Asia/Pacific (ex-China/Japan) Outlook: Managing Slower Growth Without Losing the Cycle

· Asia’s 2026 growth is normalizing, not weakening, though the growth outlook reflects resilience under mounting strain rather than acceleration. Larger investment-led economies such as India and Malaysia are sustaining momentum through public capex, infrastructure pipelines, and industrial and digital policy execution. In contrast, Indonesia’s outlook is increasingly constrained by fiscal recalibration and rising political intervention. Export-dependent economies face more structural headwinds, stemming from an uneven global tech cycle, elevated tariff barriers, and weakness in Chinese end-demand.

· Domestic demand remains the primary growth anchor, but recovery is uneven and narrow-based. Private consumption continues to support growth across Asia, yet the breadth of the rebound varies significantly. Urban wage stagnation and uneven employment quality in India, elevated household leverage in Malaysia, and shifting fiscal priorities in Indonesia are limiting upside. Services, tourism, and digital activity are providing partial offsets, but consumer sentiment remains cautious amid labour-market frictions, tight credit conditions, and rising cost sensitivity. In India, recent tax reforms are expected to provide incremental support to urban consumption.

· Disinflation is helping, creating limited but meaningful policy space. Inflation has eased across the region, with India headline recording multi-year lows, Malaysia’s inflation stabilising near the lower end of historical ranges, and Indonesia undershooting the lower band of its target. This has enabled central banks to initiate or signal easing cycles. However, policymakers remain cautious, constrained by exchange-rate sensitivity, climate-linked food price risks, and the inflationary implications of fiscal populism. As a result, rate cuts are selective rather than aggressive. However, we do see more easing than the market in India in 2026 and no 2027 RBI rate hike.

· External conditions remain fragmented, weighing on trade-led growth models. Asia continues to operate in a volatile external environment shaped by lower oil prices, uneven Chinese demand, and unpredictable U.S. tariff policy. India and Malaysia are adapting through industrial diversification, supply-chain repositioning, and market re-routing. Indonesia, however, is more exposed: its trade surplus is narrowing. Across the region, firms are recalibrating supply-chain strategies in response to geopolitical risk.

· Fiscal strategies are diverging as political priorities take centre stage. India is deploying its RBI windfall to sustain infrastructure spending while signalling gradual deficit reduction, although medium-term tax reforms will constrain fiscal flexibility. Indonesia is pursuing an expansionary and politically ambitious 2026 budget—centred on free meals, defence, and energy security—raising concerns over fiscal credibility and execution risk. Malaysia’s reform agenda, including SST expansion and fuel subsidy rationalisation, is reshaping spending priorities toward productivity and consolidation, though implementation risks remain non-trivial.

· Forecast changes: Inflation remains subdued across Asia, but has shown signs of emerging pressures, which has prompted slight changes to our inflation forecast for India and Indonesia.

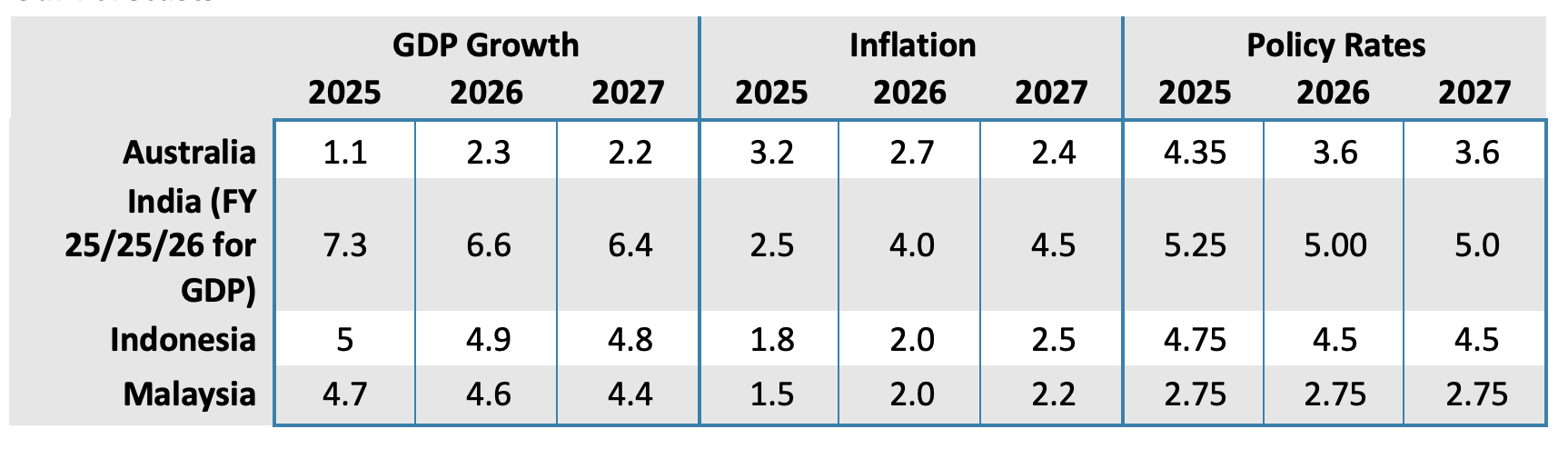

Our Forecasts

Source: Continuum Economics

Risks to Our Views

Source: Continuum Economics

Asia’s growth trajectory over 2026–27 reflects normalisation rather than stress. Headline expansion is moderating across major economies as high base effects fade and external demand weakens, but the region continues to outperform most other emerging markets. Growth is becoming more domestically anchored, supported by private consumption, targeted fiscal expansion, and state-led investment, while exports adjust to a more fragmented global trade environment shaped by U.S. tariffs and China spillovers.

Inflation remains broadly contained across Asia, driven primarily by food prices, administered costs, and modest FX pass-through rather than demand overheating. This has allowed central banks to maintain a cautious, growth-supportive stance, with limited rate cuts in select markets followed by long holds to preserve currency and financial stability.

Policy credibility remains a key differentiator. Economies combining macro discipline with targeted industrial policy—rather than broad stimulus—are best positioned to navigate slower global growth, rising protectionism, and increasing political intervention across the region.

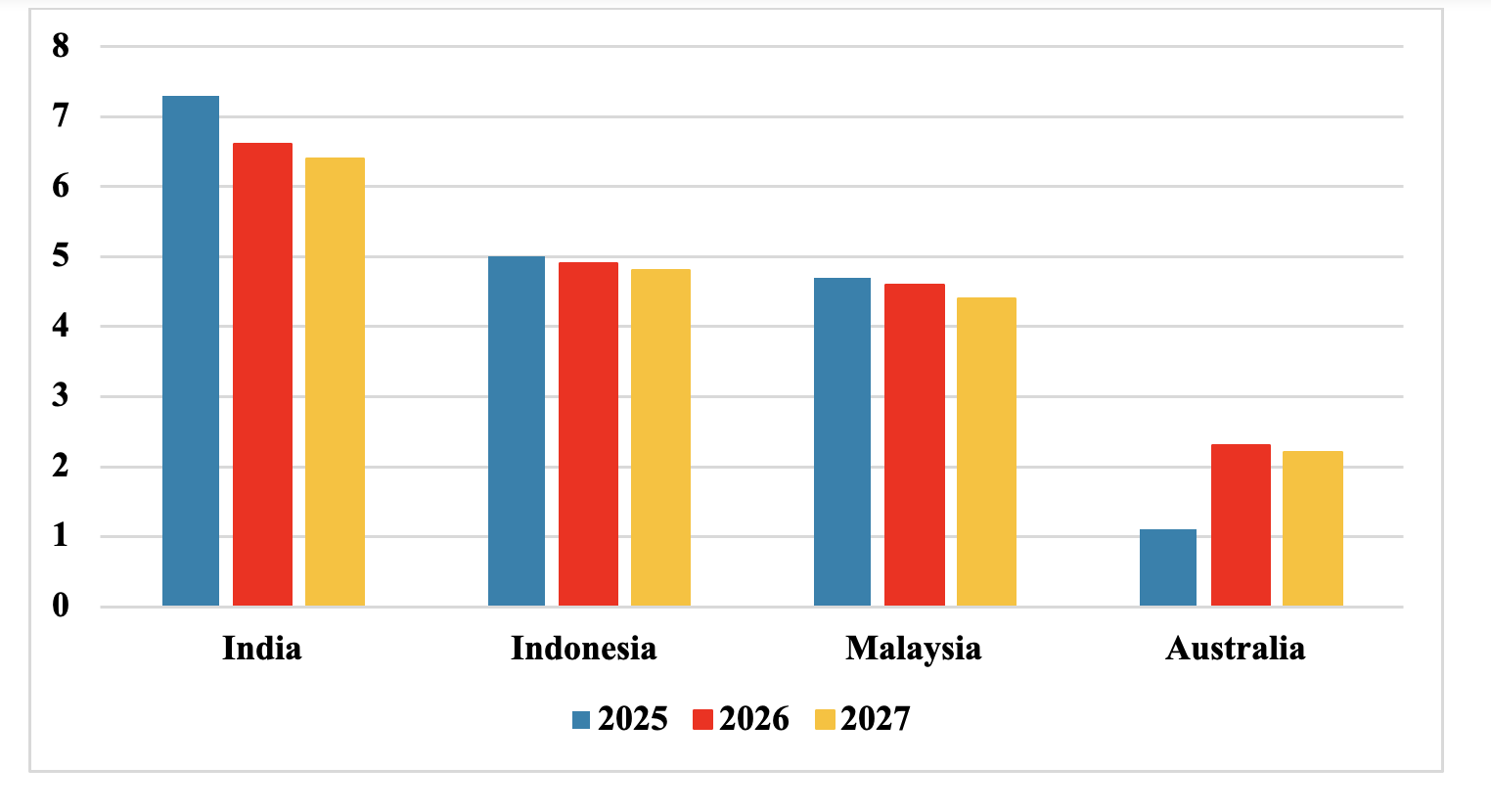

Figure 1: Real GDP Growth Forecast (% yr/yr)

Source: Continuum Economics

India: Growth Normalises as a Strong Cycle Matures

India enters 2026 and 2027 with a fundamentally resilient macroeconomic foundation, although headline growth will moderate from the exceptional rebound and the high base effects of early 2025. Real GDP growth is projected at 6.5% yr/yr in 2026 and 6.3% yr/yr in 2027, reflecting a maturing cycle rather than a loss of momentum. The drivers underpinning this outlook—private consumption, steady government expenditure, and continued investment in manufacturing and infrastructure—remain intact. The policy environment is expected to stay broadly stable, with the political centre holding and the government continuing to prioritise growth, capex, and supply-side competitiveness.

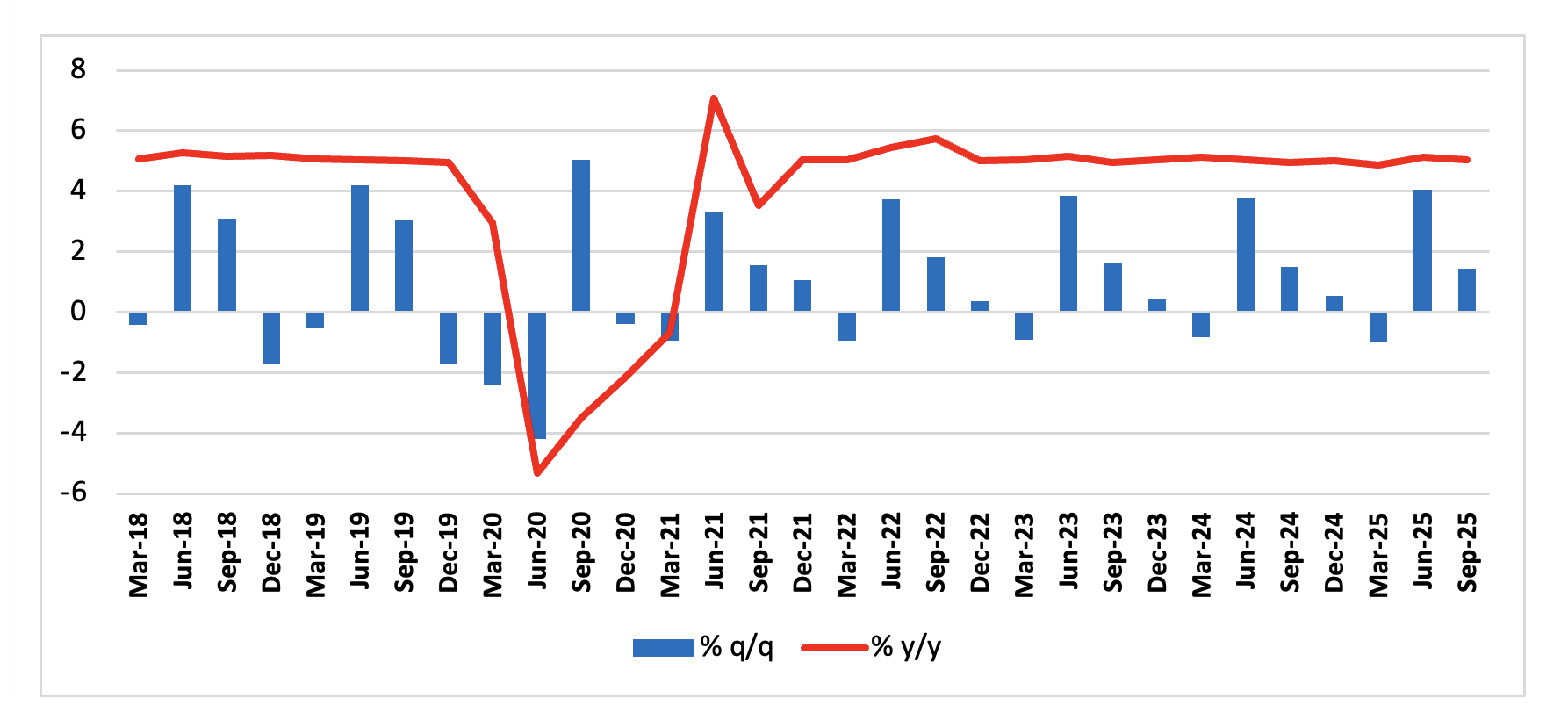

Figure 2: India GDP Forecast (% change, yr/yr)

Source: Continuum Economics

The moderation in 2026 is partly mechanical. India’s first half of 2025 delivered unusually strong readings driven by high government spending, resilient consumption, and a surge in services exports (given the front-loading due to U.S. tariff fears). This high base tempers the year-on-year arithmetic in 2026 even though underlying momentum remains firm. For 2027, domestically, consumption should remain robust, but less explosive than in FY25. No structural break is anticipated: India remains on a medium-term trajectory of 6–6.5% growth, anchored by productivity and sectoral diversification. Private consumption, which accounts for well over half of GDP, continues to drive the cycle. Rising urban wages, a stabilising rural recovery (contingent on favourable weather conditions), and expanding formal employment in services will sustain household demand. The premium segment—automobiles, electronics, travel—remains particularly strong, though mass-market categories are expected to see gradual improvement as rural incomes strengthen further.

Government spending stays central to the outlook. The government’s commitment to capital expenditure—especially in transport, green energy, and logistics—acts as a buffer against global volatility. While fiscal consolidation will continue, it will be paced rather than abrupt. With multiple state elections through 2026, the interplay of targeted welfare, infrastructure rollout, and state-level populist pledges will create localised demand impulses. These measures will not derail the national fiscal path but will influence spending priorities, particularly in agriculture, housing, and micro, small and medium enterprise (MSME) support. From a fiscal perspective, the upcoming 2026 budget will walk a fine line between industry support and fiscal consolidation. Sectors exposed to U.S. tariffs—textiles, steel, auto components, and select electronics—will likely receive targeted relief through subsidies, expanded PLI schemes, and diversified market access programmes. The government will prioritise trade competitiveness, domestic capacity building, and faster customs and logistics reforms.

In terms of sectoral growth, manufacturing enters 2026 with mixed tailwinds. Electronics, renewables equipment, pharmaceuticals, and automotive components continue to expand, supported by PLI incentives and global supply-chain diversification. However, tariff friction with the U.S. introduces uncertainty for sectors exposed to American demand. The earliest resolution to the tariff dispute appears to be in mid-2026, and even then, only in a narrow first-phase package. Large manufacturers will thus face pricing pressure, tighter margins, and potential delays to scaling plans, but the domestic market remains strong enough to offset some of the external drag. Construction and infrastructure remain bright spots. Public capex will continue to support roads, metros, ports, and energy corridors. Private developers are returning cautiously, encouraged by lower interest rates and rising semi-urban demand. Services will deliver the bulk of growth across both years. Agriculture, while still vulnerable to climate variability, is expected to have stable output. Productivity remains constrained by structural issues, but government interventions in irrigation, agri-tech, procurement systems, and crop diversification will moderate volatility.

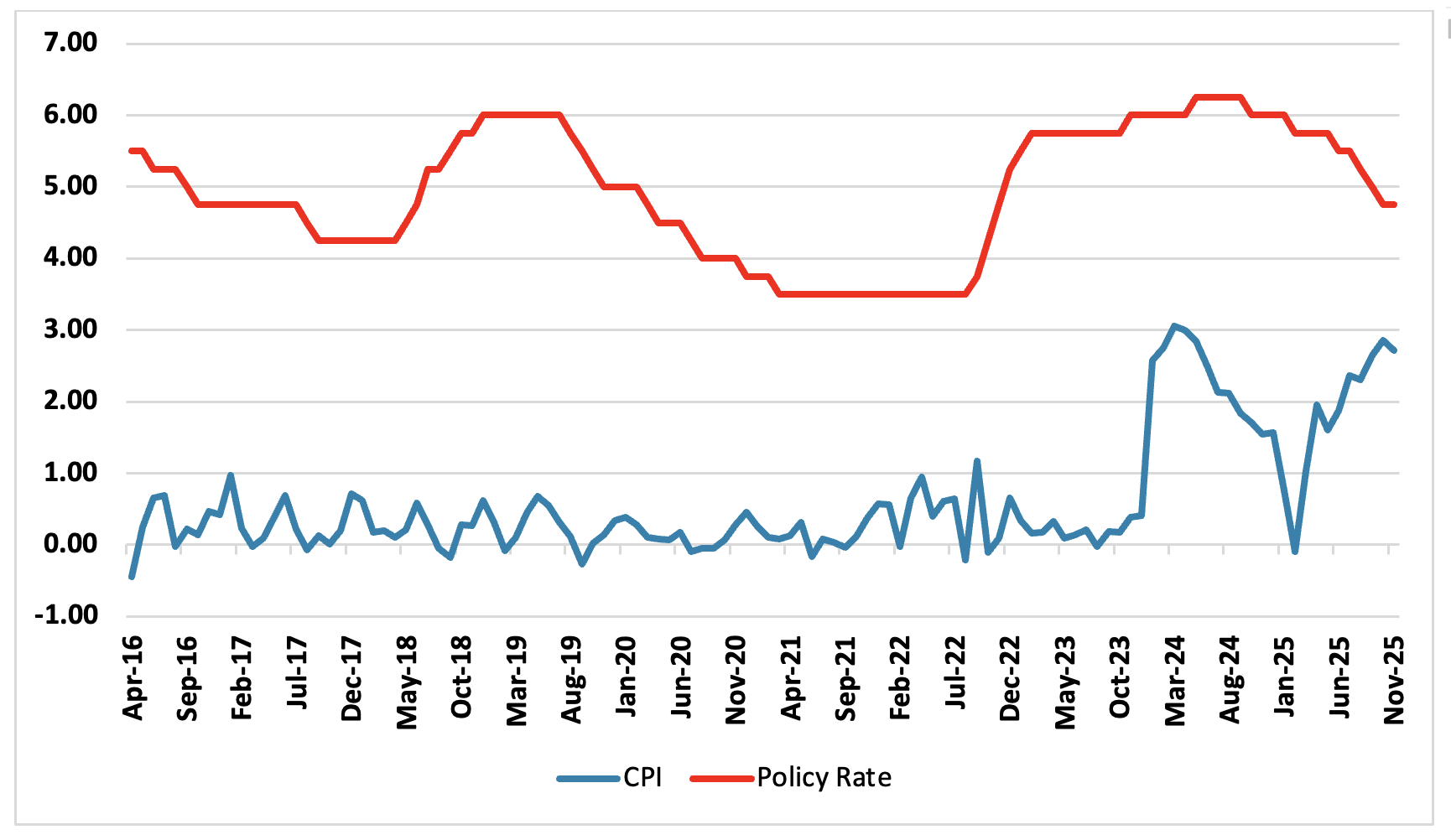

Headline inflation is expected to trend upward to 4% in 2026 and 4.5% in 2027, given base -effects and solid demand. As food dominates the CPI basket, short spikes are also expected to feed into the headline number. Core inflation remains around 4%, reflecting improved supply chains, a credible rupee management strategy, and subdued global commodity pressures. However, the outlook is not without friction. A depreciating rupee, driven by tariff-linked export softness and intermittent capital outflows, could introduce an imported inflation risk.

Figure 3: India Inflation and Policy Rate Trajectory (%)

Source: Continuum Economics

The monetary policy outlook is defined by caution rather than aggression. With inflation expected to remain within bounds, the Reserve Bank of India is likely to deliver one 25bps cut in 2026, bringing the repo rate to 5%. The move hinges on sustained underlying disinflation and the absence of new upward food shocks. The central bank’s broader stance—tight liquidity management, vigilant FX intervention, and a preference for real-rate stability will remain unchanged. However, we see the central bank governor as being dovish and wanting to maintain support for the economy, thus we do not look for RBI tightening in 2027 and see the policy rate at 5.0%. In our view, India is not in an easing cycle; it’s in a prolonged accommodation regime with optionality to tighten slowly if needed in 2027.

The most material risk to India’s outlook is the U.S. tariff environment. Negotiations have lacked real progress, and the earliest realistic window for a narrow deal appears to be mid-2026. Until then, uncertainty will weigh on investment sentiment in exposed manufacturing clusters, particularly in states like Tamil Nadu, Gujarat, and Maharashtra. A second risk is external: a sharper-than-expected rupee depreciation triggered by global risk aversion or oil price spikes. Geopolitically, on-and-off border tensions with China and Pakistan remain a feature of the landscape. There is no imminent risk of war, but periodic flare-ups could disrupt trade flows, sentiment, and investor positioning. Finally, domestic weather variability remains a lingering threat—particularly if monsoons deviate significantly from expectations, with immediate implications for food inflation and rural demand.

Indonesia: Growth Likely to Fall Short of Official Targets

Indonesia’s macroeconomic outlook for 2026–27 points to a gradual deceleration rather than a cyclical break. Real GDP growth is forecast at 4.9% in 2026 and 4.8% in 2027, down from an estimated 5% in 2025. The moderation reflects weakening external demand, softer job and income growth, and rising policy intervention under President Prabowo’s administration. Even so, Indonesia’s growth profile remains comparatively resilient within the emerging-market universe, supported by private consumption, a recovering services sector, and an increasingly expansionary fiscal stance.

Figure 4: Indonesia Real GDP Growth (%)

Source: Continuum Economics, Badan Pusat Statistik Indonesia

Source: Continuum Economics, Badan Pusat Statistik Indonesia

Critically, the outlook underscores a widening gap between political ambition and economic reality. President Prabowo’s stated target of 8% growth for 2026–30 is highly unlikely to be achieved. Nonetheless, his expansionary policy agenda—anchored in defence, social spending, and state-led investment—will provide a meaningful demand buffer as private-sector and export momentum soften. Private consumption remains the dominant growth engine, accounting for over half of GDP. However, its contribution will weaken modestly. Household consumption growth is expected to slow given subdued job creation, only gradual real income gains, and rising household sensitivity to food prices and administered costs. Monetary easing and targeted fiscal transfers will cushion the slowdown, but they will not fully offset structural labour-market constraints.

Government spending will therefore play a more prominent countercyclical role. Public expenditure is expected to rise meaningfully in the first half of 2026 as the administration attempts to stabilise growth amid mixed external conditions. This expansion will operate through two channels: higher government consumption, driven by expanded social assistance programmes, and increased public investment, largely executed via state-owned enterprises (SOEs). Although private-sector spending still dominates in absolute terms, public-sector spending growth has recently outpaced it and is likely to remain a key demand anchor through 2027.

External demand will be a persistent drag on growth in 2026. Newly implemented U.S. reciprocal tariffs will weigh on Indonesia’s exports both directly and indirectly. While Indonesia faces relatively lower tariff rates than some regional peers—offering a marginal competitive advantage—spillovers from weaker Chinese exports to the U.S. will reduce demand for Indonesian inputs embedded in Chinese supply chains. That said, the external picture is not uniformly negative. Exporters are expected to adapt by diversifying markets, supported by the signing of new free trade agreements (such as the European Union, Canada) coming online in 2026. Over time, these will help stabilise export volumes. A modest recovery in the external sector is therefore expected late in 2026 and into 2027, rather than a sharp rebound.

Sectorally, the services sector will remain Indonesia’s primary growth driver. Accounting for roughly 48% of GDP—up from 42% in 2010—and it is expected to expand at a robust pace through 2026–27. Tourism will continue its recovery, particularly inbound flows from South-east Asia and China, supporting services exports. While tourism remains smaller than in many ASEAN peers, it contributes meaningfully at the margin. There are, however, emerging regulatory risks. Stricter online regulations and selective bans on consumer technology products, such as the restrictions on certain foreign smartphones, could weigh on investor sentiment in the digital space. In addition, a new criminal code coming into effect in January 2026 introduces reputational risk, although it is unlikely to materially affect foreign tourism in established destinations such as Bali. The industrial sector, accounting for around 40% of gross value added, will grow steadily but not spectacularly. Investment linked to EV supply chains and downstream metal processing will sustain output growth.

Inflation is expected to remain comfortably within Bank Indonesia’s target range. Headline inflation is forecast at 2.0% in 2026, rising to 2.5% in 2027, up modestly from an estimated 1.8% in 2025. The increase reflects stronger domestic demand supported by fiscal stimulus, cumulative monetary easing effects, and mild FX pass-through. Food prices will contribute to the upward drift, although not due to extreme weather disruptions.

Bank Indonesia is expected to deliver one rate cut in 2026, lowering the policy rate by around 25 bps to 4.5%, followed by a prolonged hold through end-2027. The rationale is tactical rather than cyclical: easing will help support consumption and investment as external demand weakens, while still preserving FX stability and inflation credibility.

Beyond this single cut, BI is likely to remain cautious. With fiscal stimulus expanding and political pressure on policy rising, the central bank will be reluctant to loosen aggressively. The Fed are also likely to finish easing at 3.00-3.25% to end the easing cycle, though the multi year USD downtrend against DM currencies helps underpin the IDR against the USD. Monetary policy will thus play a supporting, not leading, role in sustaining growth.

Figure 5: Indonesia Inflation and Main Policy Rate (%)

Source: Continuum Economics, Bank Indonesia

Australia: Done for Now

The RBA kept rates unchanged in the December meeting at 3.6% with a hawkish outlook. It is a different picture compared to their August outlook, especially in terms of inflation. Revision in both the headline and trimmed mean CPI is significant for 2025 and 2026. They are now seeing 2025 year-end headline CPI to be 3.3% y/y (from 3% in August outlook) and trimmed mean at 3.2% y/y (from 2.6% in August outlook). In the first half of 2026, both figures have been revised 0.6% higher before moderating to 3.2% y/y and 2.7% y/y respectively in the second half. While the RBA has blamed base effect from unwinding of energy rebates and transitory factors, it is undeniable underlying inflation is rising.

The Q3 2025 wage price index stays solid at 3.4% y/y and is quite balanced between the public and private sector. Wage growth has been consistent throughout 2025 and is expected to remain at similar level in 2026 as labor market is not showing signs of softening. Household consumption growth is led by essential spending and has been supported by higher nominal wages but restrained by slow 2025 employment growth. However, the hot headline CPI inflation has driven real wage into negative territory. It could limit consumption growth in the coming quarters and we also see portion of earning has been turned into saving (Household saving ratio rising to 6.4% from 6%). Nevertheless, private demand remains to be the key contributor to GDP growth. We have revised the 2025 GDP slightly higher to 1.9%, 2026 GDP at 2.3% and now sees 2027 GDP at 2.2%.

In terms of trade, Australia is faring better than other countries that are facing a steeper tariff from the U.S.. While growth in import (+1.5%) is stronger than export (+1%), it is partially balanced by the fall in both import and export prices. Export LNG prices have been affected by weaker demand and global oversupply but was completely neutralized by the strong rise in iron ore prices on high demand, while import prices have been broadly lower on consumption and capital goods.

Private investment (+2.9%) is seeing the biggest quarterly growth since Q1 2021. It is led by business investment in machinery and equipment, mostly from data centre investment. Public investment also rebound from three consecutive quarterly fall, focusing on investment in various renewable energy and water infrastructure projects and work on road and rail projects.

The RBA has taken a more hawkish tilt than we expect in the September outlook. Not only is our last forecast cut seems to be out of the picture, RBA Governor Bullock even suggested a potential hike in the February meeting if they see a strong Q4 inflation number. We believe that maybe a step too far as we see inflation to return within target range in Q1 2026 and also as real wages prove a headwind for consumption. Our forecast for 2026 CPI is at 2.7% and 2027 CPI at 2.4%, moderating from 2025 after transitory factors fade. We are not seeing any rate changes for the RBA in 2026 and could mean 3.6% will be terminal rate as long as inflation within the target range.

Malaysia: Moderating Growth, Strong Institutional and External Buffers

Malaysia’s macroeconomic outlook for 2026–27 is characterised by steady but moderating growth as the economy adjusts to a more fragmented global trade environment and matures further along its income transition. Real GDP growth is projected at 4.6% in 2026 and 4.4% in 2027, easing from the post-pandemic rebound but broadly consistent with Malaysia’s medium-term potential. The slowdown reflects rising external headwinds and policy-driven cost pressures rather than domestic fragility. Compared with regional peers, Malaysia continues to benefit from macro stability and institutional credibility.

Much like its peers, private consumption will remain the primary growth engine of the Malaysian economy. Household purchasing power is supported by low consumption taxes, progressive wage policies, and a tight labour market. Unemployment has fallen to a ten-year low (mid-3% range) and labour force participation is at record highs, anchoring consumer demand. However, high household debt levels will cap the upside, keeping consumption growth below historical norms despite favourable labour indicators. Investment will provide the second major pillar. Malaysia continues to attract foreign direct investment into semiconductors, data centres, and advanced manufacturing as firms diversify supply chains amid geopolitical tensions. The sharp rise in capital-goods imports in late 2025 signals that announced investments are translating into physical capacity. This momentum is expected to extend into 2026, though at a more measured pace in 2027. Government spending will play a stabilising rather than expansionary role.

The external sector will remain a key growth contributor, though conditions will become more challenging. Export momentum entering 2026 is strong, led by the electronics and electrical (E&E) sector, supported by sustained global demand linked to artificial intelligence, high-performance computing, and data-centre expansion. Malaysia’s positioning in semiconductor assembly, testing, and intermediate inputs allows it to benefit disproportionately from this cycle. Commodity exports, particularly palm oil, have also performed well, aided by improved market access following EU recognition of Malaysia’s sustainable palm oil certification. Shifts in export destinations—most notably rising shipments to Mexico and the EU—point to rerouting effects as firms adapt to U.S. trade restrictions rather than a collapse in underlying demand.

The services sector will remain the largest contributor to GDP, driven by wholesale and retail trade, information and communications, and financial services. Digitalisation remains a policy priority under the New Industrial Master Plan 2030, supporting higher value-added activity and reinforcing services growth. Manufacturing will benefit from targeted industrial strategies focused on semiconductors, EV components, chemicals, pharmaceuticals, and aerospace. Construction has emerged as a reliable growth driver and will remain supportive through 2026–27. A key catalyst is the expected passage of the Urban Renewal Act (URA) by end-2025. The bill establishes consent thresholds that allow redevelopment to proceed even with minority opposition, unlocking stalled projects and facilitating regeneration of ageing urban areas.

Inflation will remain contained. Headline CPI is forecast at 2.0% in 2026 and 2.2% in 2027, up modestly from 2025 but well within Bank Negara Malaysia’s informal tolerance range. Price pressures are also primarily policy-driven, reflecting sales and services tax expansion, higher excise duties on tobacco and alcohol, and the introduction of a carbon tax affecting selected industries. Bank Negara Malaysia is expected to hold policy rates through 2026–27, following a pre-emptive cut in 2025. With growth holding up and inflation contained, there is limited case for further easing. Key risks stem from external shocks: a sharper slowdown in global electronics demand, escalating trade protectionism, or renewed China-related tensions. Domestically, high household debt and politically sensitive subsidy reforms remain constraints.