U.S. October and November Employment - Unemployment rising but economy maintains some momentum

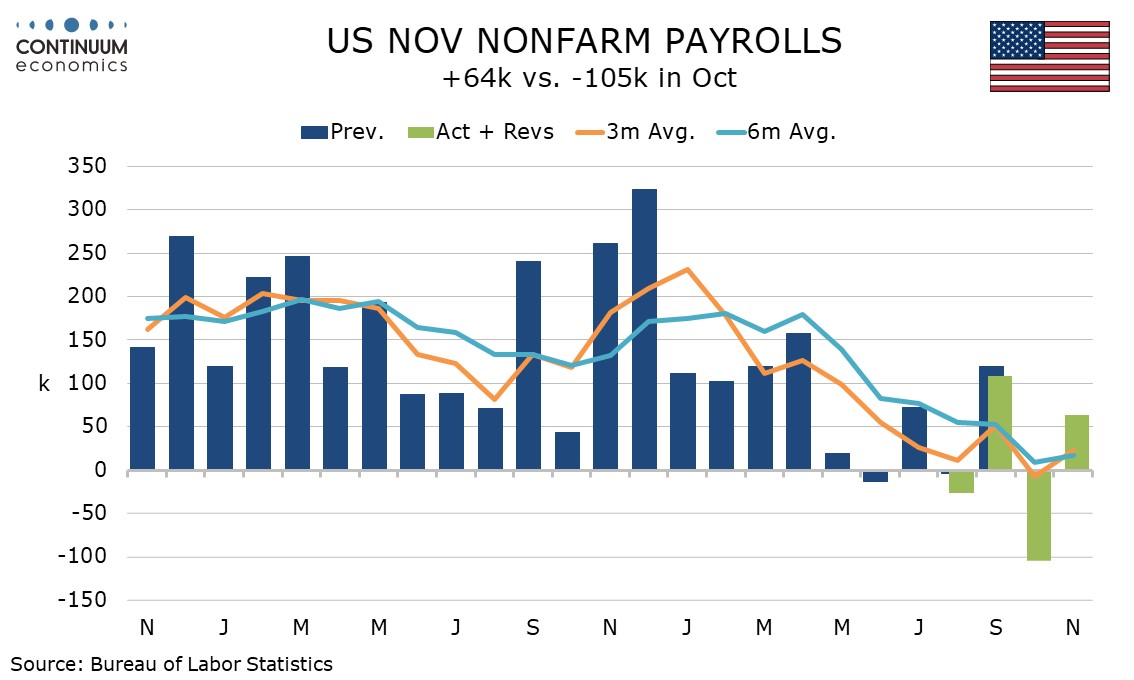

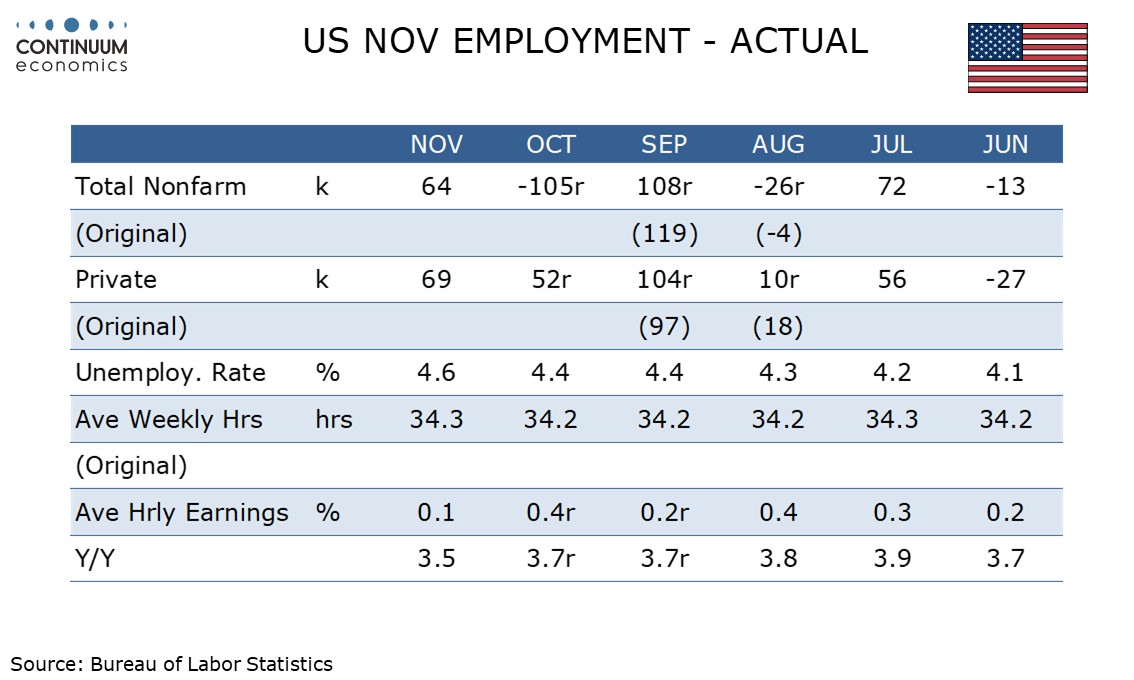

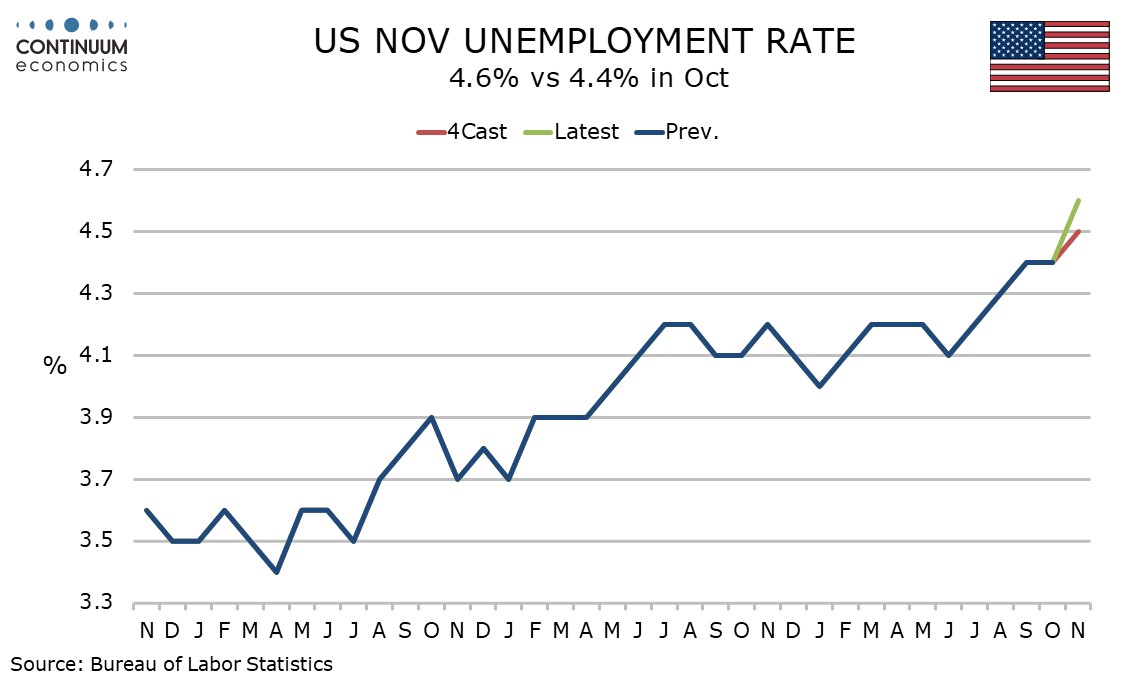

November’s non-non-farm payroll at 64k does not fully erase a 105k decline in October but private payrolls at 69k in November and 52k in October maintain moderate growth, though unemployment at 4.6% in November is the highest since September 2021, and average hourly earnings growth is slowing. October retail sales were unchanged but maintain momentum outside weakness in autos.

Government employment was particularly weak in October due to DOGE layoffs, who had continued to receive their salaries for six months and thus counted as on the payroll, came through. Federal government employment plunged by 162k in October, but fell only marginally on September and November.

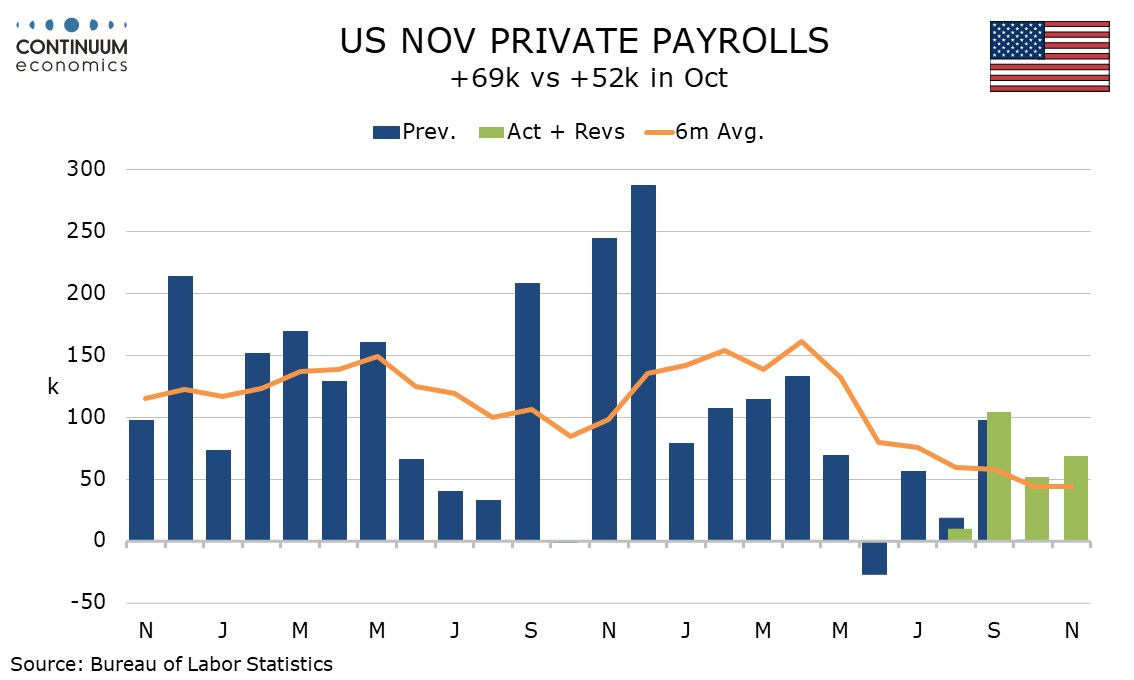

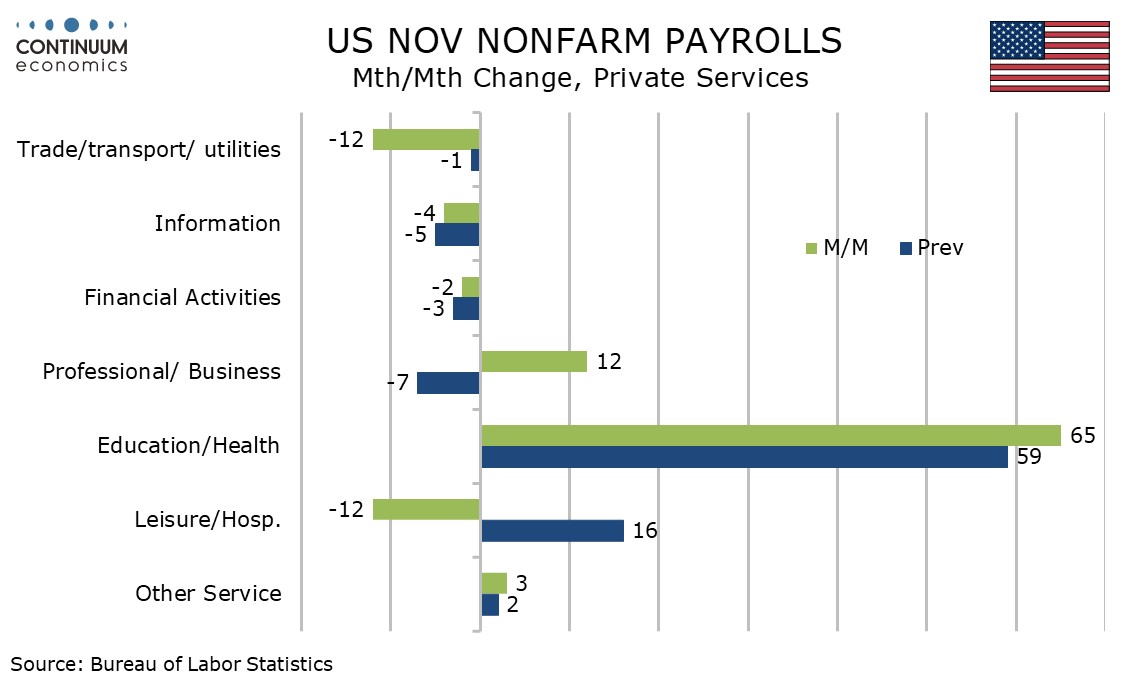

October private payrolls at 52k were in line with trend (September was above trend at 104k after a weak 10k in August) and November at 69k was slightly stronger.

Weekly ADP data released today show an average of 16.5k in weekly employment growth in the four weeks to November 29 (two week after November’s payroll was surveyed), suggesting momentum continues entering December.

While private payrolls still have positive momentum, Fed Chair Powell has expressed concern that recent data has been overstated and that the true picture is marginally negative. A rise in unemployment to 4.6% in November from 4.4% in September (October data was not collected) will maintain Fed concerns, even if the rate was rounded up from 4.564%.

The household survey shows employment up only 96k over the two months, which outperforms the overall non-farm payroll, while the labor force increased by 323k, still growing despite reduced immigration.

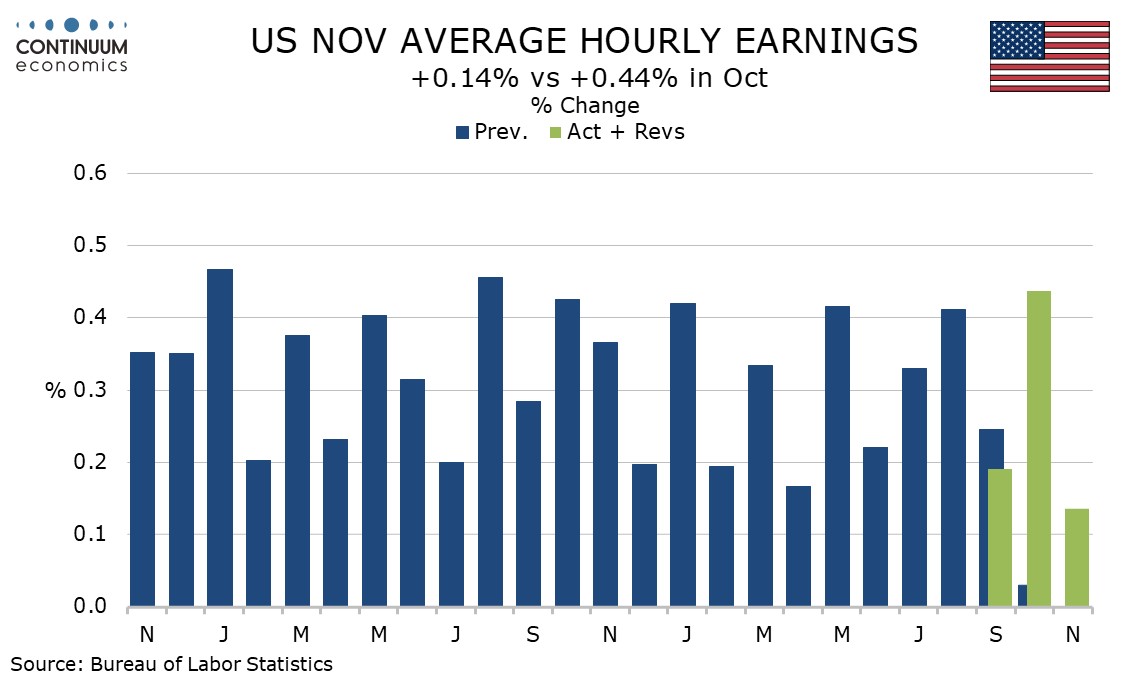

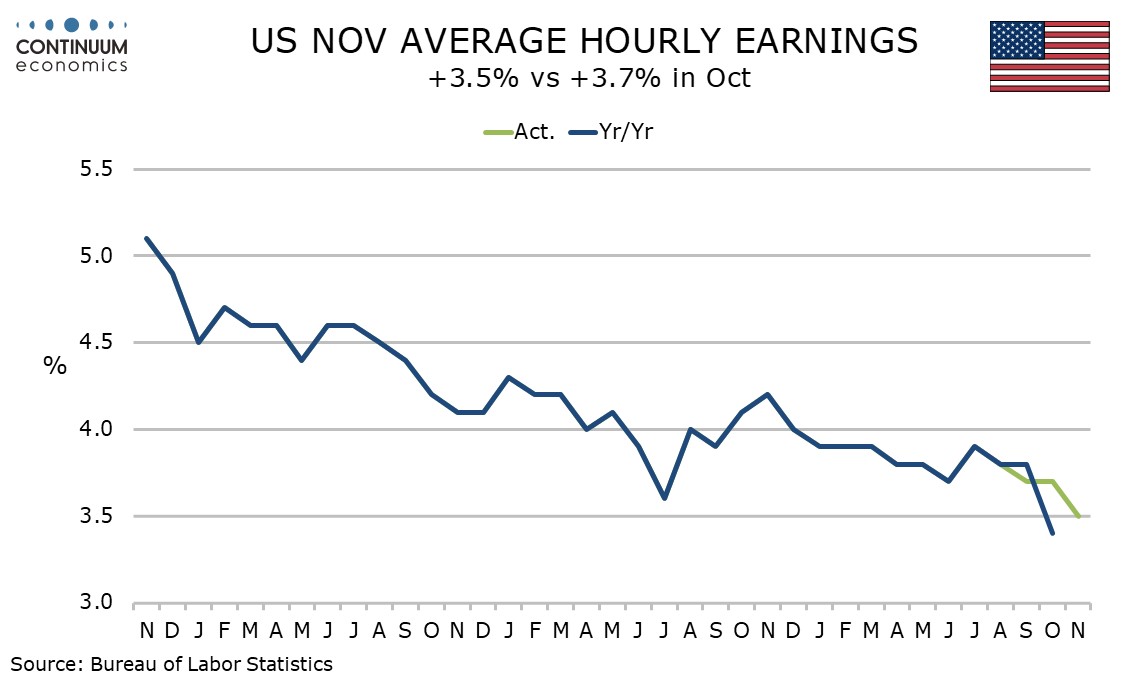

A 0.14% rise in average hourly earnings in November follows a 0.44% rise in October though trend is slowing, with yr/yr growth of 3.5% down from 3.7% in October and September and the slowest since May 2021.

November’s workweek at 34.3 hours follows three straight at 34.2 and suggests the economy maintains moderate momentum.

Employment growth however remains very dependent on health care and social assistance, up by 64k in November and 65k in October.

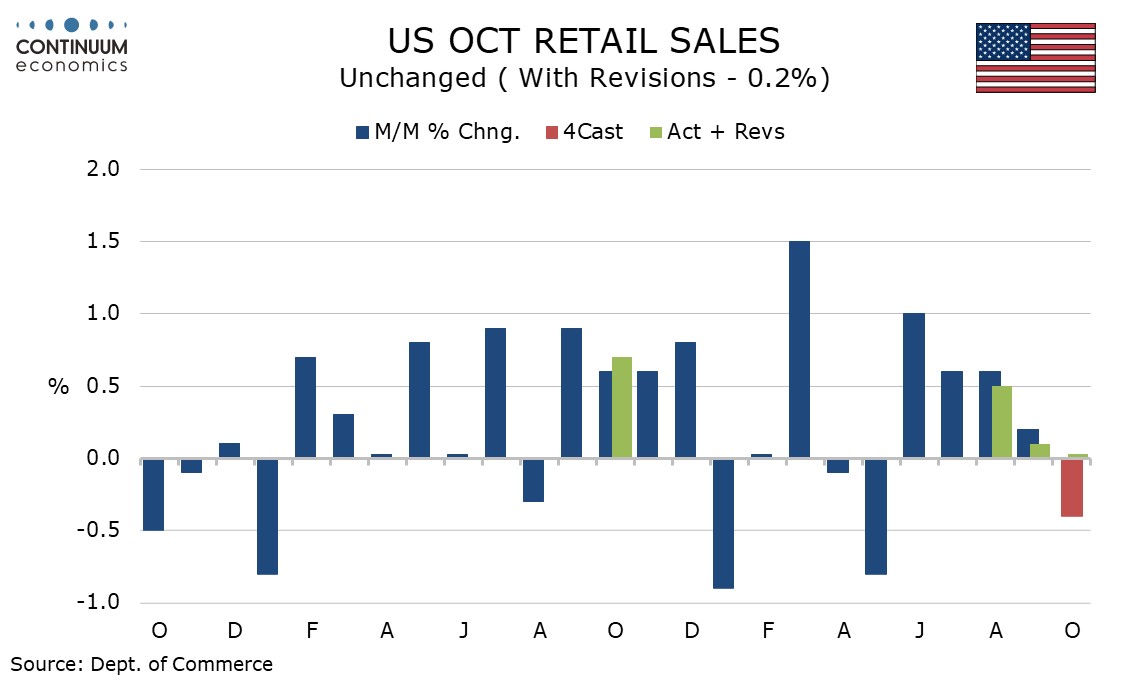

October retail sales were unchanged with auto sales hit by the expiry of a tax credit for electric vehicles. Ex-auto sales however with a rise of 0.4% were respectable, sales ex gasoline at 0.5% stronger still, and the control group which contributes to GDP firm at 0.8%, also suggesting the economy still has some momentum.

The 3 month/3 month pace ex auto and gasoline is 1.3% (not annualized) and has been very stable over the last six months.