Europe Portfolio Leverage Over Trump

The U.S. will likely introduce a 25% tariff on pharmaceuticals, which will increase pressure on the EU and other European countries (e.g. Switzerland) and also delay serious negotiations close to the 90 day reciprocal tariff deadline on July 9, adding to pressure on Europe by deliberately prolonging the economic uncertainty that is exacerbating current EU economic weakness. Trump will also likely up the temperature on Europe by demanding extra commitments for defense spending before the June 24-25 NATO summit. This will all be aimed to get the EU to soften its current negotiating positions. However, the EU and Europe should remind Trump of the huge equity and bond holdings in the U.S., where flows in recent years have benefitted the U.S.

President Donald Trump is trying to soften the EU up for trade negotiations by making them wait in line. What will happen?

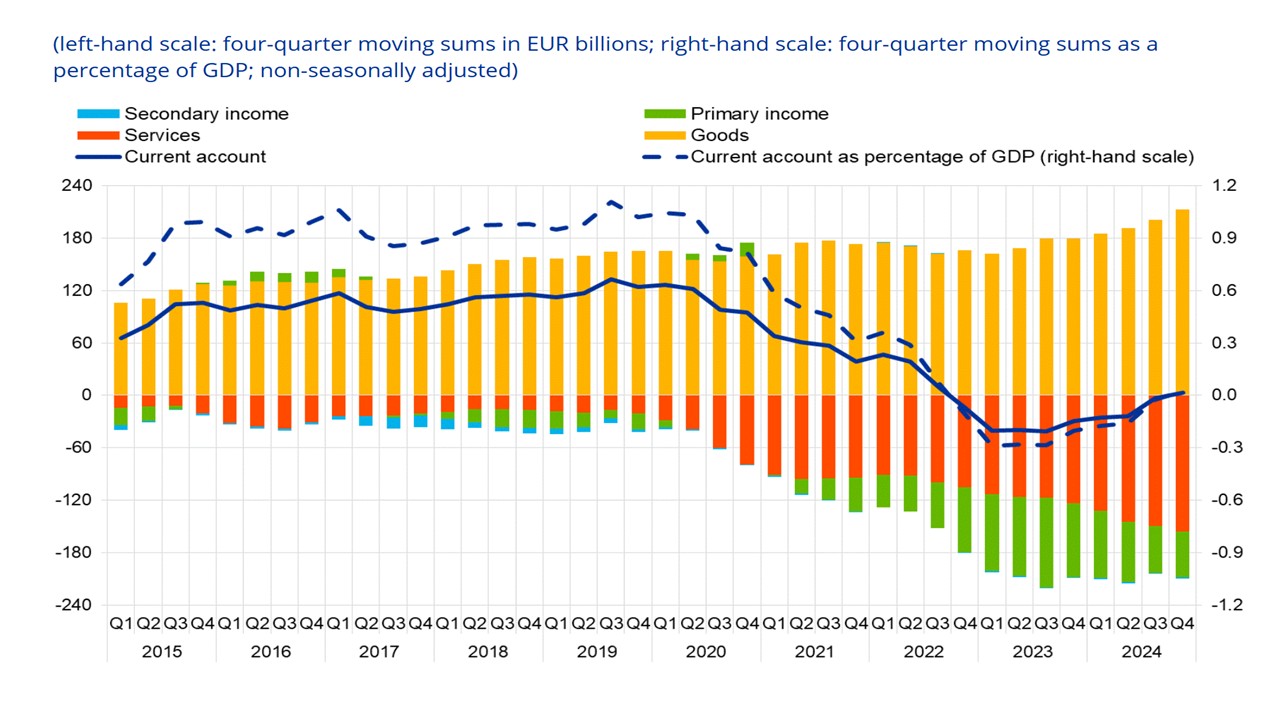

Figure 1: Eurozone Current Account Versus U.S. (EUR Blns and % GDP)

Source: ECB Quarterly BOP data (here)

Trump calls the EU as being nastier than China which not only reflects negotiating rhetoric, but also Trump’s personal deep distaste of the EU. In Washington, the priority is negotiations with key Asian countries (Japan, S Korea, India, Vietnam), to achieve further “successful” trade framework deals, this making the EU a far from urgent policy consideration of the U.S. U.S. negotiators know that the EU discussion will be tougher due to the large size of the EU and are using the July 9 90 day deadline (when EU reciprocal tariffs are due to go up 20%) as negotiating leverage.

Additionally, Trump will likely reawaken his call for European NATO members to spend 5% of GDP before the key NATO summit on June 24-25 – though in reality the U.S. would probably by happy with a 3% commitment. Trump could also reawaken his threat not to support countries that do not meet these targets. Trump call also demand direct payments from European countries for US bases and military support, given that Japan pays some of the costs of U.S. bases. This will be designed to put further pressure on Europe on both defense and trade. European NATO countries response will vary with Eastern European countries/Germany and the UK already at or heading to 3%, but Italy and Spain more reluctant to commit to 3% for domestic fiscal and political reasons.

EU officials are for now saying that they will remain strategically patient on trade negotiations, but the EU core demand for a reciprocal rate below 10% is politically unlikely for Trump. The EU has recently proposed potential tariffs on nearly billion of imports from the US — including big-ticket items like aircraft as well as passenger cars, medical devices, chemicals and plastics, and a slew of agricultural products. Also back on the list are bourbon and other spirits. This is about a quarter of the tariffs that the US may be imposing, as the EU recognises that it neither wises to accentuate an already weak EU industrial backdrop and/or reignite inflationary pressures. But “negotiated outcomes with the U.S.,” are the main aim, but with the tariff option part of a plan preparing for all possibilities.

Europe argues that the U.S. enjoys a large service surplus, which in the EZ case largely counterbalances the goods surplus (Figure 1). Indeed, we feel that the U.S. will likely demand 15% from Europe, but could be willing to give some quotas at lower than 25% for product tariffs such as steel and aluminum. This could all mean a high stakes game in late June/early July ahead of the July 9 deadline. However, domestic political pressures will likely mean that Trump does not want to escalate and this will likely see a further delay in the 20% reciprocal tariffs for the EU.

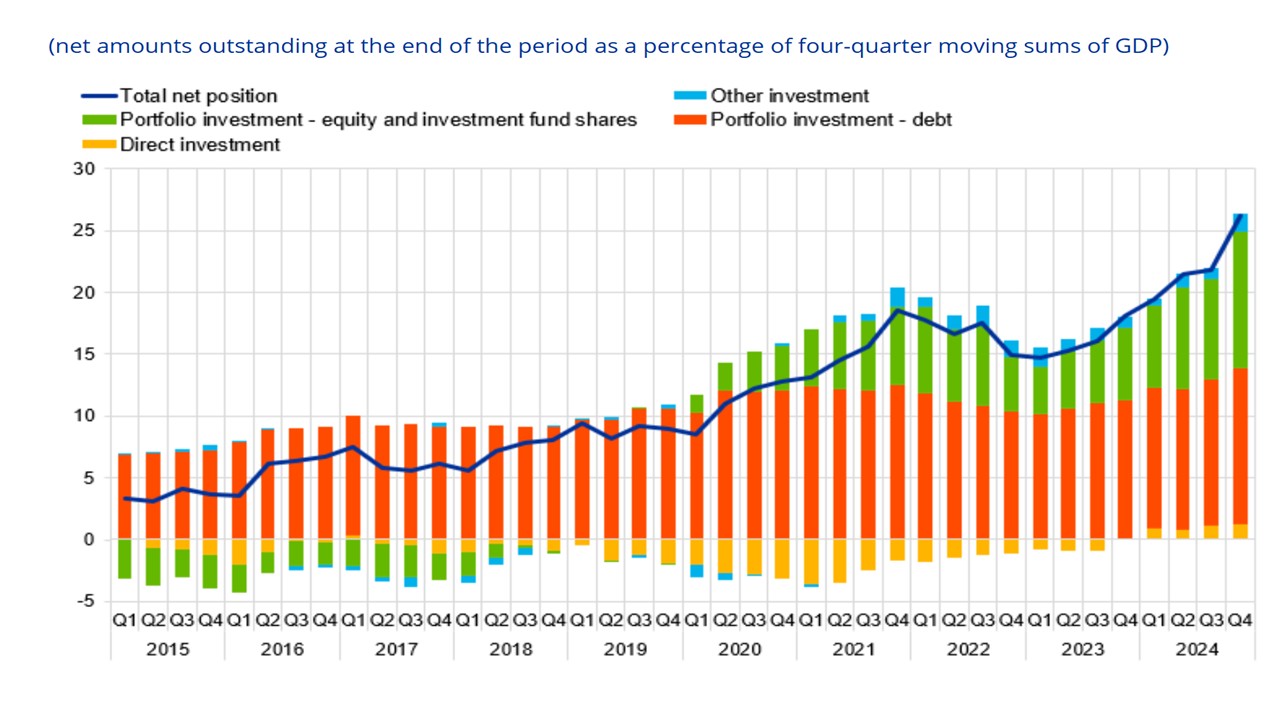

Europe does have negotiating leverage with the U.S. however. ECB balance of payments data show that EZ institutions own Eur4.6trn of U.S. equities and Eur2.7trn of U.S. debt securities (excluding official holdings). EZ end investors value of U.S. equities has surged since 2015 largely due to price changes in U.S. equities and the decline in the EUR v USD (Figure 2).

Figure 2: Eurozone Net Investment Position Versus U.S. (% GDP)

Source: ECB

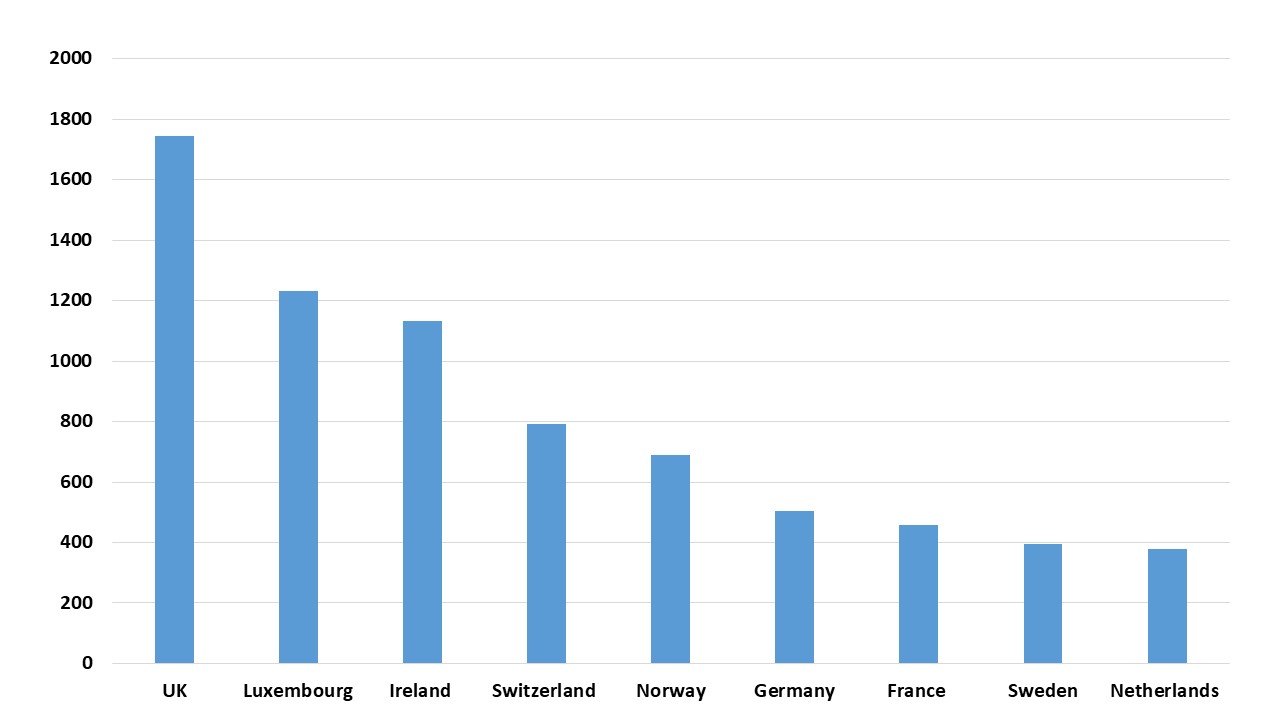

If the UK/Switzerland and Norway (Figure 3) are added in then the U.S. Tics data shows that Europe held USD8.1tn of U.S. equities as of June 2024. Given Trump’s sensitivity to the U.S. equity and bond market it is worth reminding the Trump administration of how much U.S. assets are owned by W Europe

Figure 3: Holdings of U.S. Equities End June 2024 (USD Blns)

Source: BEA Tics

This is not to say that EU politicians have much sway directly over EU/EZ investors portfolio allocations however. This is driven by prospective capital market assumptions over 5 and 10 years strategically, as well as tactical asset allocation. However, the overvaluation of the U.S. equity market means that most strategic capital market assumptions show better long-term return forecasts outside the U.S. This has been ignored in the era of U.S. exceptionalism, but the aggressive and erratic nature of the Trump administration tariffs and less Ukraine/European defense commitments has shaken long-term confidence in the U.S. This could mean a prolonged and persistent slowing of new flows into U.S. equities and some investors reducing overweight U.S. equity positions long-term.