Preview: Due January 13 - U.S. December CPI - Soft November probably understates true picture

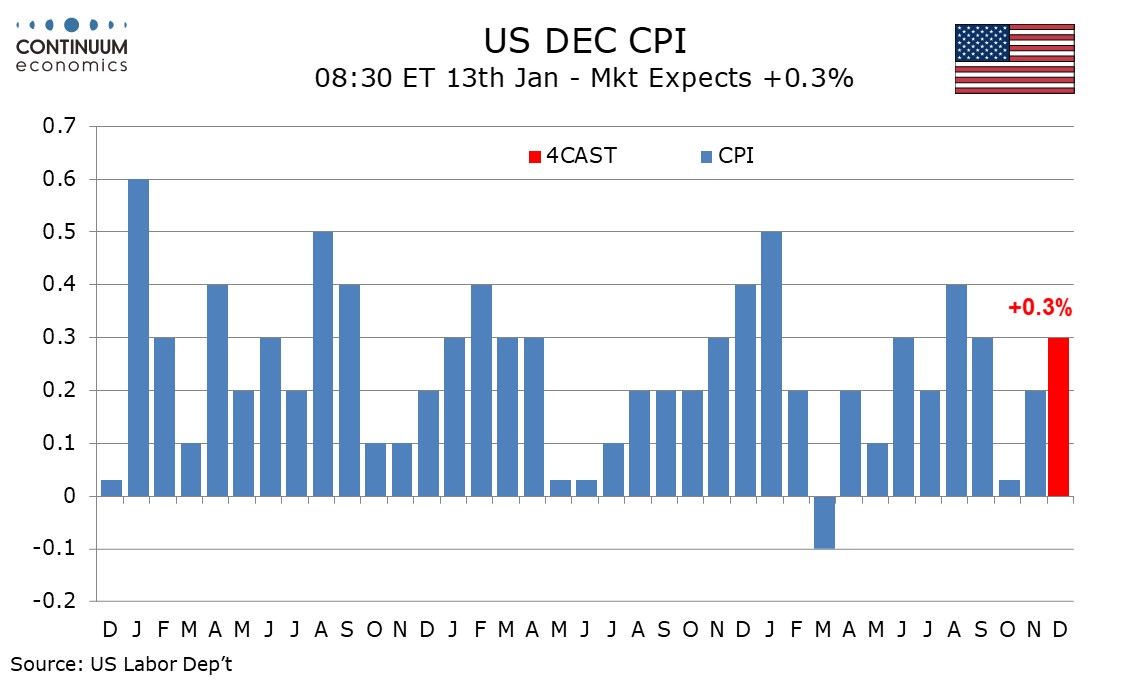

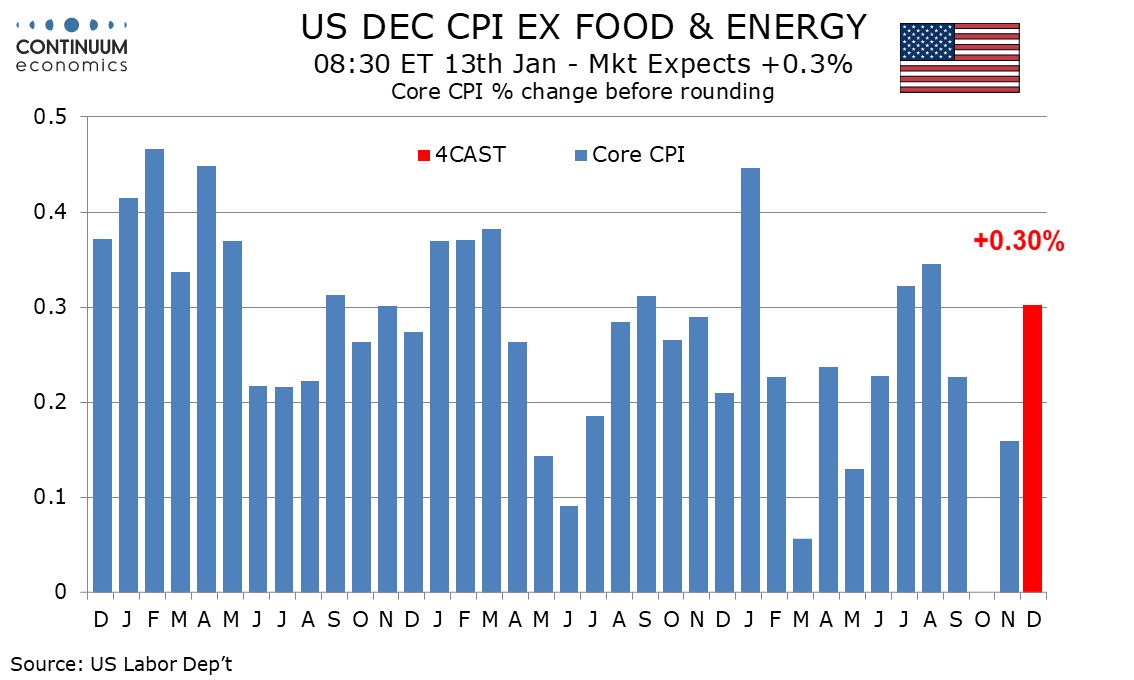

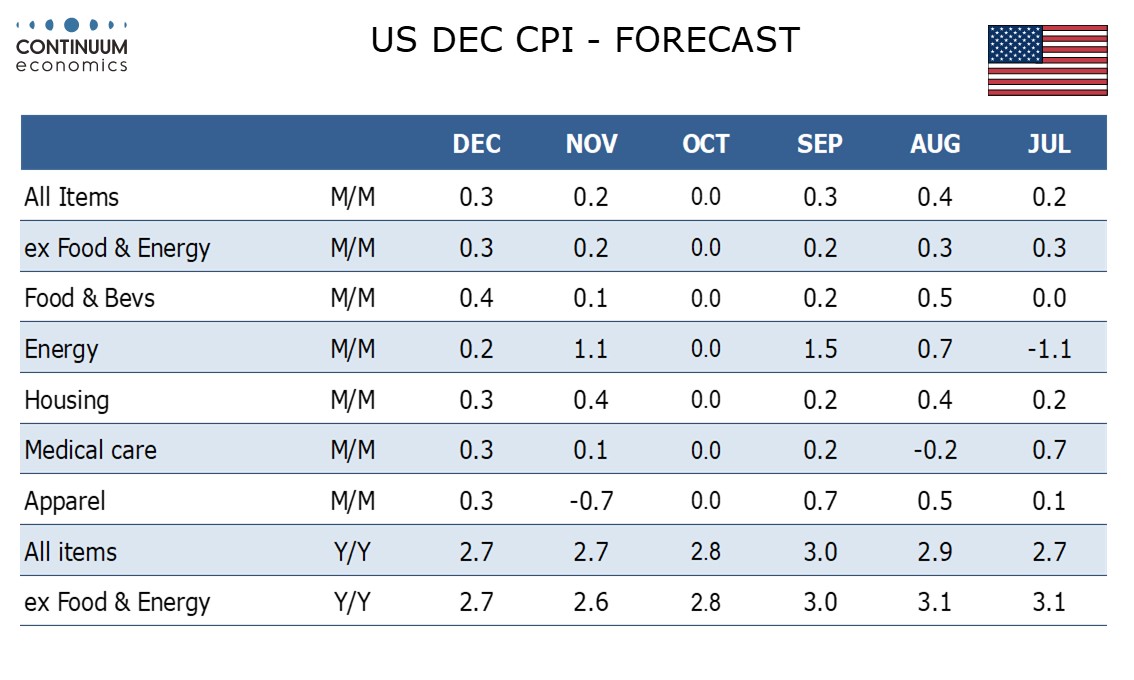

We expect gains of 0.3% in both December overall and ex food and energy CPI, with the gains being close to 0.3% even before rounding. There is extra uncertainty over this release as it is unclear whether the surprisingly soft data for November, after a missing October, represented a slowing in trend or simply measurement errors related to the government shutdown.

November’s CPI was up by only 0.204% before rounding from September with the ex food and energy CPI up only 0.156%, implying average gains over the two months on the low side of 0.1%. The government shutdown meant that no data for October was collected and for some rents which are updated only in October and April were left unchanged. Still, housing at 0.359% over the two months was stronger than many components, with the CPI weakness broad based. Particularly surprising were medical care up by only 0.088% and apparel down by 0.719% over the two months. One factor potentially distorting the data lower was a later survey than is normal for November, which may have captured more Thanksgiving discounts than is normal.

In September, the 3-month average change for both commodities less food and energy and services less energy were 0.235%, the former above a 6-month average of 0.154%, implying a tariff-led acceleration, and the latter marginally below a 6-month average of 0.251%, implying a slowing, albeit gentle. It is possible that trend is slowing as the tariff impact starts to fade, with uncertainty over their fate from the Supreme Court discouraging price hikes, while some, notably Fed’s Miran, are expecting a significant slowing in housing inflation. However, we feel that the scale of the slowing implied in November’s data is a little too good to be true, and we expect core goods and core services to both rise by around 0.3% in December. If there is a substantial surprise, it is more likely to be on the upside.

Gasoline prices are down in December but seasonally adjusted they look almost unchanged, and we expect a modest 0.2% increase in energy overall. We expect a 0.4% increase in food after an increase of only 0.073% between September and November. Gasoline was one of the few components that saw changes for both October (-2.1%) and November (+3.0%) published. Another was autos, which saw new vehicles up by 0.1% in October and 0.2% in November, and used vehicles up 0.7% in October in a bounce from a September dip before a rise of 0.3% in October. We do not expect autos to be a significant factor in December but there is upside risk in air fares which have recently been soft.

We expect yr/yr CPI to remain at November’s pace of 2.7% though there may be some slowing before rounding. We expect the ex food and energy yr/yr pace to increase to 2.7% from 2.6%.