Preview: Due May 2 - U.S. April Employment (Non-Farm Payrolls) - Few clear signals for labor market weakness

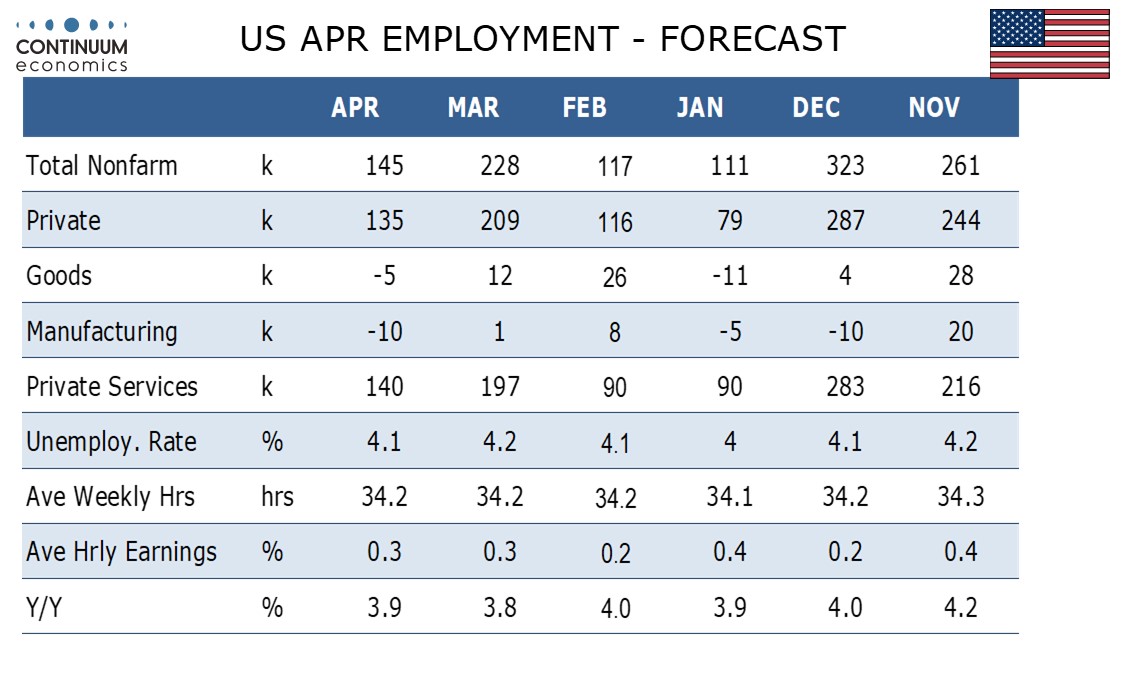

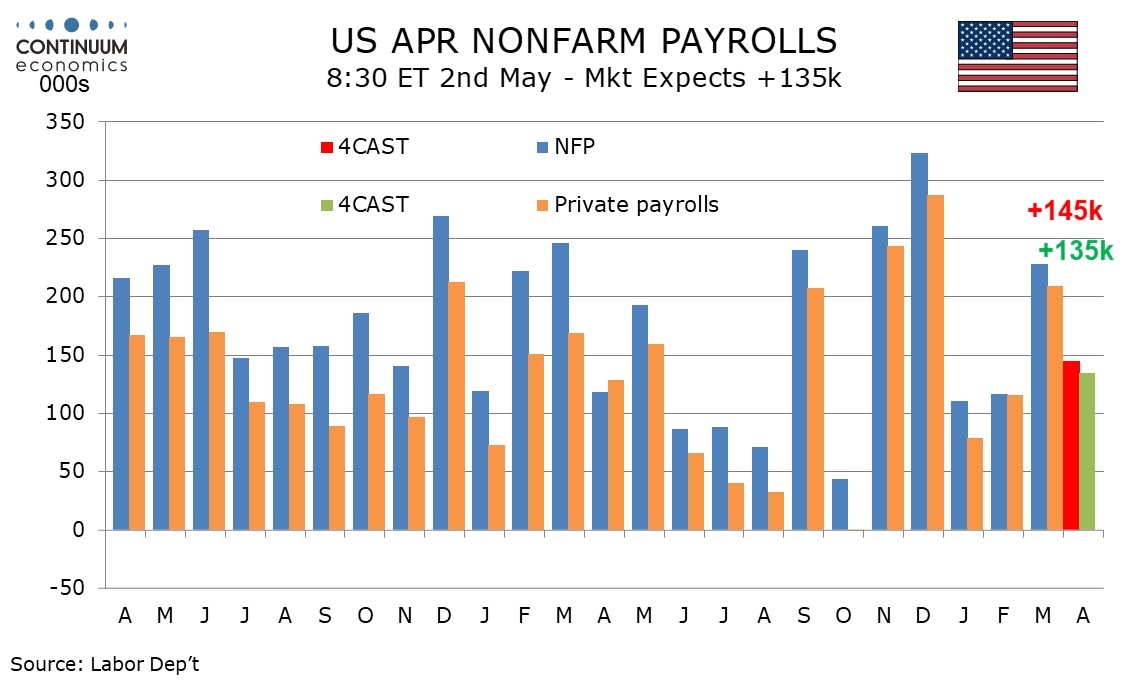

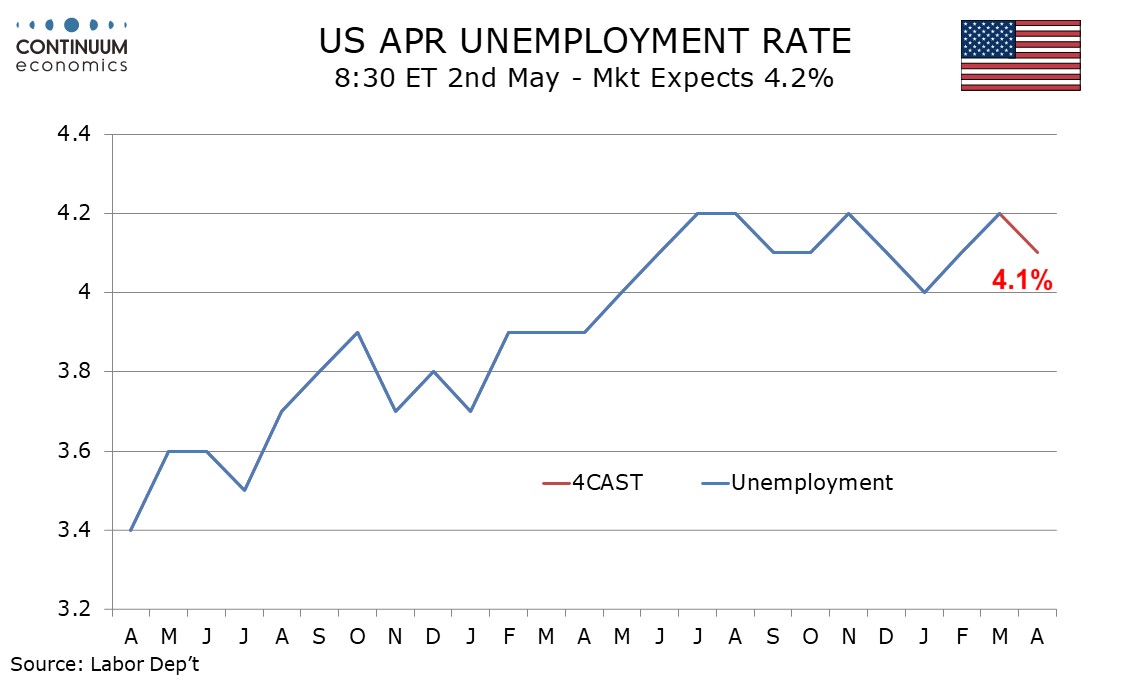

We expect a 145k increase in April’s non-farm payroll, with 135k in the private sector, the latter equal to the Q1 average. Initial claims were showing no signs of labor market weakness in the payroll survey week, with a bounce in the latest week not yet a clear change in trend. We expect unemployment to correct lower to 4.1% after a March rise to 4.2%, and an in line with trend 0.3% increase in average hourly earnings.

January and February saw below trend data with bad weather probably a factor followed by an above trend March as weather improved. The 3-month averages of 152k overall and 135k for the private sector are probably representative of trend and we expect April data to be in line with that. The overall gain may be slightly below its 3-month average as Federal government layoffs pick up, but we still expect hiring at the state and local level to outweigh declines at the Federal.

Tariffs are downside risk with manufacturing, where we expect a 10k decline, but the impact of tariffs should be limited so soon after April's announcement. A late Easter could even inflate retail employment in this report. Seasonal adjustments get tougher in the spring with increased hiring assumed, but near term downside risk looks modest. In addition to initial claims remaining low through the payroll survey week, the Dallas Fed’s weekly economic activity index remains resilient. ADP weakness was led by education and health, a sector that has been strong in recent payrolls and is unlikely to be sensitive to tariffs.

March’s rise in unemployment took the rate to 4.152% before rounding, meaning that employment growth has to only marginally exceed that of the labor force to return the rate to 4.1% before rounding. Given the current climate towards immigration, we expect slower growth in the labor force.

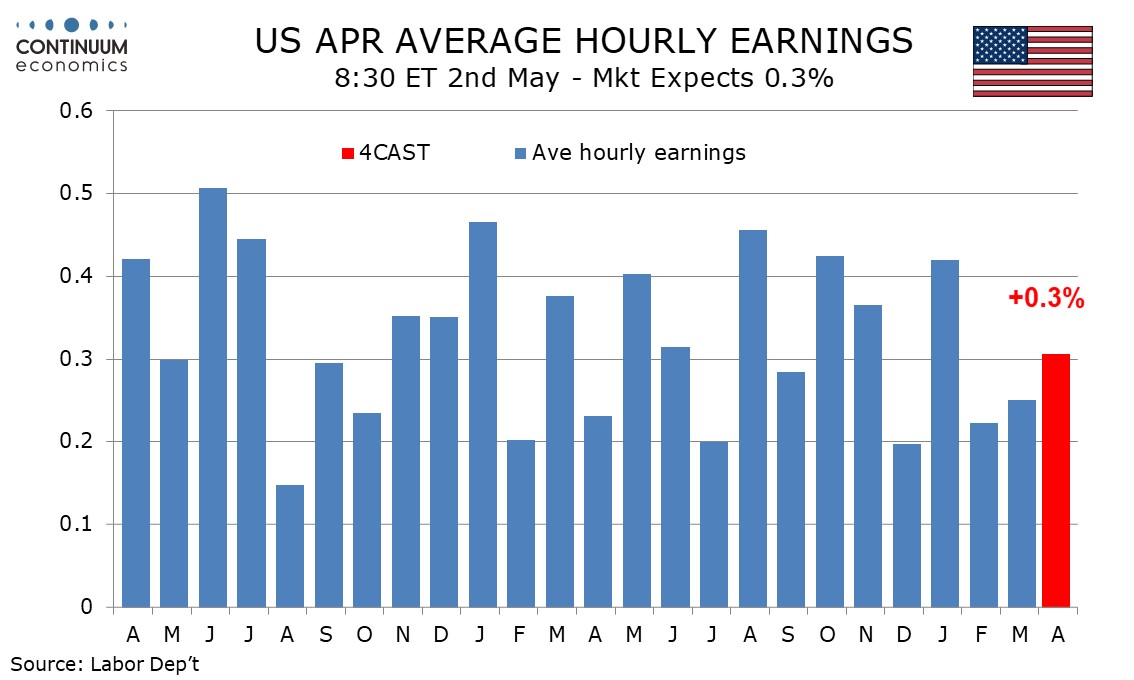

Trend in average hourly earnings is running around 0.3% per month, and we expect April to be in line with that after gains before rounding of 0.25% in March, 0.22% in February and 0.42% in January. This would see yr/yr growth edge up to 3.9% from March’s 3.8%, which was the slowest yr/yr pace since July 2024.

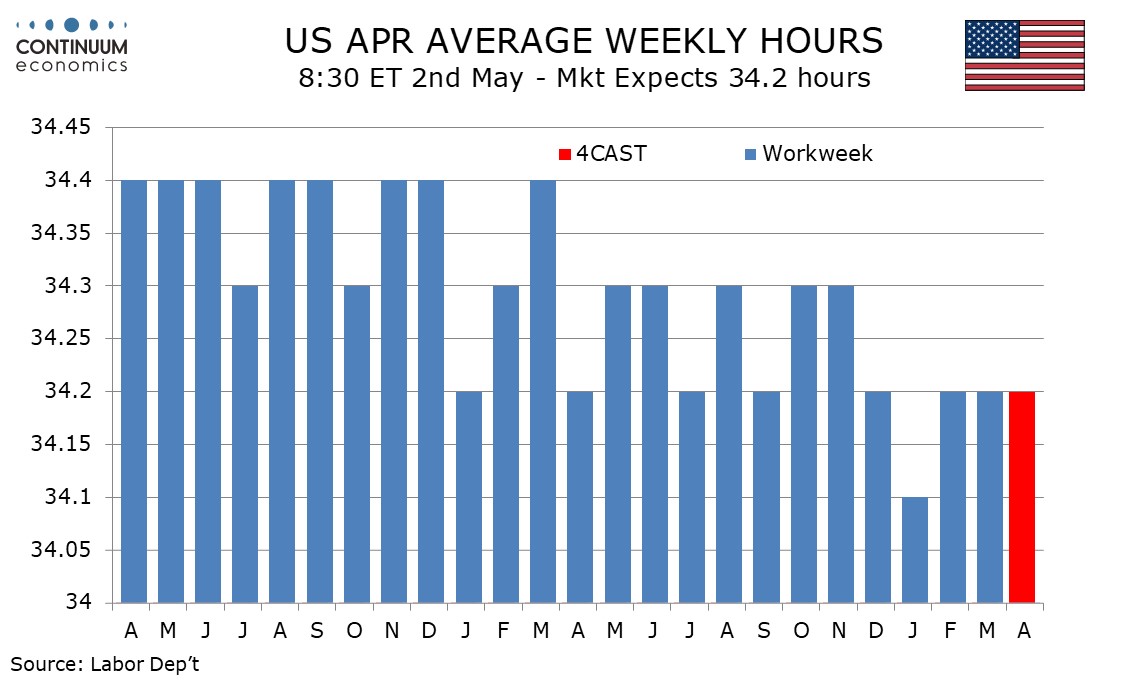

We expect an unchanged workweek of 34.2 hours, matching the data of February and March but above what was probably a weather-restrained January. Readings of 34.3 are becoming rarer while we have not seen a 34.4 something that was common in 2023, since March 2024.