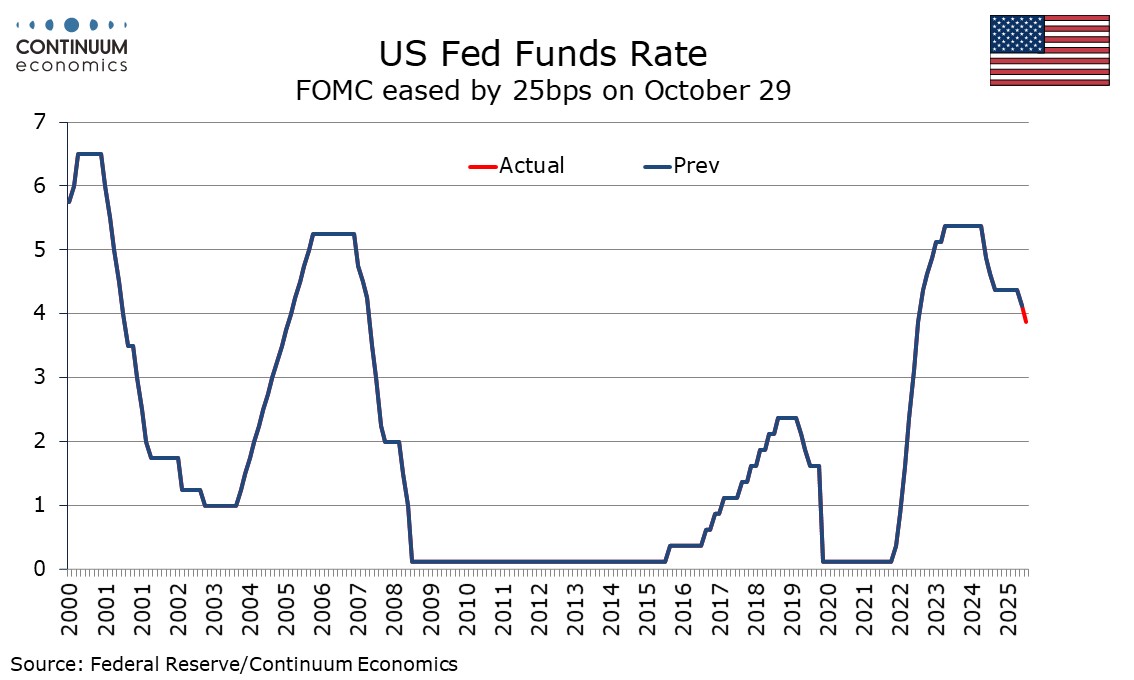

FOMC eases by 25bps, to conclude quantitative tightening on December 1

The FOMC has eased rates by 25bps to a 3.75%-4.00% range as expected and decided to conclude the reduction of its securities holdings on December 1 as Chairman Powell had hinted at on October 14. There were two dissents, Governor Miran favoring a 50bps move and Kansas City Fed’s Schmid delivering a hawkish dissent for no change. None of this is surprising.

Instead of stating that economic activity moderated in the first half of the FOMC now states that available indicators suggest activity has been expanding at a moderate pace, recognizing the absence of key data but generally seeing limited cause for alarm in what is available. There has been no fresh unemployment release since the last meeting but the FOMC states recent indicators are consistent with the unemployment rate having edged up but remaining low though August. They now stay downside risks to employment rose in recent months rather than have risen.

The phase since earlier in the year is added to an assessment that inflation has moved up, signaling recent grounds for some concern, while repeating that it remains somewhat elevated. While there are no major surprises, with risks remaining on both sides of the mandate, the changes to the statement can be seen as a little less dovish. The statement gives few hints on December’s meeting. The FOMC will be hoping the absence of data due to the government shutdown is resolved by then.