Preview: Due December 16 - U.S. October/November Employment (Non-Farm Payrolls) - Slow but still positive in the private sector

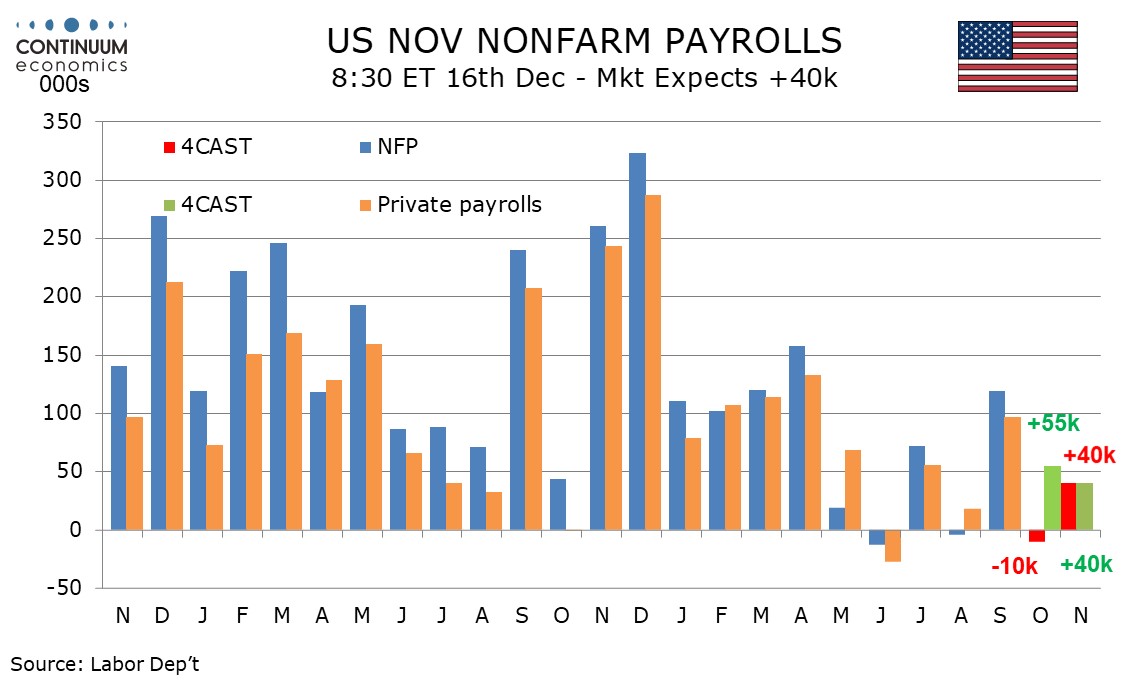

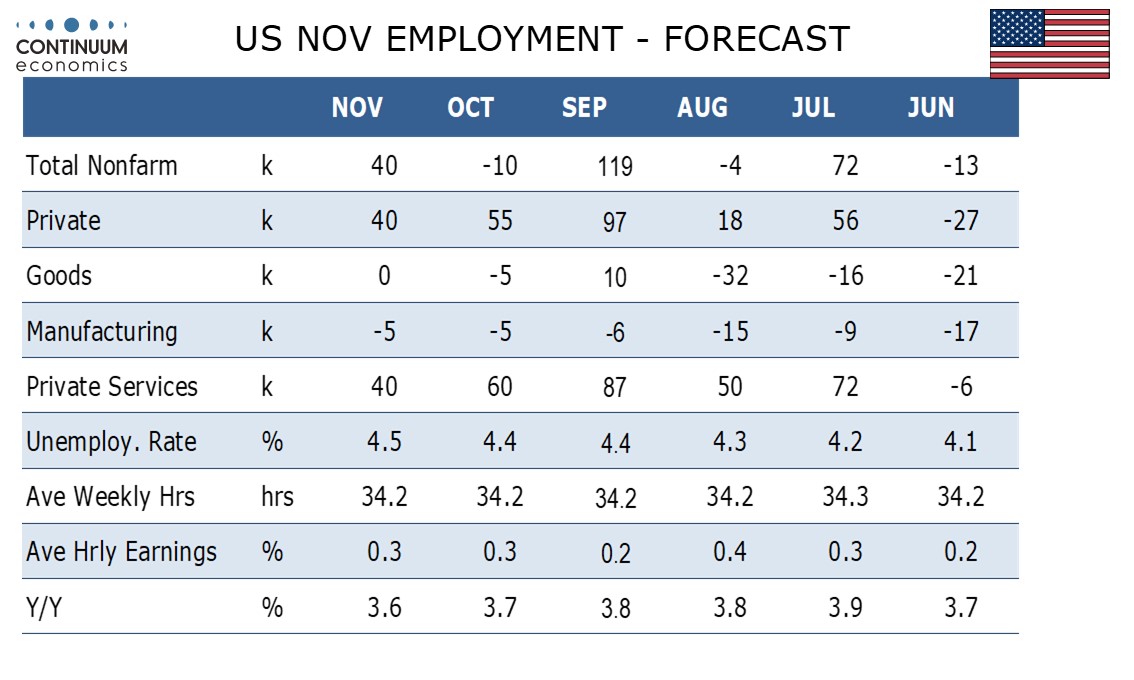

The Labor Department will release October and November non-farm payroll data on December 16. We expect November to see gains of 40k both overall and in the private sector. However we expect October to see a decline of 10k overall but a 55k increase in the private sector.

October is likely to see a sharp decline in Federal government workers as DOGE layoffs see the 6 months of salary that was provided after the layoffs run out.

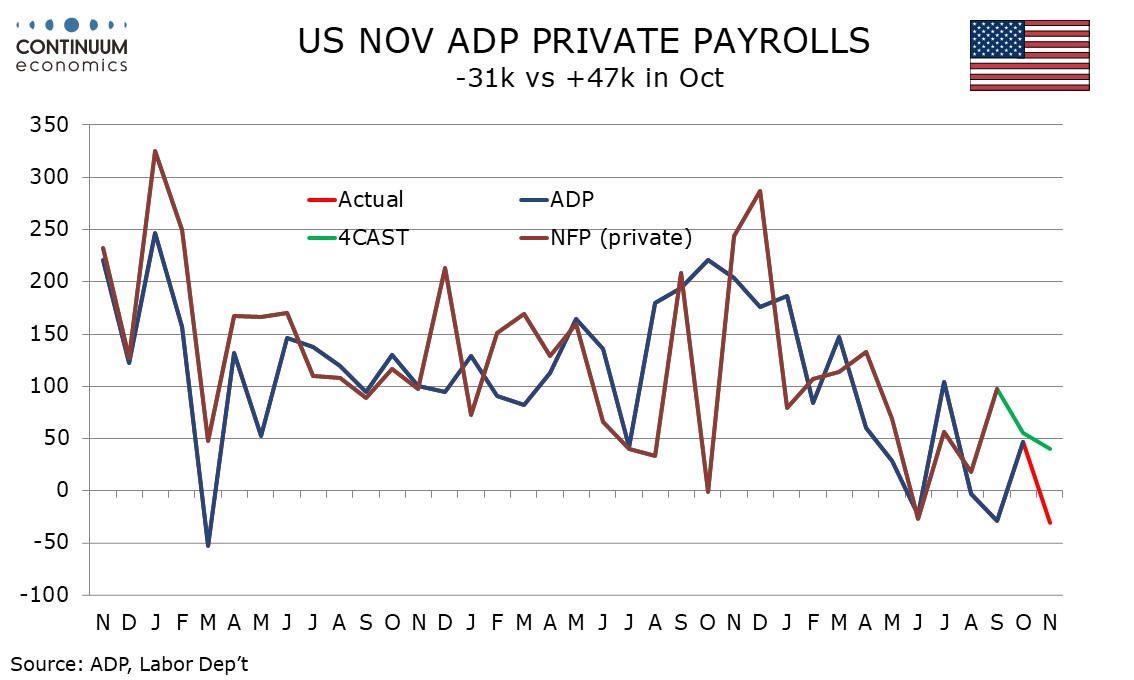

With these payroll releases being delayed, we have a little more information than usual to use in the forecasts. Our forecasts are stronger than ADP’s private sector estimates, which saw a 47k increase in October and a 31k decline in November, and also those of Revelio Labs, which saw overall payrolls down by 9k in November after a 15.5k decline in October. Revelio’s data for the private sector increased by 8k in October but fell by 19.4k in November. Still, the message is that November slowed from October in the private sector.

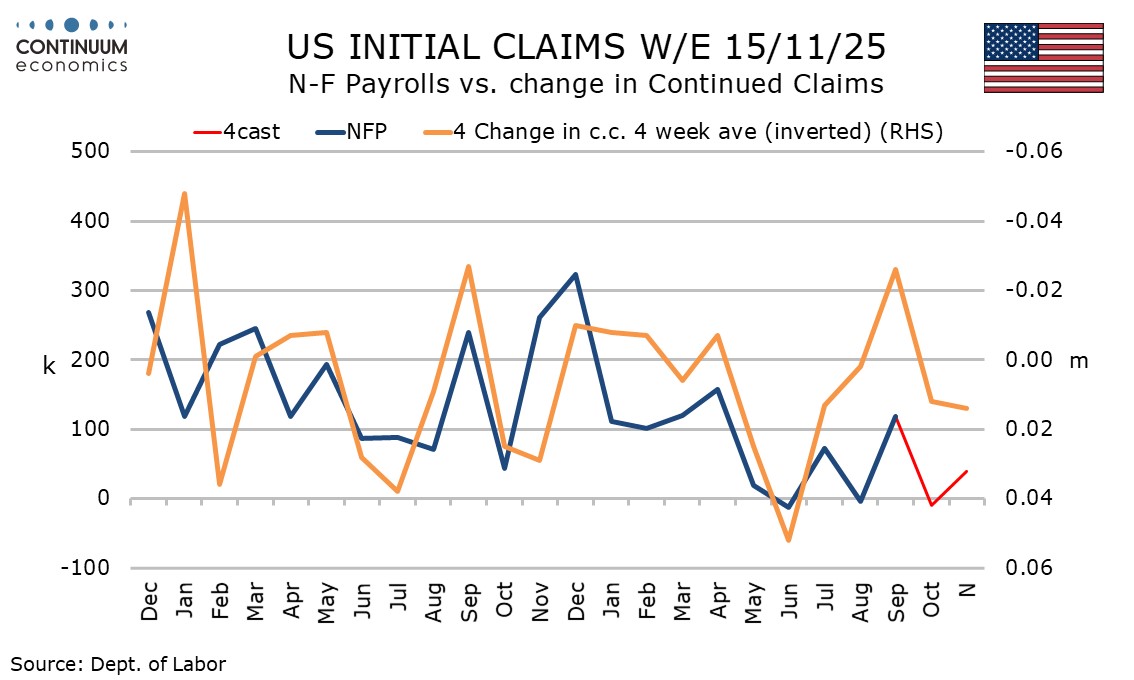

Initial claims remain low and suggest few are losing their jobs though continued claims picked up between mid-September and early November, suggesting jobs became harder to find, arguing that October and November payrolls will not be as strong as September’s’ which saw a rise of 117k, 97k in the private sector. JOLTS data on labor turnover however implied employment gains of 103k in September, consistent with September’s payroll, with a similar 99k implied for October.

On balance, it appears that private sector payroll growth remained positive but not as strong as in September, with November likely to be a little slower in the private sector than October. Our forecast for October private payrolls of 55k is close to the 57.5k average of September’s 97k and August’s 18k. We expect a slightly slower 40k in November. We expect government to be unchanged in November after a 65k decline in October.

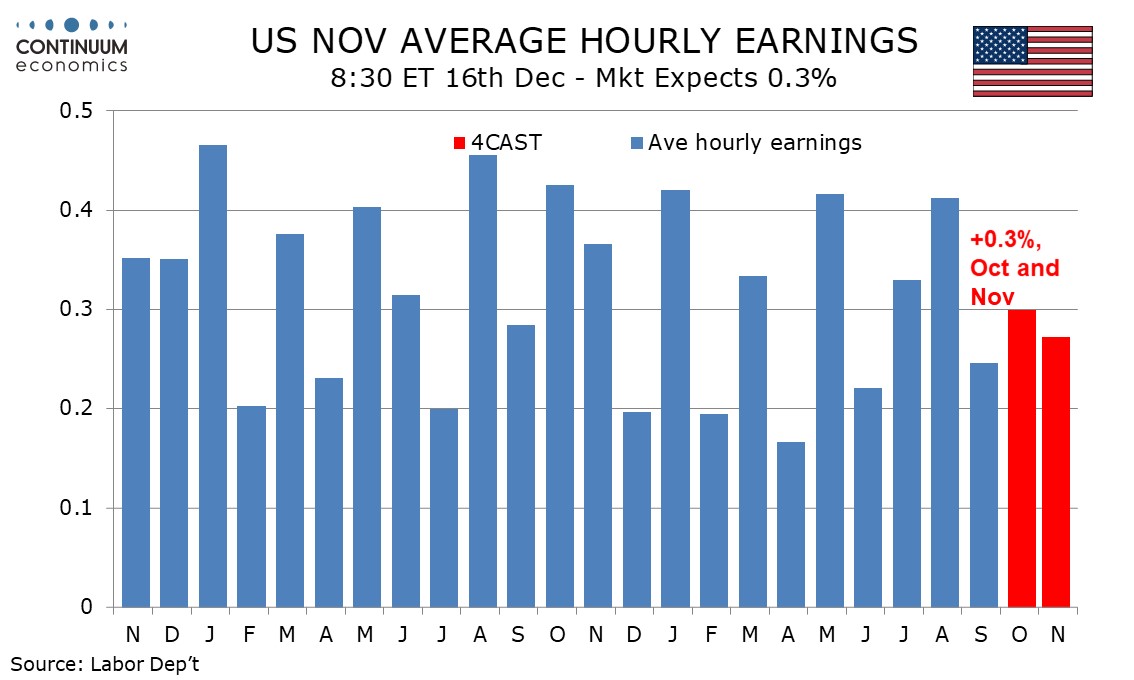

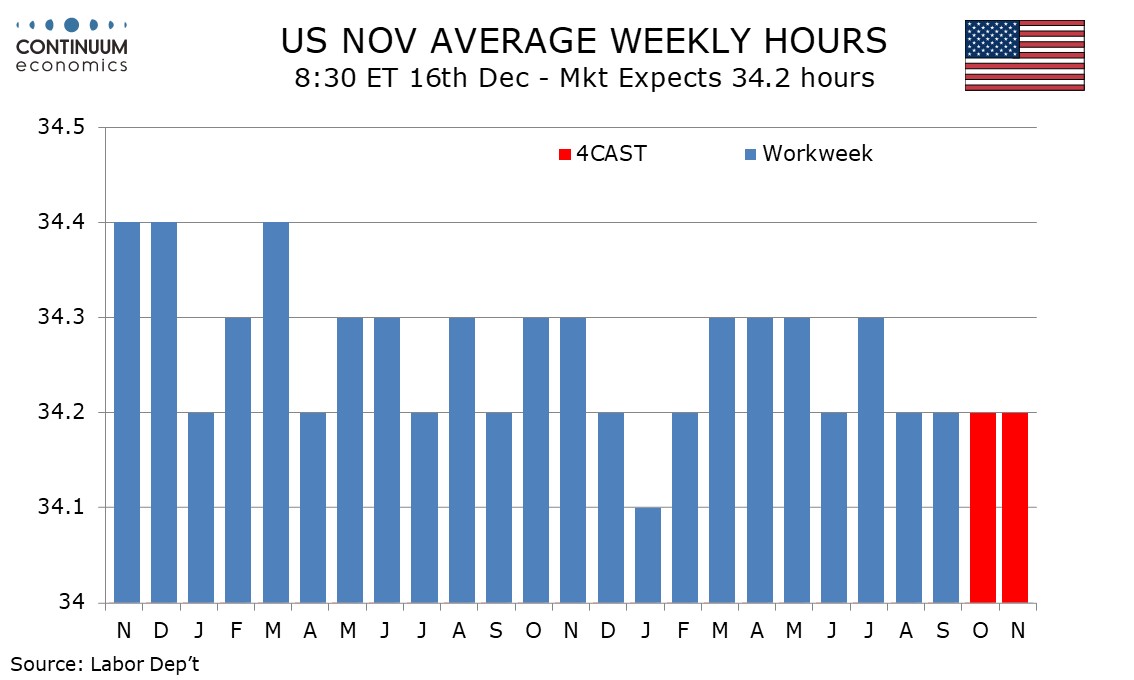

We expect average hourly earnings to rise by 0.3% in both months, which is line with trend with the last five months having seen two gains of both 0.4% and 0.2% and one of 0.3%. We expect October to be close to 0.3% before rounding but November to slow to 0.27%. Yr/yr growth would then slow to 3.6% in November from 3.7% in October and 3.8% in both August and September. We expect a workweek of 34.2 hours in both October and November, matching August and September.

While two months of non-farm payrolls will be provided, we will get an unemployment rate only for November, with data for October not surveyed. We expect a 4.5% rate in November, up from 4.4% in October which saw a third straight increase, with the rate at 4.44% before rounding. That means the labor force has to grow only marginally faster than employment over the two months to lift the rate to 4.5%.

I,Dave Sloan, the Senior Economist declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.