U.S. September CPI - Soft enough for an October FOMC easing but still above target

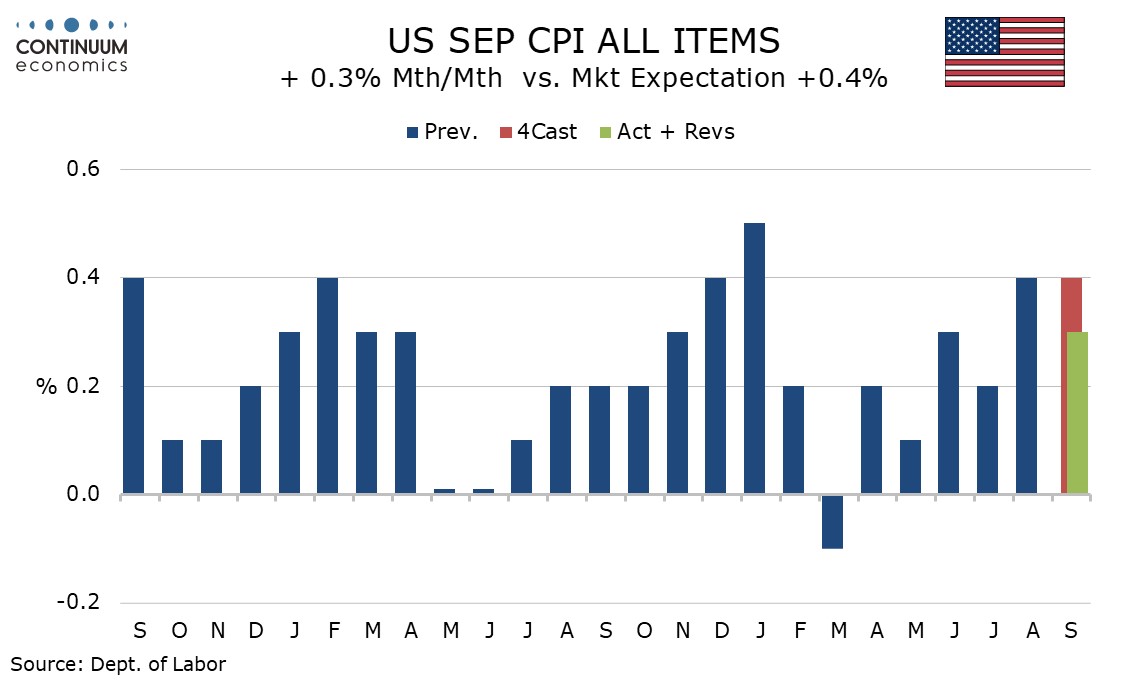

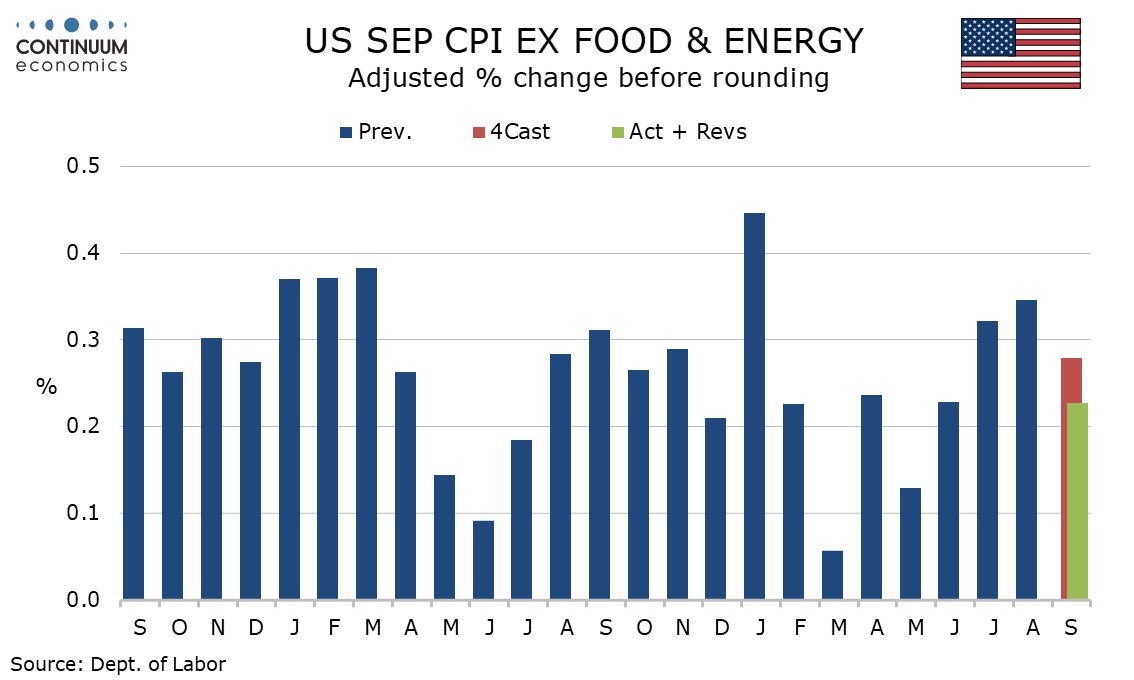

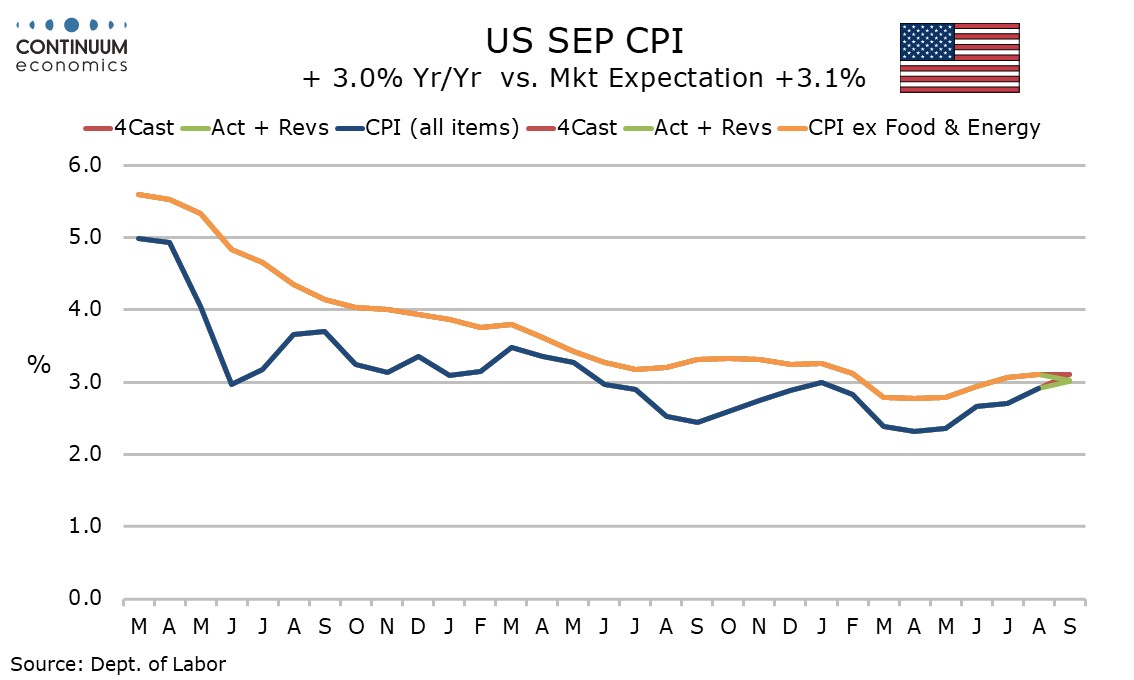

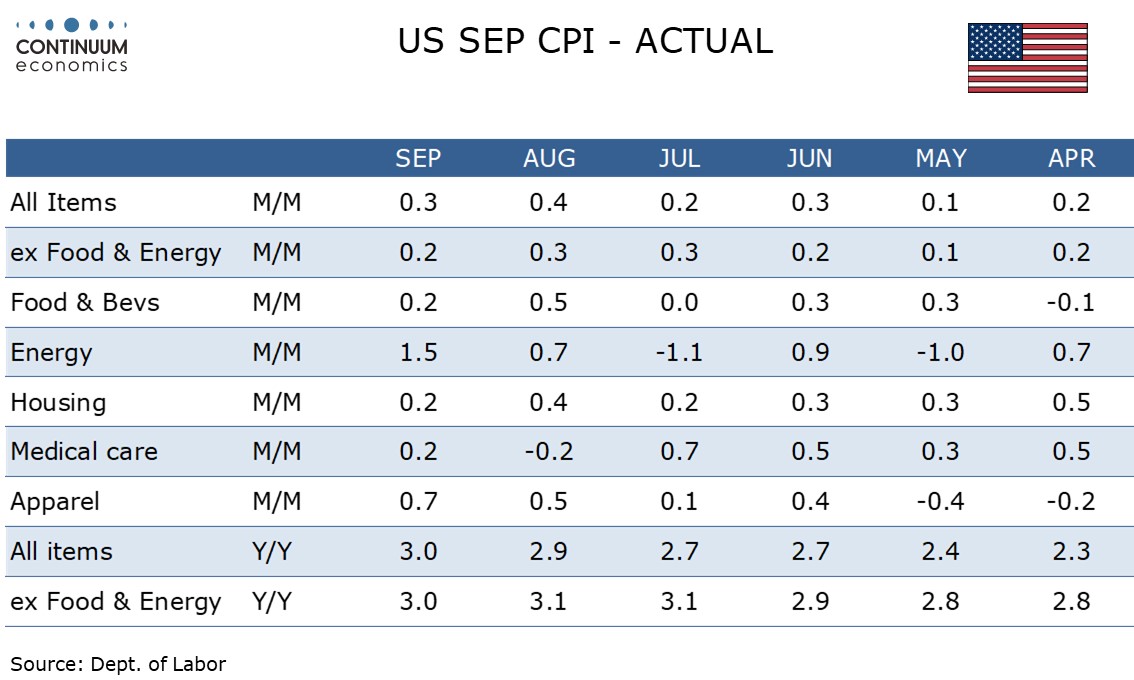

September CPI is on the low side of expectations at 0.3% overall, 0.2% ex food and energy, and should not pose an obstacle to a likely 25bps easing at the October 29 FOMC meeting. The core rate was up by 0.23% before rounding, slower than July and August gains that rise by more than 0.3% before rounding.

The data does not suggest that inflationary risks are over, with Q3 data significantly stronger than Q2’s. The risk of errors in the data is also greater than usual given the government shutdown.

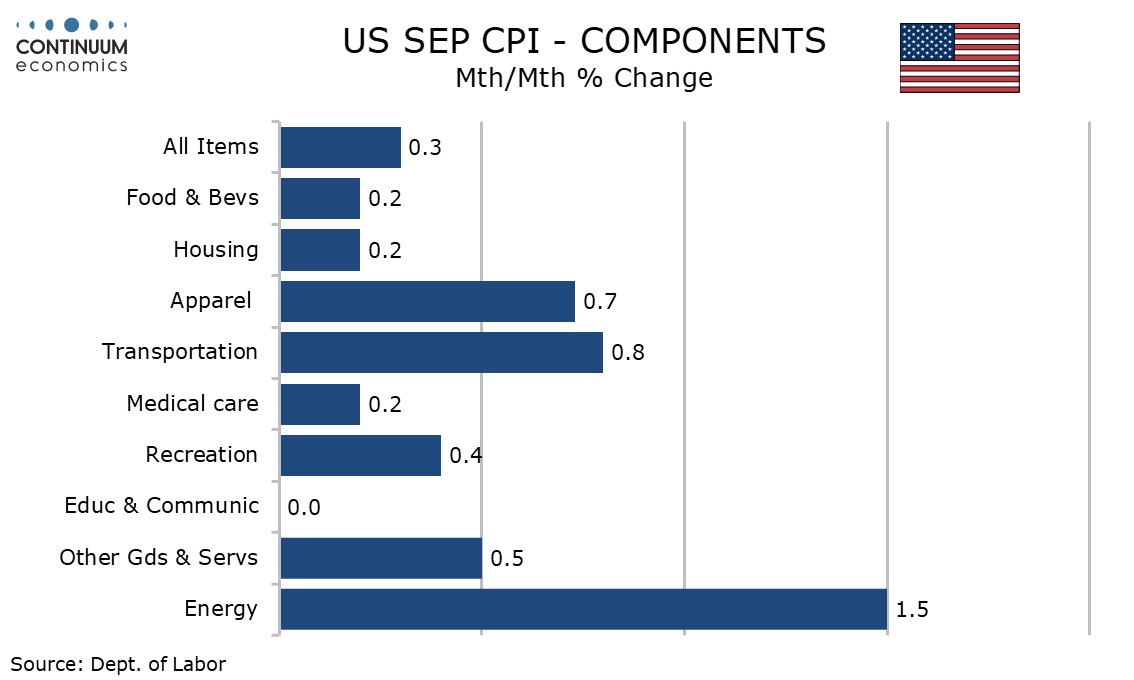

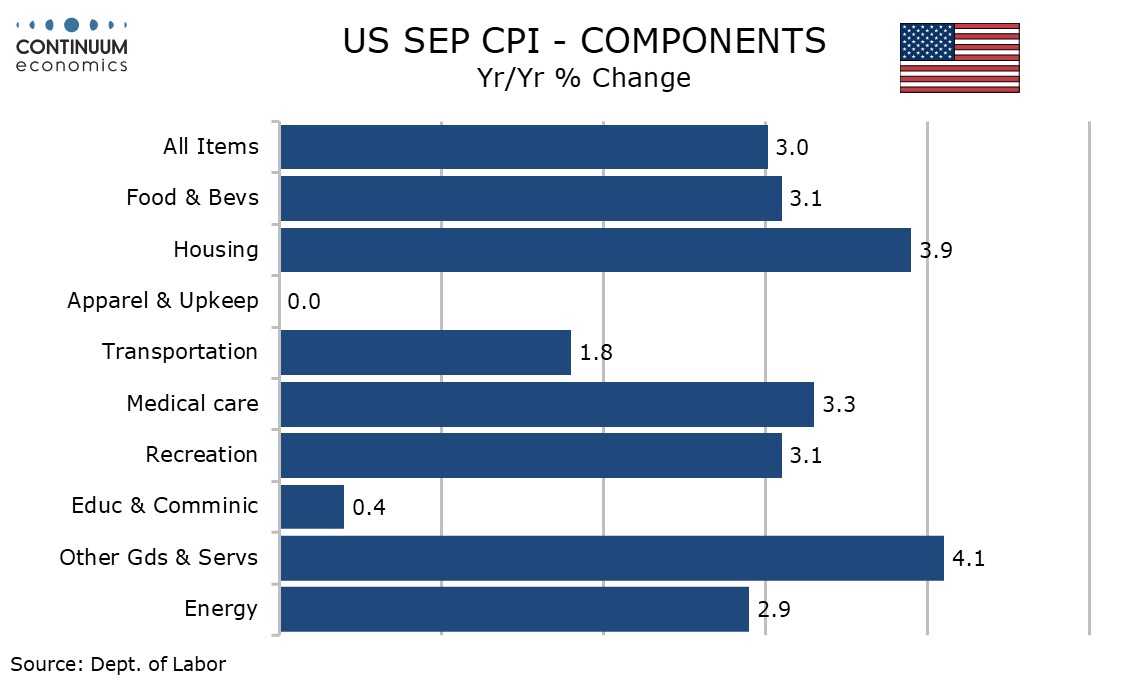

Commodities less food and energy increased by 0.2%, a slight slowing from 0.3% in August but sustaining a modest acceleration in trend since tariffs were imposed. Apparel was firm at 0.7% but used autos saw a soft month at -0.4%. New autos increased by a moderate 0.2%.

Gasoline saw a strong 4.1% increase inflated by seasonal adjustments to lead a 3.8% rise in energy commodities and a 1.5% increase in energy. Food rose by a moderate 0.2%, August’s 0.5% now looking corrective from a flat July.

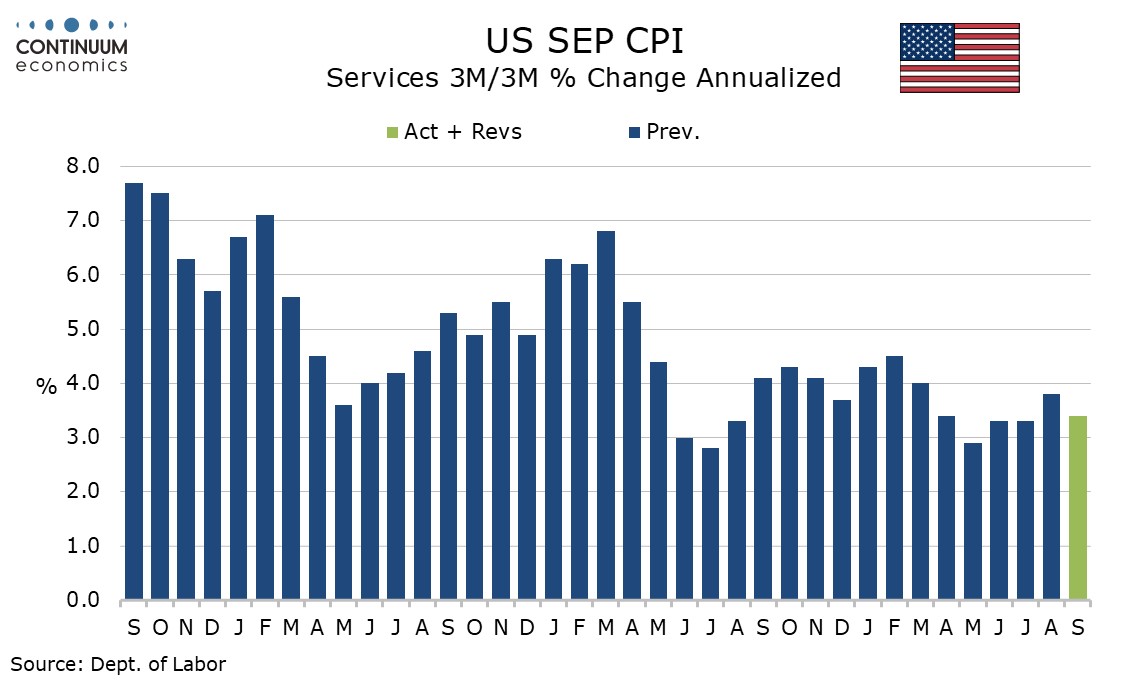

Services less energy rose by 0.2%, down from 0.3% in August and 0.4% in July despite continued strength in air fares which increased by 2.7% and a 1.3% rise in another volatile sector, lodging away from home. Services were generally encouragingly subdued outside the two sectors noted above.

However, owners’ equivalent rent was the most notable source of the slowing, up by only 0.1% after a strong 0.4% increase in August. It is unclear if this is simply a correction of August strength of a signal for a sustained slowing.

Yr/yr growth stands at 3.0% both overall and ex food and energy, the former an acceleration from 2.9% in August and the highest since January but the latter a slowing from two straight months at 3.1%.

Even when taking into account that core PCE prices are usually softer than core CPI, inflation remains above target and there is no real sign of any slowing. The core rate remains slightly stronger than the 2.8% seen in March, April and May. That is a response to tariffs, if less dramatic than many had feared.

I,Dave Sloan, the Senior Economist declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.