AI and U.S. Equities

· The AI story has driven broad momentum in the U.S. equity market, but will likely become narrower driver in 2026 and 2027, as not all big AI/tech companies will generate clear explosive revenue from areas outside cloud computing and semiconductor chips. Companies that are also dependent on external finance to fund AI investments could experience more volatility than the big cloud computing companies, especially by 2027. Though the wider AI story will remain for the U.S. equity market in 2026, these issues could cause more selectivity, relative value trades and volatility in the AI story for the U.S. equity market and at times could cause intermittent corrections in the S&P500. 2027 could see tech companies depending on external finance facing difficulties and this could cause more correction pressures in the U.S. equity market. This is a market valuation question, as the broader AI story will likely lift productivity and U.S. GDP and produce wider benefits in the next 1-5 years, with the key uncertainity whether this will be modest or moderate.

While strong positive momentum remains for the AI theme, areas of uncertainty over future revenues and profits for some companies can provide crosscurrents for U.S. equities in 2026 and 2027.

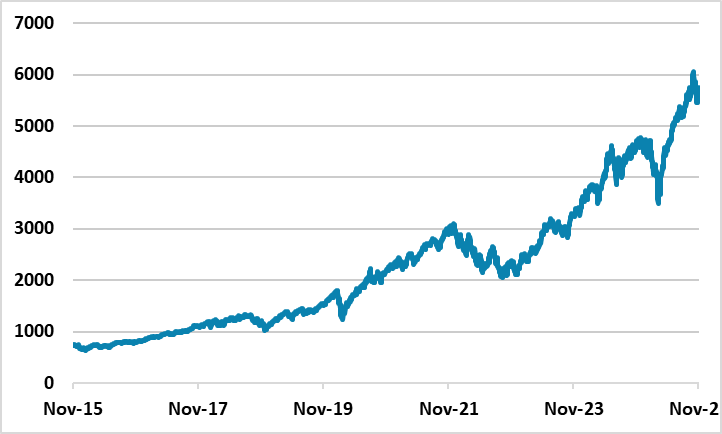

Figure 1: S&P Information Technology Sector

Source: S&P

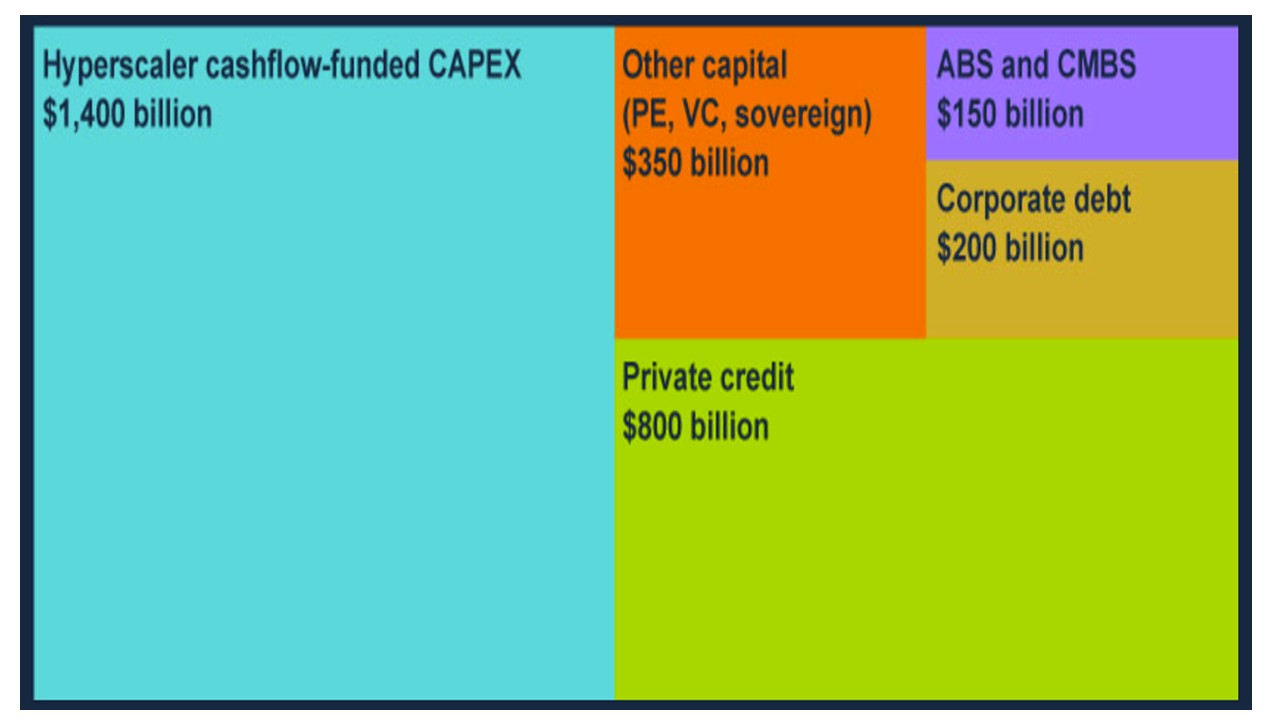

· AI/Tech investment wave remains. The latest earnings season shows momentum for the big tech companies and no major adverse earnings surprises. Though questions have been raised about the AI capex squeeze on long-term profits, the backlog of orders for Nvidia, Microsoft, Amazon and Alphabet means that investors are counting on revenue and double digit earnings to remain healthy in 2026 and 2027 for some of the Magnificent 7. Further out in 2028-30, continued strong cloud based and semiconductor revenue and profit projections are a key element behind expectations of ongoing strong AI Capex investment. Healthy cash flow means that most new investment for these companies is internally financed and any borrowing by some of the Magnificent 7 comes on underleveraged balance sheets. It is estimated that the hyperscaler should be able to fund close to 50% of overall AI Capex from cash flow (Figure 2) – ancillary investment in power generation is a separate question. So far, these cloud and chip companies have been the clear winners, and will likely be supported by U.S. financial markets through any moderate storms.

Figure 2: 2025-28 AI Investment

Source: Morgan Stanley/BOE (here)

· Uncertainty over the scale and timing of other AI revenue and low moats. Outside of cloud computing and advanced semiconductor chips, the revenue from other AI sources is less clear in terms of size and also in timing. So far the U.S. equity and private credit market has been willing to give AI Capax investment widespread backing. However, Meta is facing questions over when strong AI revenue will significantly kick in to pay for heavy investment, while Open AI losses remain very large and future circular financing from partner companies (Oracle/Softbank/Nvidia) may not be as smooth as it was in 2025. Open AI needs to increase revenue by at least 20 fold by 2030. If Open AI revenue growth does not meet this rapid rise, it could then produce a negative feedback loop to Stargate partners and thier datacentre build out and future semiconductor revenue prospects. Meanwhile, AI ad and agentic revenue is currently low, while AI services currently have lower moats to protect from competition than existing tech services. This could mean that the benefits of AI accrue more to end users than tech companies in a competitive AI enviornment. Moreover, the nature of U.S. tech companies is swinging from capital lite to capital intensive, which means the financially weaker tech companies could face volatility in financing if revenue fails to grow exponentially, causing company specific worries. This could lead to lower P/E ratios for some companies and higher financing spreads -- Oracle is already suffering to a degree. This could be a bigger issue in 2027, when more private credit will have been used. A 2nd issue is whether AI adversely impacts existing tech revenue. Some industry analysts question whether AI search will change the nature of search and lead to less traditional tech ad revenue, which could hurt corporate earnings optimism for Alphabet and Meta. A 3rd area to watch is whether any capital lite AI models catch up with the U.S. market leaders. Deepseek provided a temporary fright in early 2025, but the front running models remain in the U.S. (Open AI then Google and Anthropic).

· Overall, the S&P500 IT and Communications fwd P/E ratio remains well above the 2020 peak and are clearly overvalued, which could cause correction/consolidative absolute price movements at times, led by companies whose profits are squeezed by the AI investment or are too dependent on external finance. A very tight Equity-Bond risk premia also leaves the U.S. equity market vulnerable to moderate bad news or shift to a winner and losers mentality in investment. Given the importance of AI and tech, this will impact overall S&P 500 performance – we see scope for a 5-10% correction in 2026 and larger in 2027.

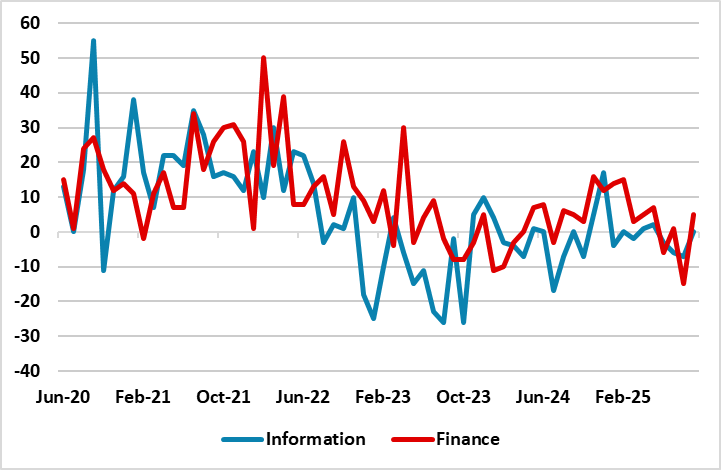

· AI, Productivity/Cost cutting and Growth. AI also has the potential to modestly or moderately raise productivity growth, which in turn boosts overall growth and suppresses inflation like the ICT revolution. This can produce a secondary boost to tech revenue and profits, as well as the wider U.S. equity market. However, it is not yet clear in the U.S. productivity numbers, whether existing AI adoption is clearly boosting productivity despite anecdotal stories – AI adoption and rollout is more of a U.S. centric story, though China and Asia are also benefitting. An alternative viewpoint is to monitor job losses caused by AI, which has been a rising feature of U.S. corporate earnings reports. However, it is unclear whether AI is being exaggerated as an excuse to cut jobs following the excessive hiring in the U.S. during the 2021-23 period. Job numbers in white collar finance and IT need to be watched closely in U.S. employment reports and other data through 2026-27 to understand the developing trend (Figure 3), but for now, are not a cause for alarm. Clear job losses, but in line with the ICT revolution, would help AI optimism without side effects. Large scale job losses would help AI optimism, but not the macro or U.S. equities ex tech stories, as it would raise long-term concerns about U.S. employment trends – and hence wages/government tax revenue and consumption/government debt. Meanwhile, as we noted in a recent article (here), AI humanoid robots are a concept and unlikely to be rolled out significantly until 2030-40, due to cost; battery life problems and levels of dexterity. This should mean that blue collar and movement intensive service jobs are better protected than white collar desk jobs in the coming years.

Figure 3: Change in Monthly Employment Finance and Information (%)

Source: BLS/Continuum Economics

Overall, the AI story will likely become narrower in 2026 and 2027, as not all big AI/tech companies will generate clear revenue from areas outside cloud computing and semiconductor chips. Companies that are also dependent on external finance to meet AI investment could have more volatile times then the big cloud computing companies, especially by 2027. Though the wider AI story will remain, these issues could cause more selectivity, relative value trades and volatility in the AI story for the U.S. equity market, and at times could cause intermittent corrections in the S&P500. This is a market valuation question, as the broader AI story will likely lift productivity and U.S. GDP and produce wider benefits multi year, with the key uncertainity whether this will be modest or moderate.

I,Mike Gallagher, the Director of Research declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.