U.S. April CPI - Little tariff pass-through so far

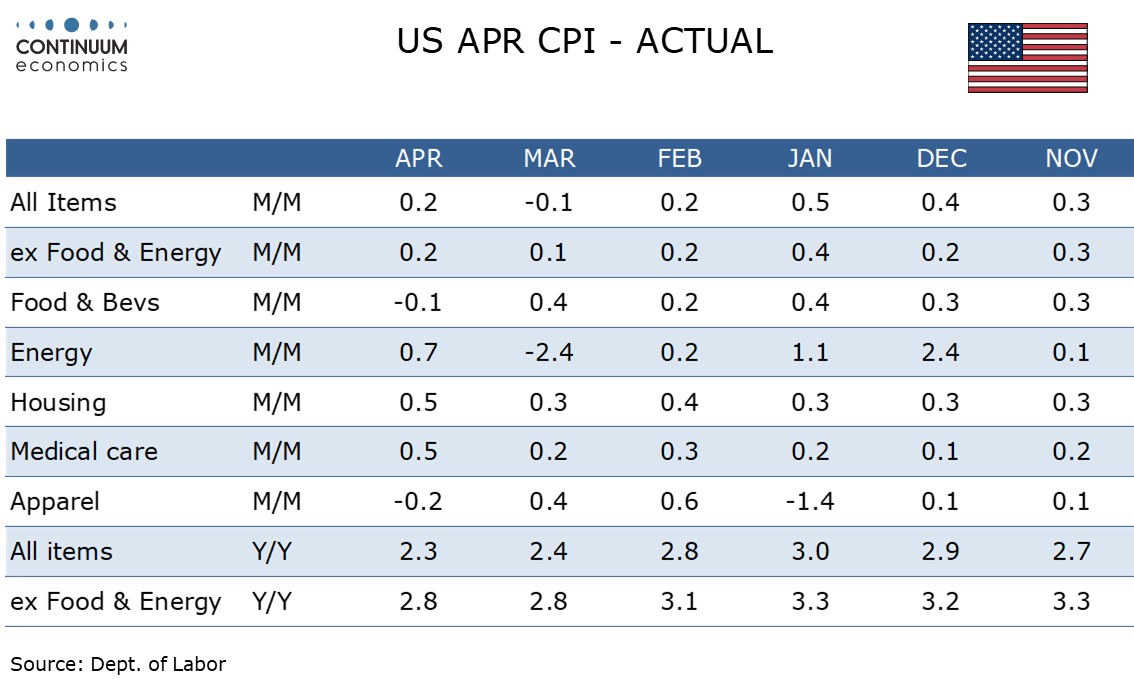

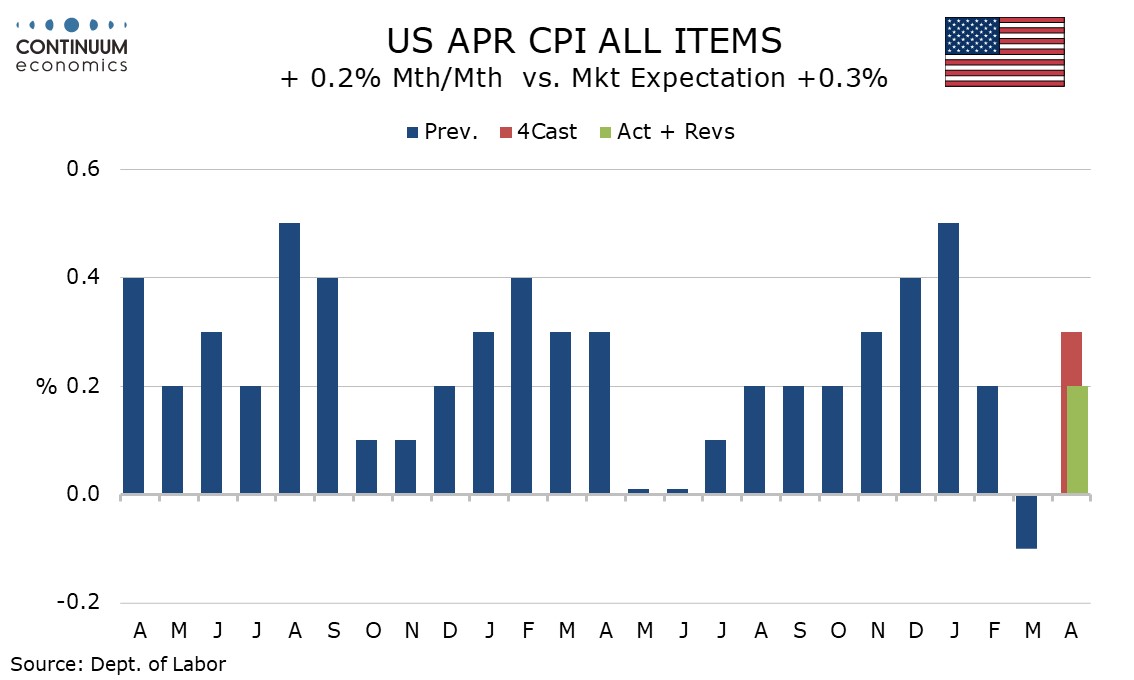

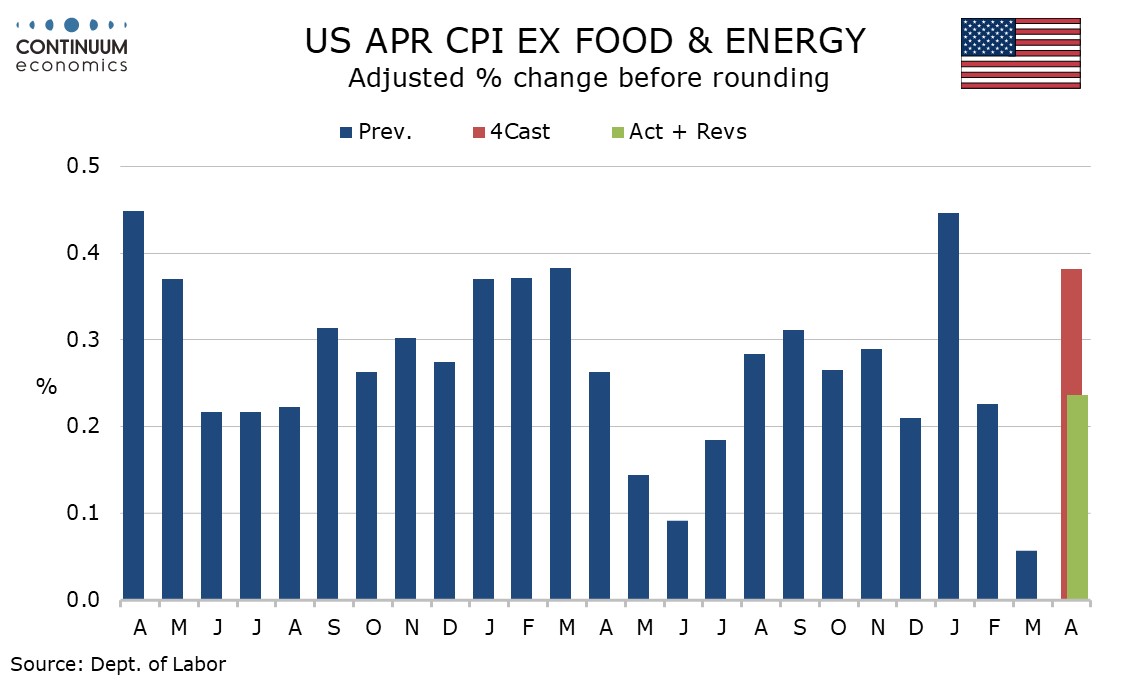

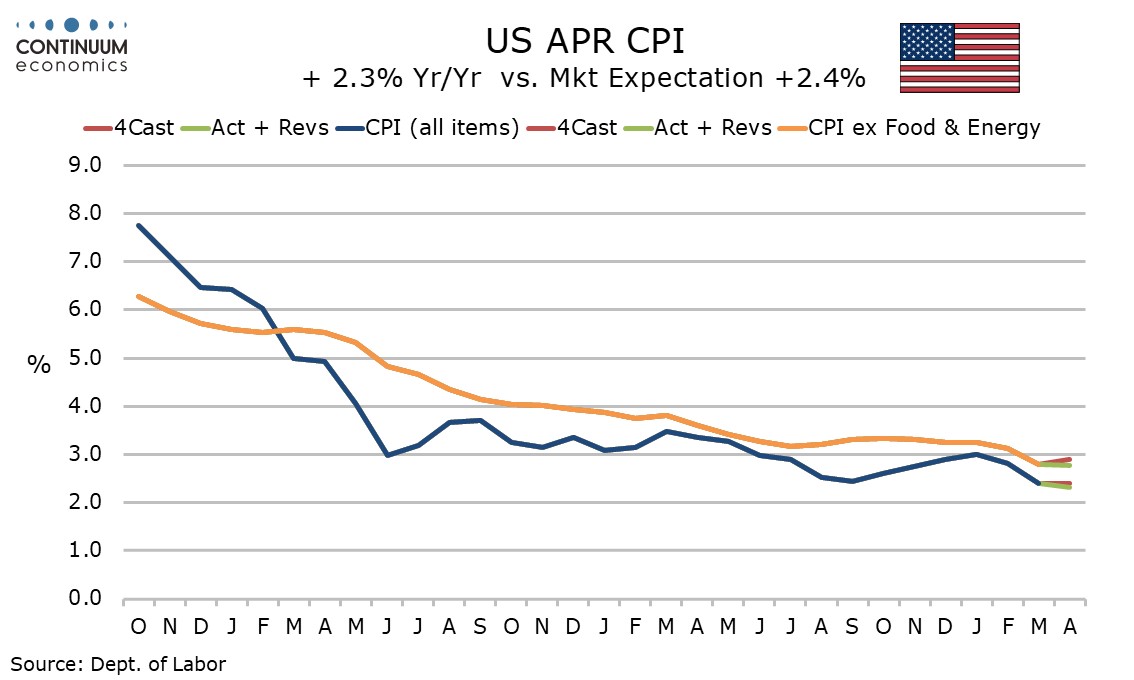

April CPI is on the low side of expectations at 0.2% both overall and ex food and energy, showing a loss of inflationary momentum since a strong start to the year in January, despite the imposition of tariffs. The core rate was up 0.24% before rounding, with the overall pace 0.22%, so the surprise is modest.

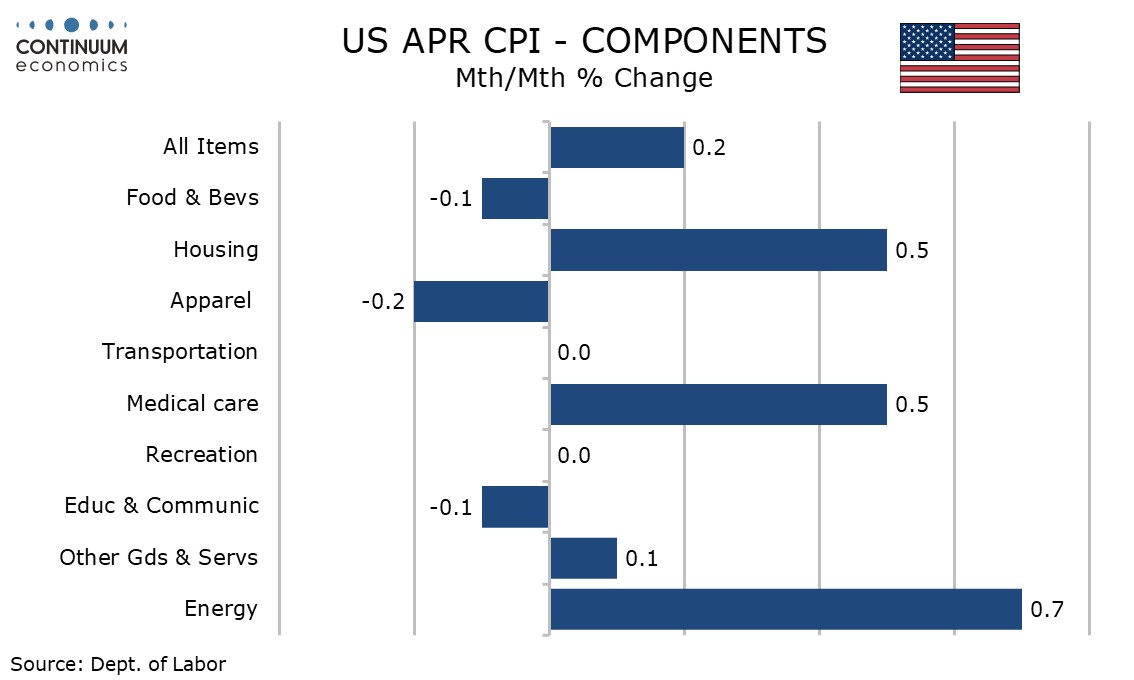

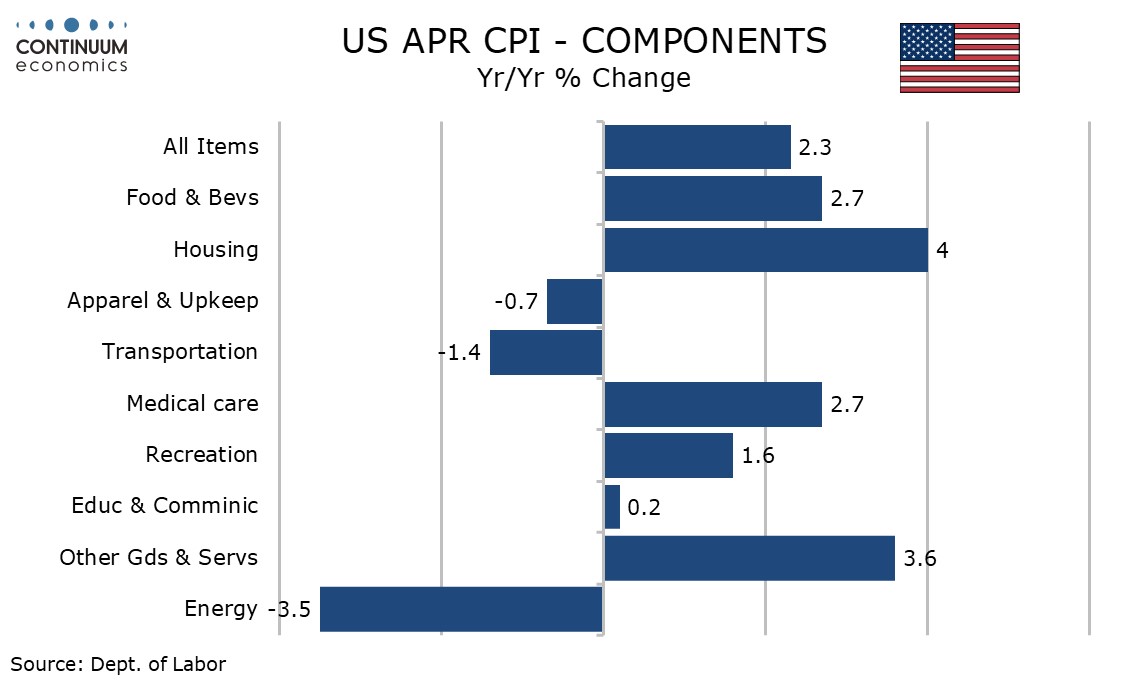

Commodities less food and energy, where tariff risk was seen as strongest, rose by only 0.1%, with used autos down by 0.5%, a second straight decline, and apparel, much of which is imported, down by 0.2%.

Energy commodities fell by 0.2% with gasoline down by 0.1% but energy services were firm with a 1.5% increase to leave energy up 0.7% overall. Food fell by 0.1% as eggs plunged by 12.7% in a correction from recent sharp gains. Eggs are still up 49.3% yr/yr.

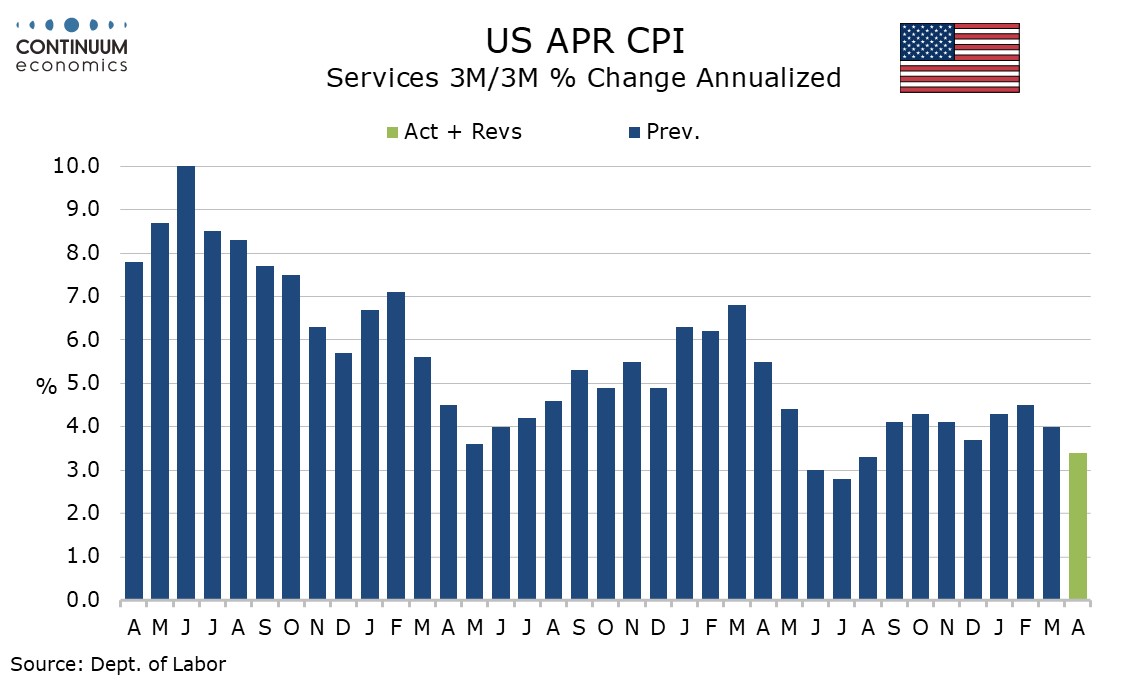

Services less energy returned to trend at 0.3% after a weak 0.1% increase in March. Air fares remain weak with a 2.8% decline reflecting reduced demand to visit the USA, but transport services rose by 0.1% after a 1.4% March decline with the air fares drop less steep than March and auto insurance correcting a March decline.

Shelter rose by 0.3% with owners’ equivalent rent up by 0.4%. Lodging away from home fell by a marginal 0.1% but remains weak after a 3.5% March drop, another sign of weakness in tourism. Medical care services were quite firm at 0.5%.

Yr/yr CPI slipped to 2.3% from 2.4% with the core stable at 2.8%, though that sustains a March dip to the lowest pace since March 2021. The overall pace is the slowest since February 2021.

The data suggest there was some downward momentum in inflation ahead of the trade war, which can be explained by easing wage pressures, while the trade war has not yet fed its way into prices. It is too early to conclude that tariffs will not lift inflation, with inventories built up and uncertainty over how long the tariffs will last.

Price hikes may still come if tariffs, which remain significant even with Trump’s multiple partial climb downs, persist once inventories are run down. However, there does appear to be some resistance to price hikes, and in sectors such as air fares and hotels the trade war may even be reducing inflationary pressure by weakening demand.