Macro Strategy

View:

September 01, 2025

Aging: Slow Growth for Some in 2020’s

September 1, 2025 8:35 AM UTC

Population aging always seems to be beyond the market horizon, but the 2020’s are already seeing population aging in some countries. What is the economic impact? Aging is already causing a peak in labor force in China and the EU. Meanwhile, the population pyramid also means less consumptio

August 28, 2025

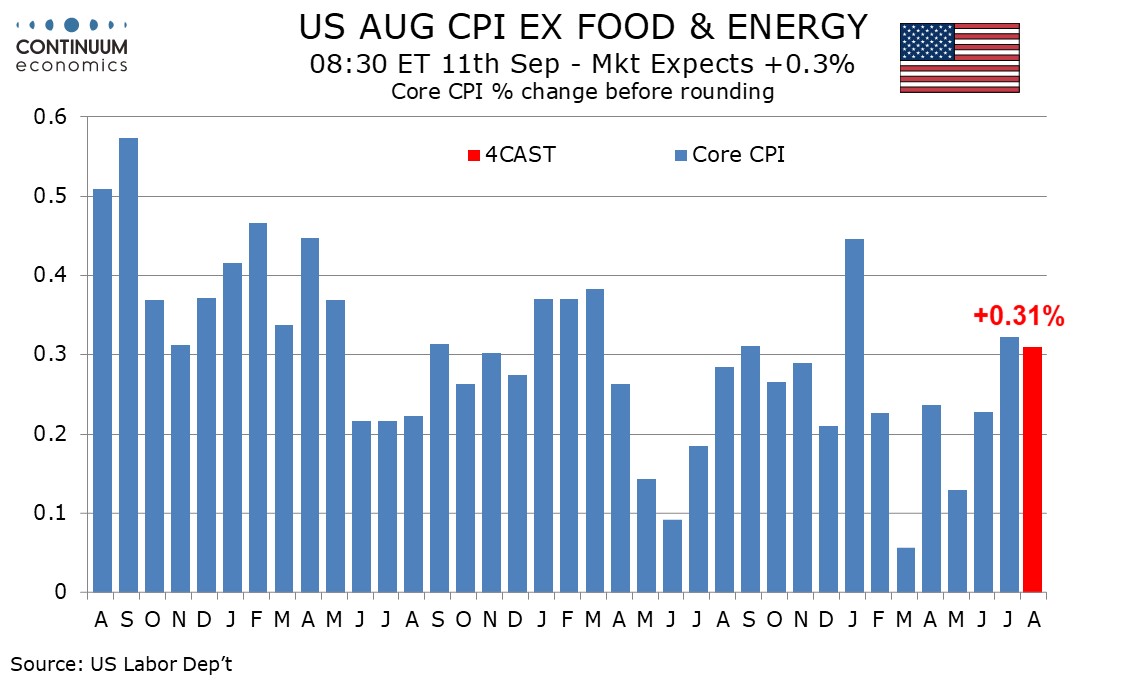

Preview: Due September 11 - U.S. August CPI - Tariff impact slowly building

August 28, 2025 5:19 PM UTC

We expect August CPI to increase by 0.4% overall and by 0.3% ex food and energy, with the respective gains before rounding being 0.37% and 0.31%. This would be the second straight gains slightly above 0.3% in the core rate with the impact of tariffs starting to escalate.

August 27, 2025

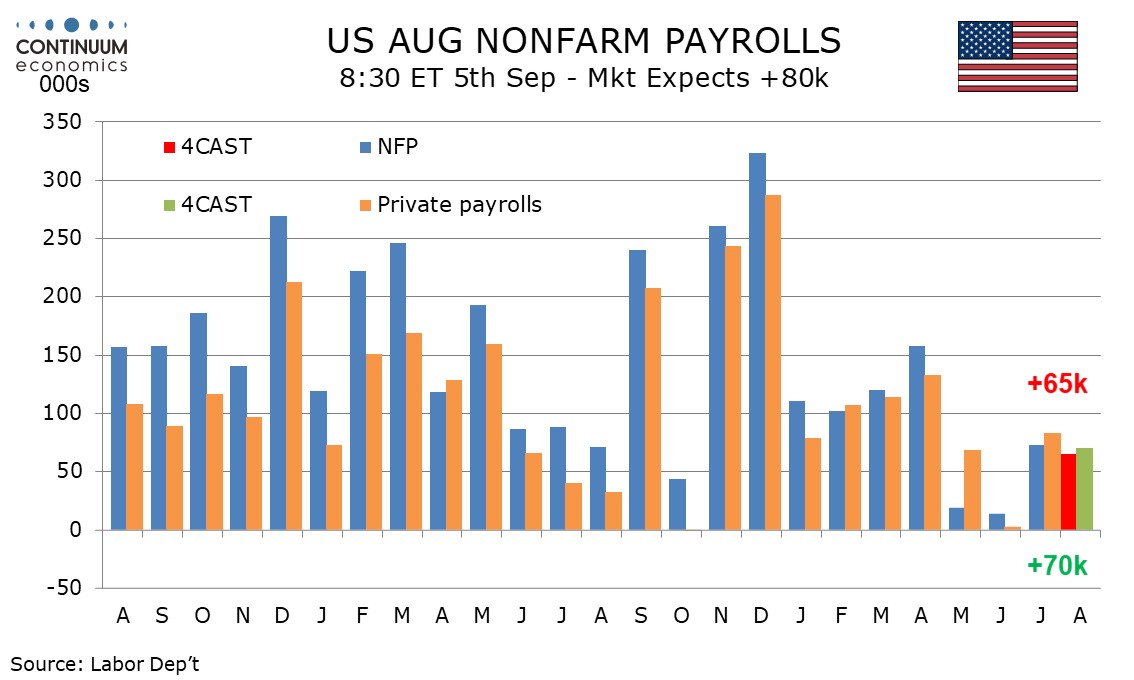

Preview: Due September 5 - U.S. August Employment (Non-Farm Payrolls) - Similar to July's, still not recessionary

August 27, 2025 2:20 PM UTC

We expect August’s non-farm payroll to look similar to July’s, with a rise of 65k versus 73k in July, above the 14k rise of June and the 19k rise of May but well below the trend that was running above 100k through April. We also expect unemployment to remain at July’s 4.2% rate and a second st

August 26, 2025

France and Italy: Deficit, ECB QT and Foreign Debt Holders Stories

August 26, 2025 7:35 AM UTC

A large budget deficit in France, looking persistent given the current political impasse, combined with ECB QT means that the market has to absorb a very large 8.5% of GDP of extra bonds. Our central scenario is that persistent French supply causes a further rise in 5yr plus French government yields

August 12, 2025

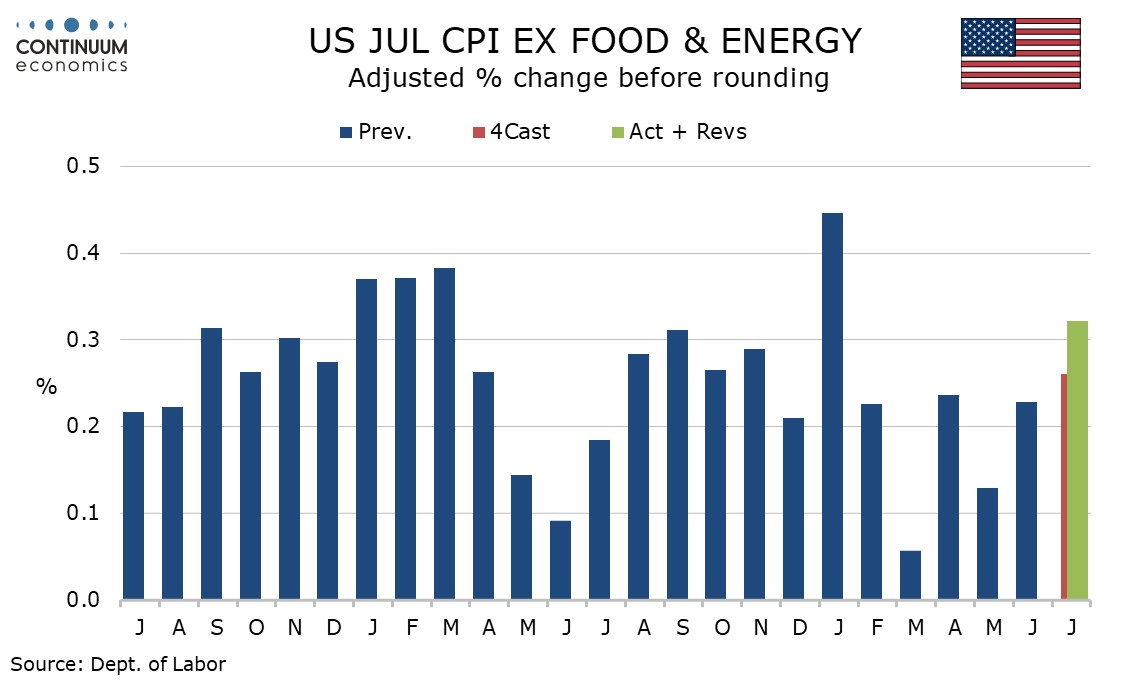

U.S. July CPI - Core rate, particularly services, a marginal disappointment

August 12, 2025 1:02 PM UTC

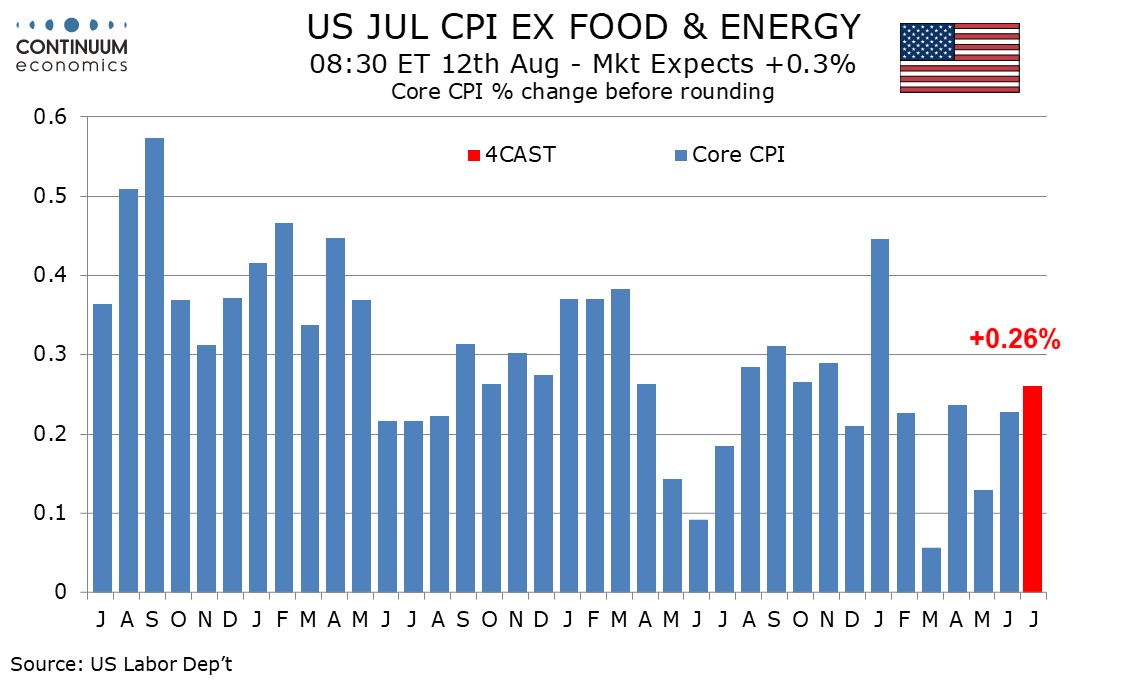

July’s CPI is in line with consensus at 0.2% overall, 0.3% ex food and energy, but the core rate of 0.322% before rounding is a little high for comfort. The detail shows the acceleration from June was more in services than goods, so the story is not a simple one of tariffs.

August 11, 2025

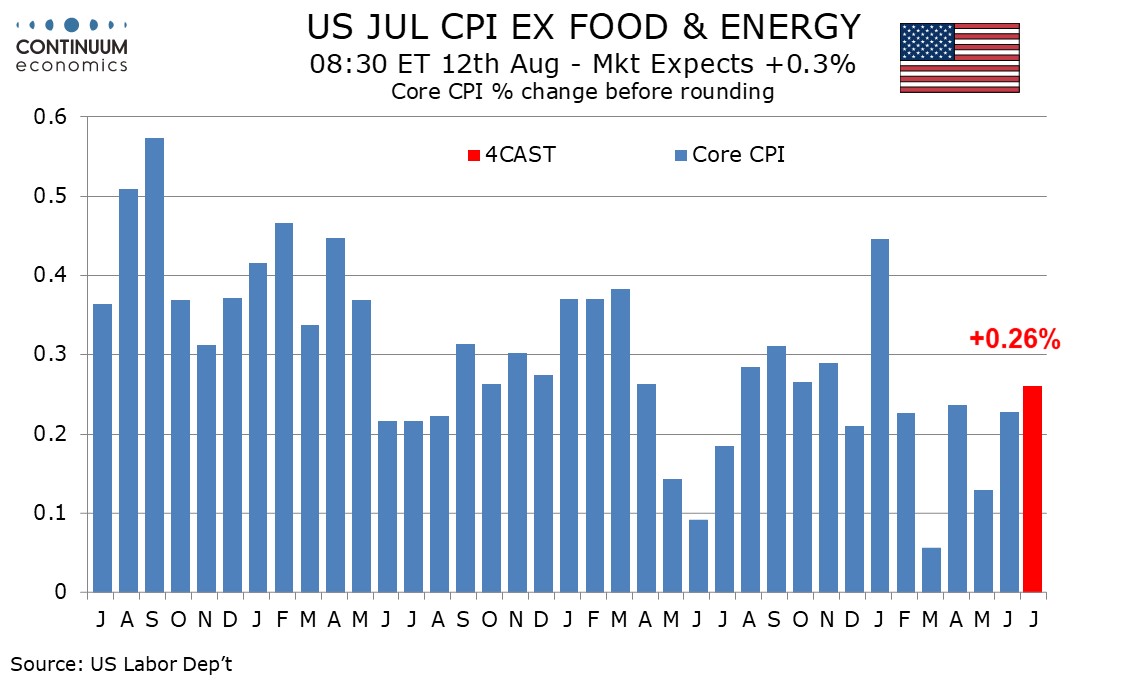

Preview: Due August 12 - U.S. July CPI - Tariff impact slowly building

August 11, 2025 1:10 PM UTC

We expect July CPI to increase by 0.2% overall and by 0.3% ex food and energy, with the overall pace close to 0.2% even before rounding but the core rate rounded up from 0.26%. This would still be the strongest core rate since January and reflect a further feed through of tariffs, something that is

August 07, 2025

EM Rates: Domestic Fundamentals Dominate

August 7, 2025 9:30 AM UTC

Once trade is agreed with the U.S., the good fundamentals actually argue for a 10yr Mexico-U.S. spread close to 400bps and this is our favored strategic risk reward for big EM government bonds. In Brazil a case can be made for a 12.75% policy rate end 2026 and 10% in 2027, but this could only mean 1

August 04, 2025

Preview: Due August 12 - U.S. July CPI - Tariff impact slowly building

August 4, 2025 12:47 PM UTC

We expect July CPI to increase by 0.2% overall and by 0.3% ex food and energy, with the overall pace close to 0.2% even before rounding but the core rate rounded up from 0.26%. This would still be the strongest core rate since January and reflect a further feed through of tariffs, something that is

August 01, 2025

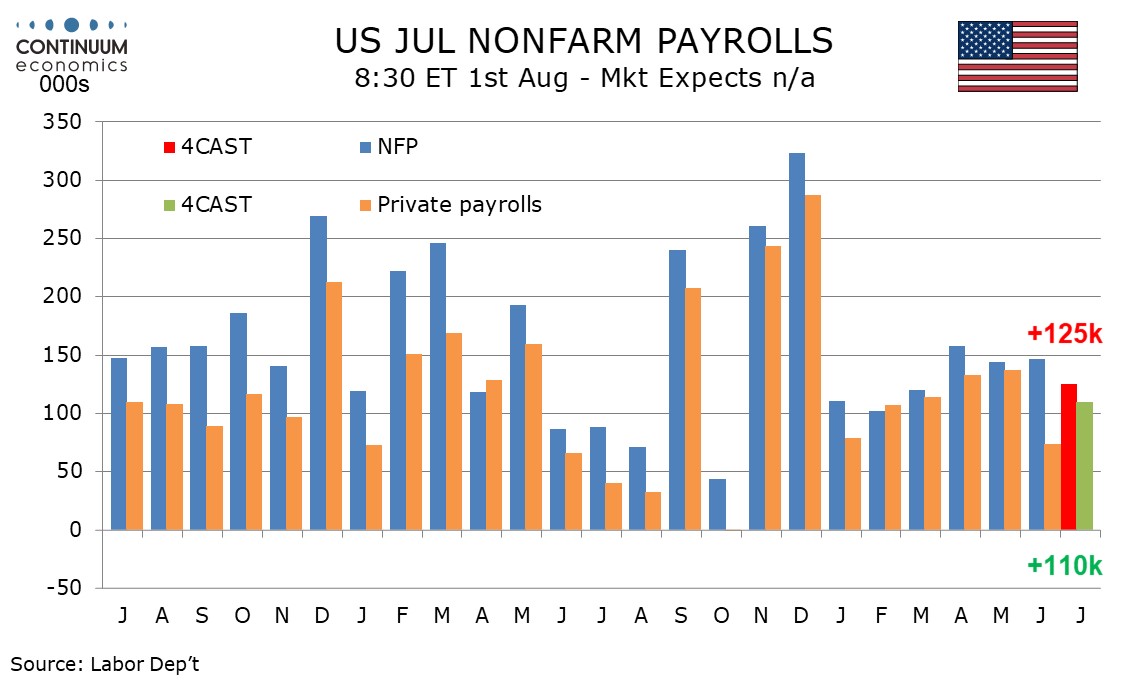

U.S. July Employment - Revisions to May and June mean trend has slowed significantly

August 1, 2025 1:06 PM UTC

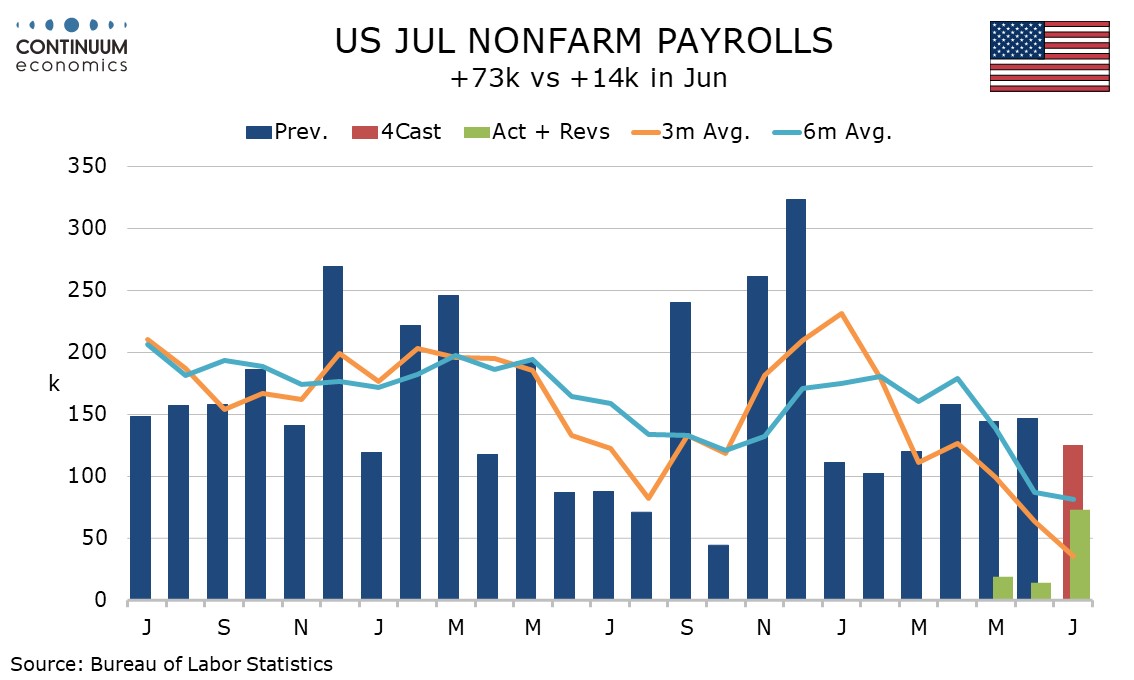

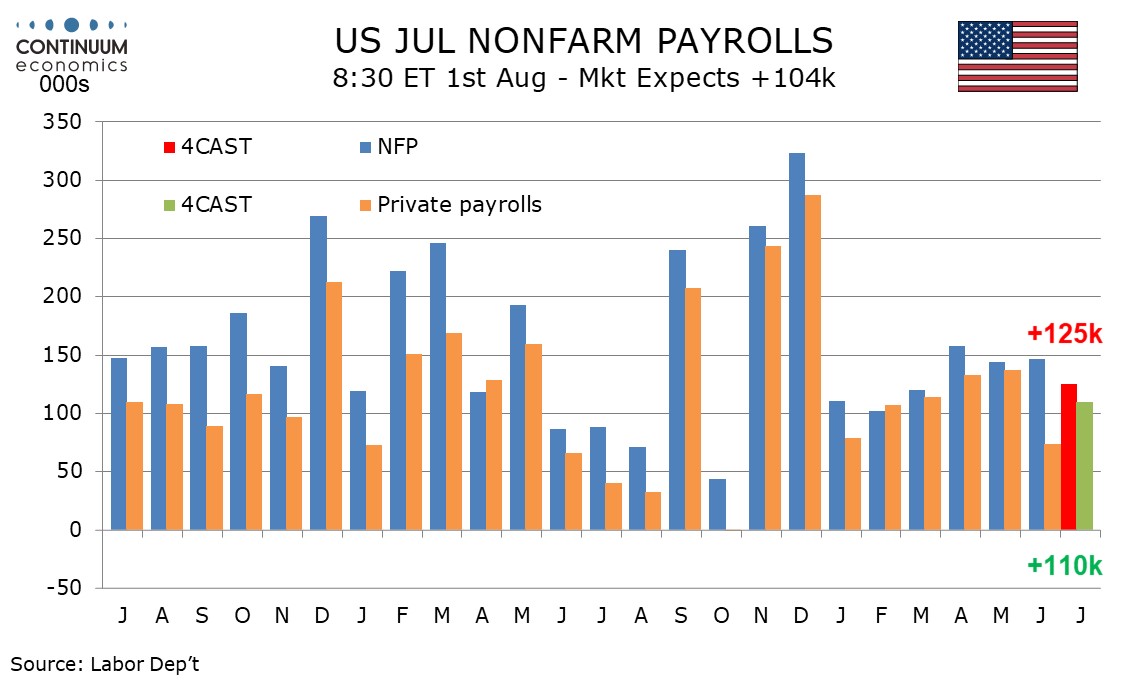

July’s non-farm payroll is weaker than expected not only with the 73k headline and 83k rise in the private sector, but also with large downward revisions totaling 258k for May and June. Unemployment remains low but edged up to 4.2% from 4.1% while average hourly earnings were on consensus at 0.3%,

July 31, 2025

Preview: Due August 1 - U.S. July Employment (Non-Farm Payrolls) - Slower overall, but stronger in the private sector

July 31, 2025 1:26 PM UTC

We expect a 125k increase in July’s non-farm payroll, slightly slower than in each month of Q2 but slightly stronger than in each month of Q1. We expect a 110k rise in private sector payrolls, up from 74k in June but slower than in April and May. An unchanged unemployment rate of 4.1% and a 0.3% r

July 30, 2025

Fed's Powell Remains Cautious Over Tariff Risk

July 30, 2025 7:34 PM UTC

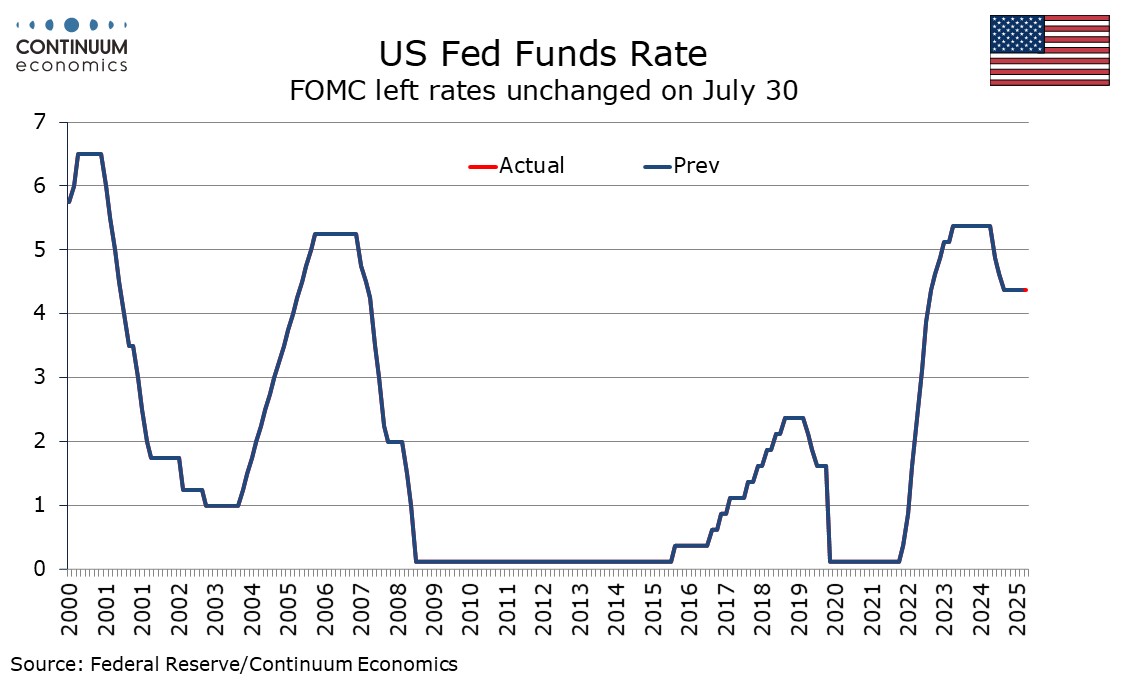

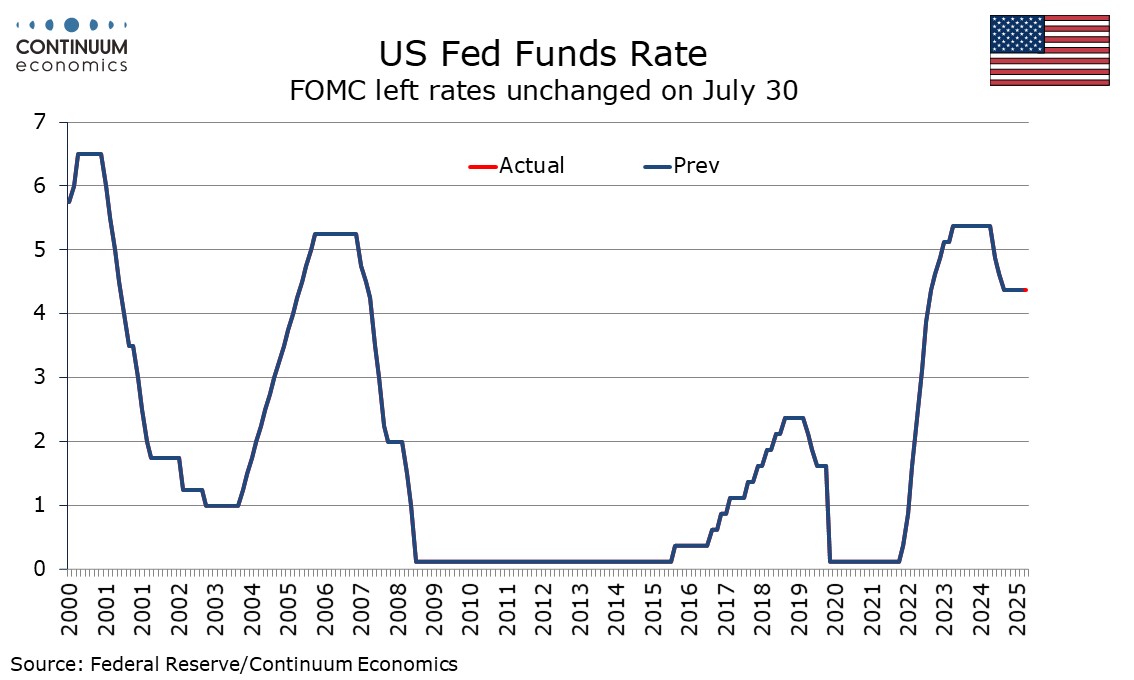

The FOMC left rates unchanged at 4.25-4.5% as expected, though there were two dissenting votes for easing, from Governors Waller and Bowman, who had already given signals in that direction. The statement made a concession to the doves stating that growth moderated in the first half of the year, but

FOMC leaves rates unchanged, two dissents for easing, language more dovish on growth

July 30, 2025 6:16 PM UTC

The FOMC left rates unchanged at 4.25-4.5% as expected, though there were two dissenting votes for easing, from Governors Waller and Bowman, who had already given signals in that direction. The wording of the statement also contains a dovish shift, stating that growth moderated in the first half of

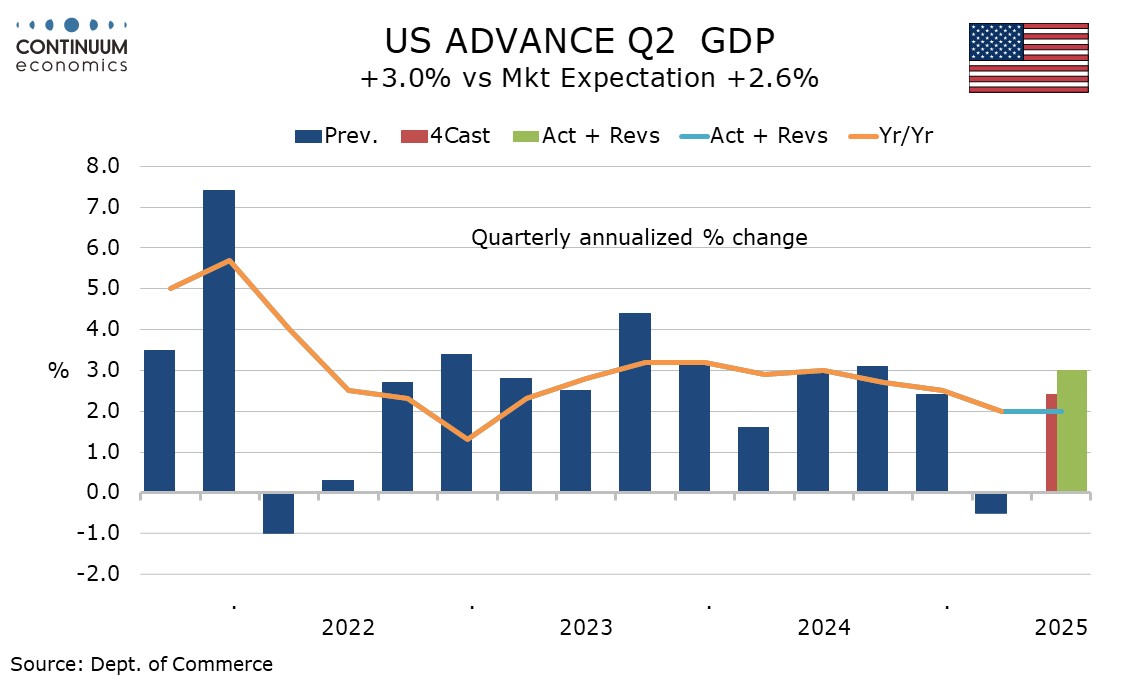

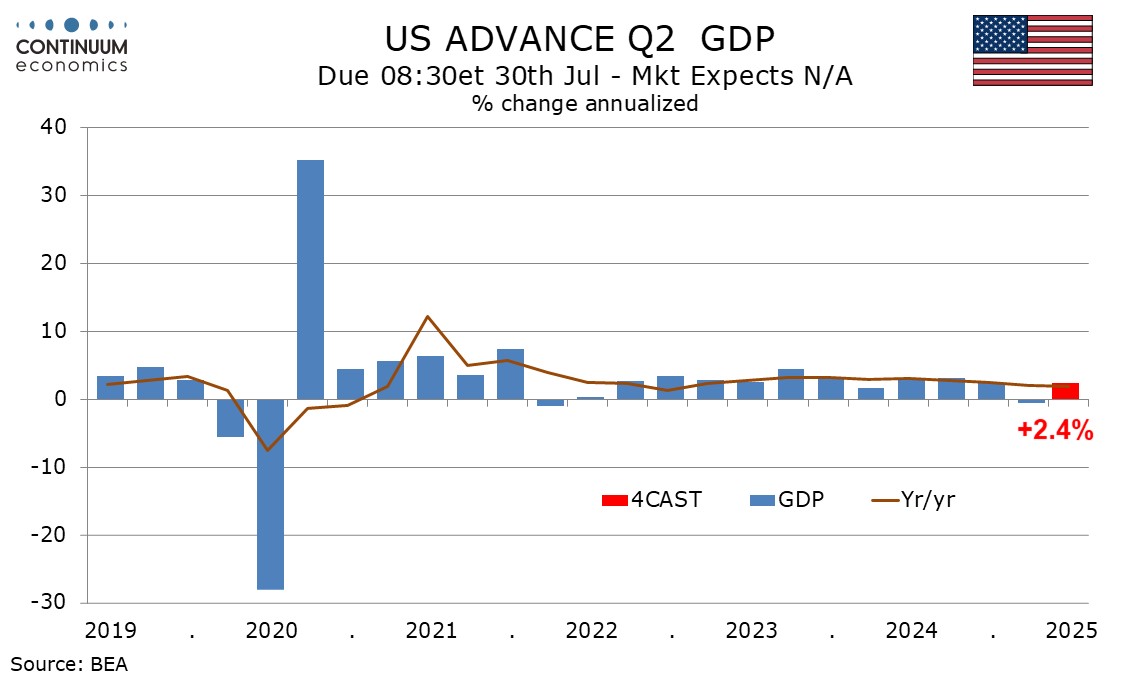

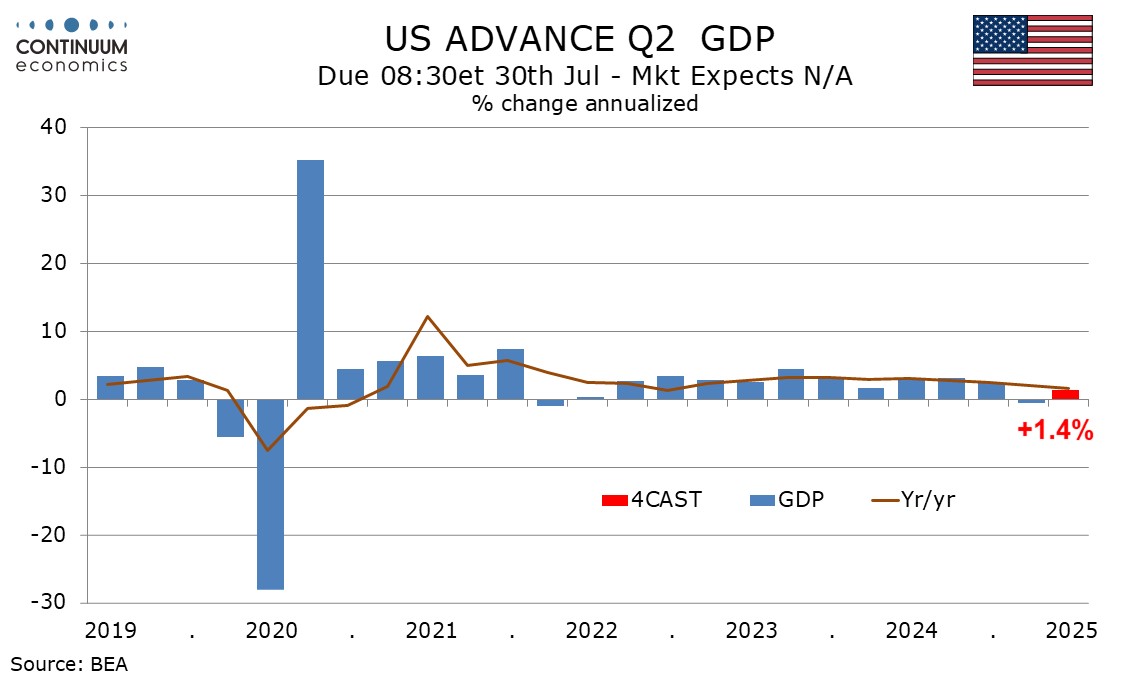

U.S. Q2 GDP - Subdued underlying growth, but with persistent price pressures

July 30, 2025 1:12 PM UTC

The advance estimate of Q2 GDP at 3.0% is stronger than expected though an above consensus outcome had looked likely after yesterday’s decline in June’s trade deficit. Given extreme volatility in net exports the Q2 data should be seen alongside Q1’s 0.5% decline, giving an average of an unimpr

DM Household Sluggish Borrowing

July 30, 2025 10:45 AM UTC

· Overall, restrained credit supply from banks; abundant employment/income or wealth for most households but restrained financial conditions for low income households could have restrained household lending growth to GDP. However, the surge in government debt and ensuing fear of fut

July 28, 2025

Food Glorious Food

July 28, 2025 10:15 AM UTC

· Global food prices should see small increases in the future, as production continues to rise broadly in line with increasing demand driven by population and a rising consumption per person in EM countries. However, China will remain dependent on food imports given it has limited roo

Indonesia’s 2026 Blueprint: Growth Goals Amid a Shaky Global Backdrop

July 28, 2025 5:54 AM UTC

Indonesia’s newly approved 2026 macroeconomic framework targets robust growth, fiscal discipline, and poverty eradication. However, external headwinds—including unresolved US tariff risks—and tepid domestic consumption pose serious execution risks. Without sharper prioritisation and institutio

July 24, 2025

EM Currencies with a USD Downtrend

July 24, 2025 10:15 AM UTC

· BRL, ZAR and MXN have been helped by FX carry trades and bond inflows on still wide interest rate differentials. However, actual reciprocal tariff risks are high for all three countries and a wave of profit-taking could be seen. Elsewhere, though we see a U.S./China trade deal by

July 17, 2025

Preview: Due July 30 - U.S. Q2 GDP - Rebounding from a negative Q1, but a subdued first half of the year

July 17, 2025 5:54 PM UTC

We expect a 2.4% annualized increase in Q2 GDP, which after a 0.5% decline in Q1 would leave the first half of the year rising at a pace close to 1.0%. A similar pace may be seen in the second half of the year if tariffs persist. Our Q2 forecast has been lifted from 1.4% on a generally improved tone

Deal or Dilemma: What the US–Indonesia Trade Pact Really Means

July 17, 2025 5:46 AM UTC

The US–Indonesia trade deal marks a significant geopolitical and economic pivot, reducing a threatened 32% tariff to 19% in exchange for USD 34bn in US imports and open market access. While the agreement offers Jakarta temporary relief, it locks the country into a transactional trade model amid ri

July 15, 2025

Tax Shortfalls and Slow Growth Complicate Indonesia’s Budget Plans

July 15, 2025 3:05 PM UTC

Indonesia’s fiscal position is coming under renewed strain, as weaker-than-expected revenue collection forces the government to widen its 2025 budget deficit to 2.78% of GDP—above initial targets but still below the legal threshold. Delays in VAT implementation, falling commodity prices, and mod

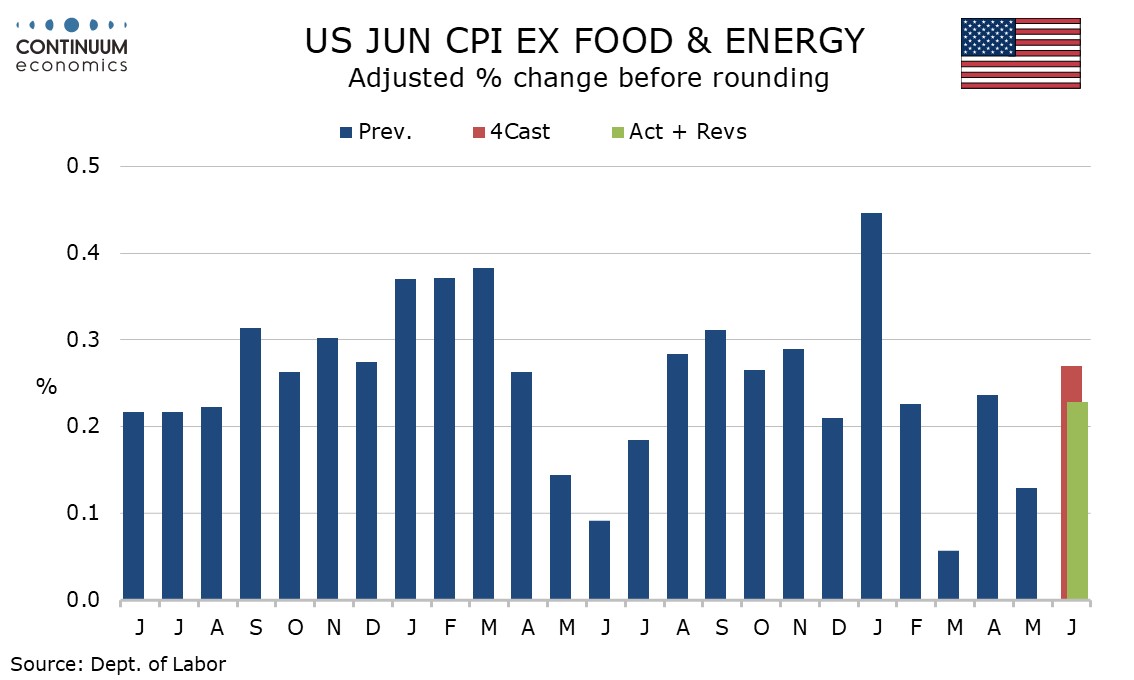

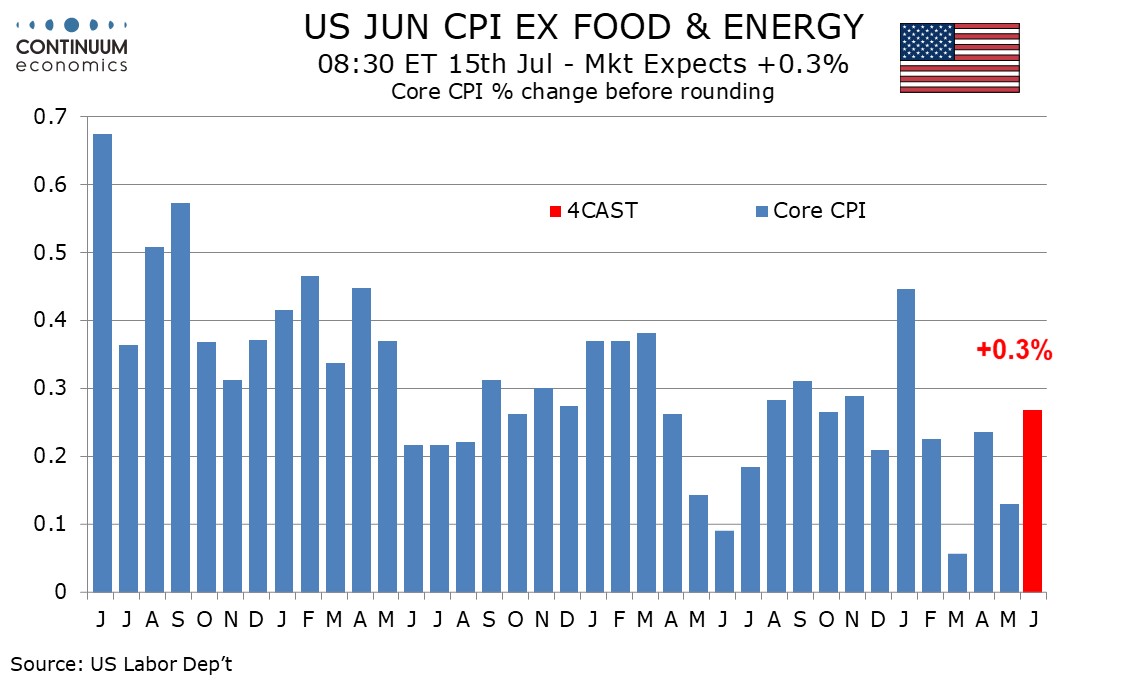

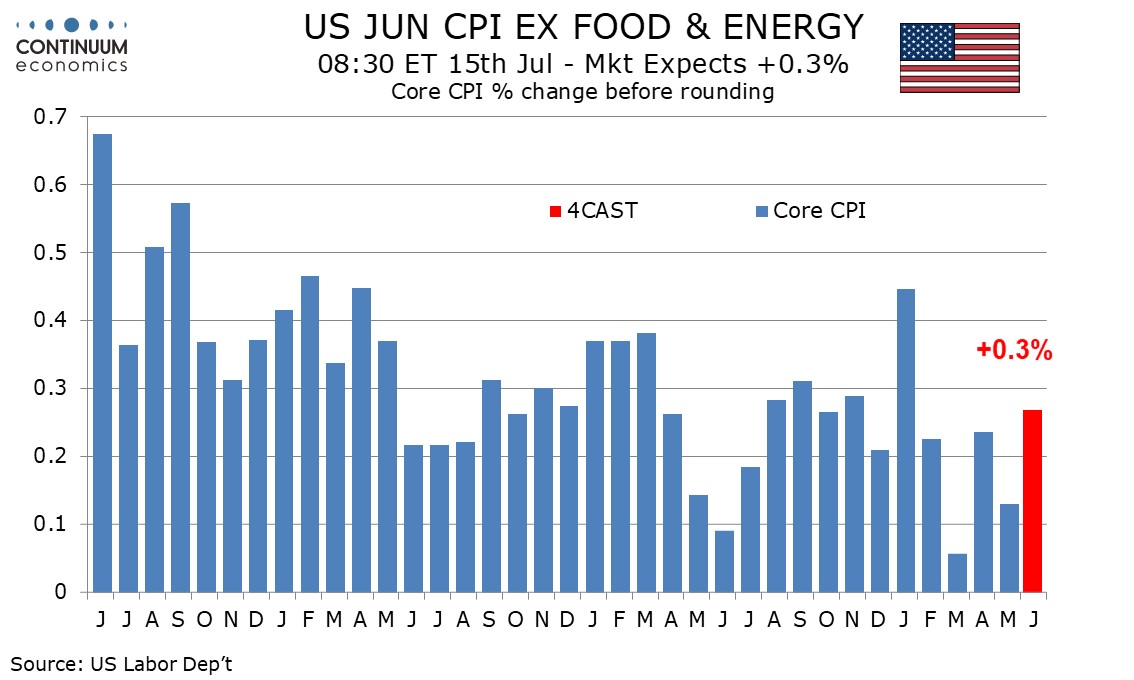

U.S. June CPI - Tariff pass-through limited but not zero

July 15, 2025 12:58 PM UTC

June core CPI at 0.228% before rounding is on the low side of expectations and still shows a limited, though not zero, feed through from tariffs. Moderate gains in food and energy lifted overall CPI to a 0.3% increase, with the gain rounded up from 0.287%. Trump will use this data to argue for Fed

July 14, 2025

Preview: Due July 15 - U.S. June CPI - A little more from tariffs

July 14, 2025 2:15 PM UTC

We expect June CPI to increase by 0.3% overall and by 0.3% ex food and energy, with the overall pace close to 0.3% before rounding but the core rate rounded up from 0.27%. This would still be the strongest core rate since January and reflect tariffs starting to feed through, something expected by Fe

July 11, 2025

High Stakes and Heavy Metals: The Geopolitics of the US–Indonesia Tariff Deal

July 11, 2025 7:37 AM UTC

As the U.S. sharpens its protectionist stance, Indonesia is scrambling to avert a 32% tariff by offering a USD 34bn investment-anchored trade package, including energy and agricultural imports, Boeing orders, and sovereign wealth fund commitments. This negotiation goes far beyond trade—it is a hig

July 10, 2025

Preview: Due August 1 - U.S. July Employment (Non-Farm Payrolls) - Slower overall, but stronger in the private sector

July 10, 2025 2:53 PM UTC

We expect a 125k increase in July’s non-farm payroll, slightly slower than in each month of Q2 but slightly stronger than in each month of Q1. We expect a 110k rise in private sector payrolls, up from 74k in June but slower than in April and May. An unchanged unemployment rate of 4.1% and a 0.3% r

July 03, 2025

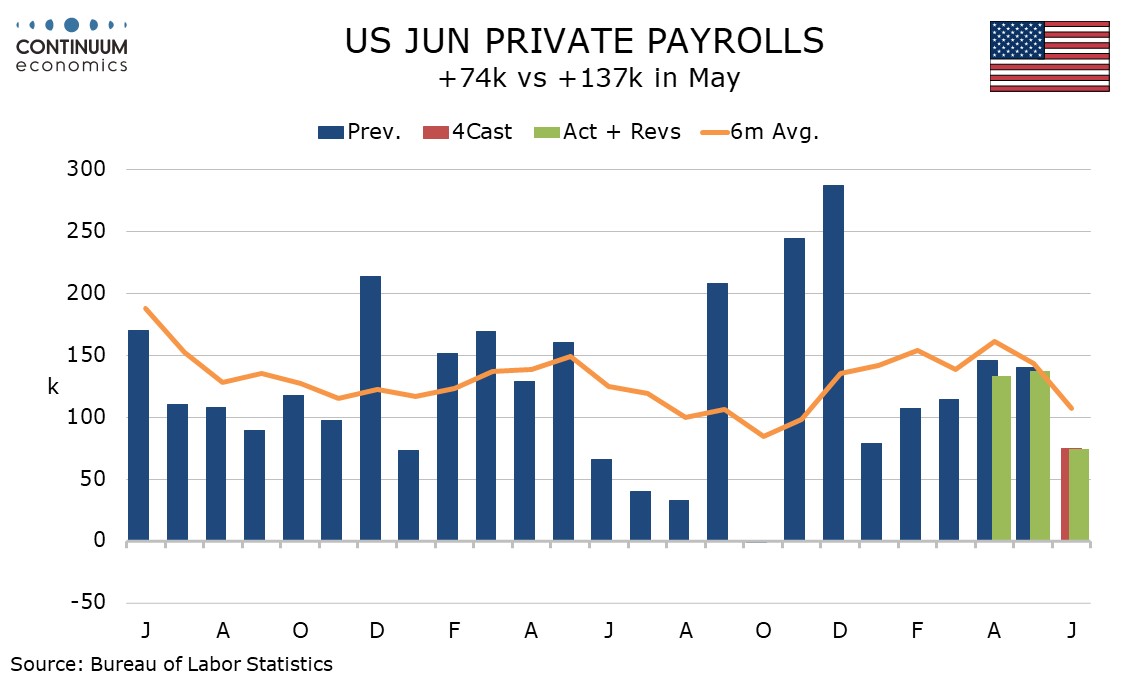

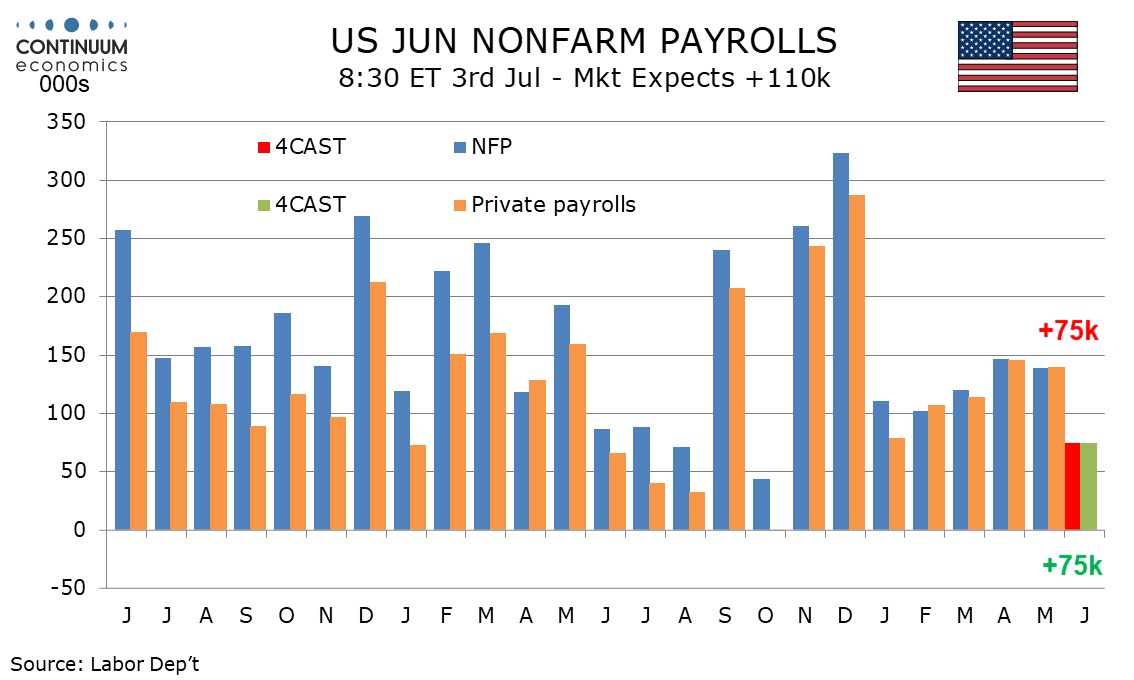

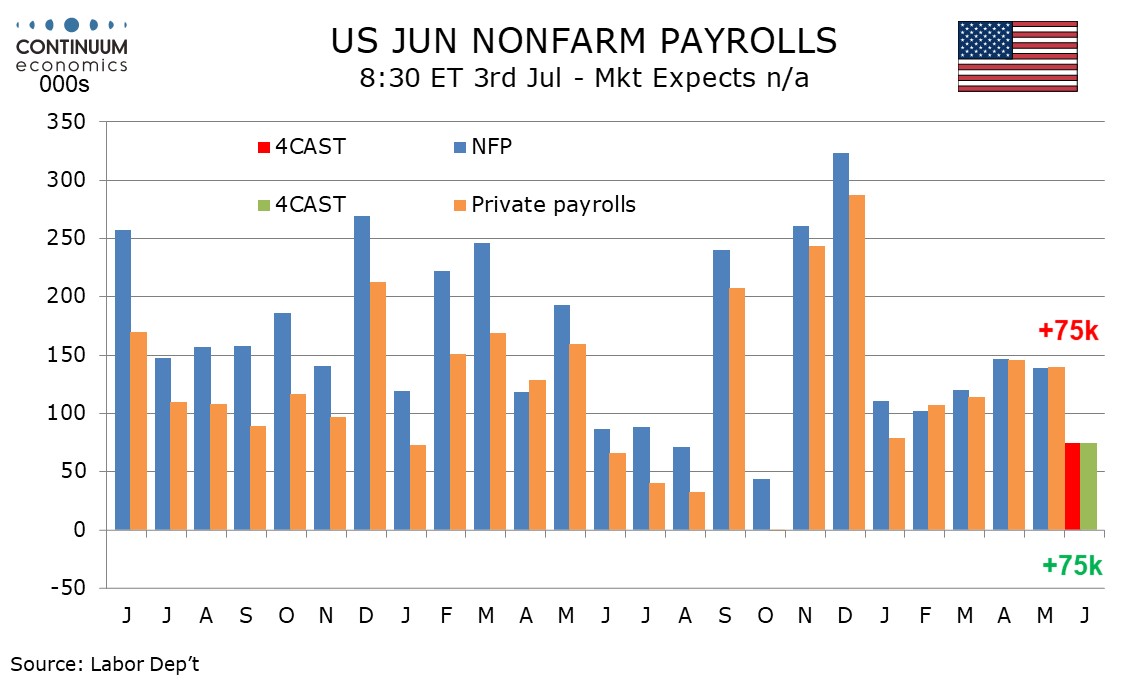

U.S. June Employment - Some signs of slowing activity, but lower unemployment suggests no urgency for Fed easing

July 3, 2025 1:09 PM UTC

June’s non-farm payroll is surprisingly strong overall with a rise of 147k, with 16k in net upward revisions, but private payrolls at 75k are weaker than expected, with 16k in net negative revisions. Unemployment unexpectedly fell to 4.1% from 4.2%, but average hourly earnings are weaker than expe

U.S. Assets and Valuation

July 3, 2025 9:30 AM UTC

The U.S. equity market has returned to be clearly overvalued on equity and equity-bond valuations measures and is vulnerable to a new correction in H2 on any moderate bad news (e.g. further economic slowing and corporate earnings downgrades). In contrast, U.S. Treasuries are at broadly fai

July 02, 2025

Preview: Due July 3 - U.S. June Employment (Non-Farm Payrolls) - Increasing signs of slowing, but not a recession

July 2, 2025 1:01 PM UTC

We expect a 75k increase in June’s non-farm payroll, significantly slower than May’s 139k though consistent with a slowdown in growth rather than an economy entering recession. We expect an in line with trend 0.3% increase in average hourly earnings and an uptick in unemployment to 4.3% after th

DM Central Banks: Overlooking Lagged 2021-23 Tightening and QT?

July 2, 2025 8:30 AM UTC

We are concerned that DM central banks are underestimating the lagged impact of 2021-23 tightening and ongoing QT, which impacts the transmission mechanism of monetary policy. Central banks need to consider cyclical and structural issues, but also need a more rounded view of the stance and implica

July 01, 2025

Preview: Due July 15 - U.S. June CPI - A little more from tariffs

July 1, 2025 6:42 PM UTC

We expect June CPI to increase by 0.3% overall and by 0.3% ex food and energy, with the overall pace close to 0.3% before rounding but the core rate rounded up from 0.27%. This would still be the strongest core rate since January and reflect tariffs starting to feed through, something expected by Fe

June 27, 2025

U.S. Q2 GDP to see only a modest rebound from a decline in Q1

June 27, 2025 6:05 PM UTC

The release of advance May trade and inventory data, plus May consumer spending, provides us with clearer signals on Q2 GDP, even if we have not yet seen any data for June. We currently expect a modest annualized gain of 1.4%, following a 0.5% decline in Q1, leaving a subdued first half of the year.

June 25, 2025

EM FX Outlook: USD Less in Favor, but EM Mixed

June 25, 2025 8:05 AM UTC

• EM currencies face cross currents on a spot basis. The USD downtrend against DM currencies can be a positive for undervalued or strong EM currencies. This could benefit the Brazilian Real (BRL), Mexican Peso (MXN) and Indonesian Rupiah (IDR), though moves will be choppy with occasiona

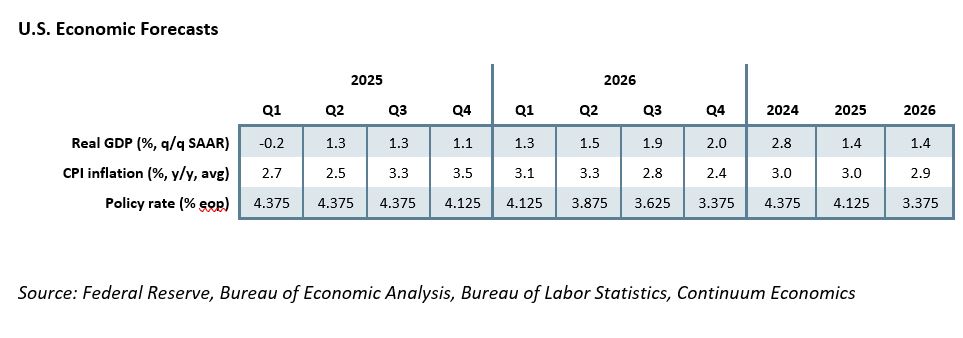

Outlook Overview: Trump’s Fluid Policies

June 25, 2025 7:20 AM UTC

· President Donald Trump still wants to use the tariff tool, and we see the eventual average tariff rate being in the 13-15% area, lowered by deals but increased by more product tariffs. Any lasting legal block on reciprocal tariffs will likely see the administration pivoting towards ot

June 24, 2025

Asia/Pacific (ex-China/Japan) Outlook: Slower Trade, Softer Inflation, and Looser Policy

June 24, 2025 9:24 AM UTC

· Asia’s growth profile in 2025 reflects a region navigating structural transition amid external strain. Investment-led economies like India are benefitting from infrastructure spending, industrial policy momentum, and political continuity. In contrast, trade-reliant markets such as V

Equities Outlook: Choppy Then 2026 Gains

June 24, 2025 8:15 AM UTC

Though the U.S. equity market has rebounded, we still scope for a fresh dip H2 2025 to 5500 on the S&P500 as hard data softens further to feed into weaker corporate earnings forecasts and CPI picks up and delays Fed easing. However, the AI story is still a positive, while share buybacks

DM FX Outlook: USD uncertainty increases as Trump changes the rules

June 24, 2025 7:05 AM UTC

· Bottom Line: After making initial gains after the election, the USD has followed a similar path to the first Trump presidency, falling back steadily this year as optimism on the economy has faded, with the introduction of tariffs contributing to more negative sentiment. Much as in the

June 23, 2025

Iran: Measured Next Steps?

June 23, 2025 3:17 PM UTC

A measured or modest Iran retaliation could be used by the U.S. to seek a path back towards negotiation. Israel would likely want to continue to degrade Iran nuclear and military facilities, but the U.S. could eventually pressure Israel to stop. This is our baseline, though the military attac

DM Rates Outlook: Yield Curve Steepening?

June 23, 2025 8:30 AM UTC

• We see the U.S. yield curve steepening in the next 6-18 months. 2yr U.S. Treasury yields can step down with cautious Fed easing on a modest/moderate growth slowdown and also if the Fed keeps an easing bias in H2 2026. 10yr U.S. Treasury yields face a tug of war between lower short-dated y

June 20, 2025

Preview: Due July 3 - U.S. June Employment (Non-Farm Payrolls) - Increasing signs of slowing, but not a recession

June 20, 2025 4:29 PM UTC

We expect a 75k increase in June’s non-farm payroll, significantly slower than May’s 139k though consistent with a slowdown in growth rather than an economy entering recession. We expect an in line with trend 0.3% increase in average hourly earnings and an uptick in unemployment to 4.3% after th

U.S. Outlook: Slowdown but not Recession, Cautious Fed Easing

June 20, 2025 2:14 PM UTC

• Policy uncertainty remains high and final details of the tariffs will depend on the decisions of the courts as well as those of President Trump. However the magnitude of the tariffs is becoming easier to predict than the detail. Trump looks set to insist on a minimum average tariff of at

Commodities Outlook: Policy Realignment

June 20, 2025 9:30 AM UTC

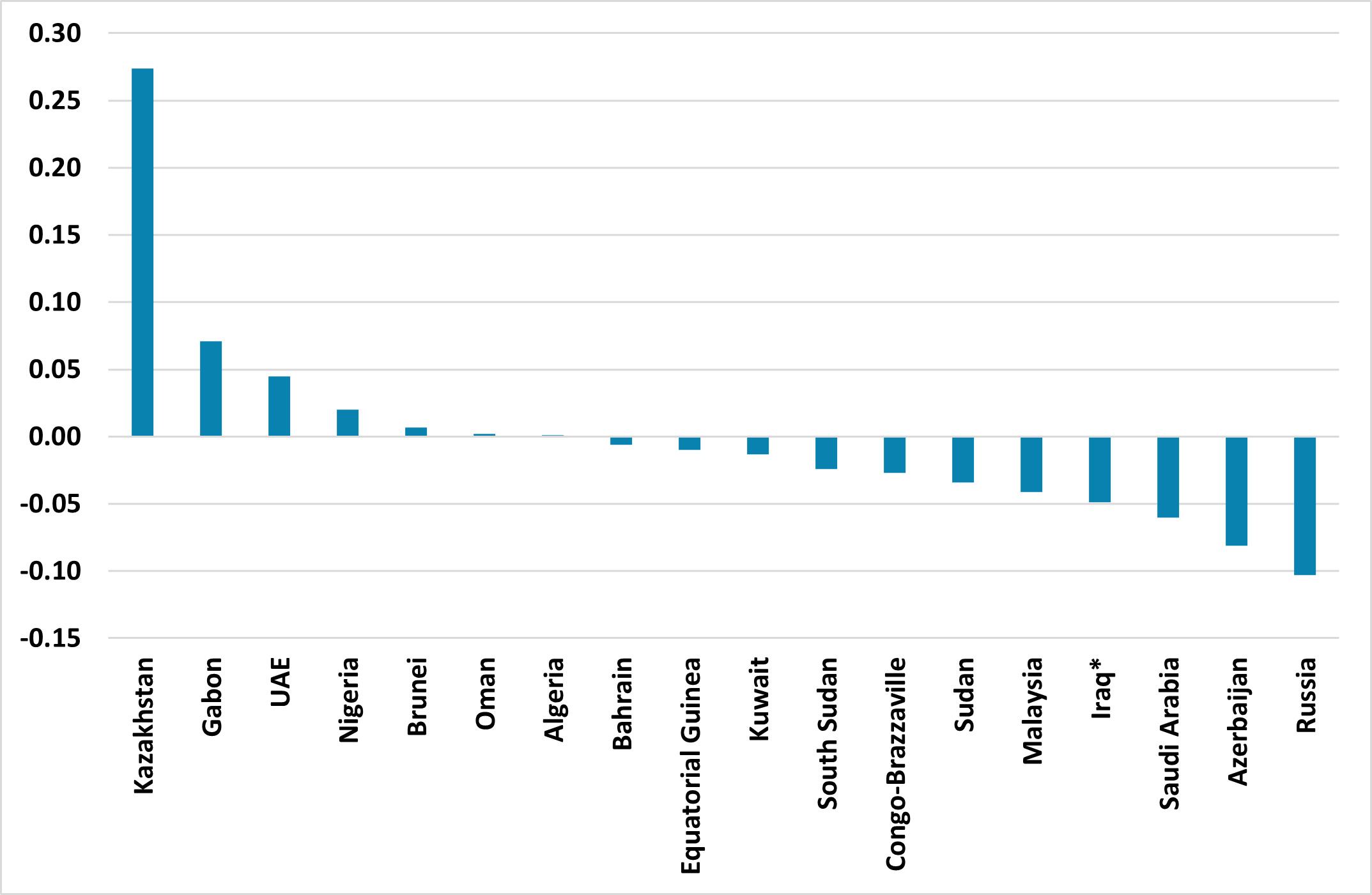

In Q2 2025, eight OPEC+ countries pledged a faster oil supply hike, motivated by market share losses, internal frictions, and geopolitical shifts. However, actual output has fallen short due to overproduction offsets, domestic consumption, and capacity limits. Further gradual increases are expected,

June 18, 2025

Fed: Hold Then Cautious Easing

June 18, 2025 7:27 PM UTC

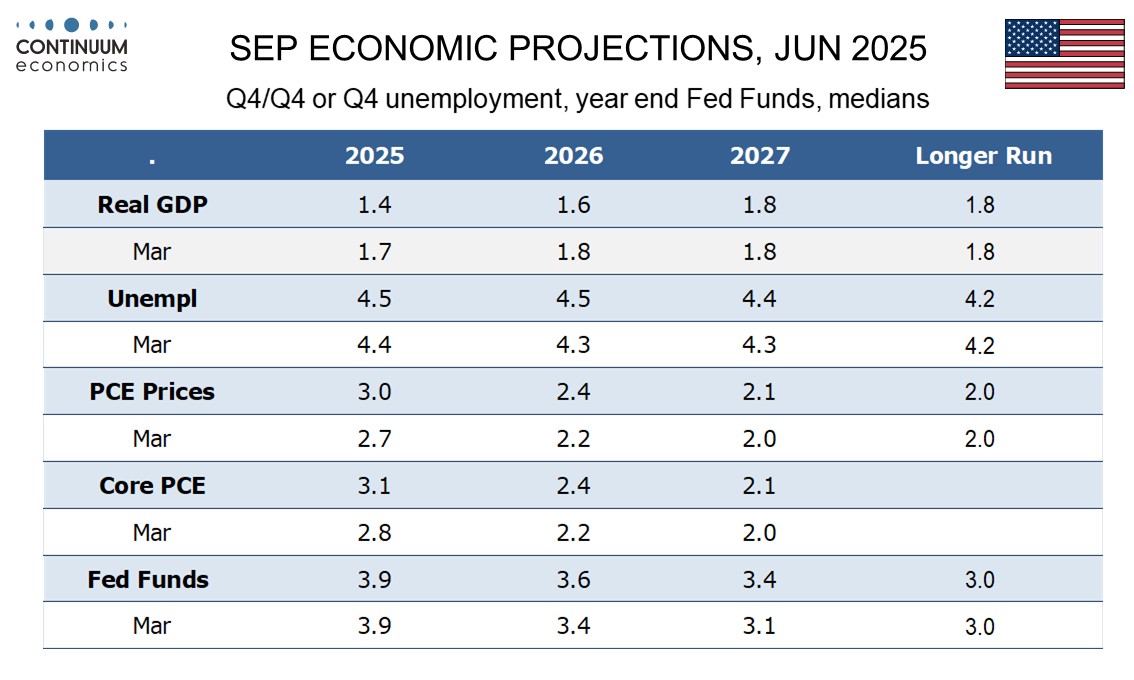

Though the SEP reduced growth forecasts and boosted inflation, the guidance from the Fed remains that policy is on hold in the coming meetings. Though the FOMC median still has two 2025 cuts, the breakdown shows that this was a close call and a lot of members see no cut or only 25bps. We look for

FOMC more pessimistic than March forecasts but not compared to May statement

June 18, 2025 6:23 PM UTC

The FOMC has left rates unchanged at 4.25-4.50% as expected. The median rate forecast is unchanged at 3.9% for end 2025 but the FOMC now sees only 25bps of easing in 2026 rather than 50bps, with 2027 still seeing 25bps, but the end 2027 rate is now seen at 3.4% from 3.1%, leaving a slightly hawkish

June 13, 2025

BOE QT: Slowdown in September?

June 13, 2025 8:15 AM UTC

BOE QT is part of the reason behind both a steeper yield curve and subdued M4 and lending growth. The MPC in September will likely accept that to avoid impacting the monetary transmission mechanism that annual rundown of gilts needs to be slowed from GBP100bln pa to GBP75bln. Internal differences

June 12, 2025

Trump Tariffs: China and July 9 Reciprocal Deadline

June 12, 2025 7:17 AM UTC

We attach a 65% probability to a U.S./China reaching a new trade deal that reduces the minimum overall tariff to 15-20% imposed by the U.S., most likely agreed in Q4 2025 and to be implemented in 2026. However, a 35% probability exist of no deal and this could eventually mean higher tariffs (Fig

June 11, 2025

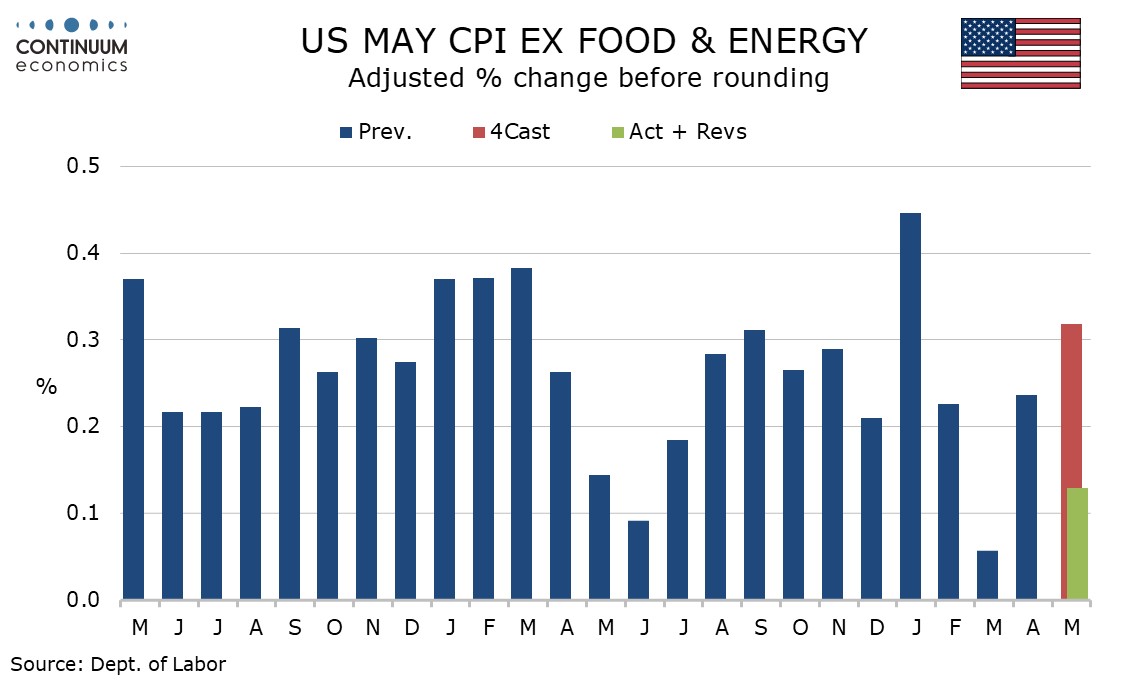

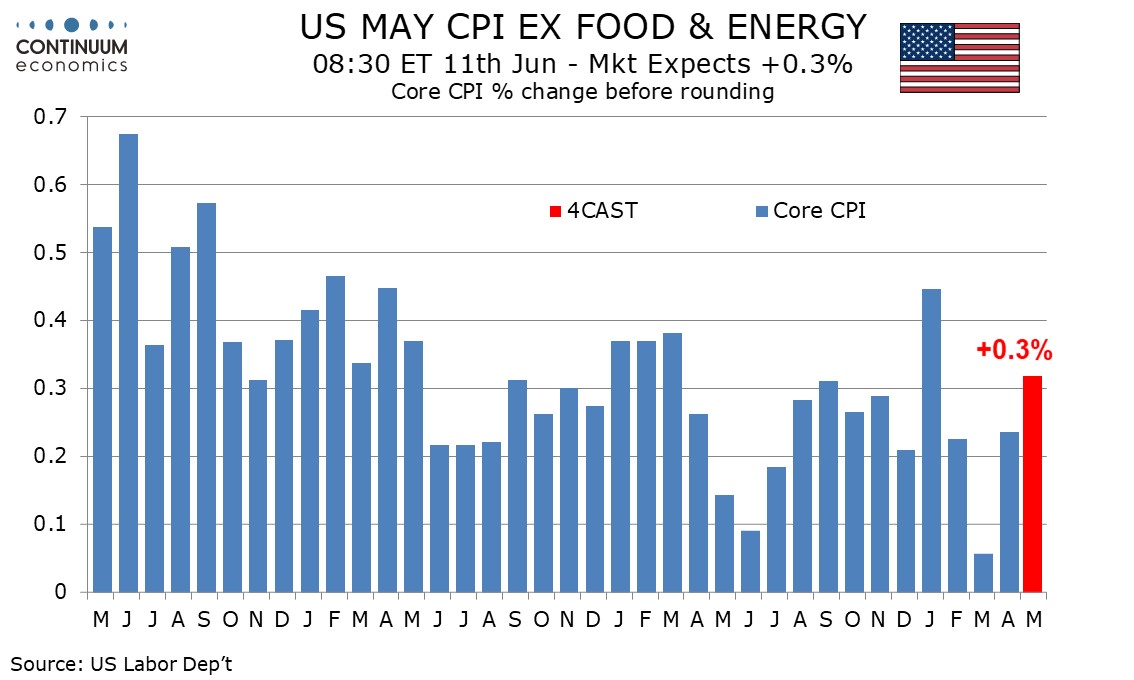

U.S. May CPI - Little tariff pass-through, with inflationary pressures elsewhere fading

June 11, 2025 12:59 PM UTC

May CPI has surprised significantly to the downside, up only 0.1% both headline and core, with the respective gains before rounding being 0.08% and 0.13%. The data is subdued across the board, with commodities ex food and energy unchanged despite tariffs and services ex energy on the low side of tre

June 10, 2025

Preview: Due June 11 - U.S. May CPI - Tariff impact still modest, but starting to build

June 10, 2025 1:03 PM UTC

We expect May CPI to increase by 0.2% overall and by 0.3% ex food and energy, the core rate still seeing a modest impact from tariffs given a Q1 inventory build up and uncertainty over low long tariffs will persist, though at 0.32% before rounding we expect the strongest rise in the core rate since

June 06, 2025

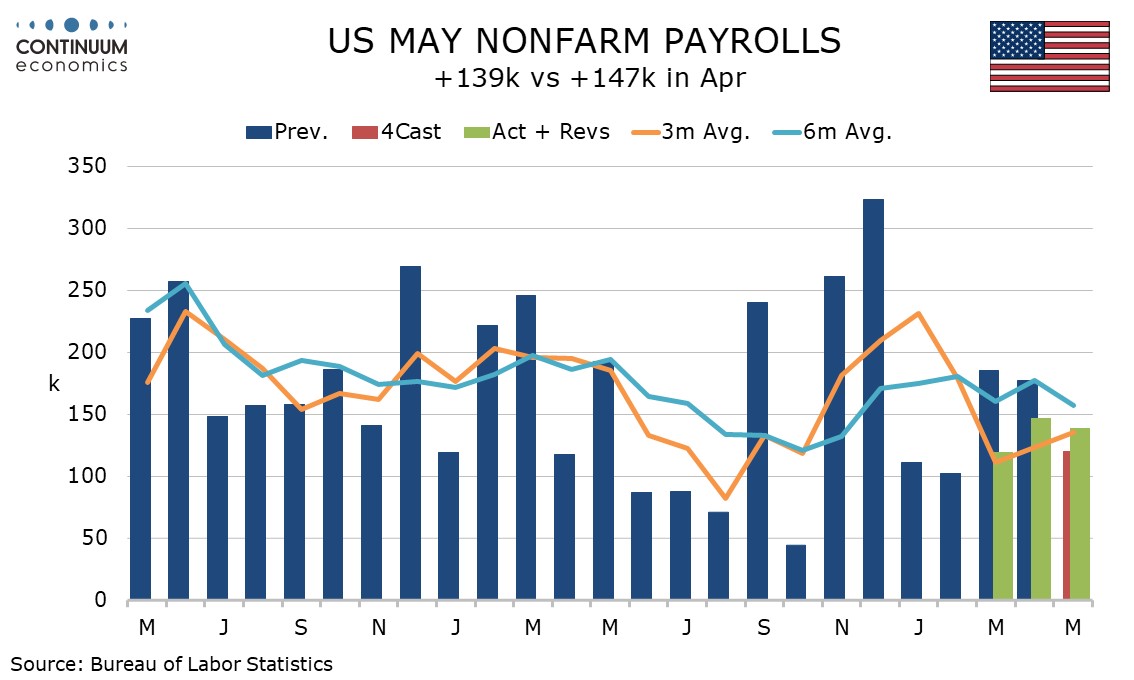

U.S. May Employment - Resilient picture suggests no urgency for Fed easing

June 6, 2025 1:03 PM UTC

May’s non-farm payroll with a 139k increase, is on the firm side of expectations, particularly after the ADP report, and suggests the economy is not on the cusp of recession yet. Revisions were negative at 95k but leave a stable-looking picture, while average hourly earnings were above trend with

June 05, 2025

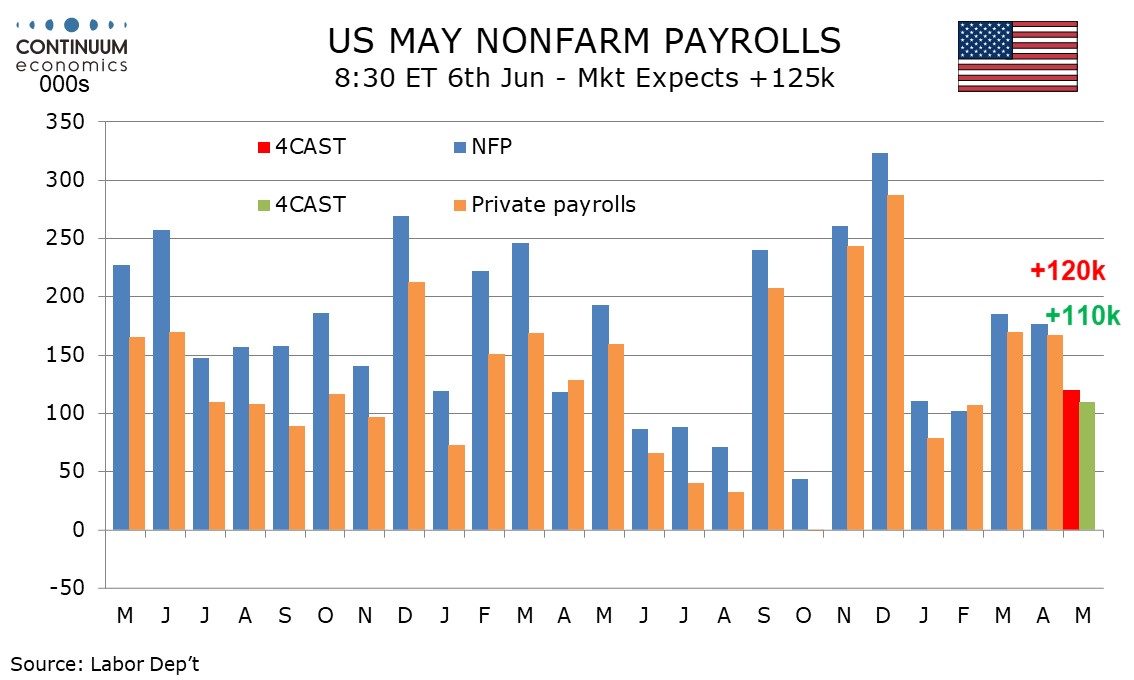

Preview: Due June 6 - U.S. May Employment (Non-Farm Payrolls) - Some slowing, but not a recession signal

June 5, 2025 2:04 PM UTC

We expect a 120k increase in May’s non-farm payroll, with 110k in the private sector, slower than seen in March and April but stronger than what may have been weather-restrained months in January and February. We expect a slightly stronger 0.3% rise in average hourly earnings and an unchanged unem