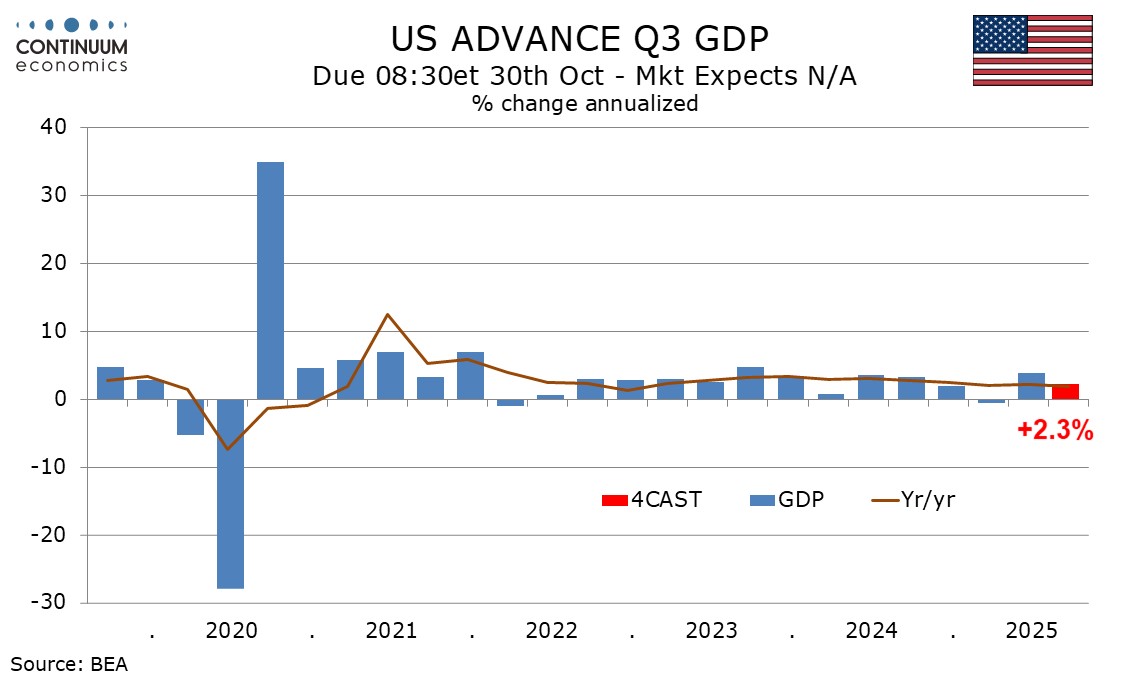

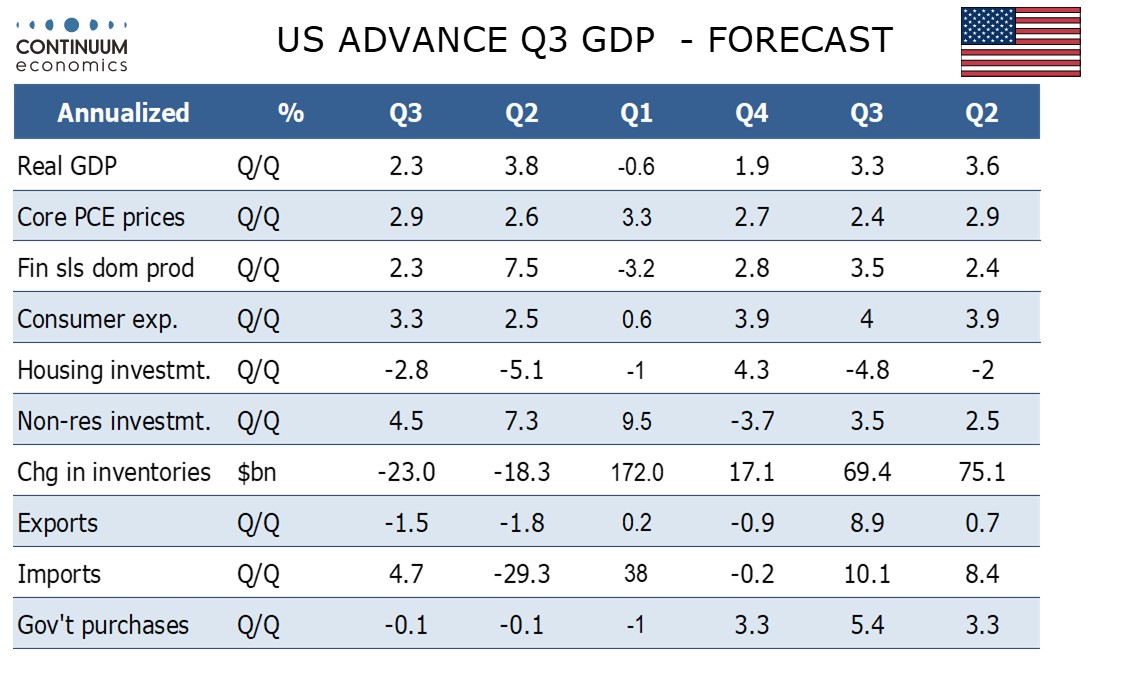

U.S. Q3 GDP heading for a rise of 2.3%, led by consumer spending and business investment

With the US government shutdown not looking set for a quick resolution, it is a good time to take a fresh look at Q3 GDP, which is scheduled for October 30, the day after the FOMC next meets, though the release could be delayed even if the shutdown is over by then. We now look for an increase of 2.3%, a significant upward revision for a 1.2% forecast made with our quarterly outlook, though still weaker than a 3.8% estimate coming from the Atlanta Fed.

Since we published our quarterly outlook we have seen an upward revision to Q2 GDP with generally constructive implications for Q3, as well as stronger than expected August data for the trade balance, durable goods orders and new home sales.

The Q2 GDP revisions were particularly strong for consumer spending, which appears to have accelerated further in Q3, even when assuming that September’s increase in real terms at 0.2% will be slower than 0.4% gains seen in July and August. This would leave consumer spending up by 3.3% in Q3, though with real disposable income heading for a weak rise of only 0.2%, strength in Q3 consumer spending may be difficult to sustain in Q4.

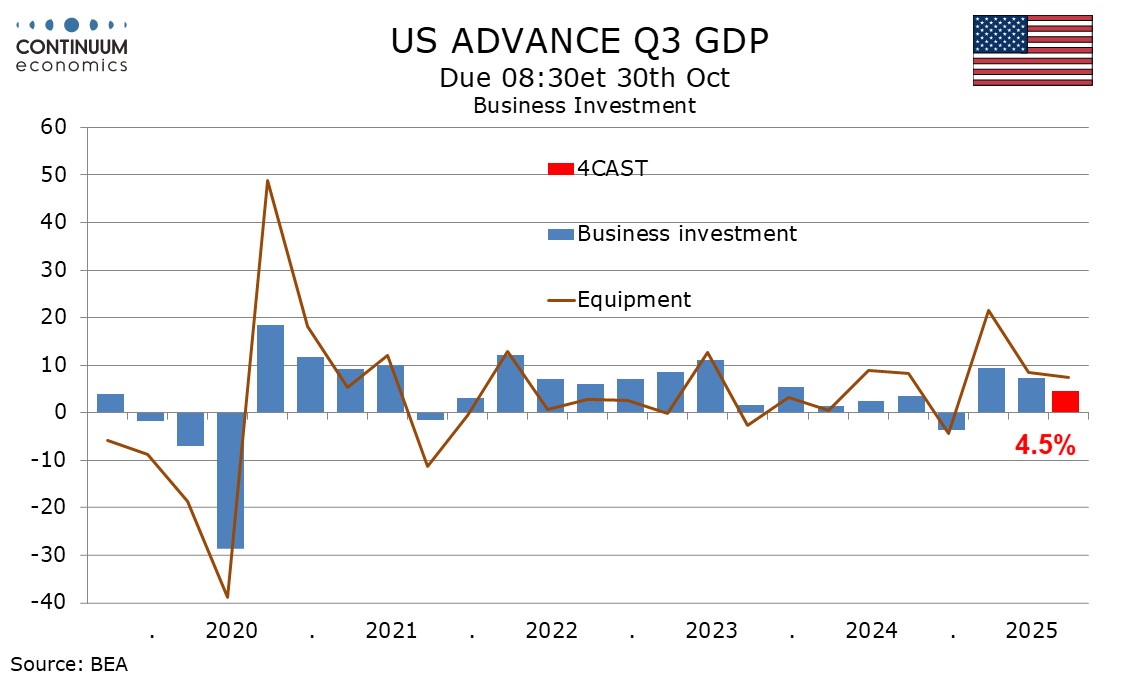

We expect a 4.5% increase in business investment, with continued strength in the AI-fueled intellectual property and equipment, but increasing weakness in structures. We expect housing investment to fall by 2.8%, a third straight decline but less negative than Q2’s -5.1%. For government we expect a second straight marginal 0.1% decline, with Federal spending less negative but state and local less positive.

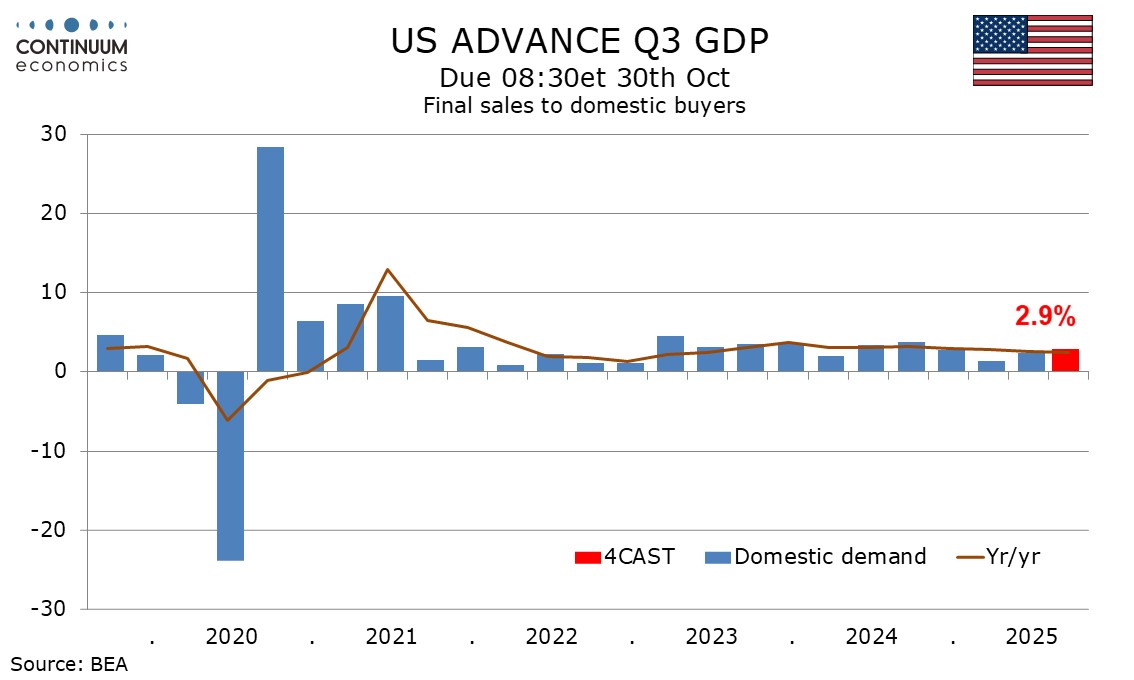

This would leave final sales to domestic buyers (GDP less inventories and net exports) up by 2.9%, stronger than Q2’s 2.4% and Q1’s 1.4%. We expect final sales (GDP less inventories) to rise by 2.3%, matching GDP, with inventories seeing a similar decline to Q2’s modest correction from a strong Q1 build up.

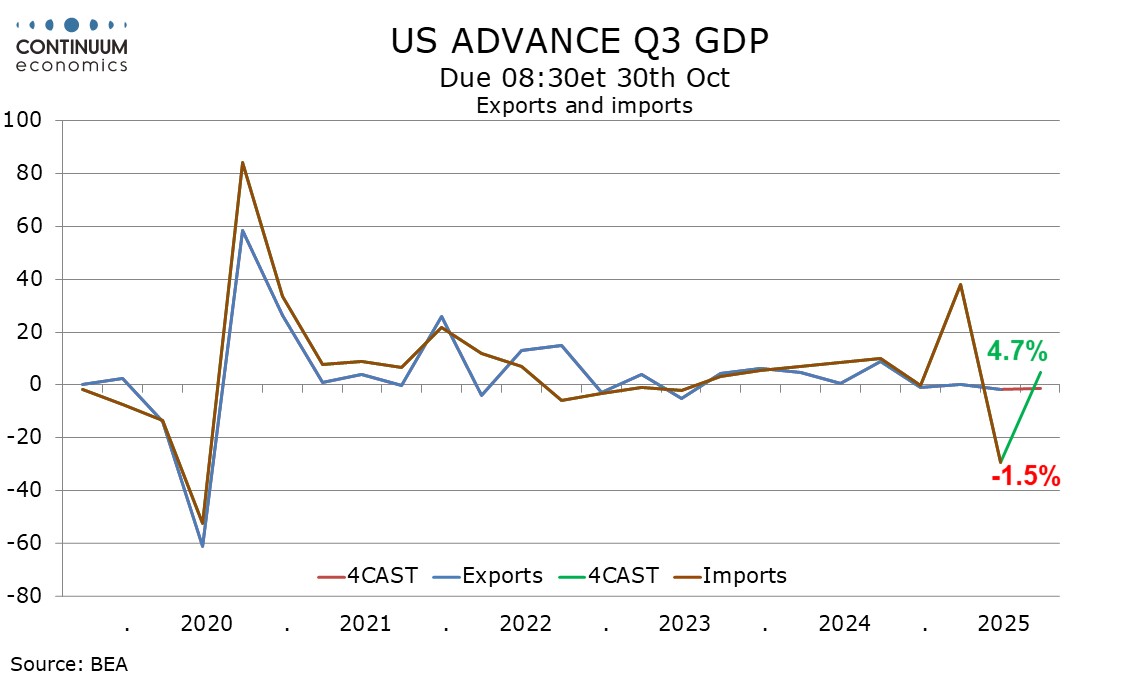

We expect a negative contribution of 0.6% from net exports, even when assuming a September trade deficit closer to August’s narrower deficit than July’s wider one. August’s deficit in real terms was still wider than the Q2 average, which fell sharply after a pre-tariff surge in Q1. In Q3 we expect a 1.5% decline in exports and a 4.7% rise in imports, the latter supported by reduced tensions with China.

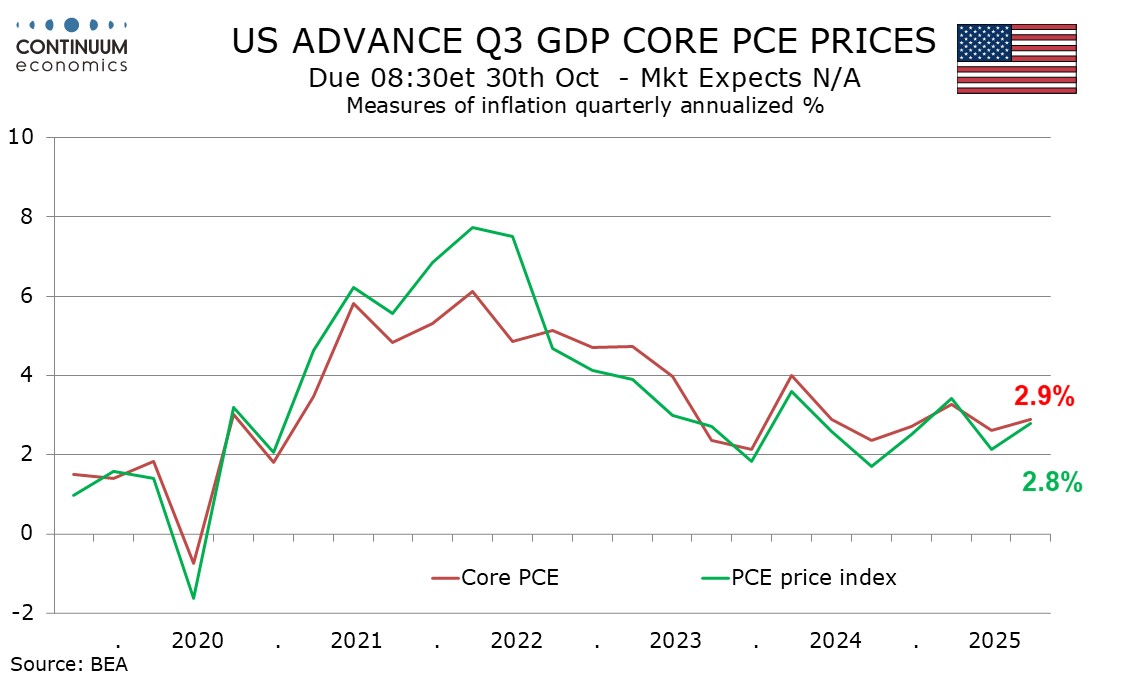

Prices appear to be regaining some momentum, even if the feed through from tariffs remains modest. We expect a 2.9% increase in the Q3 core PCE price index. This would be up from 2.6% in Q2 but would match the yr/yr pace. We expect overall PCE prices to rise by a similar 2.8% in Q3, and by 2.7% yr/yr.