FOMC more pessimistic than March forecasts but not compared to May statement

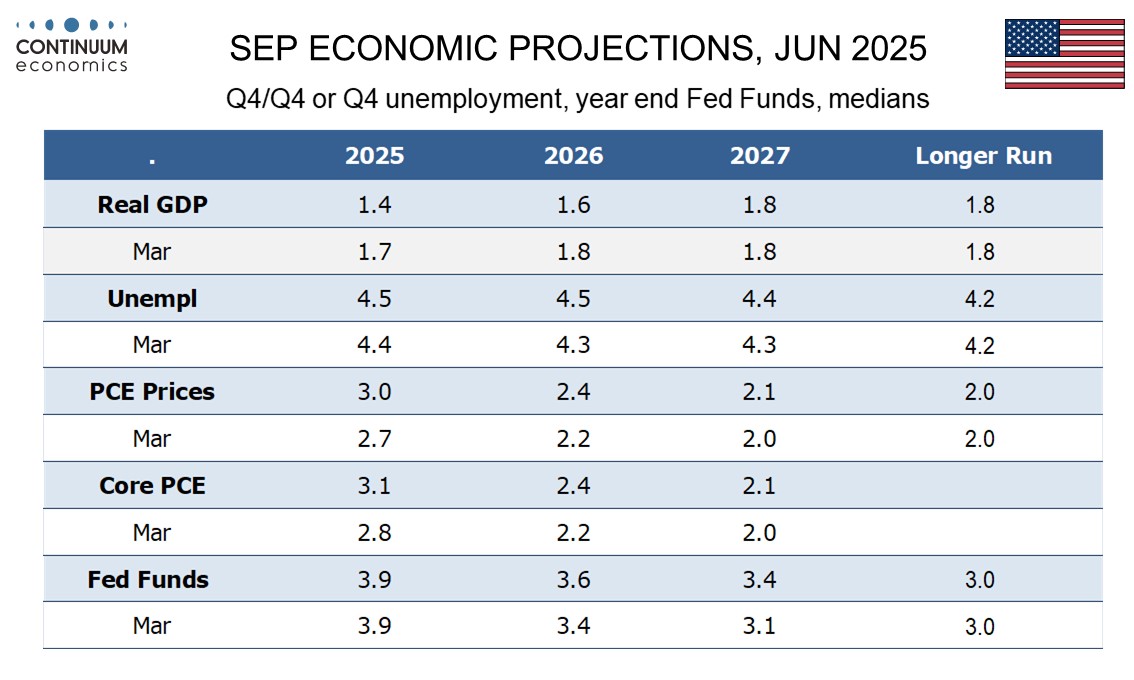

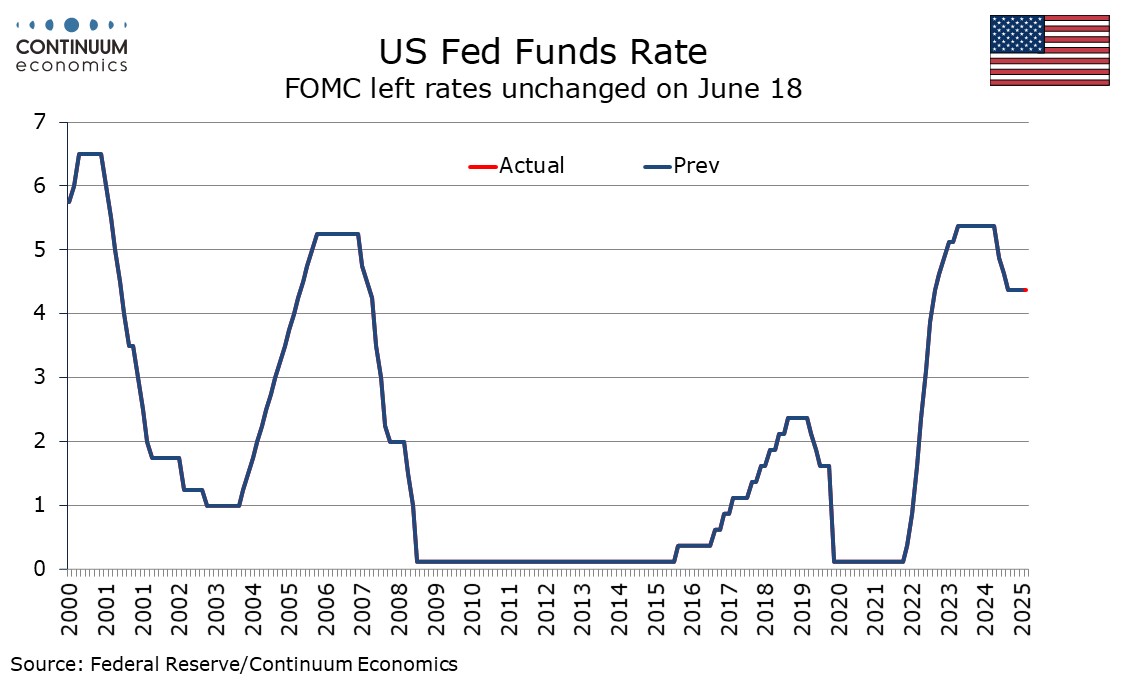

The FOMC has left rates unchanged at 4.25-4.50% as expected. The median rate forecast is unchanged at 3.9% for end 2025 but the FOMC now sees only 25bps of easing in 2026 rather than 50bps, with 2027 still seeing 25bps, but the end 2027 rate is now seen at 3.4% from 3.1%, leaving a slightly hawkish shift.

GDP forecasts have been revised lower for 2025 and 2026, by 0.3% and 0.2% respectively, while unemployment has been revised higher. There are significant upward revisions to inflation forecasts, core PCE to 3.1% from 2.8% in 2025, to 2.4% from 2.2% in 2026 and to 2.1% from an on-target 2.0% in 2027. The revisions to the forecasts are from March forecasts made before the April 2 tariff announcement, and this shows a bigger hit to growth and a larger boost to inflation from tariffs than was the case in March, even with the partial climb downs seen from Trump since then.

The 2025 dots show seven seeing no change in rates this year, two seeing only one 25bps easing, eight seeing two moves and two seeing three, meaning a clear upward skew from the median that sees two easings. For 2025 and 2026 however there is a marginally dovish skew from the more hawkish medians, with 2026 seeing six above the median and nine below, and 2027 seeing five above the median and eight below.

While the forecast comparison is from March the statement comparison is from May. The FOMC now states that uncertainty has diminished, rather than increased further, but remains high, and that unemployment remains low rather than has stabilized at a lower level. A reference in the May statement to risks of higher unemployment and higher inflation having risen is removed, showing that the adjustment to the economic forecasts is from the March forecasts not from May perceptions.