Preview: Due December 23 - U.S. Q3 GDP - A second straight solid quarter though Q4 is likely to be slower

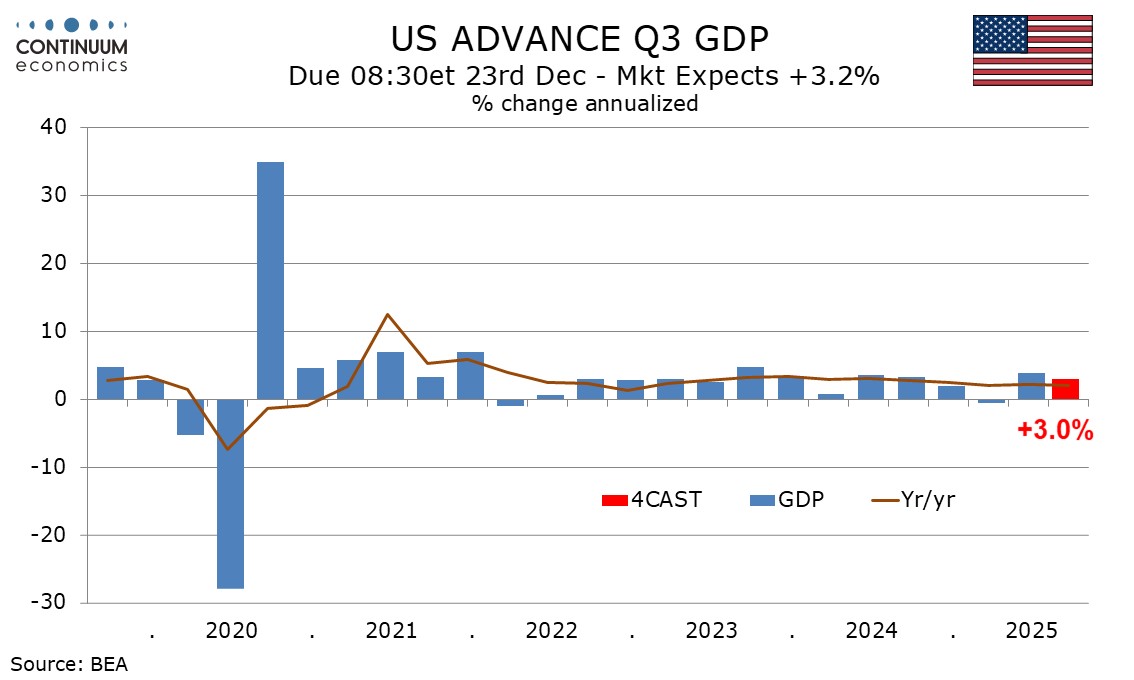

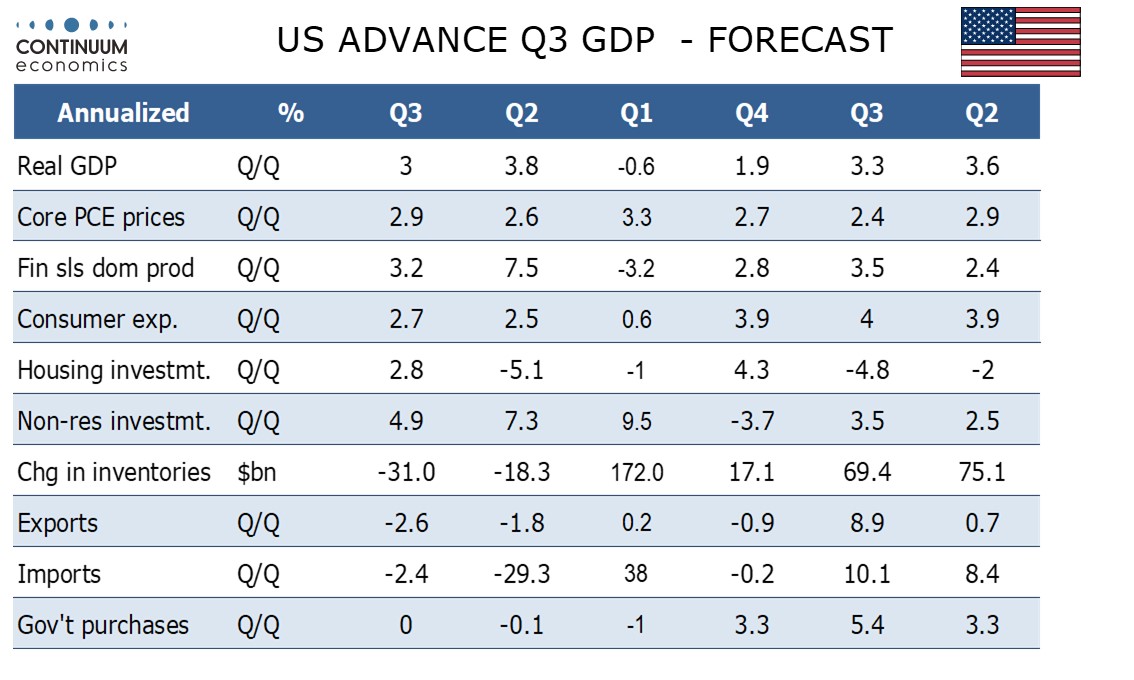

We now look for a 3.0% annualized increase in the delayed Q3 GDP release, lifted by some recent data. This would be a second straight solid quarter to follow a weak Q1, though Q4 is likely to be weaker, in part due to the government shutdown that persisted through October and much of November.

Q3 data on consumer spending has already been published and shows a 2.7% annualized increase, though this is well ahead of real disposable income which rose by only 0.4%, suggesting some consumer vulnerability entering Q4. Q4 auto sales are likely to slip as a tax credit for electric vehicles expires, but October retail sales were resilient ex autos.

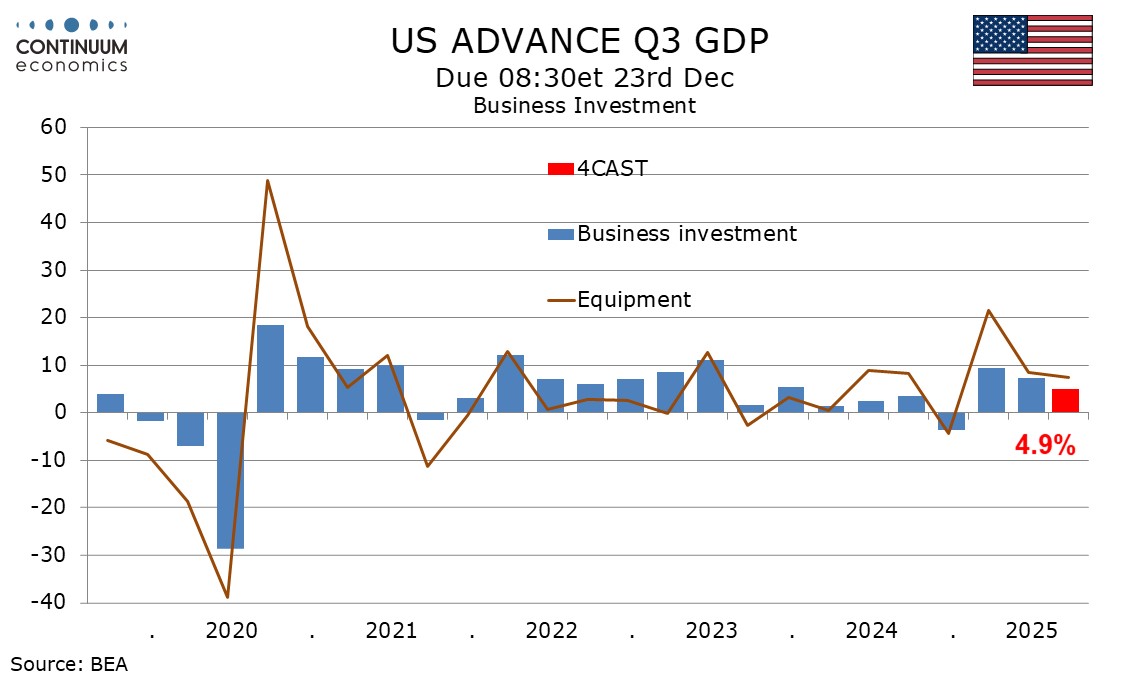

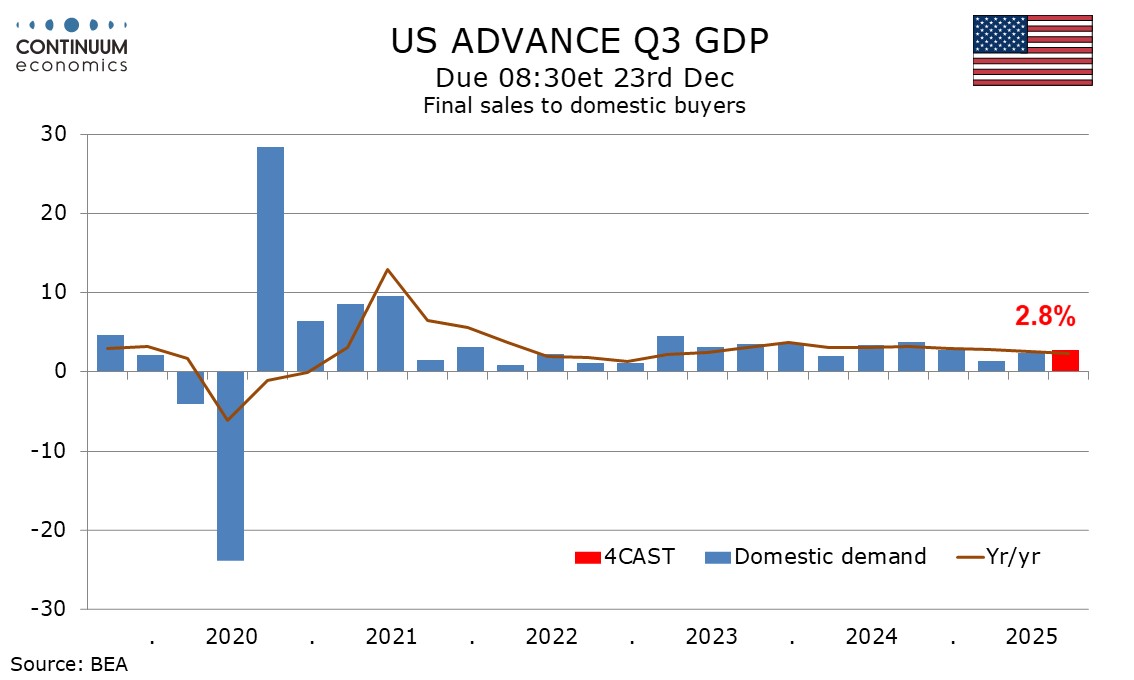

Business investment is set to remain healthy at 4.9% supported by AI, if slower than the preceding two quarters, again with healthy gains in equipment and intellectual property but weakness in structures. We expect residential investment to rise by 2.8% after two straight declines, and government to be unchanged, similar to Q2. Government is likely to see a temporary dip in Q4.

This will leave final sales to domestic buyers (GDP less inventories and net exports) at a three quarter high of 2.8%.

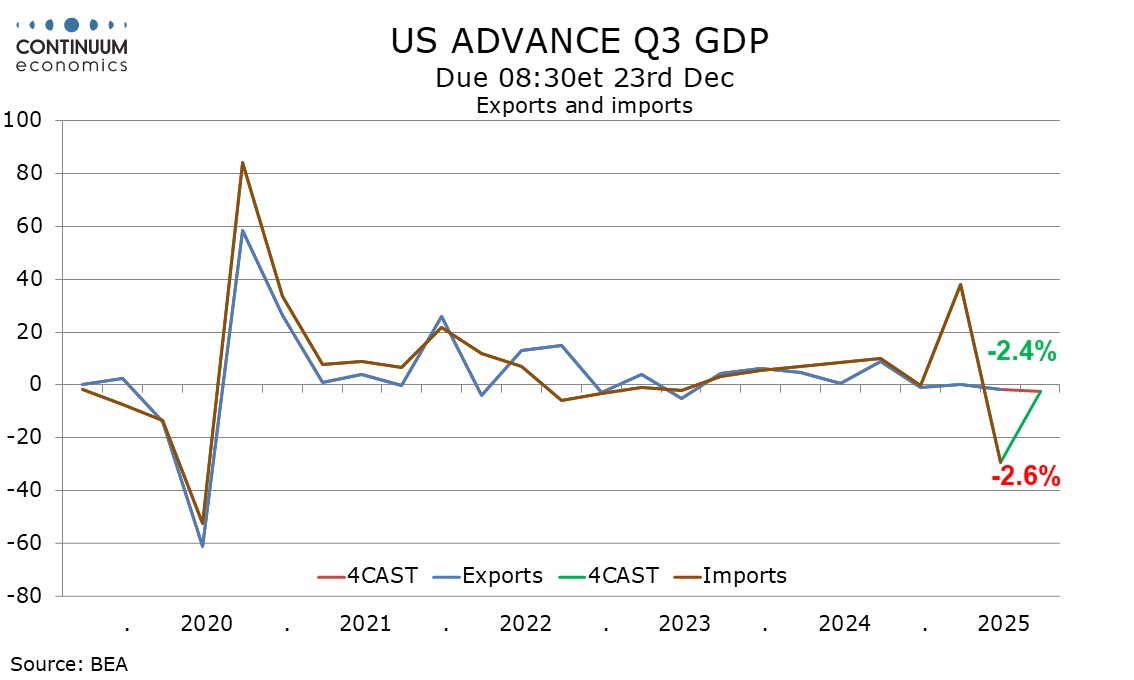

We expect a modest positive from net exports, adding 0.4% to GDP. We expect exports to fall by 2.6% and imports to fall by 2.4%, but imports will fall by more in USD terms. A narrower than expected September trade deficit lifted the picture, though much of the surprise came from exports of non-monetary gold, which may have a limited impact on GDP.

Even with a slightly stronger than expected September, led by autos, we expect inventories to deduct 0.2% from Q3 GDP, as a correction from a strong Q1 inventory build up ahead of the tariffs continues. We expect a 3.2% rise in final sales (GDP less inventories).

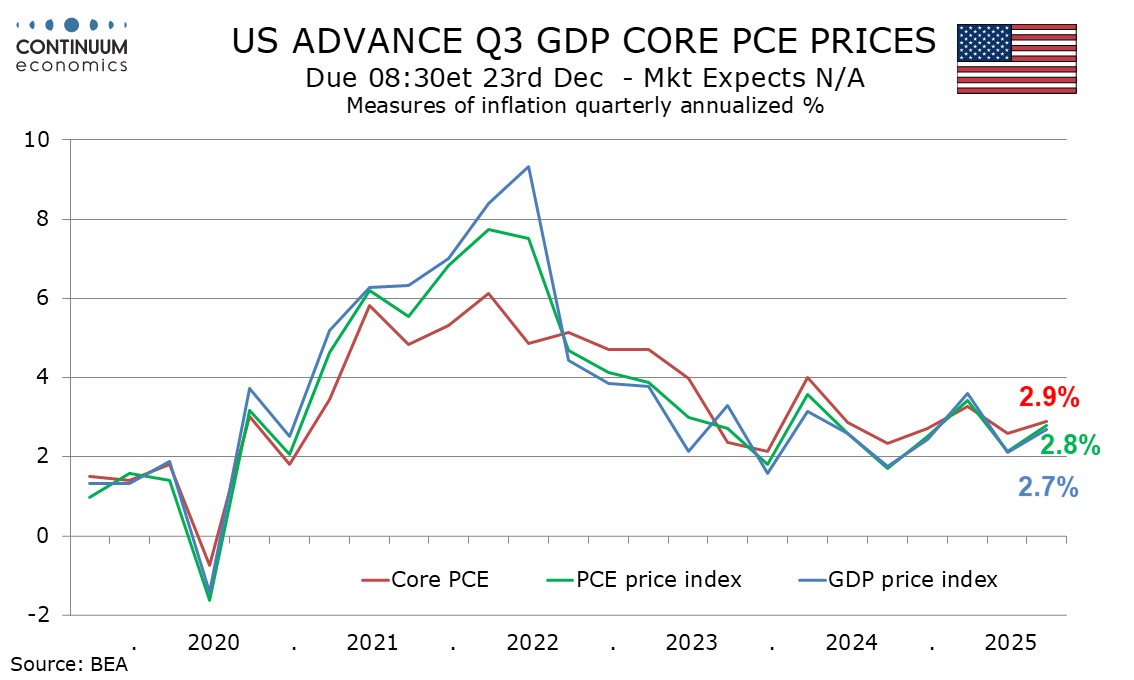

Q3 PCE and core PCE price data has already been released, at 2.8% and 2.9% annualized respectively. We expect the overall GDP price index to be marginally slower than this at 2.7%.