AI and U.S. Productivity

· Structural labor and overall productivity will be boosted if current AI adoption is sustained at a pace quicker than the adoption of the internet. However, not all areas of the U.S. economy are exposed to AI benefits, as manual work can only be replaced by humanoid robots with major advances in robotics and battery life. Some structural benefits will likely start to come through in the next few years, but the main benefit will likely come in the 2030’s. However, cyclical productivity could be boosted by the AI build out boom in semiconductor chips and data centers due in the 2026-30 period in the U.S.

Estimates of the structural boost to overall U.S. productivity from AI in 10 years are centred around 0.25-1.3%, but what are the forces and will some of this be seen?

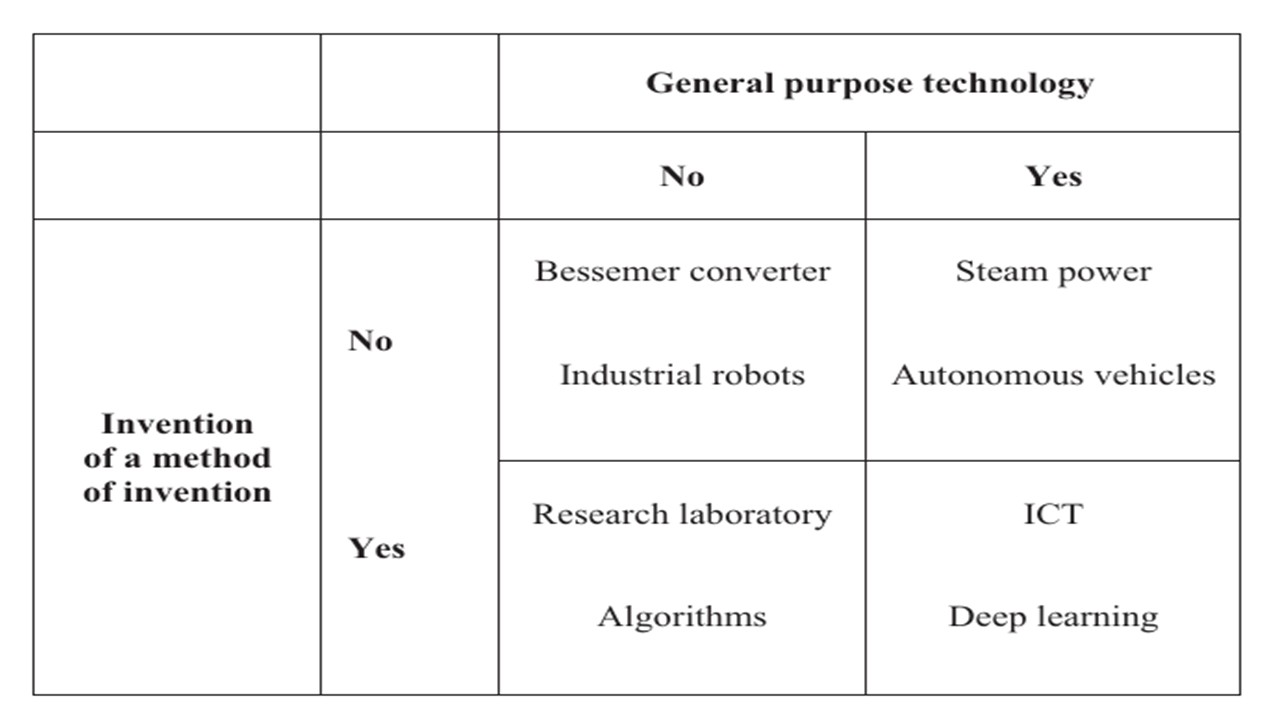

Figure 1: General Purpose Technology and Invention

Source: Crafts 2021 (here)

AI will have an impact in boosting productivity, but debate among economists varies significantly over the next 5-10 years. Optimists see all the waves of AI advances coming early and in close proximity to each other, while other caution that AI waves can vary over time. Two different waves are AI as a general purpose technology (GPT) and then separately as a method of invention (Figure 1). The first wave includes existing chat GPT services and enterprise AI LLM models, as well as the new agentic AI models. If AI can also quickly invent fundamentally new services and product breakthrough, then a 2nd wave of invention benefit can occur. However, most experts feel that the latter will lag adoption of AI as a general purpose technology, given previous experience and also as Advanced General Intelligence (AGI) could be required to produce a watershed in invention (scientists estimates on AGI vary from 2 to 30 years from 2026).

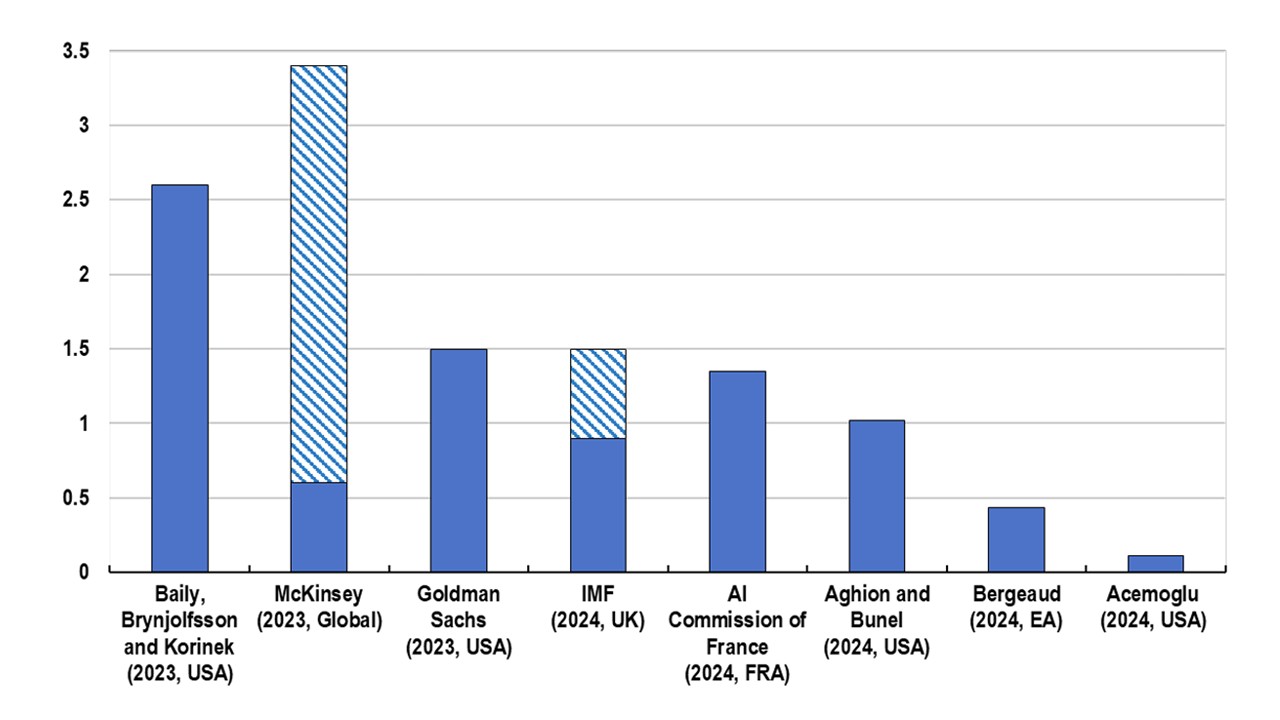

It typically takes time before a GPT has a substantial impact on productivity. The technology improves, complementary investments and innovations are made, businesses are re-organized, and learning accrues. Economists’ projections on the impact of AI over the next 10 year vary significantly (Figure 2). One reason is different forecasts on the proportion of the economy that is exposed to AI, with optimists arguing around 50% of the U.S. economy and OECD/others at 35%. Manual labor needs not only AI, but also major advances in robotics/battery life to ensure wider exposure to AI in the economy. The major issues for robotics are short daily battery life, high cost and insufficient dexterity of humanoid robots for manual mining/construction/manufacturing and service jobs (fixed placed industrial robots are different). Prospects for AI in computer programming/finance/professional business services can thus not be extrapolated across the economy. Most experts do not see widespread adoption of humanoid robots until the mid-2035’s (Mc Kinsey (here), which promises a 2nd wave of productivity boost in the 2035-45 period but not 2026-30. Concept humanoid robots are exciting, but the implemention phase will likely be long.

Figure 2: Predicted Increase in Annual Labour Productivity Growth over a 10-year Horizon Due to AI (%)

Source: OECD 2024 (here)

The 2nd difference among economists is the adoption rate of AI over the 10 year period from 2022 and the Chat GPT breakthrough. Optimists assume 50% adoption by exposed sectors but most mainstream economists assume 30-35%, given the adoption rates for ICT and the internet. Anecdotal evidence suggest that U.S. company adoption is surging at a faster pace than internet adoption (here), which could mean earlier benefit and larger adoption rates. The OECD in 2024 estimated a 0.6-0.9% per annum boost to labor productivity over a 10yr period for the U.S. and lower for other DM economies, with whole economy at a slower pace of 0.25-0.6%.

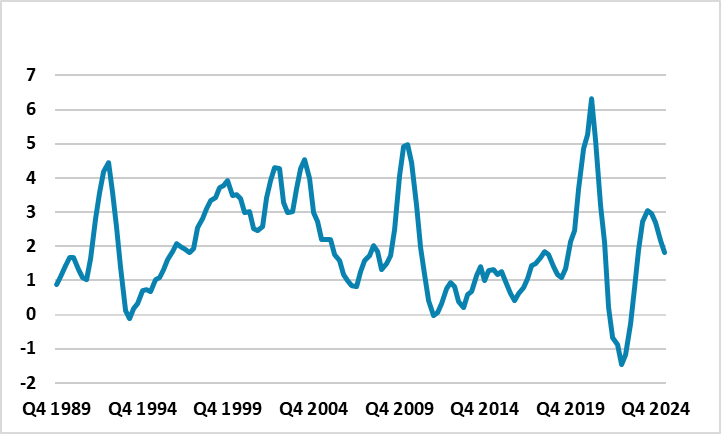

Actual U.S. productivity has already started to pick-up (Figure 3) from the lacklustre rates seen after the GFC. It is probably too early for AI services to be structurally lifting productivity, as we are still in an early phase of full adoption of Enterprise and Agentic AI. However, cyclical productivity could have been helped by the AI enablers boom (semiconductors/data centers and enterprise AI investment and production). Fed chair Powell also noted that the productivity pick-up could be related to the boost to technology usage caused by the 2020-21 COVID pandemic, rather than AI.

Actual cyclical U.S. productivity will likely benefit further from the AI enablers boom in 2026-30, but this is not the same as a structural lift to productivity that boost trend growth. The finances of the major tech companies are strong enough to sustain the projection of continued strong growth in semiconductors/other hardware, enterprise AI and data centers. However, some of the model and application AI companies are more dependent on outside finance and could be overvalued (here), but this is unlikely to significantly curtail the AI build out phase in 2026-27. The outlook for 2028-30 depends on AI application revenue growing exponentially and disappointment could slow the AI build out and cyclical productivity. However, this could cause some confusion and arguments, as some could claim that the AI boom is already structurally lifting productivity e.g. Kevin Hassett CEA and potential Fed chair, rather than it being a cyclical boost.

Figure 3: Output Per Hour Non-Farm Sector (%)

Source: Datastream/Continuum Economics

Economists, fund managers and central bankers can look at a number of issues to watch for AI boosting labor productivity and the impact of overall productivity and trend GDP.

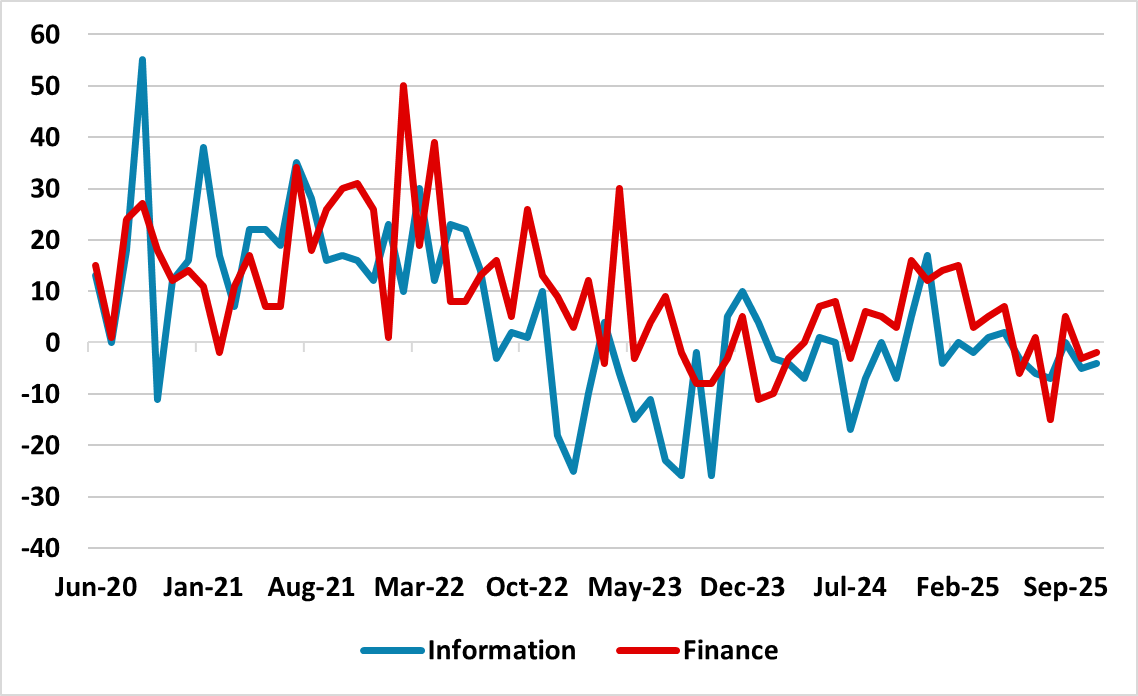

· AI adoption/jobs key sectors and watershed moments. Economists should take an eclectic view looking at incoming data on AI adoption rates (companies optimism versus and daily intense usage). Secondly, net employment changes in finance/information technology and professional services in the NFP numbers could provide some understanding of the effects of AI automation on employment (though general economic conditions will also have an impact). Recent data suggests that this trend is not yet leading to large scale net job losses (Figure 4). Thirdly, an AI watershed moment could occur that accelerates AI investment and adoption trends. However, this is unlikely to be AGI arriving with optimists saying this is still 2-3 years away and pessimists saying it is 20-30 years away. Technolgists are focused on voice activated AI or agentic AI to potentially produce a watershed moment.

Figure 4: Change in Monthly Employment Finance and Information (%)

Source: BLS/Continuum Economics

· Fully autonomous vehicles usage can ramp up and eventually replace blue collar drivers, though adoption has been small rather than rapid. Autonomous level 4 taxis are starting to appear in the U.S., but level 5 is not yet ready for adoption and rollout. China has seen a surge in level 4 taxis, but profitability is dented by high running costs. Most experts feel that full autonomous vehicles are a 2030-45 story. AI non-humanoid robots could be scaled up in a manufacturing setting however, where the cost savings could be large enough. It is worth noting that China uses of robots in manufacturing has surged in recent years to overtake Japan’s intensity of usage and come close to S Korea high levels. These trends need to be watched.

What does this mean for overall productivity growth and trend GDP? The San Francisco Fed has estimates that the boost in 10yr overall productivity increase will be between 0.7-1.3% of GDP (here). Some of the labor market productivity estimates in Figure 2 are consistent with that, as economists rescale labor productivity into lower total productivity estimates. The OCED though is lower at 0.25-0.6% per annum for overall productivity. Meanwhile, the effect of trend GDP is also impacted by other influences, such as the U.S. slowdown in population and immigration that will be a headwind to trend growth.