U.S. Equities: Smaller Correction But Still Overvalued

· We are revising up our end 2025 S&P500 forecast from 6000 to 6500 for a number of reasons. Private sector data shows the risk of a U.S. hard landing is lower than a couple of months ago, with economic data more consistent with a soft landing. Additionally, the tech/AI optimism has not been dented, while buybacks would only be hurt by a hard landing. Even so, the U.S. equity market is now extremely overvalued on equity only and equity-bond valuations measures. In 2026, we expect a 5-10% correction and then a rebound, that ends up leaving the S&P500 at 6600 by end 2026.

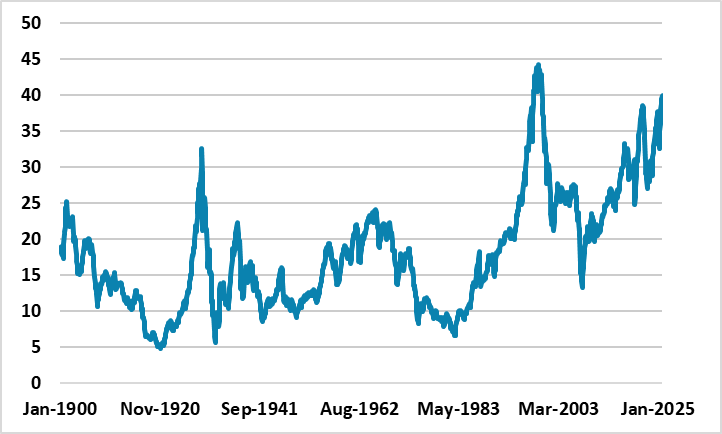

Figure 1: 12mth Fwd S&P500 P/E versus 10yr Inverted Real Bond Yield (%)

Source: Datastream/Continuum Economics (Using Real Indexed Linked Yields and Projections).

We are revising up our end 2025 S&P500 forecast from 6000 to 6500 for a number of reasons.

· Soft Landing. The private sector data recently is more consistent with a soft landing rather than a hard landing, even without federal data. Though we do still see the high average tariffs being an economic headwind in H2 2025 and 2026, we will revise down the probability of a U.S. recession from 30% in the December outlook. Tariffs do not appear to be causing a harder landing and the U.S. economy is muddling through on AI Capex boom and balance sheet strength of U.S. households. This all reduces the risk of a sharper slowdown in corporate earnings, though we do expect a deceleration.

· Buybacks. If the economy sees a soft landing then buybacks can be counted on at an aggressive pace. A harder landing would likely slow buybacks and amplify a correction, but this is a lower probability risk than a couple of months ago.

· AI/Tech wave remains. The latest earnings season shows momentum for the magnificent 7 and no major adverse surprises. Though questions have been raised about the AI capex squeeze on 2026 profits, the backlog of orders for Nvidia, Microsoft, Amazon and Alphabet means that investors are counting on a revenue and earnings pick-up in 2027 for some of the Magnificent 7 – with Meta facing more serious questions due to the lack of a big server business. Slower Magnificent 7 profit growth could prompt intermittent correction in the next 14 months, but it is difficult to be confident about a major reset and this means that underlying bullishness will remain in place. Even so, S&P500 IT and Communications fwd P/E ratio remains well above the 2020 peak and is clearly overvalued, which could cause correction/consolidative absolute price movements at times.

However, we are not revising our end 2026 S&P500 forecast of 6600, despite a soft landing and the Fed likely easing to 3.00-3.25% Fed Funds by end 2026. The U.S. equity market is clearly overvalued on a broad array of equity valuation measures and also against 10yr real bond yields (Figure 1). Rather than going into the merits of each measure, we would note that the fwd 12mth P/E ratio and CAPE P/E (Figure 2) have been the best predictor of future returns and current 5 and 10yr capital market assumptions would show some mean reversion in P/E ratios. However, peak valuations do not last years but rather months and quarters. 2022 sky high valuations were noticeable from January 2021 to April 2022 before major P/E derating occurred. Extremely elevated valuations (CAPE P/E over 40) existed January 1999 to September 2020, before valuations cracked.

Figure 2: S&P500 CAPE Shiller P/E Pushing Back Towards 2000 Peak

Source: Continuum Economics

Our baseline for 2026 is not a bear market, but rather a correction followed by a recovery that leaves the market little changed from end 2025 levels. The 2022 and 2001 P/E derating were caused by major catalysts in the shape of aggressive Fed tightening and a recession respectively. No large adverse catalyst is in our baseline U.S. economic and policy view for 2026. However, we see 10yr U.S. Treasury yields remaining close to current levels (here) throughout 2026, which leaves a strain in equity-bond relatives. Any moderate adverse news could be enough to prompt a 5-10% correction in U.S. equites.

One potential catalyst is the economy, if high tariff levels feed through later and more powerfully then we are projecting to cause a harder landing in the economy. An early end to Fed easing or a Fed pause is more mixed for U.S. equities, as the money and bond market would likely believe that further easing would likely arrive in H2 2026. Meanwhile, Supreme Court rejection of Trump’s reciprocal tariffs would cause short-term volatility, but the Trump administration would likely find some replacements and also a considerable number of key trading partners have agreed trade frameworks in principle that include specified tariff levels, and these would stand. On the political front, an attempt by the Trump administration to derail the mid-term election or dispute the election result would raise political risk and likely prompt an equity market correction, but is a modest probability scenario.