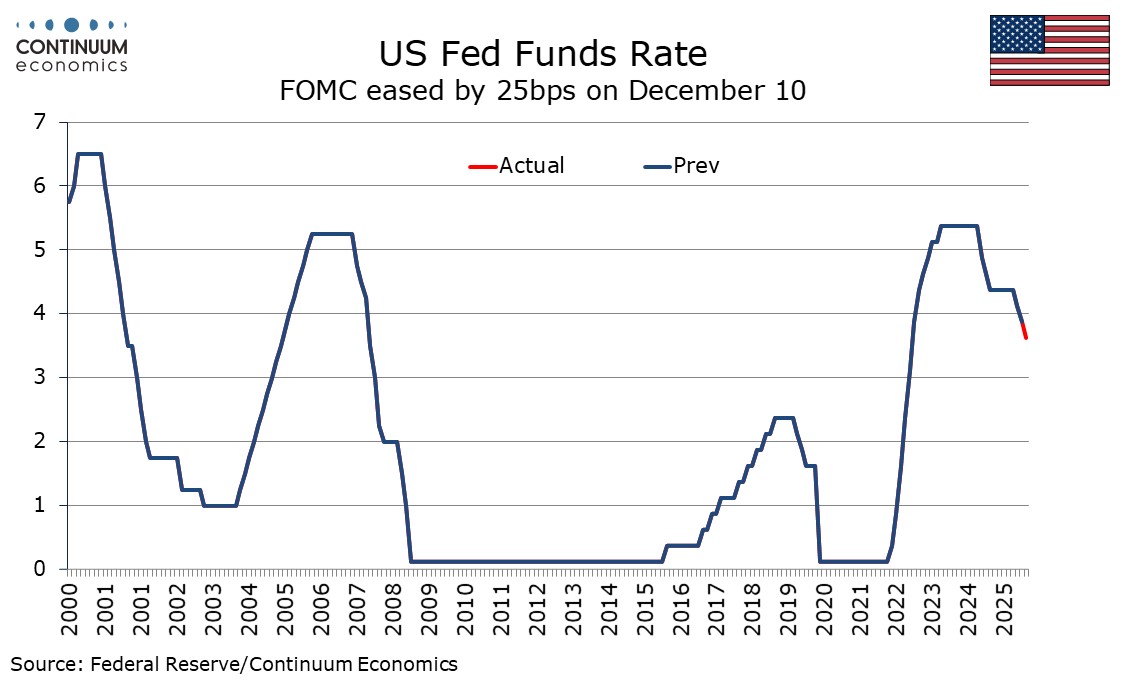

FOMC eases by 25bps, dots unchanged from September

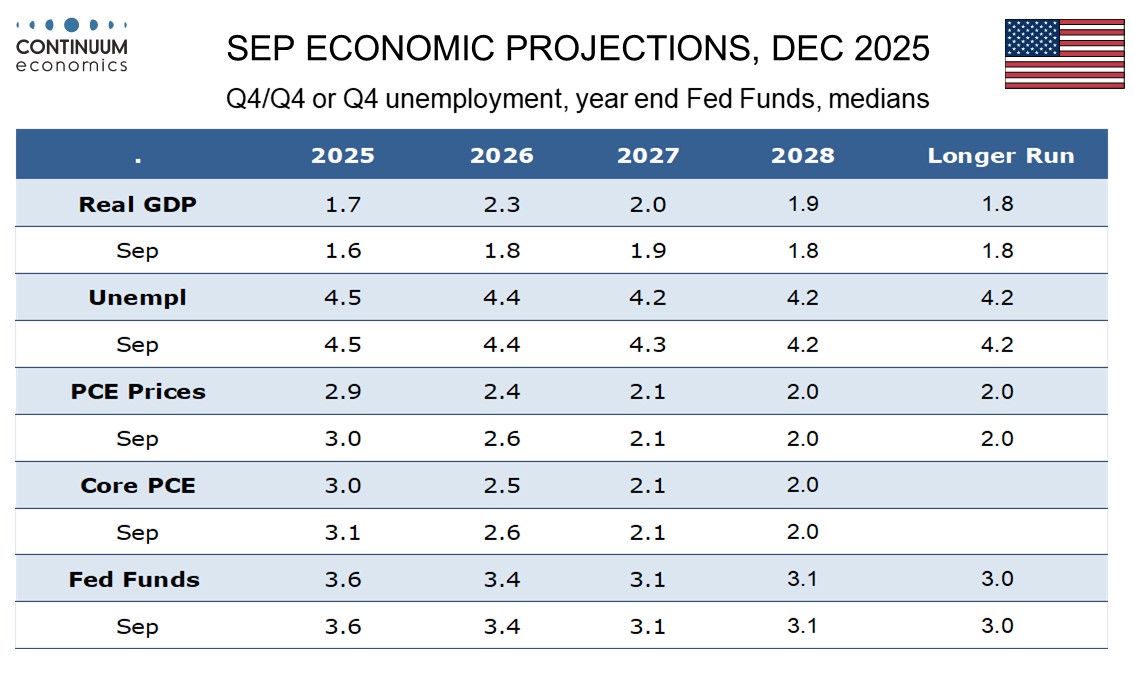

The FOMC has eased by 25bps as expected to a 3.50-3.75% Fed Funds target range, with two hawkish dissents for no change from Schmid (who dissented in October) and Goolsbee, while Miran again dissented for a steeper 50bps ease. The dots are unchanged from September, implying one 25bps ease in both 2026 and 2027 which would take policy to near neutral.

The 2025 dots show six favoring no change, implying four non-voters opposed the latest ease. The 2026 dots show seven above the median, eight below and four on the median. The economic forecasts show GDP surprisingly upgraded for each tear from 2025 through 2028, 2026 particularly sharply to 2.3% from 1.8%. PCE price forecasts are revved marginally lower for 2025 and 2026, which may have assisted the decision to ease.

Changes to the statement are moderate. A reference to unemployment edging up persists but a reference to it remaining low is removed. Inflation is still seen as somewhat elevated. The FOMC will now consider the extent and timing of additional changes to the target range, rather than just additional changed. Reserve balances are no seen at adequate levels meaning the Fed will now initiate purchases of shorter term Treasury securities to maintain an ample supply of reserves