EM FX Outlook: High Real Yields Still Help

• EM currency 2026 prospects come against a backdrop of a further but slower USD depreciation against DM currencies, but inflation differentials, domestic central bank policy and politics also matter. We forecast the Mexican Peso (MXN) will likely be more volatile, as President Donald Trump wants to renegotiate USMCA. This will drag on throughout 2026 and a deal may only be reached in 2027 (here). In contrast the Brazilian Real (BRL) has already seen a correction and has scope to 5.20 v USD after the October 2026 presidential election.

• In Asia, the Chinese Yuan (CNY) will gain some marginal ground versus the USD, but will likely be strongly restrained by China’s authorities desire to maintain competitiveness. The Indonesian Rupiah (IDR) is undervalued and has scope for modest gains. Other EM currencies will be mixed versus the USD on a spot basis, though the Turkish Lira (TRL) will fall given the still high inflation.

• On a total return basis over the next 12 months, BRL stands out due to the prospect of still very wide interest rate differentials. The TRL will attract carry trades also, but will likely be more volatile. The CNY will likely still see negative total returns versus the USD (Figure 1), as interest rate differentials will remain adverse.

Figure 1: 12mth Total Returns Versus the USD (%)

Asia

2026 will likely be choppy but restrained on USDCNY. The USD remains overvalued across the board and will likely see losses against DM currencies, which will help CNY sentiment. Due to low inflation the CNY has depreciated in real terms in the last few years and the trade surplus is now 5% of GDP, which has prompted the IMF to recently call for a rebalancing away from exports via a Yuan appreciation. However, despite further Fed cuts, money and bond yield spreads remain adverse for the CNY (Figure 1), though the impact is lessened somewhat by capital controls. Perhaps most important is the desire of China authorities. Though a softer USD could build pressure for a test of 7.00 on USDCNY, China will likely be reluctant to allow this to break and we would expect verbal and then actual intervention. Though China will maintain a good current account surplus, the trade truce with the U.S. still leaves effective tariffs hurting exports to the U.S. China cannot be confident of redirecting exports to other countries and thus will likely want to avoid making the export situation worse by allowing CNY appreciation and then the market targeting 6.70 on USDCNY! A comprehensive trade deal with the U.S. may ease these export concerns, but this is only a 30% probability event in 2026. China will resist via FX intervention and at times this could be strong. Thus we see USDCNY boxed in for 2026 and forecast 7.10 for end 2026.

Figure 2: USDCNY and 2yr China-U.S. Government Bond Spread (%)

Source: Datastream/Continuum Economics

2027 is unlikely to bring a comprehensive trade deal. While we do not expect an invasion or blockade of Taiwan in 2027 (here), grey warfare could raise tensions and this should restrain the CNY – invasion/blockade would likely trigger sanctions from the West and could cause a war with the U.S., which would severely hurt China non-military economy. We see USDCNY at 7.10 by end 2027.

We expect a mixed picture across other Asian currencies through 2026, with divergent fundamentals. The Indian rupee (INR) is forecast to depreciate to 90.8 on USD/INR by end-2026 and 91.5 by end-2027, reflecting sustained portfolio outflows amid renewed foreign interest in China and South Korea tech; a dovish RBI governor willing to tolerate currency softness and downward pressure from lower domestic rates. While the RBI will step in to prevent disorderly moves, it is unlikely to resist a gradual move that supports exports, particularly in the absence of a US-India trade deal. For Indonesia, we see the IDR settling at 16,450 v USD by end-2026, with a modest recovery to 16,000 on USD/IDR by end-2027, constrained by cautious Fed easing in 2026 and a pause in 2027 and also investor concerns over President Prabowo’s fiscal plans. Even so, the IDR is undervalued against the USD and we see IDR gains in 2027. In contrast, the Malaysian ringgit (MYR)—which has already rebounded sharply in 2025 on AI and semiconductor tailwinds—will remain supported by strong trade fundamentals and a current account surplus. We forecast 4.10 on USD/MYR by end-2026 and a further appreciation to 4.05 by end-2027 as global trade uncertainty eases and Malaysia consolidates its gains in the high-tech manufacturing cycle.

LatAm

BRL and MXN have seen strong recoveries against the USD in 2025, but how much further can this go into 2026?

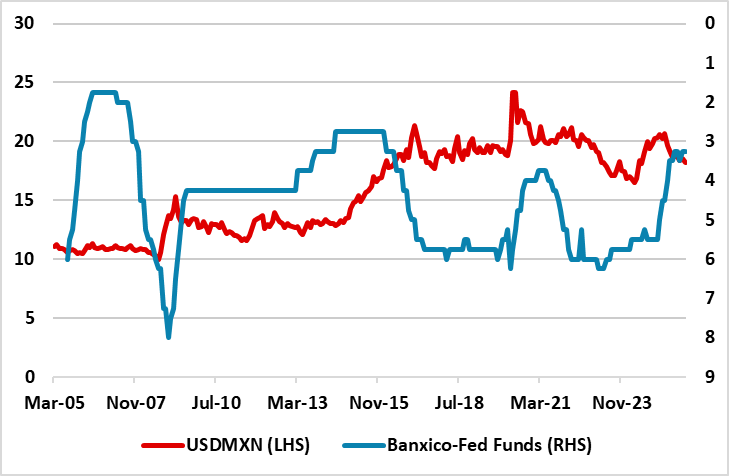

The MXN will be in the spotlight, as President Donald Trump wants to renegotiate USMCA in 2026, which will deepen the trade drama at times in 2026 (here). A renegotiation will be problematic, but we feel that Mexico sees the big picture and will concede to keep most exports going to the U.S., but agreement may not be reached until late 2026 or 2027! This could mean a choppy and weaker MXN in H1 2026. The gap between the Banxico and Fed policy rate is also now getting narrow (Figure 3), which can encourage a correction after 2025 gains. Furthermore, the real effective exchange rate for MXN remains above the 10yr average in contrast to the BRL picture. Finally, the MXN saw little benefit from the major USD downtrend 2002-08. We could push to 19.0 on USDMXN. H2 could see some support for the MXN, as Banxico stops easing and the Fed continues down to 3.00-3.25%. Thus we see a recovery in the MXN in H2 2026, but only to 18.8 on USDMXN. 2027 will likely be better, with the odds of a revised USMCA being delivered by then high and reducing multi-year trade concerns. This can help MXN appreciate to 18.5.

Figure 3: Mexico Exchange Rate and Policy Rate Differentials (Level and %)  Source: Datastream and Continuum Economics

Source: Datastream and Continuum Economics

BRL has already seen a correction in Q4 2025 and now should stabilises ahead of the October 2026 presidential elections, which will likely see a runoff between Lula and Freitas (an ex Bolsonaro minister here). With tight opinion polls the risk is for pre-election fiscal slippage and this could stop the BRL rebounding. However, global investors are not concerned provided worst case fiscal situations do not play out and they are more focused on the still large carry and bond yield differentials versus the U.S. When the USD saw a multi-year downtrend in 2002-08, the BRL appreciated significantly against the USD. The U.S. tariffs on Brazil do not change this picture due to exemptions and the modest percentage of exports going to the U.S. The BRL real effective exchange rate is still below the 10yr average. H2 will likely see a pause around the election and will have different outcomes depending on who is the victor, but our baseline for now is 5.20 for end 2026 – a Freitas victory could see a test of 5.00. BCB easing in 2026 will likely only be moderate rather than aggressive and we look for 300bps of cuts to a still high 12.0% Selic rate. 2027 will likely see more BCB cuts to 9.50%, but then lower short and long-term yields help reduce government debt servicing and we would also see some fiscal consolidation. This can keep the BRL underpinned and we forecast 5.20 for end 2027.

EMEA

EMEA currencies will continue to be divergent depending on inflation and interest rate differentials in 2026. We expect the downward pressure will remain for TRY and RUB as inflation differentials remain large versus the U.S., despite inflation easing moderately in both countries following previous aggressive monetary tightening. We envisage RUB would remain volatile in 2026 since inflationary pressures won’t likely soften as quickly as CBR expects coupled with foreign capital inflows remaining weak until sanctions are lifted and global investor confidence in Russia rebuilds. Macroeconomic instability will remain substantial unless the Ukraine war comes to an end. (Note: Our baseline view in Ukraine is Trump’s latest peace proposal will likely be used as a starting point turning into a Russia-friendly peace deal (70% probability) late 2026/early 2027 or war dragging into 2027 (30% probability)). RUB will still be falling on a spot basis in 2026 due to inflation differentials and our end year USD/RUB rate predictions are at 90 and 93 for 2026 and 2027, respectively. (Note: If sanctions are lifted with pace in 2027 after Ukraine war ends, this could mean less RUB depreciation than our central scenario, but still unlikely since we think global investors will be cautious even the war ends).

When it comes to TRY, we continue to see losses for TRY in 2026 as inflation remains much higher than Turkiye’s main trading partners, the current account deficit is large and foreign capital inflows are weaker-than-expected. The arrest of opposition mayors, loss in investor confidence and stubborn services inflation continue to risk the disinflationary process (here). In 2026, TRY will still be falling on a spot basis but at a slower pace than the interest rate differentials against the USD, since we expect CBRT will continue its cutting cycle in 2026, but at a cautious pace due to stickiness in inflation and domestic risks. Our prediction for the USD/TRY rate stands at 48 by the end of 2026, and 52 for end 2027. (Note: sticky inflation could stay above expectations due to stubborn food and services prices, which would mean more TRY depreciation than our central scenario, likely pushing the rate over 50 for end-2026).

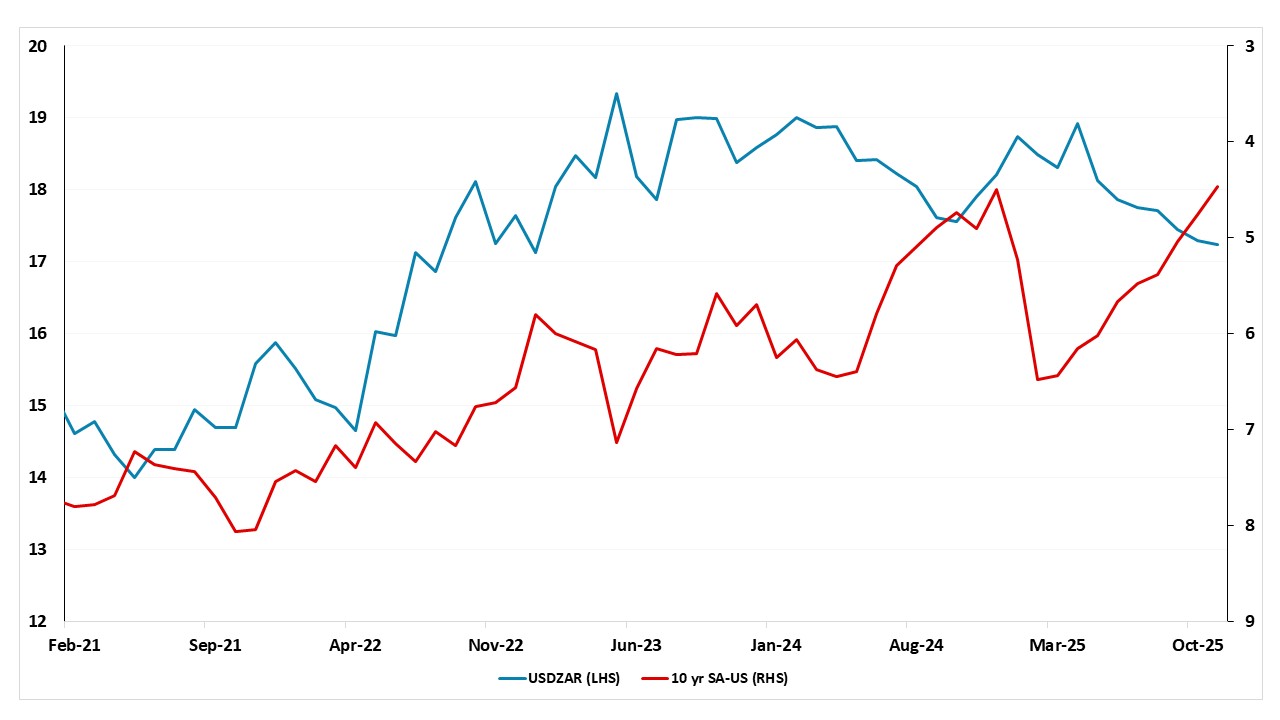

Turning to South Africa, despite SARB continued its cutting cycle in H2, stronger ZAR, and few power cuts in H2, we foresee cautious and data-dependent SARB will likely try to bring inflation down to new 3% anchor. This will mean SARB goes on hold and assess the impact of earlier cuts before continuing its easing cycle in 2026, which will match the Fed pause. Even so, we forecast inflation is set to move closer to 4% in H1, which could pressurize ZAR. On the ZAR upside, if Trump relents on tariffs, power cuts continue to be managed, and a decline in oil prices in 2026 in line with our forecasts, we are likely to see a more risk positive picture emerging with ZAR in 2026. However, 10yr yield spread are now much narrower (Figure 4) and this will likely slow portfolio inflows and mean a weaker ZAR in 2026. Under current circumstances, our end year USD/ZAR rate prediction stand at 17.4 for 2026, and 17.6 for 2027.

Figure 4: USD/ZAR Rate and 10yr South Africa-U.S. Government Bond Yield (%)