Preview: Due December 18 - U.S. November CPI - A two month change with October canceled

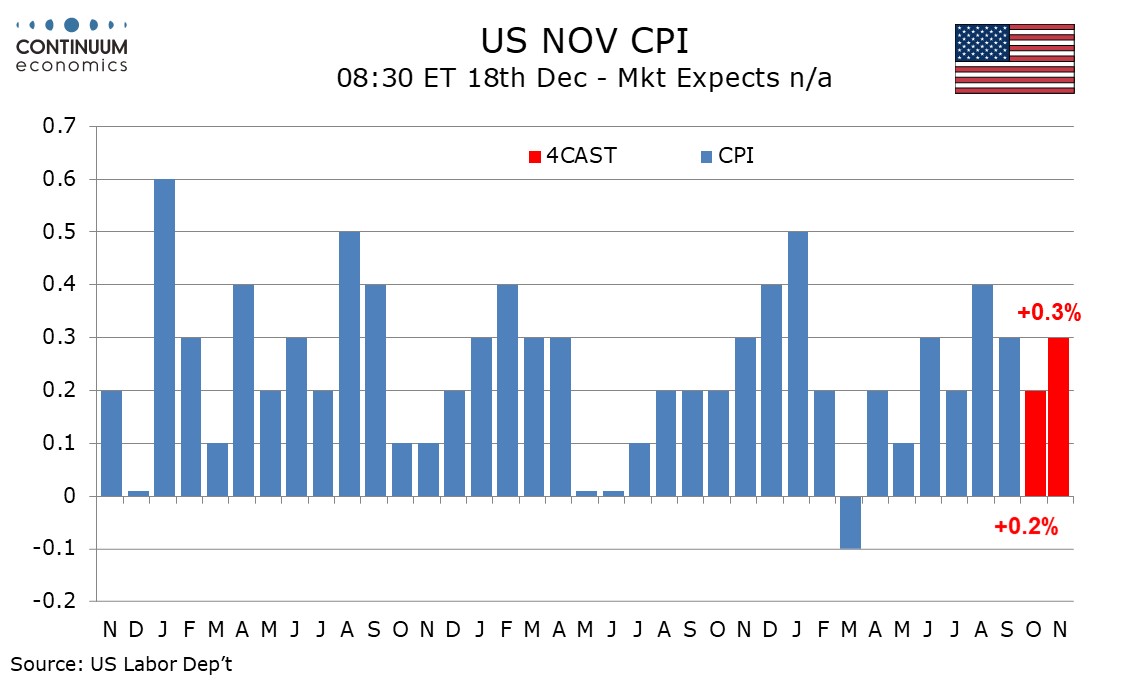

The labor market will not publish monthly changes for each month so it is the two monthly change that will be published, we expect 0.49% for overall CPI, assuming October at 0.16% and November at 0.33%, and the core rate up by 0.53% over the two months. Gasoline prices are likely to dip in October but reverse higher in November. We expect food to rise by 0.3% in October and 0.2% in November.

The labor market will not publish monthly changes for each month so it is the two monthly change that will be published, we expect 0.49% for overall CPI, assuming October at 0.16% and November at 0.33%, and the core rate up by 0.53% over the two months. Gasoline prices are likely to dip in October but reverse higher in November. We expect food to rise by 0.3% in October and 0.2% in November.

Gains of 0.26% ex food and energy would be stronger than September’s 0.23% but below July and August which we both rounded down to 0.3%. The Q3 average change in the core rate was 0.30%, so our forecast assumes some loss of momentum in Q4 relative to Q3. This will be in part of a fading impact from tariffs, though the impact is unlikely to be done until early 2026. A component to watch will be owners’ equivalent recent, which was below trend at 0.1% in September. This is probably corrective from a strong 0.4% in August though Fed’s Miran has been justifying a dovish view on an expectation that this sector is poised to slow.

Within the core rate breakdown we expect a slightly stronger tariff lift on October than November but this could be balanced by the government shutdown restraining prices in October more than in November. We also expect used autos to be stronger in November than October. Published data will not however provide separate changes for October and November. Our forecasts imply yr/yr growth of 3.0% both overall in October and November, both matching their September outcomes, though only November will see yr/yr rates published.