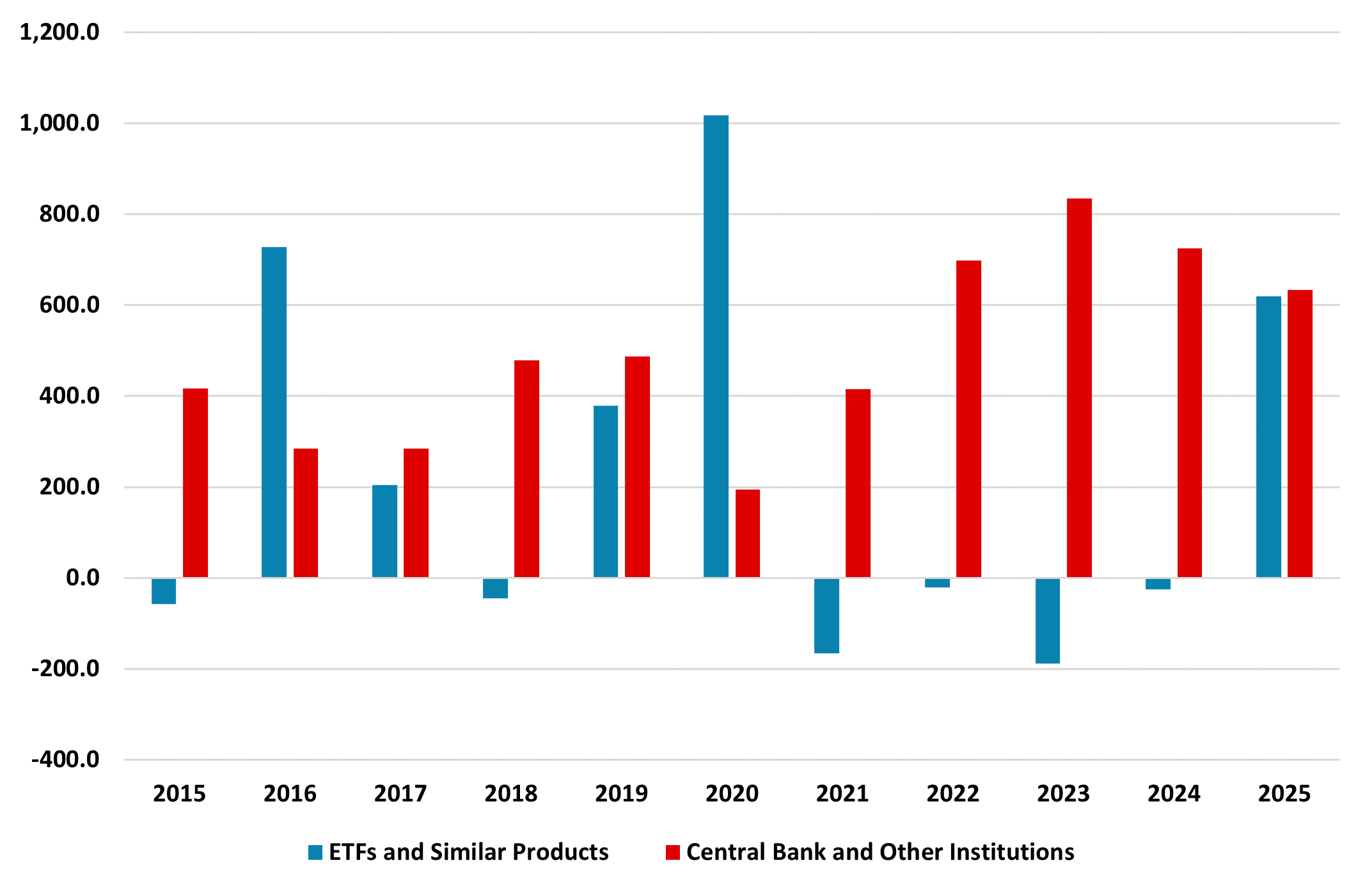

U.S. Asset Inflows After April’s Trump Tariffs

November 21, 2025 8:00 AM UTC

· Net foreign portfolio inflows have not been hurt by Trump’s April tariff drama, with the AI and tech boom attracting new equity inflows. Flows could become more volatile with a U.S. equity bear market or recession, but these are modest risk alternative scenarios rather than high r

November 20, 2025

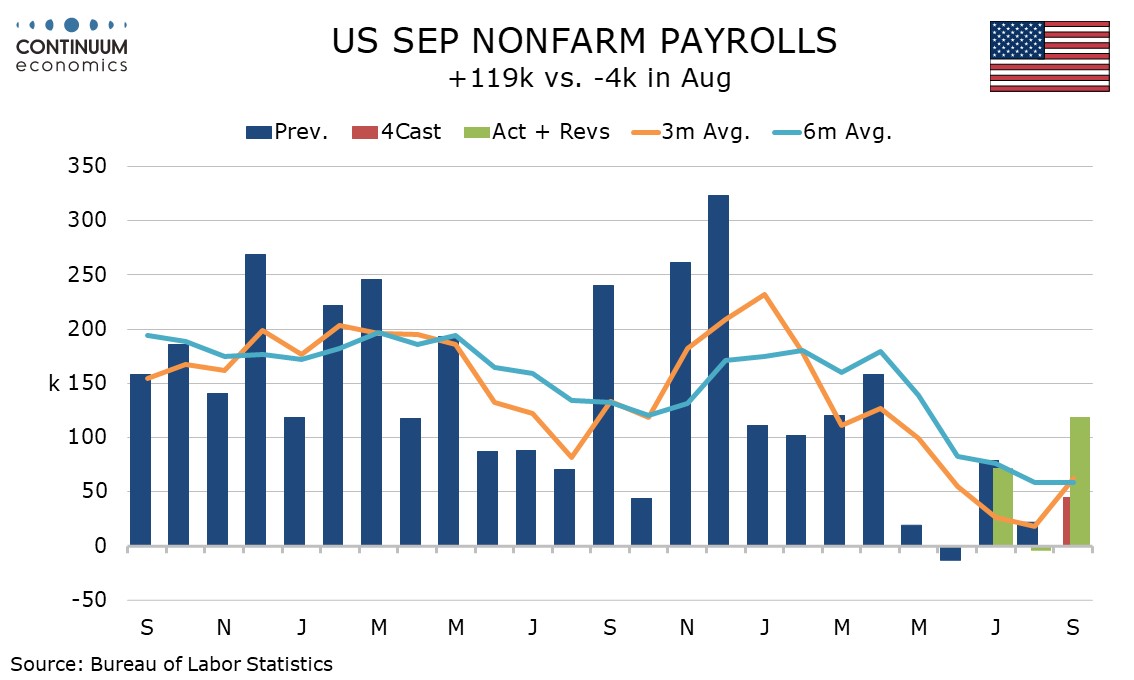

U.S. September Employment - Case for a December easing looks a little weaker

November 20, 2025 2:04 PM UTC

September’s non-farm payroll will be the last released before the December 10 FOMC meeting and is surprisingly firm at 119k, albeit with 33k in negative revisions. A rise in unemployment to 4.4% from 4.3% and a 0.2% rise in average hourly earnings provide only marginal offsets to the headline. Nov

November 19, 2025

Preview: Due November 20 - U.S. September Employment (Non-Farm Payrolls) - Still subdued, but slightly stronger than in August

November 19, 2025 2:38 PM UTC

We expect September’s non-farm payroll, delayed from October 3, to show another subdued rise, of 45k, with 50k in the private sector, but marginally stronger than July’s respective gains of 22k and 38k. We expect unemployment to slip to 4.2% from 4.3% on a fall in the labor force, while averag

November 18, 2025

Markets 2026

November 18, 2025 10:30 AM UTC

· The Fed, ECB and BOE will likely drive further 10-2yr government bond yield curve steepening, with 10yr Bund yields rising due to ECB QT and German fiscal expansion. 10yr JGB yields are set to surge through 2%, as BOJ QT remains excessive and underestimated. The BOJ could partiall

November 13, 2025

Japan/China Tensions Over Taiwan

November 13, 2025 10:45 AM UTC

China wants to make Japan cautious about helping the U.S. in future military scenarios. With PM Takaichi tougher stance, China could decide to escalate tensions to reduce the risk of Japan becoming involved in future years. This could be restrictions of some critical minerals from China to Japan

November 12, 2025

UK Gilts: Fiscal, Politics and BOE

November 12, 2025 9:55 AM UTC

· 2yr Gilt yields have scope to fall through 2026, as we see growth and inflation slowing more than the BOE and this will likely see the MPC changing view and cutting policy rates to 3.25% in H1 2026. Though a pause could then be seen, we see one final BOE cut then being delivered to

November 11, 2025

EZ Rates: 2026 ECB Easing But 2027 French Crisis?

November 11, 2025 9:45 AM UTC

· Financial conditions are tighter than suggested by a 2% ECB depo rate, which will both dampen an EZ economic pick-up and cause further disinflation. We see the ECB delivering two further 25bps cuts to a 1.5% ECB depo rate, which can mean a further decline in 2yr Bund yields. Howev

November 06, 2025

U.S. Equities: Smaller Correction But Still Overvalued

November 6, 2025 10:25 AM UTC

· We are revising up our end 2025 S&P500 forecast from 6000 to 6500 for a number of reasons. Private sector data shows the risk of a U.S. hard landing is lower than a couple of months ago, with economic data more consistent with a soft landing. Additionally, the tech/AI optimism has n

November 05, 2025

Japan: Not Abenomics 2

November 5, 2025 10:30 AM UTC

· While some fiscal stimulus into 2026 is likely from the new PM Takaichi, this is unlikely to be aggressive given the JGB supply pressures and the need for support from other parties in passing fiscal measures. A return to QE (2nd arrow of Abenomics) is highly unlikely, with the BOJ

November 04, 2025

Preview: U.S. October CPI - An important number that may never be seen

November 4, 2025 3:59 PM UTC

October US CPI, while scheduled on November 13, may never be released even if the government shutdown is resolved, given lack of data collection during the month of October. However what the number would have been does matter. Our forecast is for a 0.2% increase overall, with a 0.3% rise ex food a

U.S. Treasuries: Waiting for Data and Yield Curve Steepening

November 4, 2025 1:57 PM UTC

• Multi quarter we still look for 75bps of further Fed easing by end 2026, which will likely initially bring 2yr yields down to 3.4%. However, once the Fed Funds rate get closer to 3.0-3.25% and the slowdown turns into a soft landing, the 2yr will likely move to a premium versus Fed Funds

October 29, 2025

FOMC - Strong Differences of Opinion Leave December Decision Dependent on Incoming Information

October 29, 2025 7:58 PM UTC

After a statement that contained no major surprises, the highlight of FOMC Chairman Jerome Powell’s press conference was his comment that there were strong differences on policy going forward, and that a December ease was far from assured. While we still feel that on balance easing in December is

FOMC eases by 25bps, to conclude quantitative tightening on December 1

October 29, 2025 6:21 PM UTC

The FOMC has eased rates by 25bps to a 3.75%-4.00% range as expected and decided to conclude the reduction of its securities holdings on December 1 as Chairman Powell had hinted at on October 14. There were two dissents, Governor Miran favoring a 50bps move and Kansas City Fed’s Schmid delivering

October 24, 2025

U.S. September CPI - Soft enough for an October FOMC easing but still above target

October 24, 2025 12:58 PM UTC

September CPI is on the low side of expectations at 0.3% overall, 0.2% ex food and energy, and should not pose an obstacle to a likely 25bps easing at the October 29 FOMC meeting. The core rate was up by 0.23% before rounding, slower than July and August gains that rise by more than 0.3% before roun

October 23, 2025

Preview: Due October 24 - U.S. September CPI - Firm but a little less so in core rate

October 23, 2025 1:07 PM UTC

While the government shutdown continues with no sign of a near term deal, September’s US CPI, originally scheduled for October 15, will be released on October 24. The release was considered essential as it is needed for annual cost of living adjustments to Social Security benefits. It is however p

October 13, 2025

Preview: Due October 24 (even if shutdown continues) - U.S. September CPI - Firm but a little less so in core rate

October 13, 2025 1:58 PM UTC

While the government shutdown continues with no sign of a near term deal, September’s US CPI, originally scheduled for October 15, will be released on October 24 even if the shutdown continues through then. The release was considered essential as it is needed for annual cost of living adjustments

October 06, 2025

U.S. Q3 GDP heading for a rise of 2.3%, led by consumer spending and business investment

October 6, 2025 3:23 PM UTC

With the US government shutdown not looking set for a quick resolution, it is a good time to take a fresh look at Q3 GDP, which is scheduled for October 30, the day after the FOMC next meets, though the release could be delayed even if the shutdown is over by then. We now look for an increase of 2.3

October 02, 2025

DM Central Banks: Wider-Ranging Conditions More Than Neutral Rates

October 2, 2025 6:55 AM UTC

· Neutral policy rate estimates and forward guidance provide some help at the start of easing cycles, but less so at mid to mature stages. For the Fed, ECB and BOE we look at a wider array of economic and financial conditions, alongside our own projections over the next 2 years to m

October 01, 2025

Preview: Due October 15 (dependent on shutdown ending) - U.S. September CPI - Firm but a little less so in core rate

October 1, 2025 6:29 PM UTC

We expect September CPI to increase by 0.4% overall and by 0.3% ex food and energy, matching August’s outcomes after rounding, though before rounding we expect overall CPI to be rounded down from 0.425%, and the core rate to be rounded up from 0.28%, contrasting August data when headline CPI was r

AI/Humanoid Robots and Disinflation?

October 1, 2025 9:40 AM UTC

· Overall, a number of forces from the AI wave will impact inflation. Power demand could push up power prices, but productivity enhancements and product innovation could be disinflationary like Information and Communications technology (ICT). One other key uncertainty on a 1-5 year