U.S. November CPI - Is the tariff impact fading?

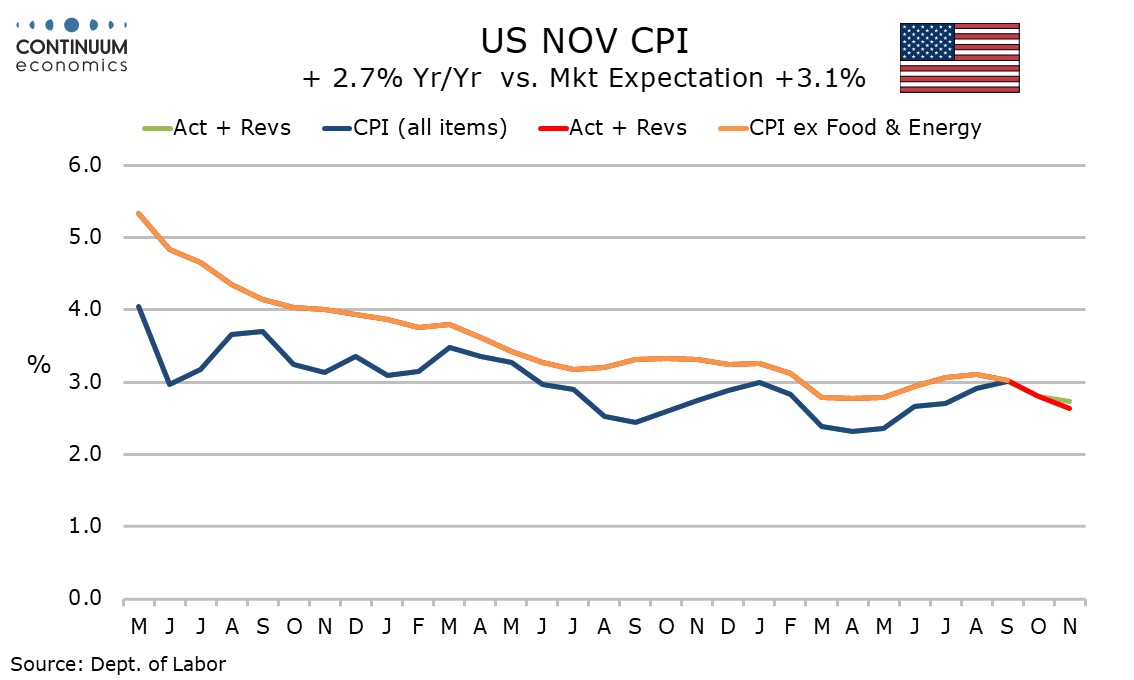

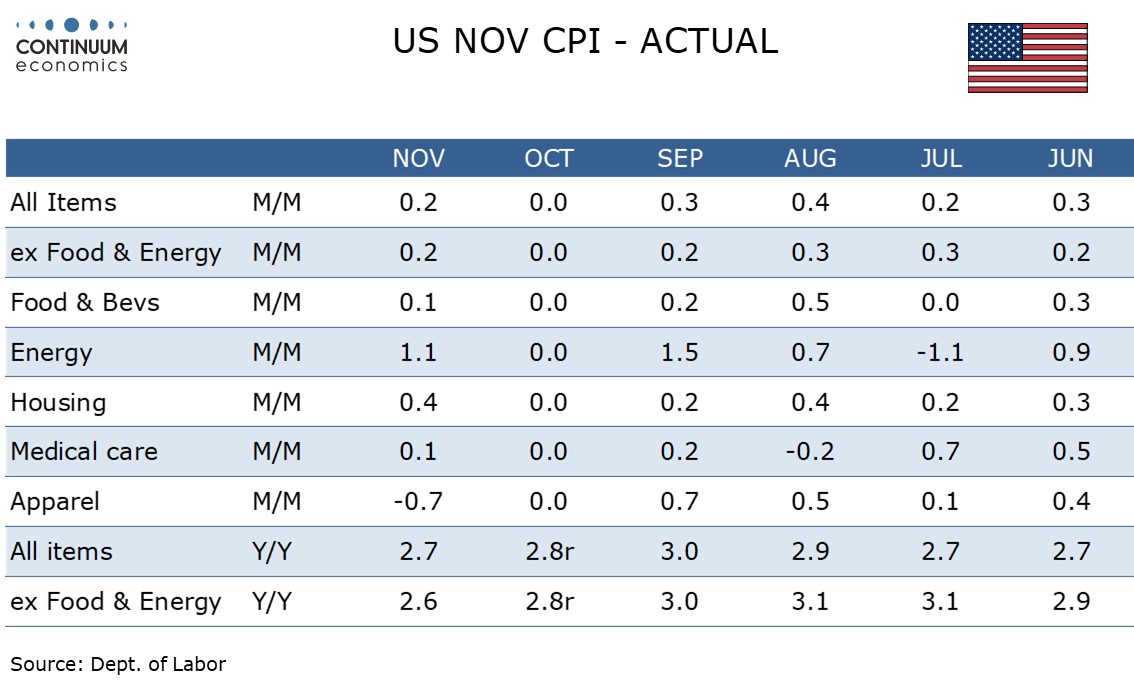

November’s CPI is significantly lower than expected, at 2.7% yr/yr, 2.6% ex food and energy, compared with 3.0% for both series in September (October data will not be released). November’s core CPI index is up only 0.16% from September’s, implying an average rise of less than 0.1% per month over the last two.

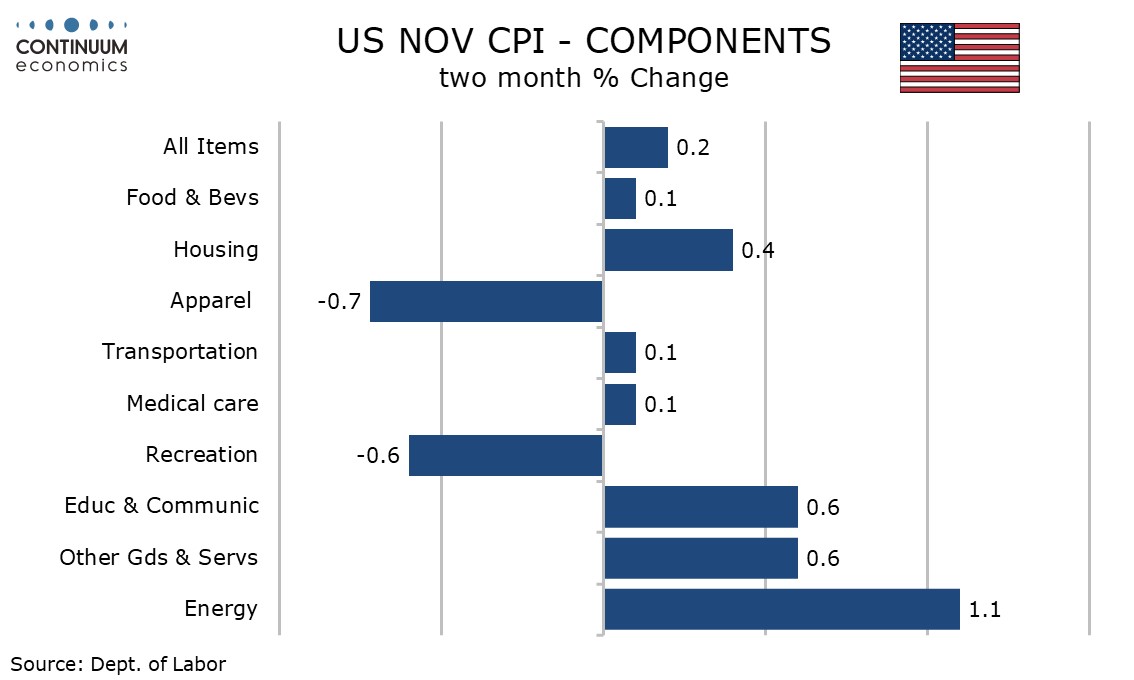

Overall CPI is up by 0.20% over the two months, implying an average gain of 0.1%, though weekly data on gasoline prices suggested a dip in October and a rise in November, so perhaps CPI would have been unchanged in October and up by 0.2% in November.

The surprisingly soft data may reflect an easing of tariff feed-through, or pricing decisions being delayed until the Supreme Court delivers a verdict on the tariffs, or even pricing decisions simply being delayed until the New Year. The data is certainly significantly softer than expected. It may reflect a weakening consumer picture in Q4 restraining prices, though another possibility is that difficulties in measuring prices given the turmoil in government has the data under-estimated. Still, the data will be encouraging to the Fed doves.

Prices for food, transport and medical care rose only 0.1% over the two months, while apparel fell by 0.7% and recreation fell by 0.6%. Two month gains of 0.6% in education and communication and other goods and services are more in line with what would be expected. Even a 0.4% rise in housing is quite subdued for two months, with owners’ equivalent rent up by 0.3% over the two months.

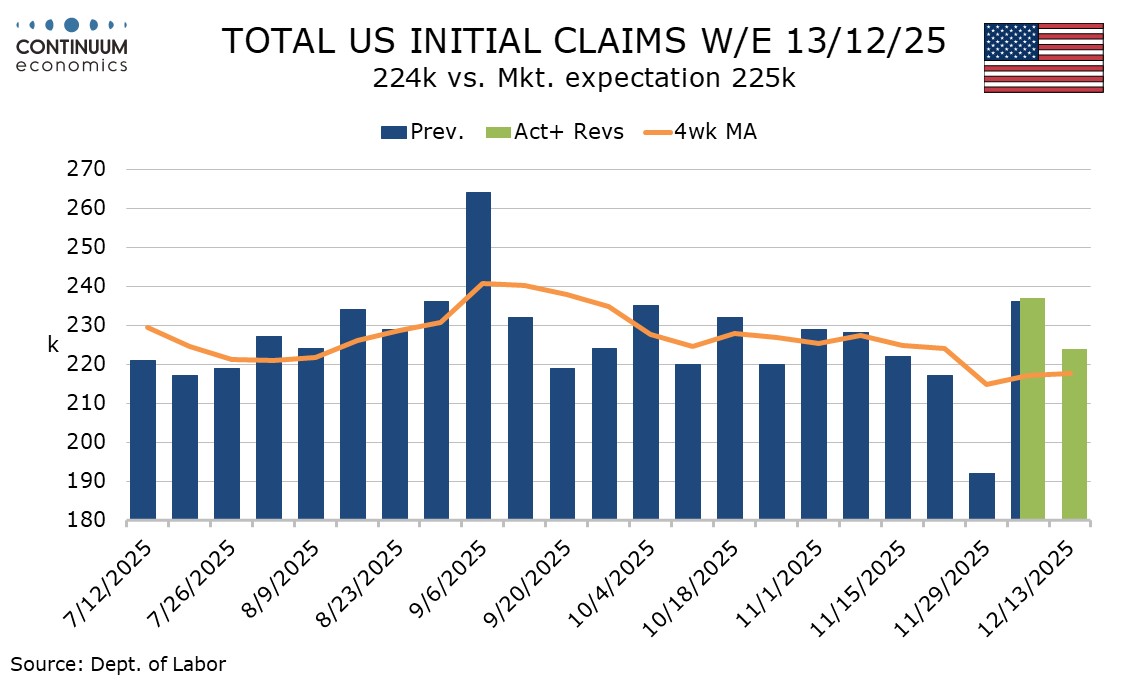

Weekly initial claims cover December’s payroll survey week and at 224k represent a return to trend after last week’s correction higher to 237k from a very low 192k seen in the Thanksgiving week. The 4-week average of 217.5k is down from 224.75k in November’s payroll survey week.

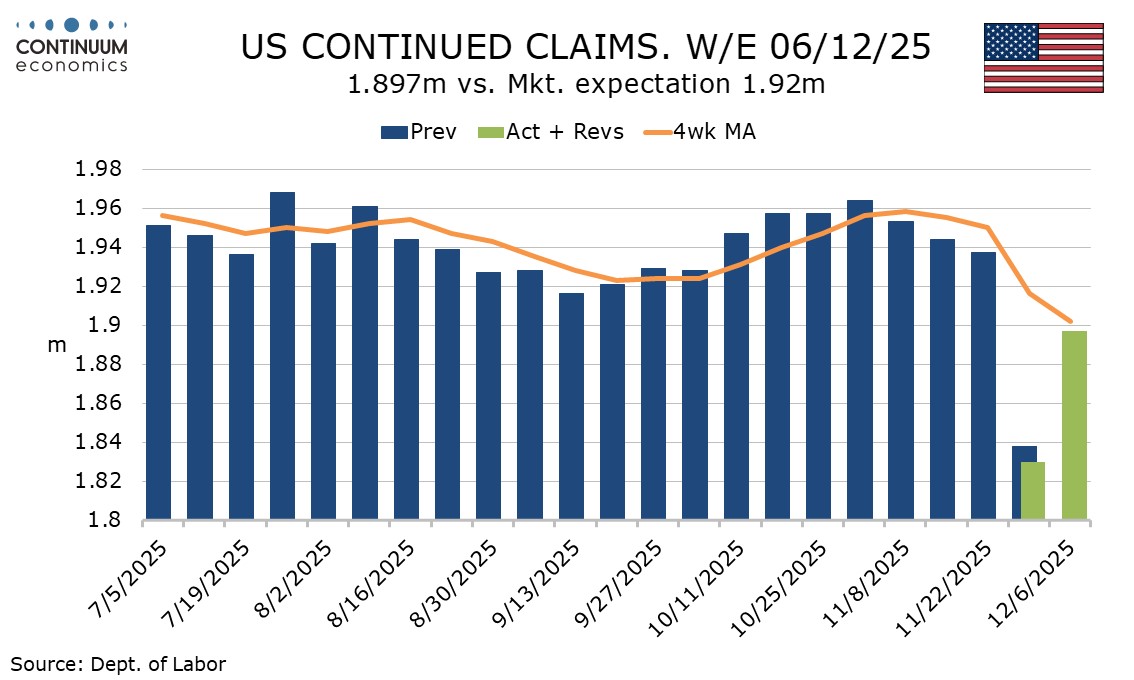

Continued claims cover the week before initial claims and with a 67k rise to 1.897m have not fully reversed a 107k fall in the Thanksgiving week. Trend, which was rising through October, is now falling. The signals for December’s payroll are somewhat positive.

I,Dave Sloan, the Senior Economist declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.