Preview: Due October 15 (dependent on shutdown ending) - U.S. September CPI - Firm but a little less so in core rate

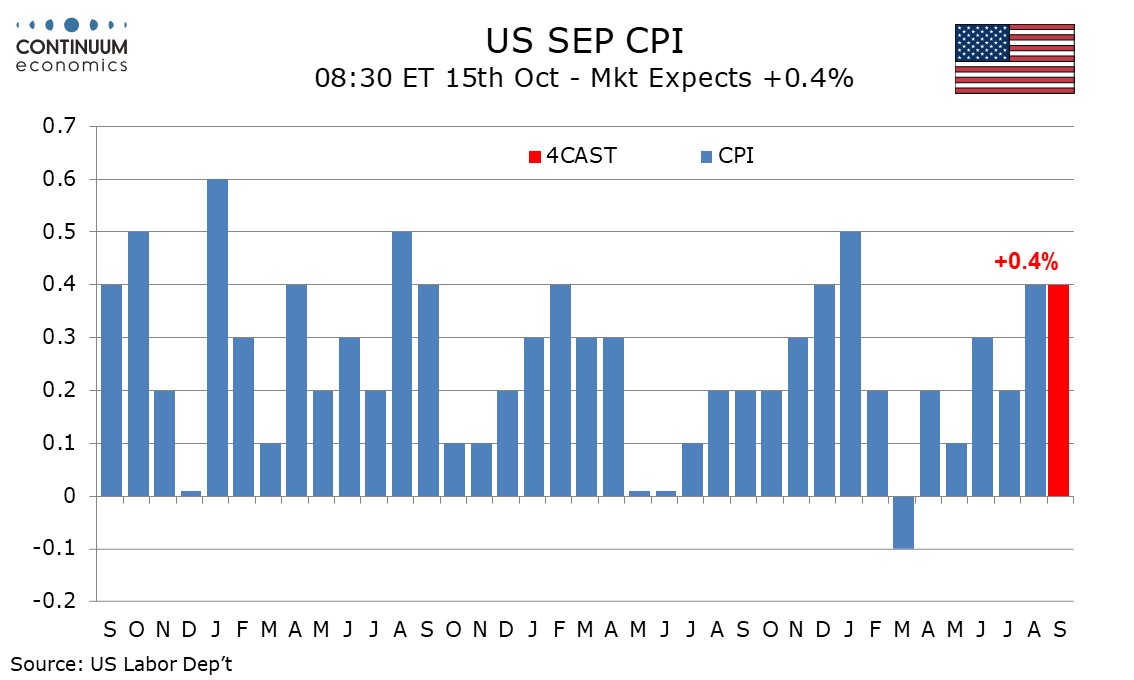

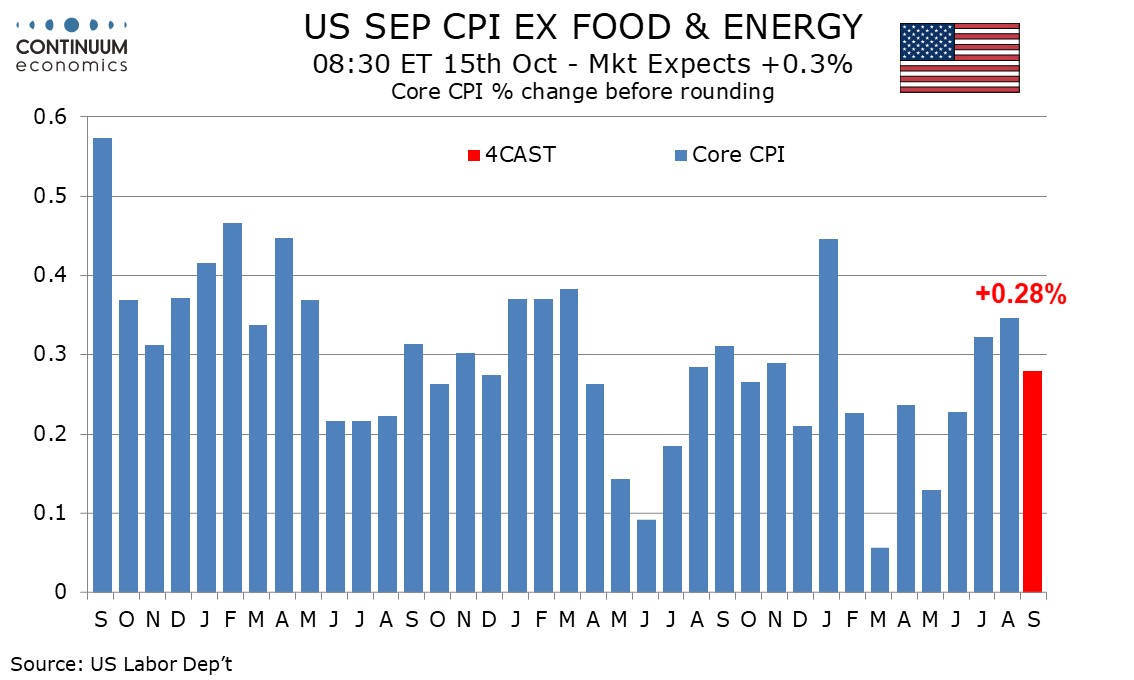

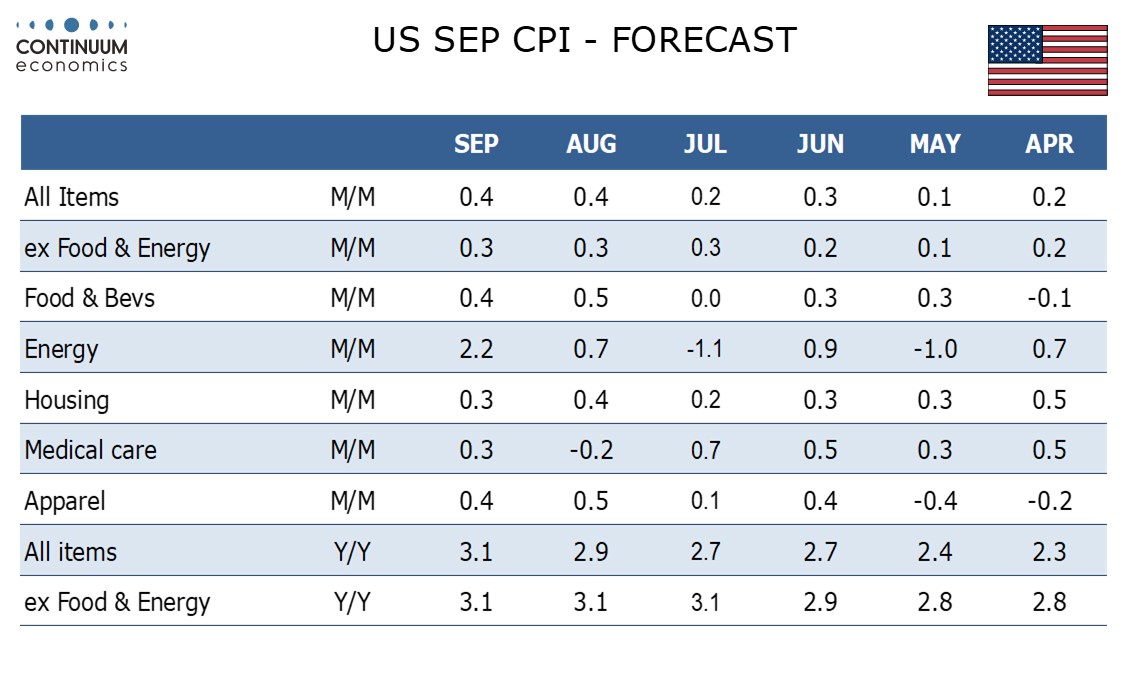

We expect September CPI to increase by 0.4% overall and by 0.3% ex food and energy, matching August’s outcomes after rounding, though before rounding we expect overall CPI to be rounded down from 0.425%, and the core rate to be rounded up from 0.28%, contrasting August data when headline CPI was rounded up from 0.38% and the core rate was only marginally below 0.35% before rounding.

While scheduled on October 15 the government shutdown leaves the actual timing of the release uncertain, with no guarantee that it will be seen before the October 29 FOMC meeting. It is also possible the accuracy of the eventual release will be compromised. Even before the shutdown, recent CPI releases had seen increasing numbers of inputs estimated to reduced staffing.

We expect a 4.0% rise in gasoline prices, inflated by seasonal adjustments, to lead a 2.2% increase in energy. We expect a second straight firm rise in food, 0.4% versus 0.5%, with tariffs playing a part. We expect tariffs to also play a part in a second straight 0.3% increase in commodities ex food and energy.

We expect services excluding energy to come in below 0.3% before rounding, which would be below recent trend, with a 0.3% rise in August having followed a 0.4% increase in July. Components likely to correct below trend after strong August gains are air fares, which rose by 5.9% in August, and shelter, which rose by 0.4% in August inflated by above trend gains of 0.4% in owners’ equivalent rent and 2.3% in lodging away from home.

We expect yr/yr growth ex food and energy of 3.1% for a third straight month. We expect yr/yr growth in overall CPI to catch up with the core rate for the first time since February 2023, rising to 3.1% from 2.9% in August.