Japan: Not Abenomics 2

· While some fiscal stimulus into 2026 is likely from the new PM Takaichi, this is unlikely to be aggressive given the JGB supply pressures and the need for support from other parties in passing fiscal measures. A return to QE (2nd arrow of Abenomics) is highly unlikely, with the BOJ undertaking aggressive QT that will likely push 10yr JGB yields above 2% in 2026. The supply picture is so bad that a large spike in JGB yields could be seen, but this would likely prompt slower BOJ QT (via a U turn on monthly bond buying) rather than a return to QE. We do see a further BOJ policy rate hike, but the market needs to be watchful of the government interfering with the BOJ’s slow interest rate normalization plan.

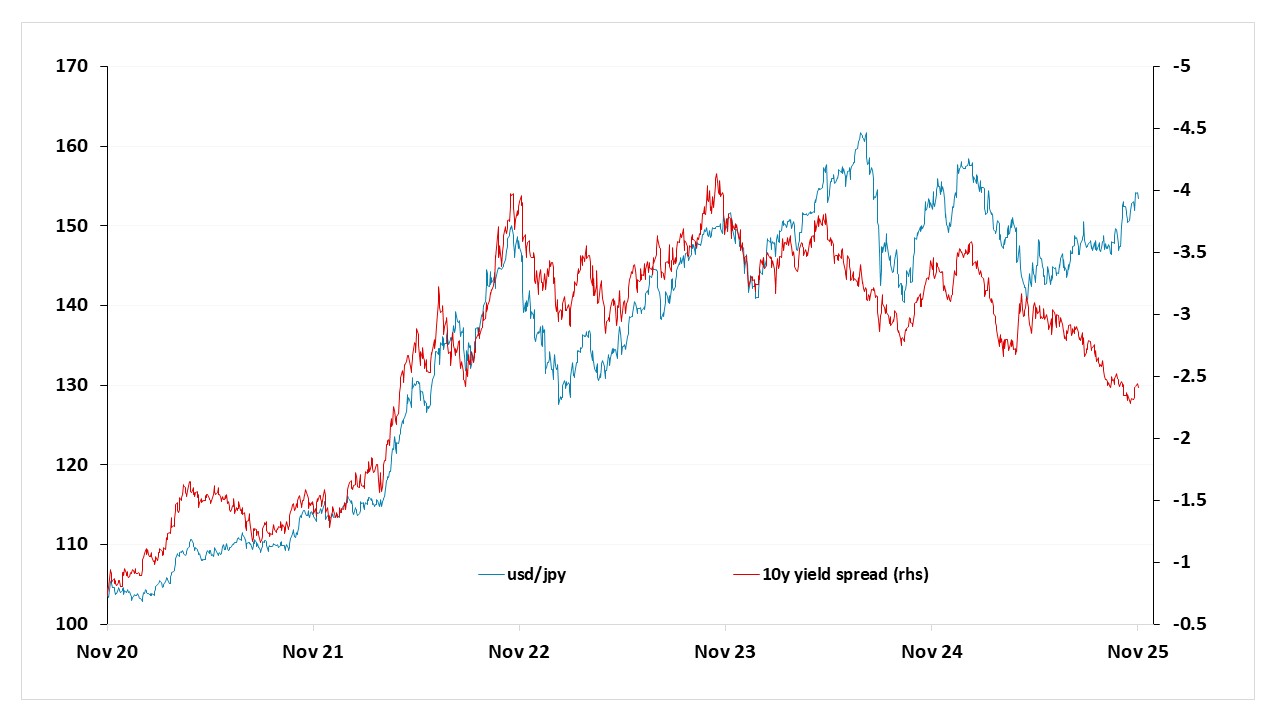

· The JPY has been weak with the change of LDP leader, but also the inverse relationship with the buoyant and overvalued U.S. equity market. Though this can carry on in the near-term, the JPY is once again undervalued versus fundamentals such as the 10yr U.S.-Treasury-JGB spread. We can see JPY appreciation in 2026 and our end 2026 forecast is now 140.

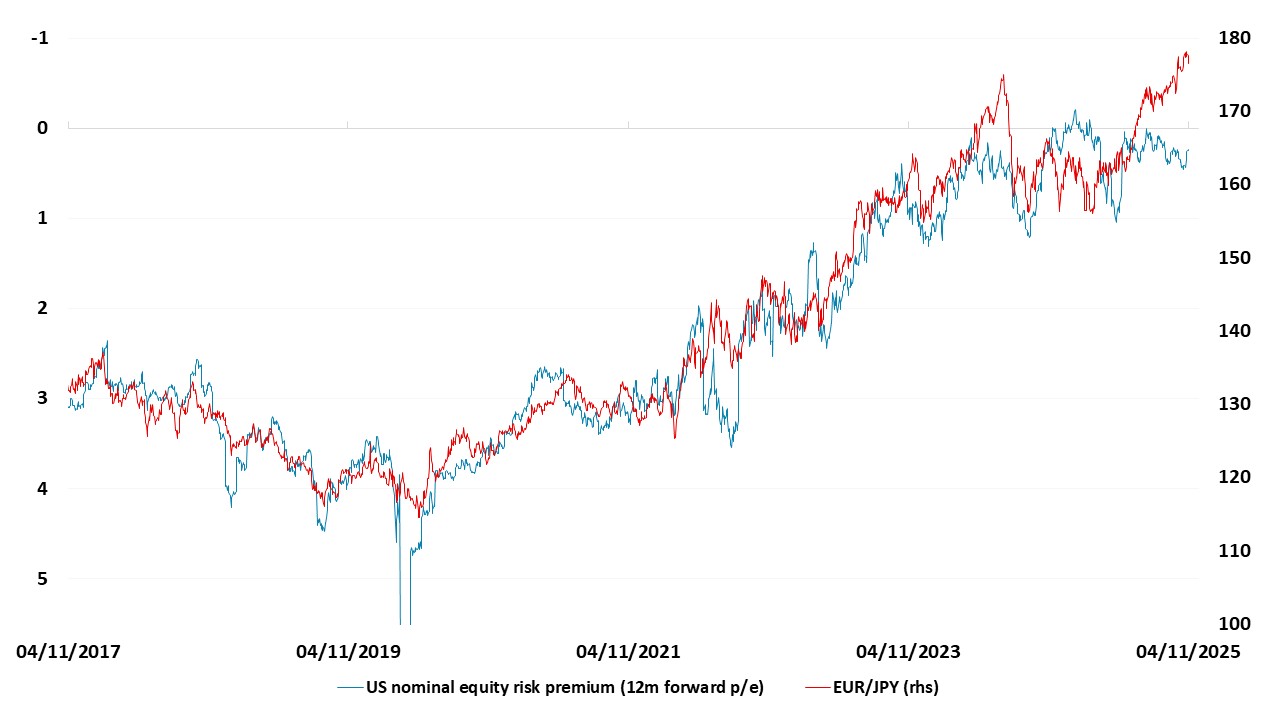

Figure 1: BOJ Aggressive QT Compared to other G4 (% of GDP)

Source: Continuum Economics

Speculation about a return to Abenomics with the election of PM Takaichi has impacted sentiment towards Japanese assets. It is certainly the case that the new LDP leader would like to undertake more fiscal stimulus, but the LDP needs support from other parties to turn desires into reality. The plans so far have been moderate in nature reflecting a desire to help consumers with cost of living/increase investment in high tech growth industries and national security. However, a more radical reduction in consumption tax does not appear to be feasible, given the long-term trajectory. Ishin, the new coalition partner of LDP, may persuade Takaichi to eliminate sales tax on food item as a token of gratitude, given its alignment with Takaichi’s political tilt. While it is still early to assess Takaichi’s policy without any detail, she does not seem to be taking an aggressive path with “responsible proactive fiscal” approach. Given the fiscal health of Japan, only a moderate spending increase will be possible without significantly raising new debts. We do not believe Takaichi will take the path of raising massive debt to push spending. Instead, she will likely allocate special grants for SMEs and wait for tax revenue to pick up on stronger business foundations from the gradual transition in business price setting & consumer behavior, before additional spending plans.

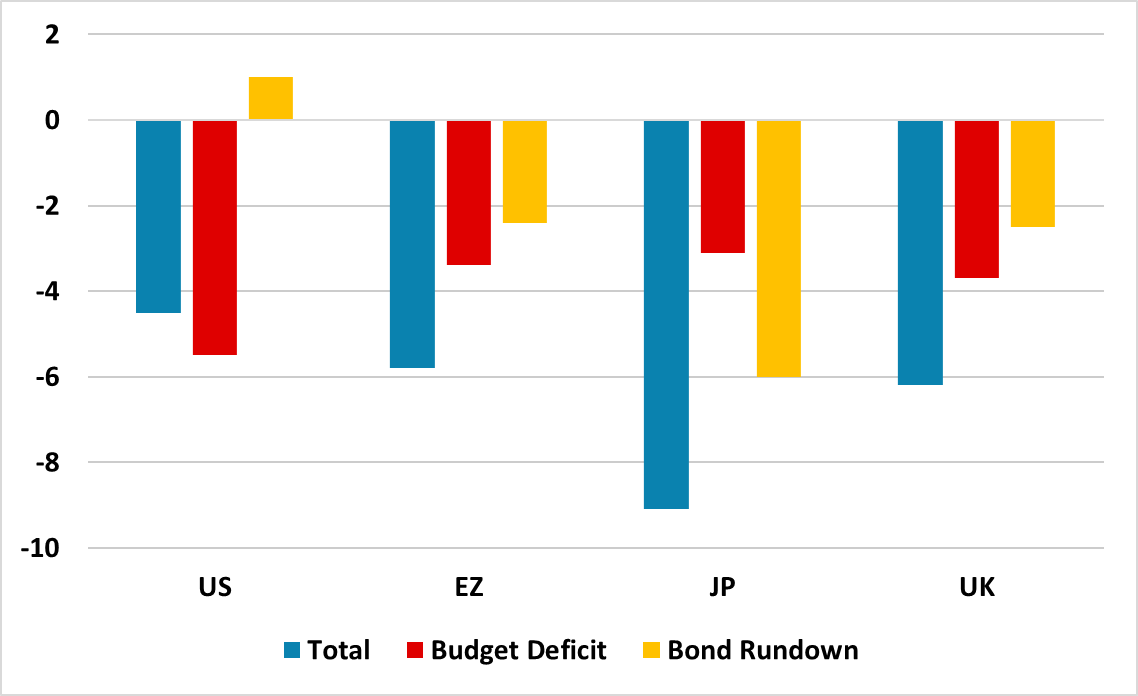

However, it is highly unlikely that Abenomics 2nd arrow of aggressive QE will be revisited. In fact the BOJ is the only major central bank that is still increasing the scale of QT, as it winds down bond buying operations into 2027 to partially counterbalance the end to rollover of maturing JGB’s. We estimate that BOJ QT will likely be close to 6% of GDP in 2026 (Figure 1), which leaves the JGB market facing the heaviest supply situation in the G4. This will likely produce renewed upward pressure on 10yr JGB yields and we still forecast that 10yr yields will likely reach 2% in early 2026, due to this supply deluge. Japanese investors will be interested at these yield levels, but the 10-2yr yield curve is currently not steep (Figure 2) and supply can cause an upwards movement in yields in the main scenario. Indeed, the supply is so large that yields could spike beyond our forecast and this could cause the BOJ to slow the pace of QT by raising the monthly pace of bond purchases for a while!

Figure 2: 10-2yr JGB Curve and BOJ Policy Rate (%)

Source: Continuum Economics

Meanwhile, we still feel that the BOJ will likely hike the policy rate, given core and headline inflation both on current and 2026 BOJ forecasts. We see a 25bps hike at the December 19 BOJ meeting (here) and then one further hike in H1 2026 to 1.0%. However, we feel that CPI will likely undershoot BOJ projections for 2026 inflation, as businesses face resistance from Japan households over higher CPI and this leads to a slowing of wage and unit labor cost growth in 2026 and then eventually CPI. This process would also hurt consumption and provide an extra reason for the BOJ to go on hold. Moreover, we have so far not had any signs that the new government wants to interfere with the BOJ and prompt an early pause in rate normalization or a U turn on policy rates. However, this last point needs to be watched closely, as PM Takaichi does not appear happy with the BOJ normalization process as she feels that the BOJ inflation goal has not yet been achieved.

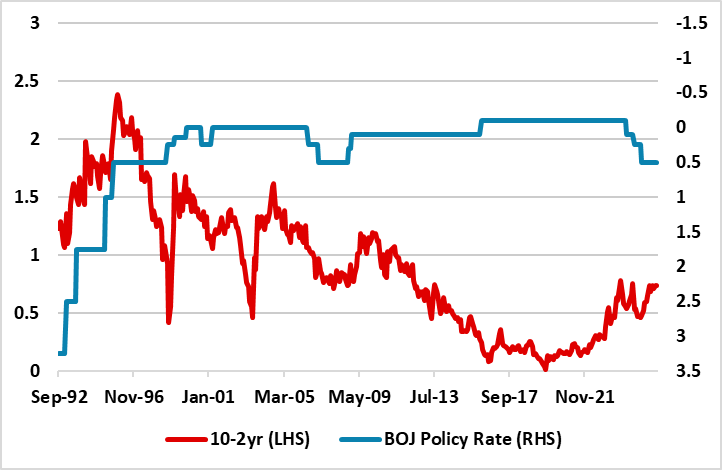

Figure 3: USDJPY and 10yr U.S.-JGB Government Bond Spread (level and % )

Source: Continuum Economics

The concerns over the return of Abenomics has also impacted the JPY, which has fallen significantly against the USD and the EUR in recent weeks. USDJPY is now a long way out line with the 10yr U.S.-JGB government bond spread (Figure 3), while the JPY is weaker than the still low U.S. equity risk premium would suggest (Figure 4). EURJPY movements are in line with the level of the S&P500, but this is problematic for JPY bears given the overvaluation of the U.S. equity market. JPY sentiment can remain negative near-term and we are changing our end 2025 USDJPY forecast from 135 to 148. However, structurally the JPY weakness is out of line with the metrics shown above and is hugely undervalued in real terms. We can see JPY appreciation in 2026 and our end 2026 forecast is now 140.

Figure 4: EURJPY and U.S. Equity Risk Premium (Level and %)

Source: Continuum Economics