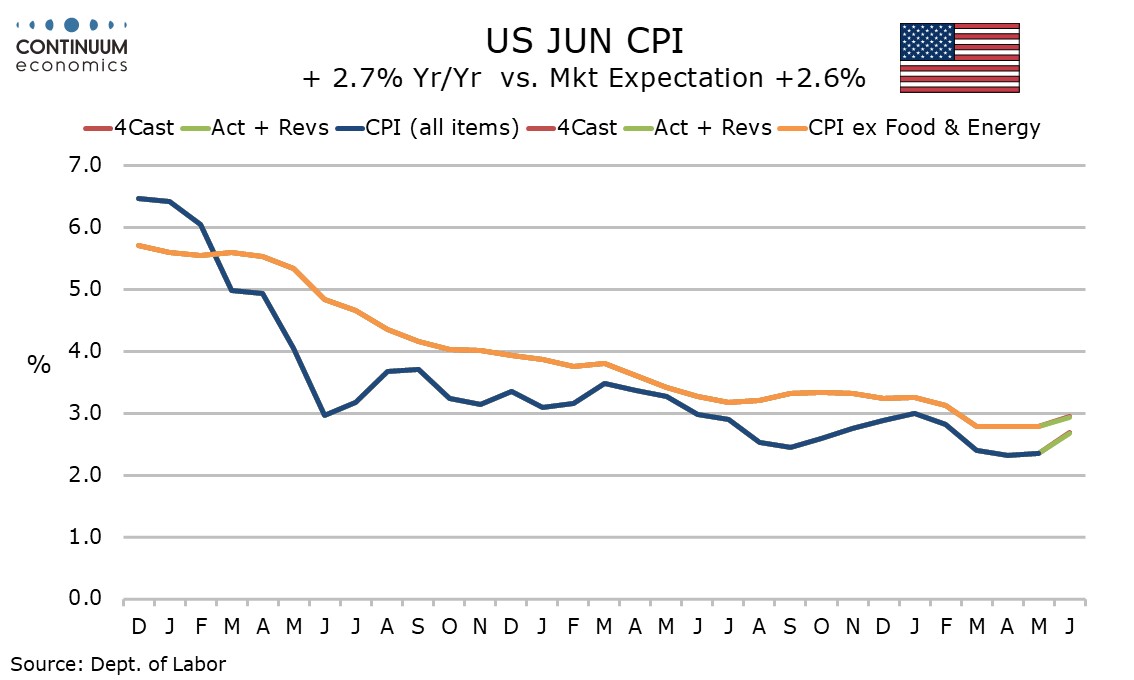

U.S. June CPI - Tariff pass-through limited but not zero

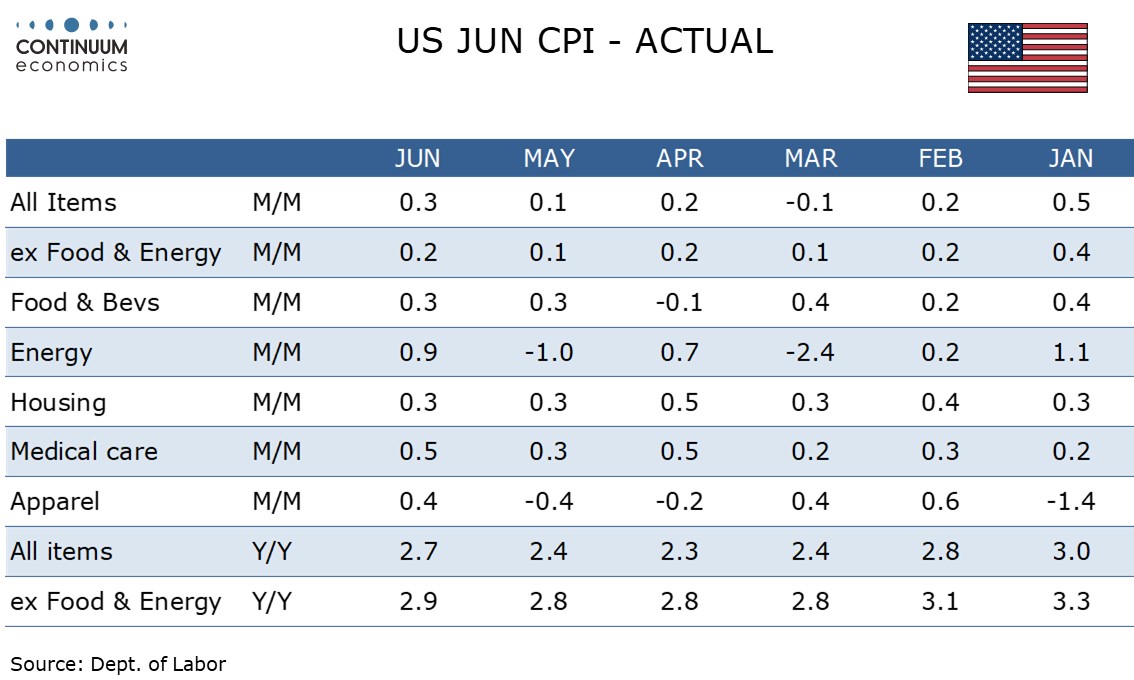

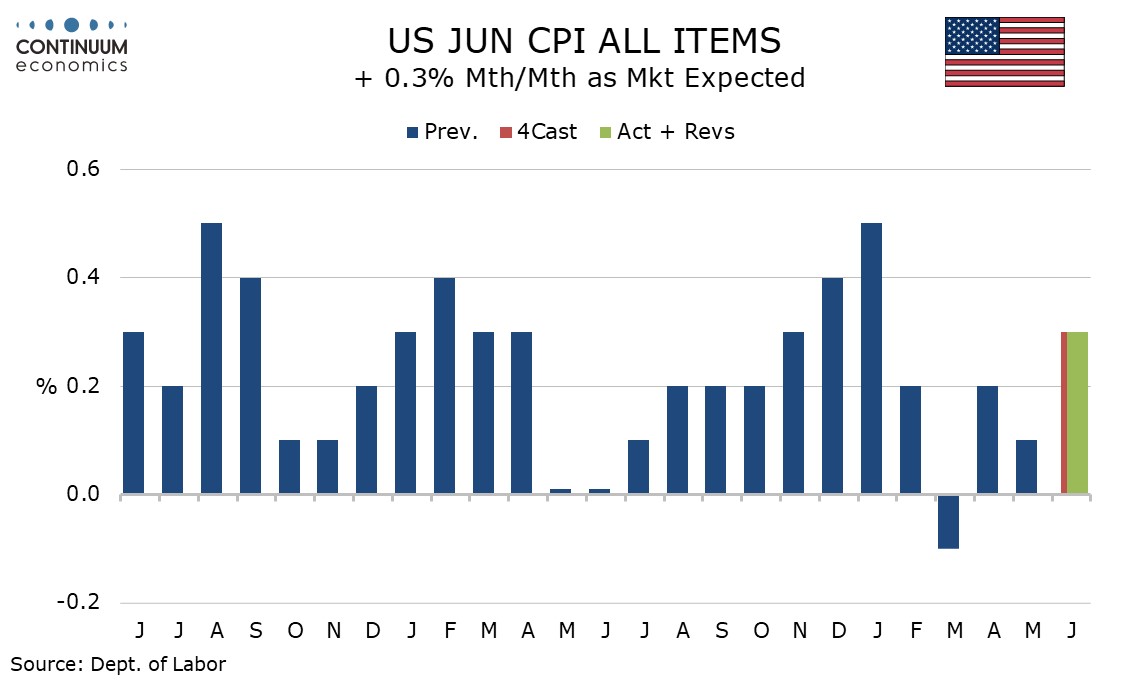

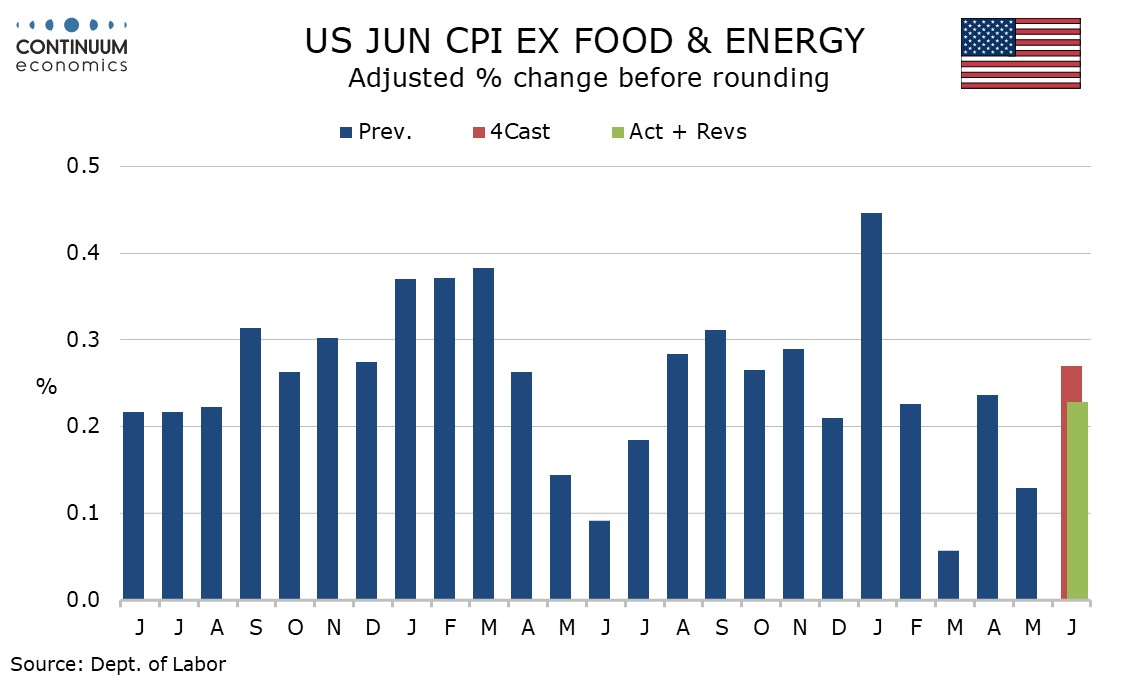

June core CPI at 0.228% before rounding is on the low side of expectations and still shows a limited, though not zero, feed through from tariffs. Moderate gains in food and energy lifted overall CPI to a 0.3% increase, with the gain rounded up from 0.287%. Trump will use this data to argue for Fed easing though uncertainty over the tariff picture argues for a wait and see stance from July’s meeting.

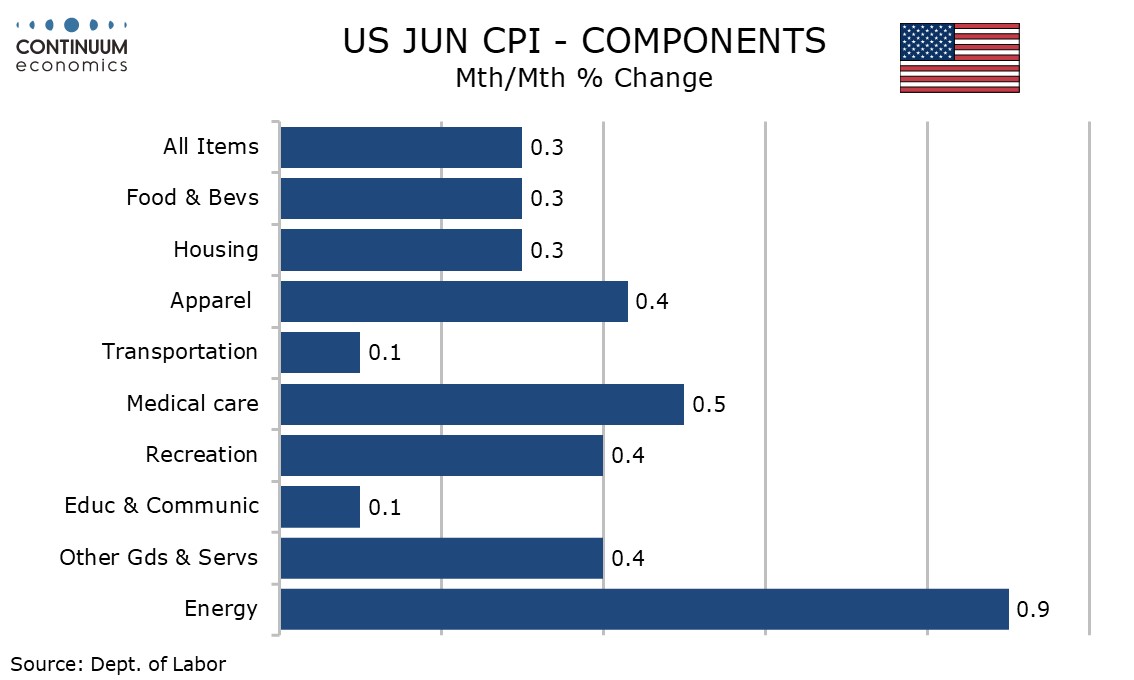

Commodities less food and energy rose by 0.2%, despite continued weakness in autos as new vehicles fell by 0.3% and used vehicles fell by 0.7%. This means some strength elsewhere, though a 0.4% rise in apparel needs to be seen alongside a 0.4% decline in May. Still, this is the strongest rise in commodities ex food and energy since February.

Shelter less energy rose by 0.3% after a 0.2% increase in May. Medical care services were firm at 0.6% while transportation services at 0.2% reversed a May decline. Airline fares at -0.1% and auto insurance at +0.1% were virtually unchanged following recent respective weakness and strength. Shelter rose by 0.2% restrained by a 2.9% fall in volatile lodging away from home. Owners’ equivalent rent rose by 0.3%.

Food was quite firm at 0.3% despite eggs with a 7.4% plunge continuing to erase recent strength. Prices of some foods are probably being lifted by tariffs. Energy rose by 0.9% with gasoline at 1.0%. A brief rise in gasoline prices was seen during the conflict between Israel and Iran.

Yr/yr growth was firmer as year ago weakness dripped oil, overall CPI at 2.7% from 2.4% getting closer to the core which edged up to 2.9% from 2.8%.

Inflation is still higher than the Fed would like and would probably be marginally softer without tariffs. With more tariffs scheduled for August the Fed will not be willing to dismiss inflationary risks, even if the tariff impact so far has been less than many feared.