U.S. September Employment - Case for a December easing looks a little weaker

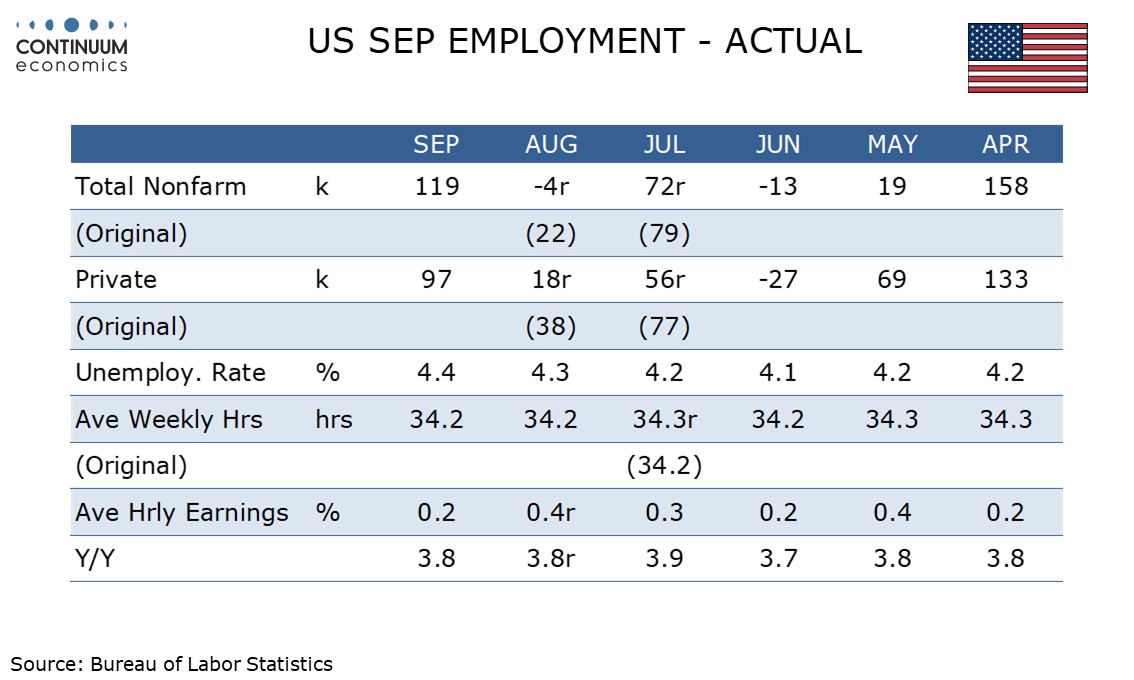

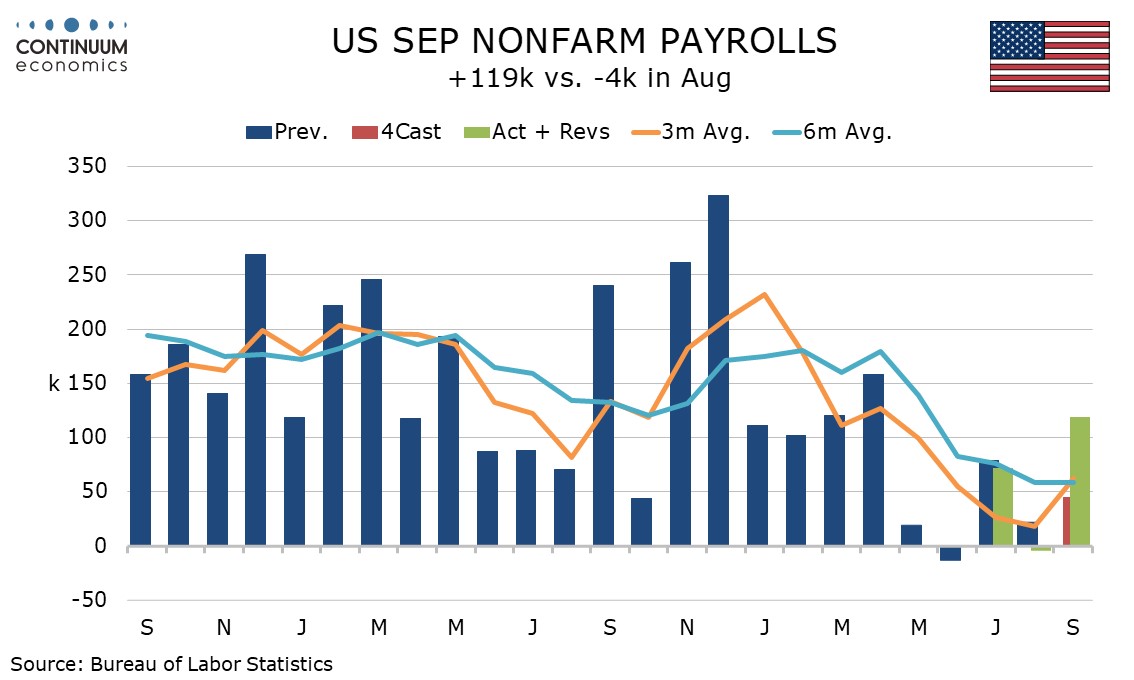

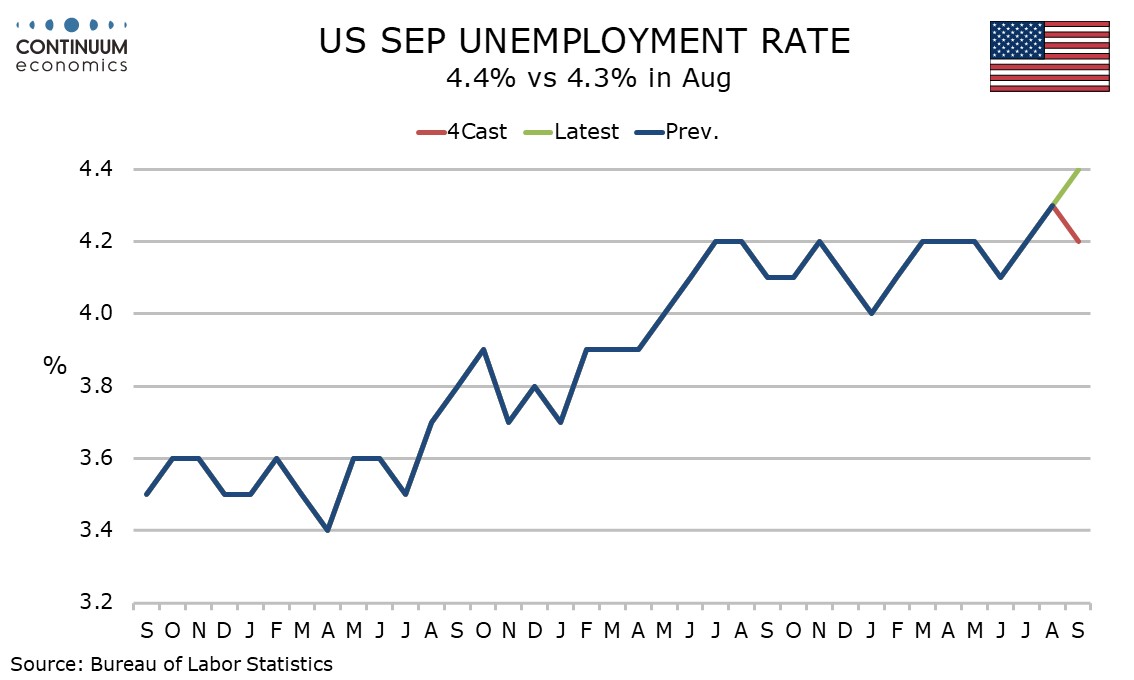

September’s non-farm payroll will be the last released before the December 10 FOMC meeting and is surprisingly firm at 119k, albeit with 33k in negative revisions. A rise in unemployment to 4.4% from 4.3% and a 0.2% rise in average hourly earnings provide only marginal offsets to the headline. November’s (and October’s) payroll will not be seen until December 16, but initial claims for its survey week at 220k do not suggest much has changed in the labor market since September’s payroll.

The resilience of November’s payroll and the likelihood that the FOMC will have limited fresh information before it next meets argues against an easing in December, though with several Fed speakers due to speak in the remainder of this week and the data schedule, including for Q3 GDP and October and November CPI, still unclear, we will not make a final call on December’s meeting quite yet.

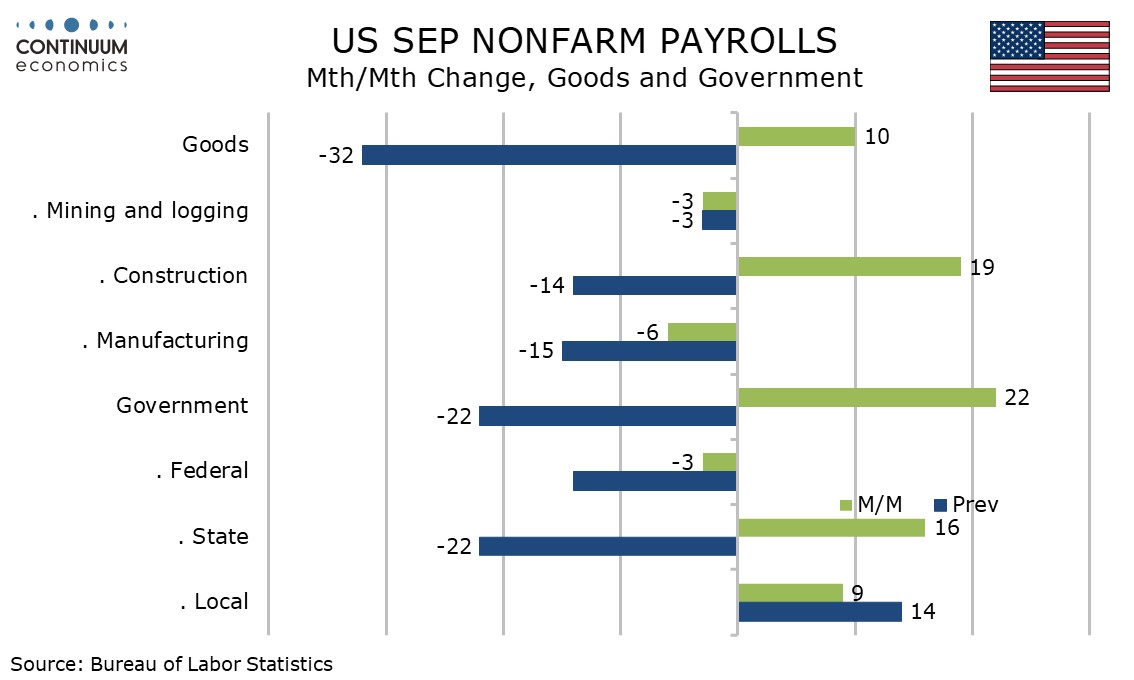

Private payrolls increased by 97k in December, above expectations and the strongest since April, though this leaves a surprising 22k rise in government, led by State employees. Government is set to see a sharp drop, probably by around 75k, in October, as DOGE layoffs reach the end of their 6-month pay package provided with their redundancies.

Goods producing employment rise by 10k on a 19k ruse in construction, consistent with recent signs that the housing sector is getting support from the resumption of Fed easing. Manufacturing fell by 6k.

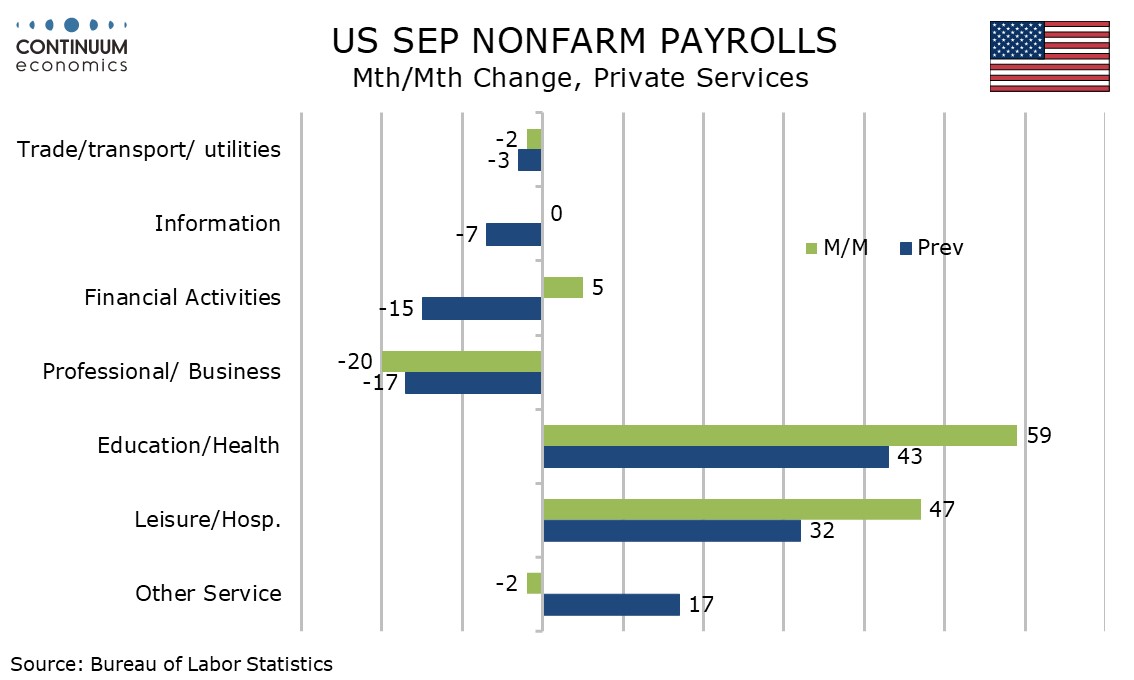

Private services rose by 87k, led as has been the recent pattern by health care and social assistance at 57k, with leisure and hospitality also firm at 47k. Retail same a respectable 14k increase but weakness was seen in temporary help at -16k and transport and warehousing at -25k.

While the unemployment rate at 4.4% from 4.3% is at its highest since October 2021 the household survey detail shows a strong 251k rise in employment and an even stronger 470k rise in the labor force, surprising given the immigration picture. The rise in unemployment does not look like a sign of economic weakness. There will be no unemployment data for October. October will see a non-farm payroll, but it will be released with November’s data on December 16.

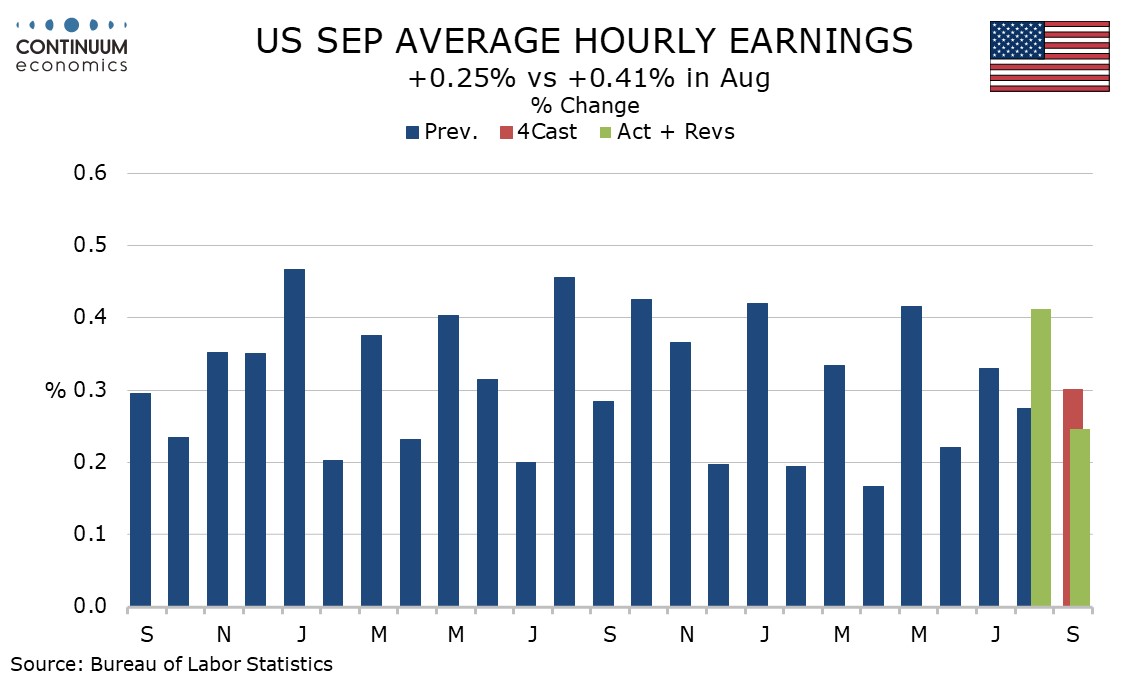

Average hourly earnings were marginally weaker than expected at 0.246% before rounding, rounding down to 0.2%, though this follows an upwardly revised 0.41% rise in August. Yr/yr growth was stable at an upwardly revised 3.8%. The earnings and unemployment data, while weaker than expected in the headlines, provide only marginal offsets to the upside surprise in the payroll.

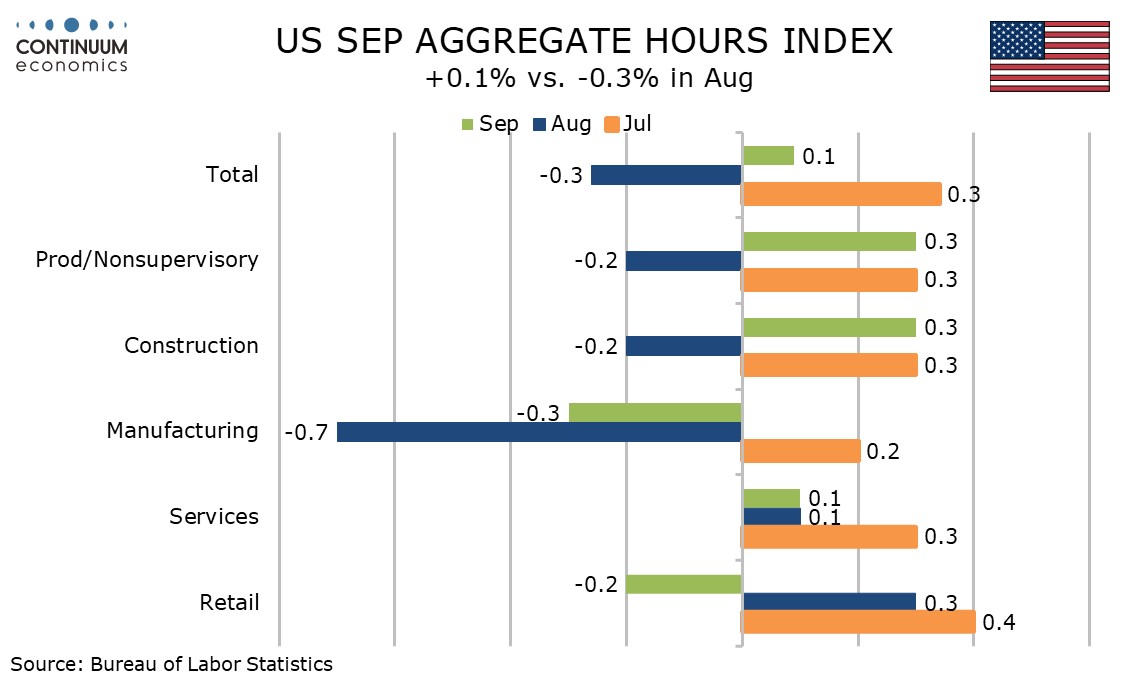

The workweek was unchanged at 34.2 hours leaving aggregate hours worked up by 0.1%. Consistent with employment data construction was firmer at 0.3% but manufacturing fell by 0.3%. Services increased by 0.1%, but retail, despite a rise in employment, fell by 0.2%.