U.S. June Employment - Some signs of slowing activity, but lower unemployment suggests no urgency for Fed easing

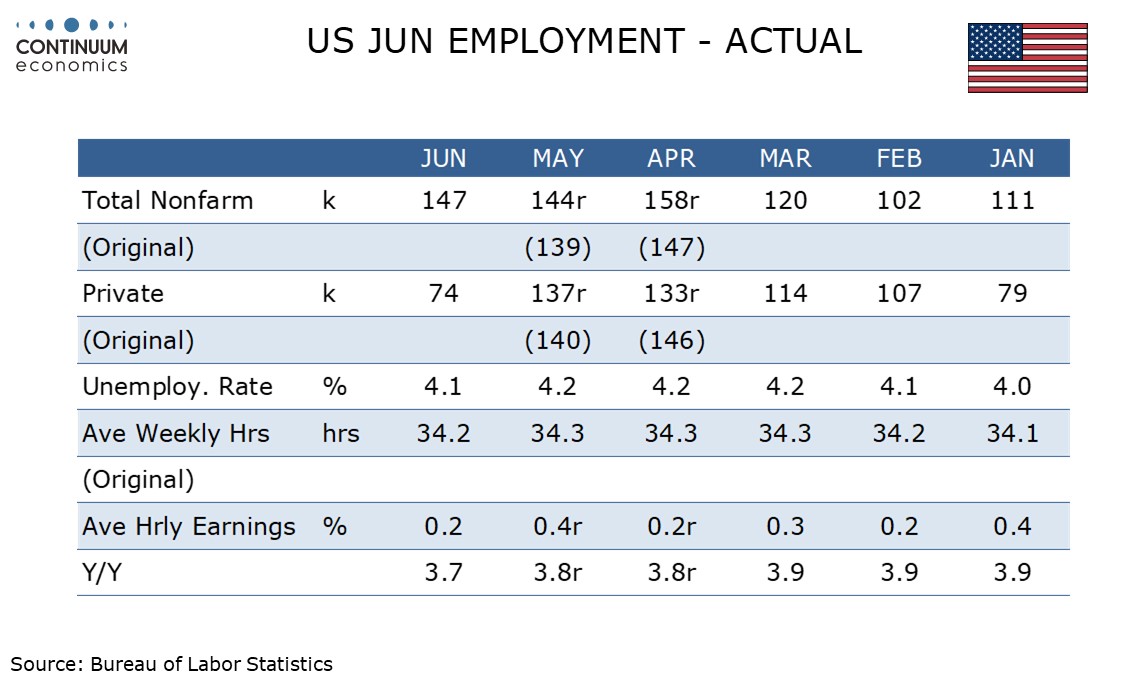

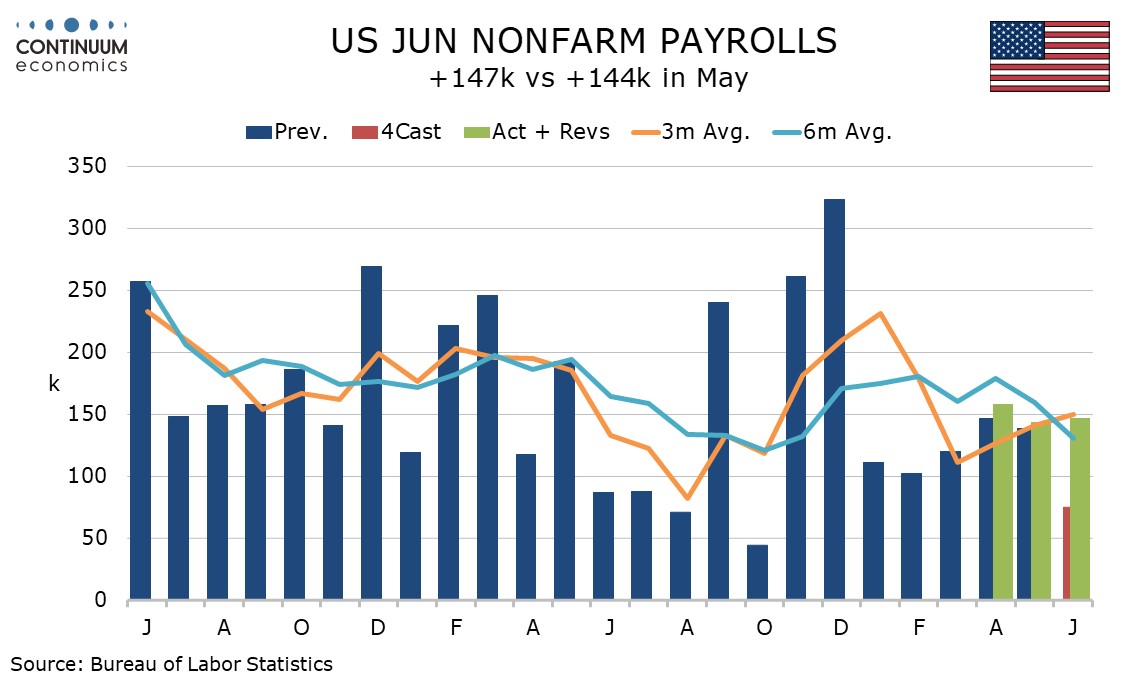

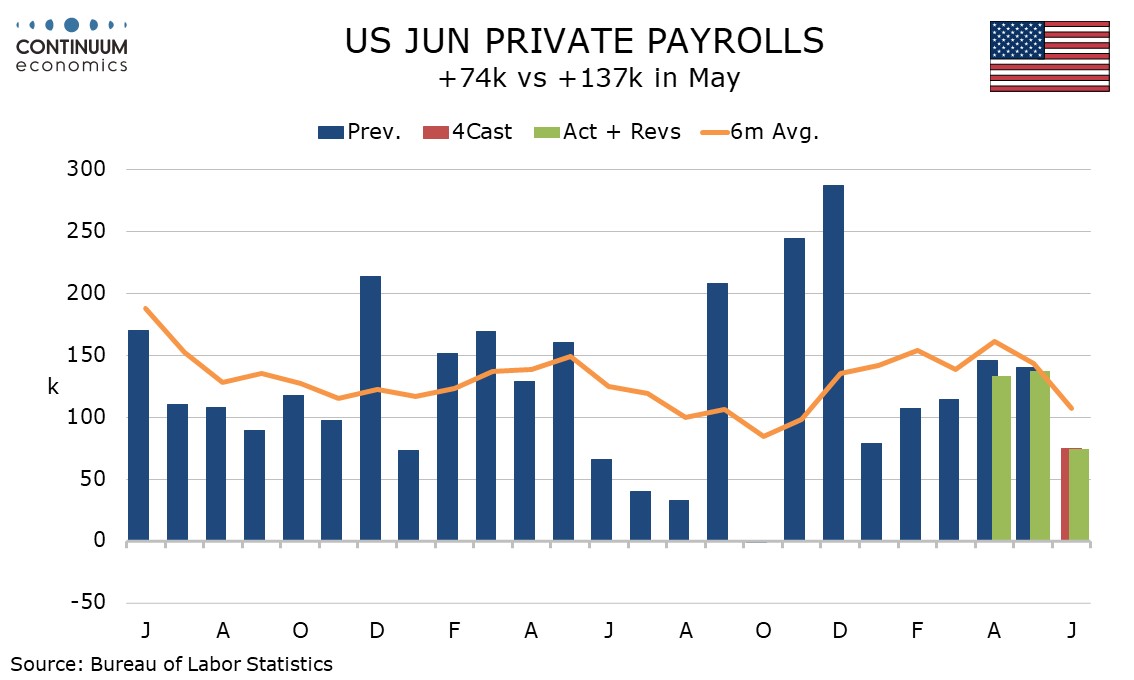

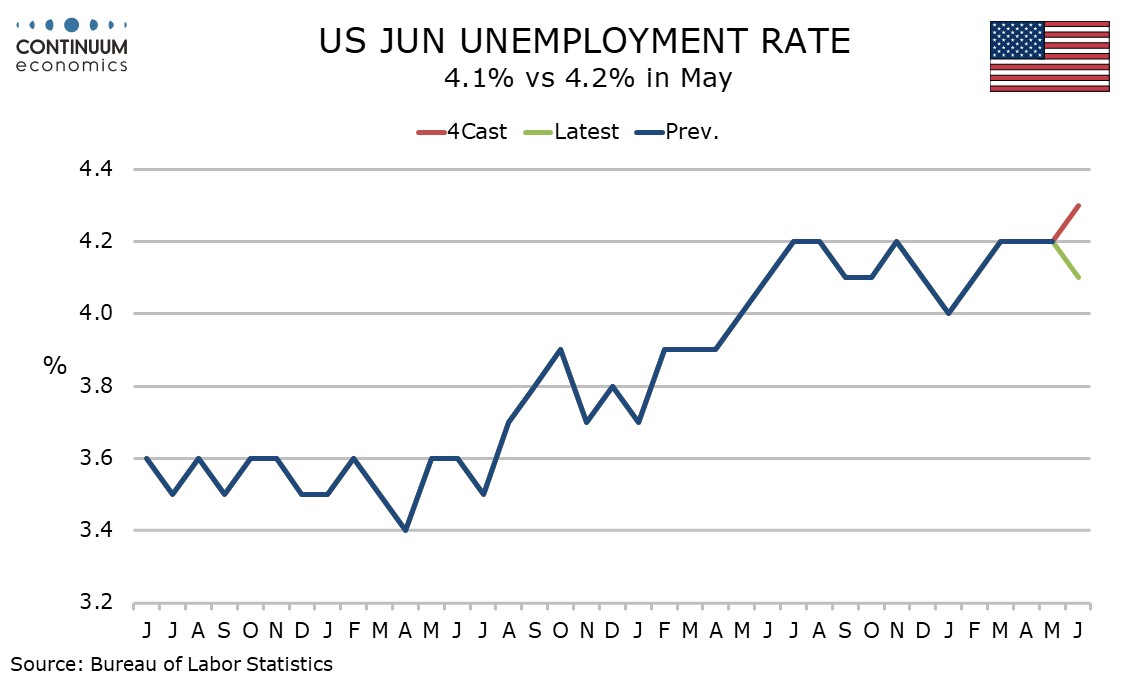

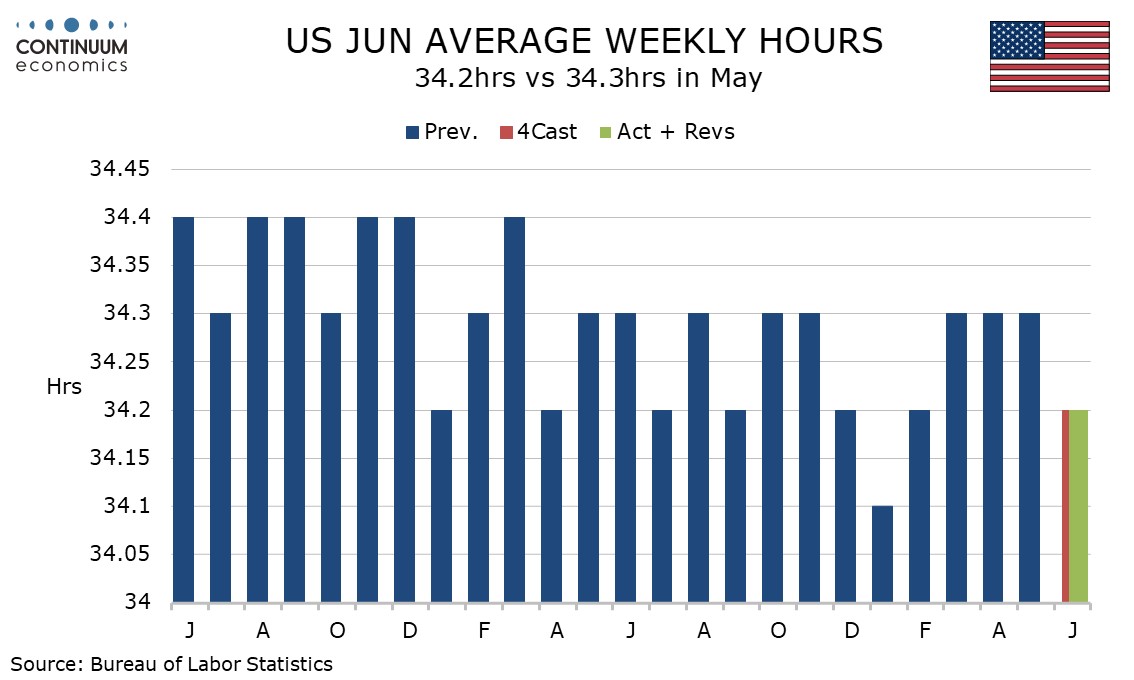

June’s non-farm payroll is surprisingly strong overall with a rise of 147k, with 16k in net upward revisions, but private payrolls at 75k are weaker than expected, with 16k in net negative revisions. Unemployment unexpectedly fell to 4.1% from 4.2%, but average hourly earnings are weaker than expected with a rise of 0.2%, while the workweek fell to 34.2 hours after three straight months at 34.3.

The 73k surge in government is the biggest surprise. Federal government fell by a modest 7k, but state government surged by an unusual 47k, 40k of that in education, while local government rose by a less unusual 33k, 23k of that in education.

The 74k rise in private payrolls is the weakest since a hurricane-impacted 1k decline in October 2024, though weaker data were also seen in June, July and August of 2024 with no major special factors. The slowing came mainly in private sector services, up by 68k with 59k of that coming in health care, with even the rise in health care a significant slowing in what had been a strong trend.

Leisure and hospitality rose by 20k, leaving private services weak elsewhere. Goods were resilient with a rise of 6k with construction up by 15k but manufacturing down by a modest 7k. A fall in weekly initial claims to 233k from 237k suggests a recent increase there has peaked, hinting that we should not expect weakness in July payrolls.

The fall in unemployment came on a 130k fall in the labor force. The household survey estimated employment up by 93k. The labor force decline follows a steeper 625k fall in May which followed a 544k increase in April. The data is volatile but it is likely that reduced immigration is starting to be felt in the labor force. That will restrict the scope for unemployment gains even if employment slows further, which is far from assured.

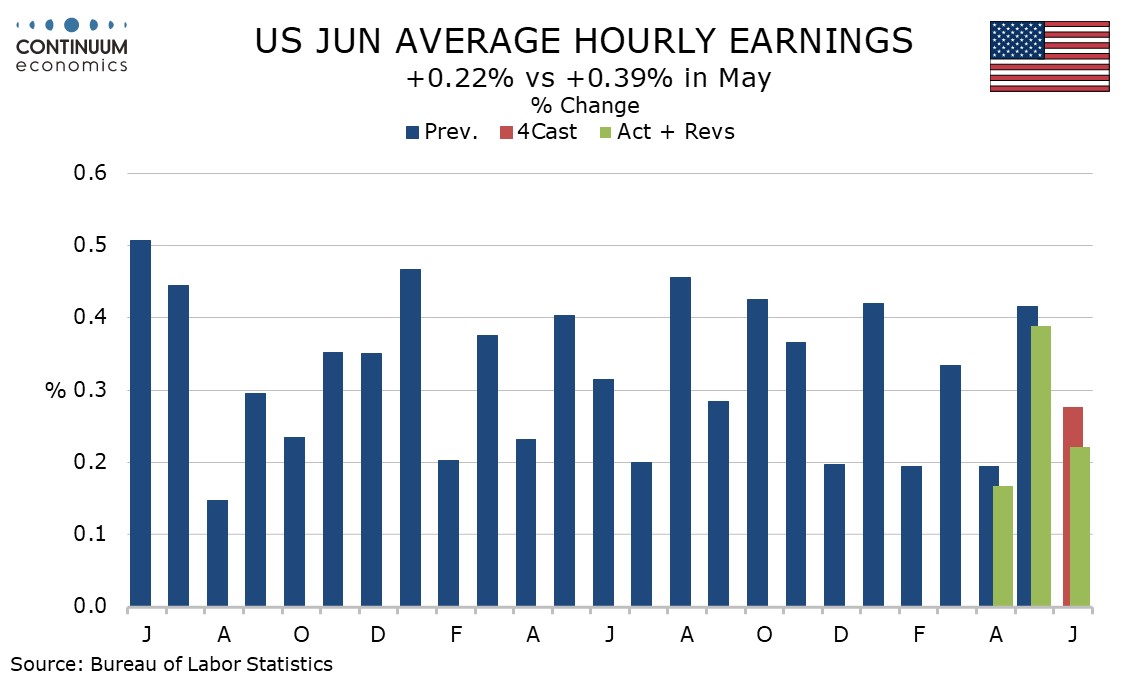

Average hourly earnings rose by 0.22% before rounding with marginal downward revisions to April and May before rounding. This saw yr/yr growth slowing to 3.7%, the lowest since July 2024, with May revised to 3.8% from 3.9%.

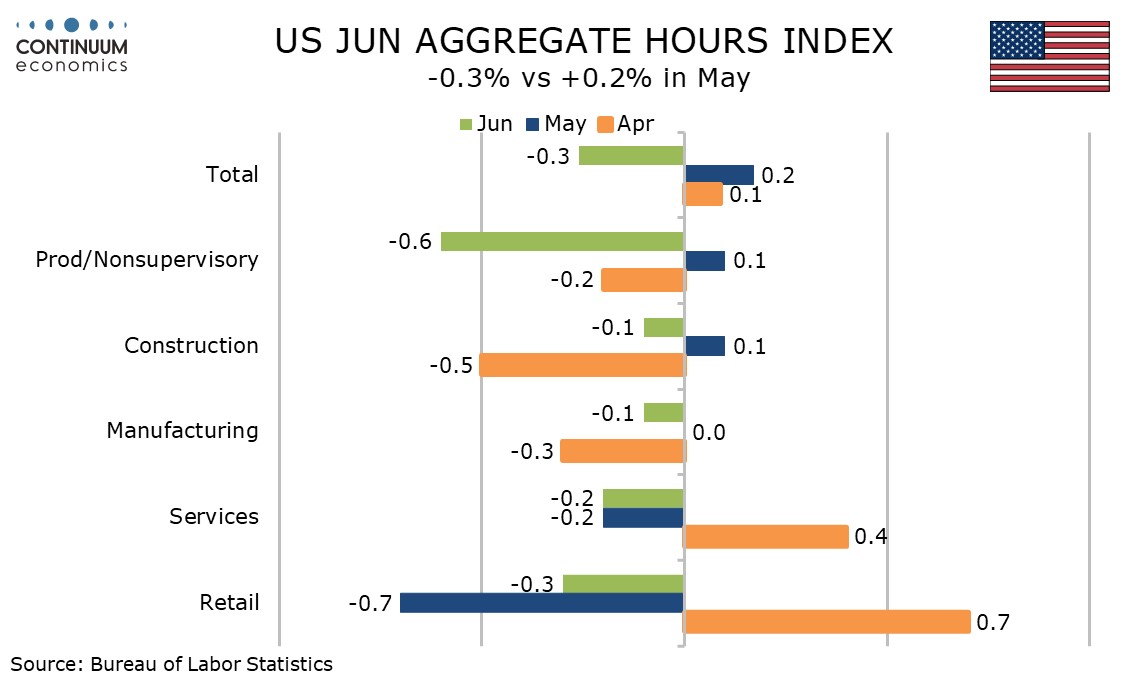

A dip in the workweek saw aggregate hours falling by 0.3% in June, though Q2 saw an annualized gain of 1.8%, up from 0.7% in Q1 when GDP saw a marginal decline. Weakness in aggregate hours was broad based.

This mixed report is probably fairly neutral for the Fed. The economy is showing some signs of an underlying slowing but does not appear to be on the cusp of recession and unemployment remains low. However slowing wage growth provides some offset to the tariff threat in terms of inflation. The Fed will probably still think it is appropriate to wait until a clearer impact of tariffs on prices is available.