Preview: U.S. October CPI - An important number that may never be seen

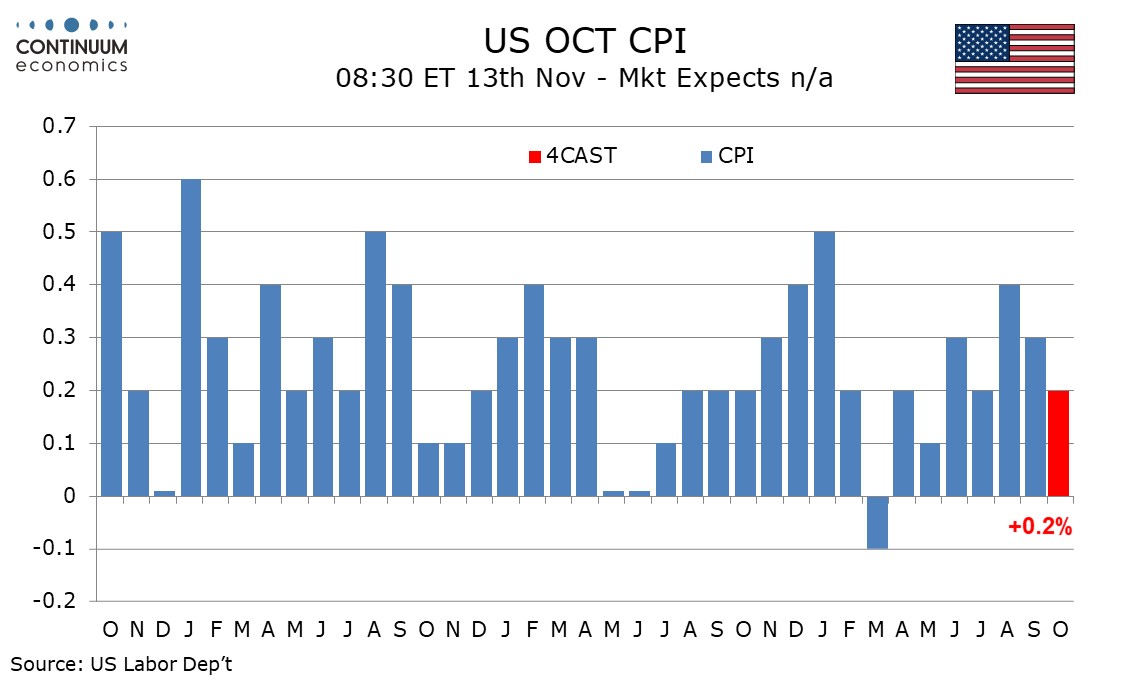

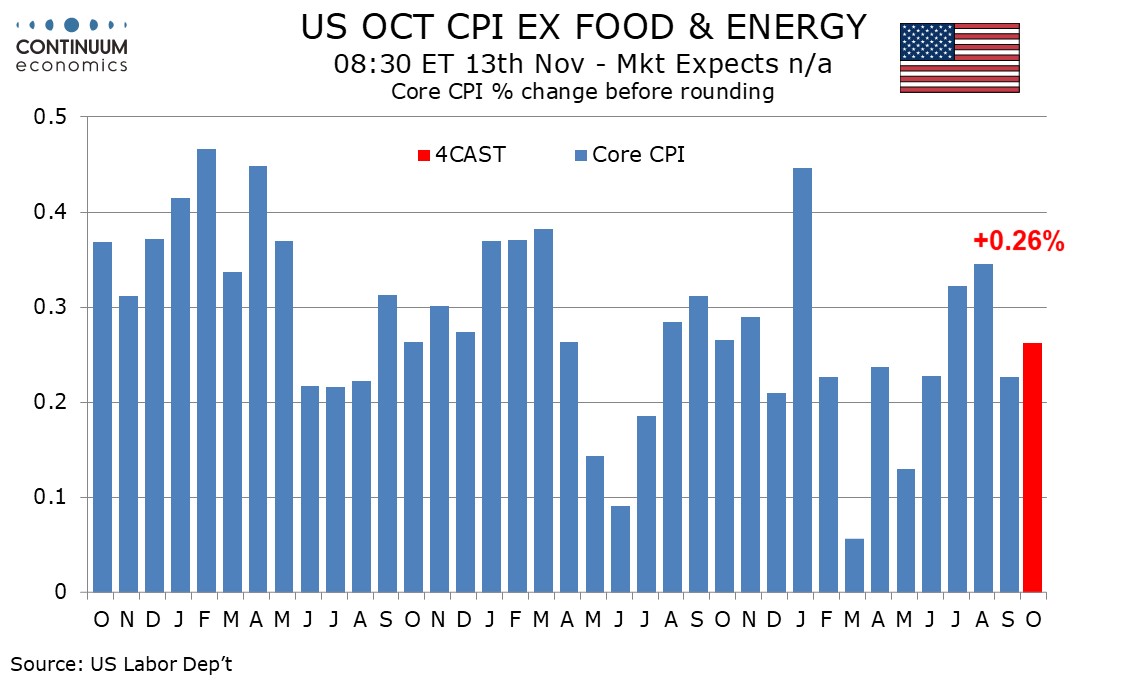

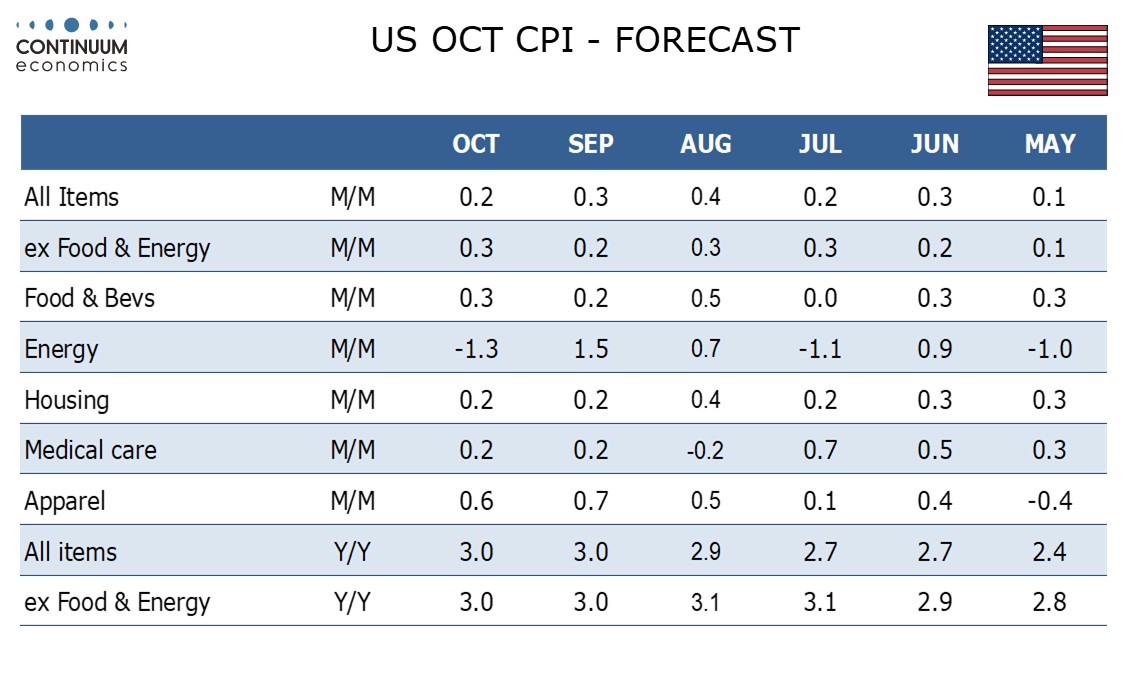

October US CPI, while scheduled on November 13, may never be released even if the government shutdown is resolved, given lack of data collection during the month of October. However what the number would have been does matter. Our forecast is for a 0.2% increase overall, with a 0.3% rise ex food and energy, with the respective gains before rounding being 0.16% and 0.26%.

September’s CPI was released despite the shutdown as it was needed for annual cost of living adjustments for Social Security, but saw an unusually large number of components estimated, leaving uncertainty over whether the data was quite as soft in the core rate as the 0.2% (0.23% before rounding) outcome showed.

September’s core rate was a slowing from two straight gains of 0.3% which were both on the firm side of 0.3% before rounding. The most notable area of weakness in September was a 0.1% rise in owners’ equivalent rent that followed an above trend 0.4% increase in August. The soft September will probably prove to be corrective though a change in trend in owners’ equivalent rent is not to be ruled out. Fed’s Miran has justified his dovish view in part by expecting one. We however expect services less energy to return to trend at 0.3% after a 0.2% gain in September, though air fares may slow from recent strength.

Commodities less food and energy also increased by 0.2% in September, down from 0.3% in August, restrained by a dip in used autos despite tariffs continuing to feed through to several components. We expect used autos will remain subdued in October, keeping the core rate slightly below 0.3% before rounding. Gasoline prices look set to partially correct a September increase that lifted overall September CPI to 0.3% while we expect a 0.3% October increase in food, where tariffs are also being felt. Yr/yr rates are likely to be unchanged from September, at 3.0% both overall and ex food and energy.

I,Dave Sloan, the Senior Economist declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.