U.S. Q1 GDP dips, Imports surge goes into inventories and business investment

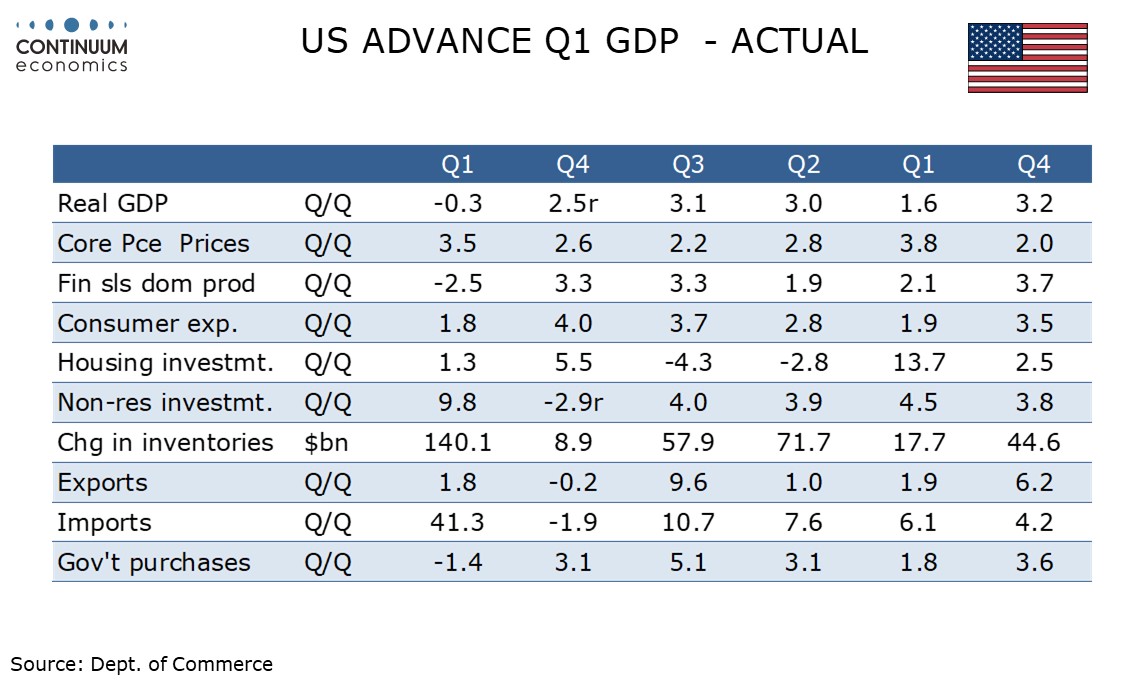

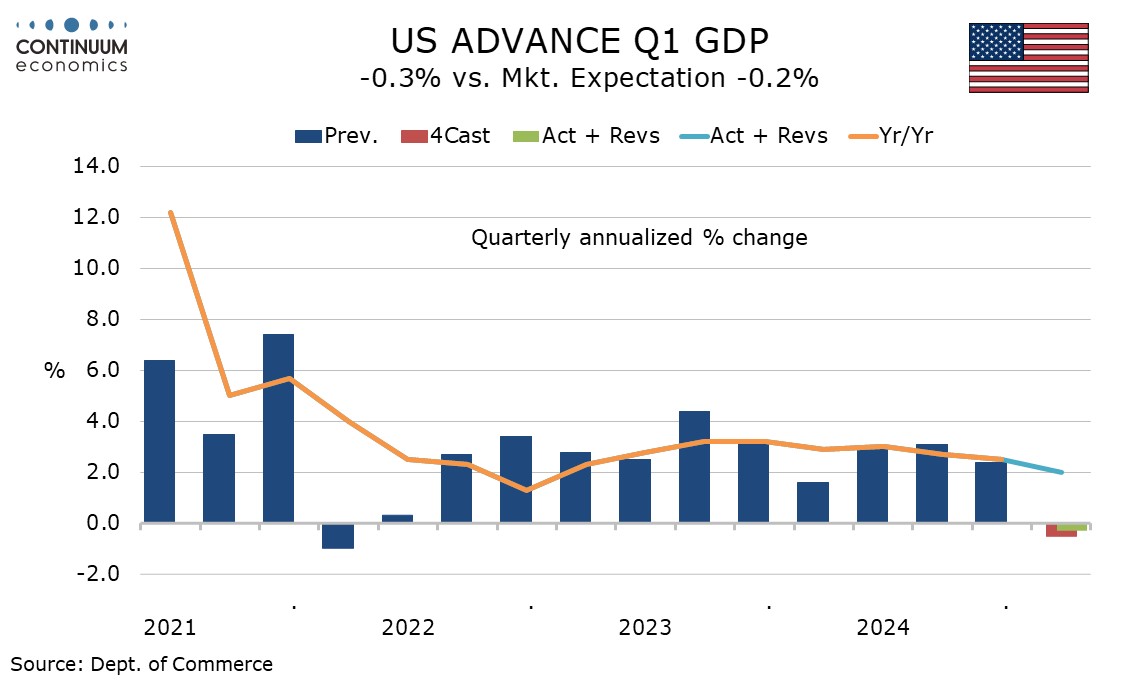

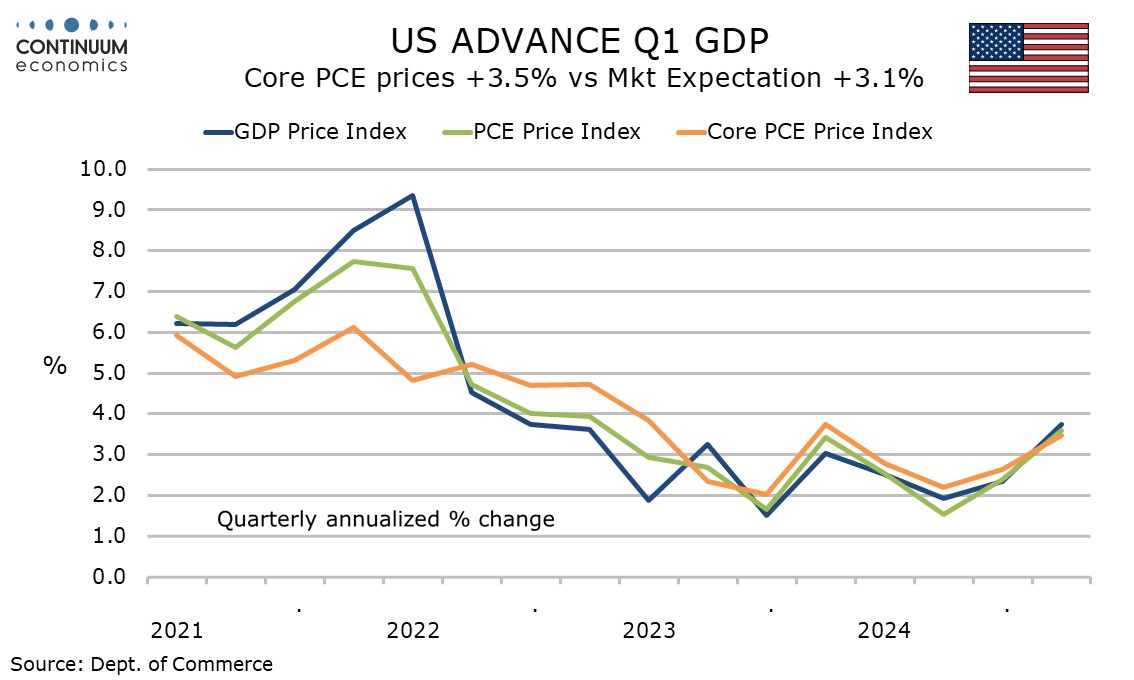

The 0.3% decline in Q1 GDP is in line with expectations that were downgraded from a marginal increase after yesterday’s sharp rise in March’s advance goods trade deficit. A 3.5% rise in the core PCE price index is stronger than expected. While the Q1 data does not tell us very much about Q2, the stagflationary risks are real.

Detail shows a massive 41.3% rise in imports, which with exports up by a modest 1.8% means a negative contribution of 4.83% from net exports. Some of the import surge went into a large inventory build-up, which added 2.25% to GDP.

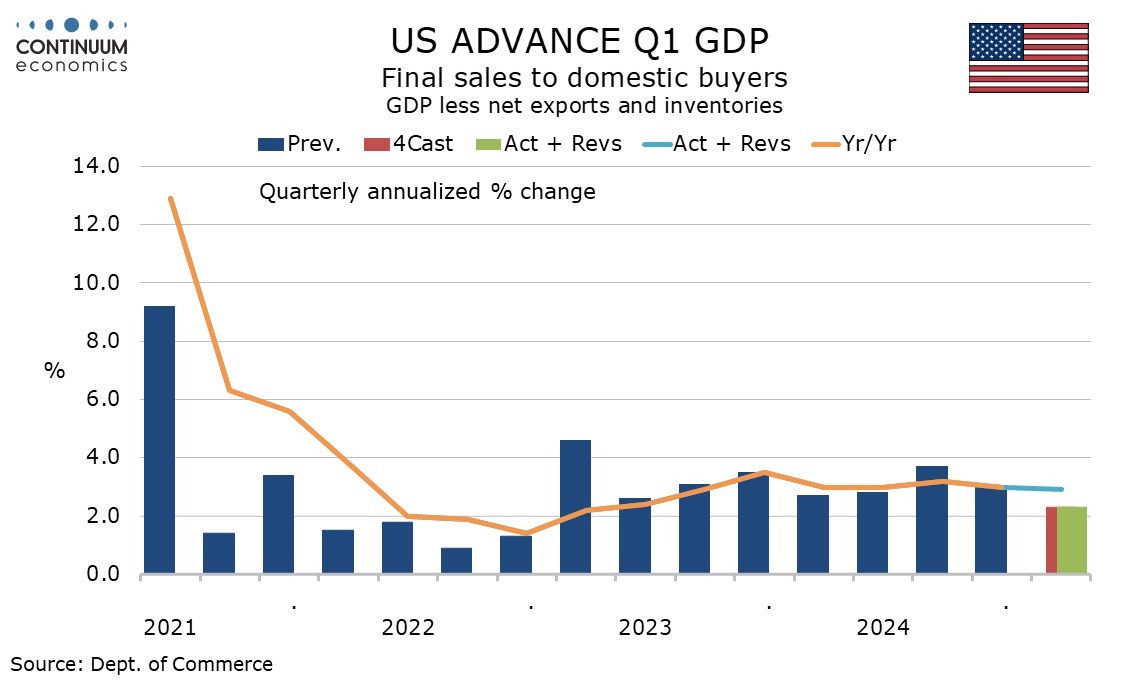

Final sales to domestic buyers (GDP less inventories and net exports) rose by an in line with trend 2.3%, while final sales to private domestic buyers rose by a healthy 3.0% with government weaker than expected at -1.4%. The government weakness was led by a fall of 8.0% in defense following three straight strong gains. Federal nondefense fell by 1.0% while state and local rose by a below trend 0.8%.

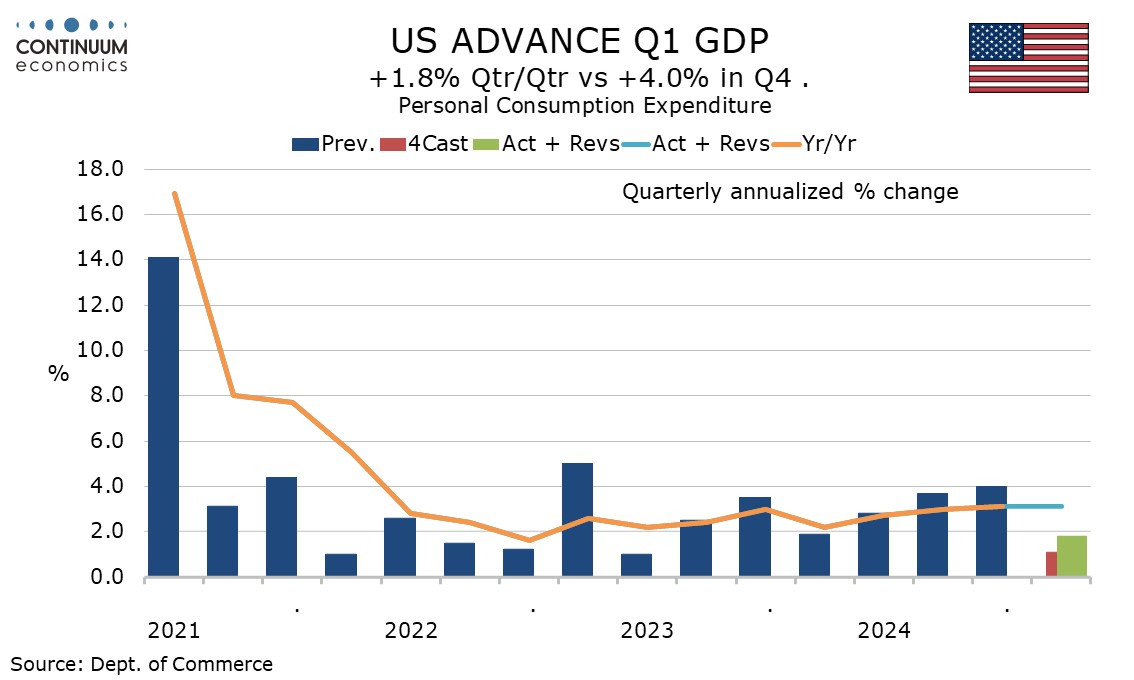

A 1.8% rise in consumer spending was a 7-quarter low, though stronger than expected with the upside surprise largely on a 2.5% rise in services. Goods rose by a modest 0.5%, after having been hit by bad weather in January. Real disposable income outperformed spending with a rise of 2.7%, but was supported by some one-time increases in government benefits.

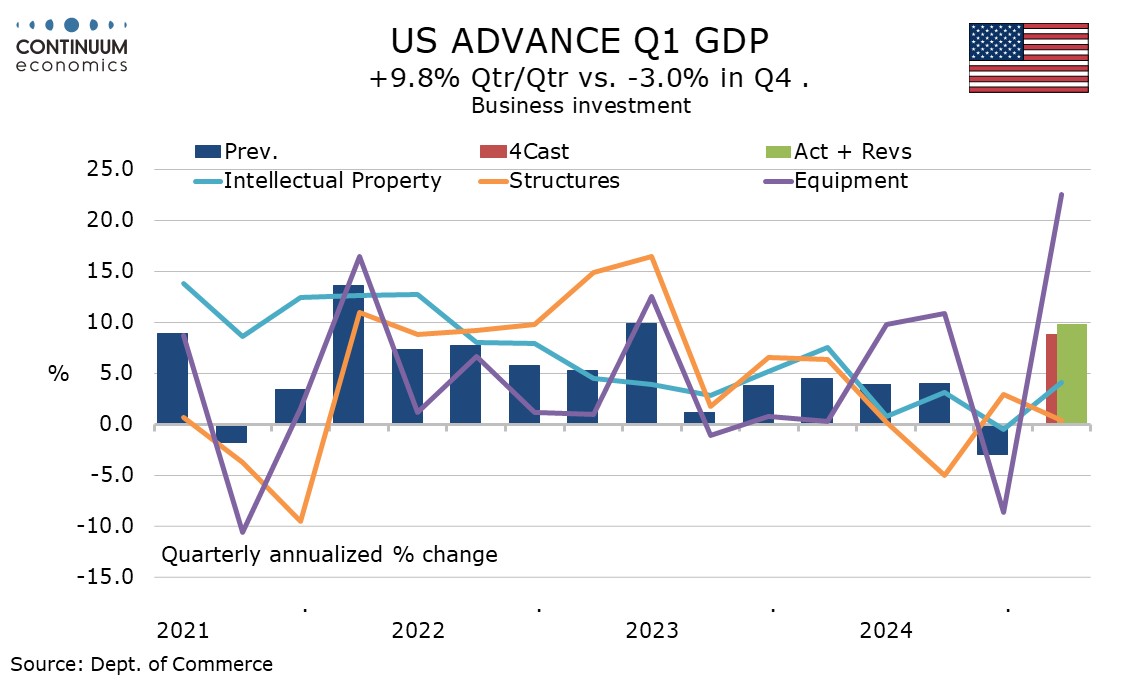

Outside inventories, the imports surge appears to have gone into a strong rise in business investment, which rose by 9.8%, led by a 22.5% surge in equipment which added 1.06% to GDP. Also lifting business investment was the end of a strike at Boeing, which contributed to a decline of 8.7% in Q4. Business investment in structures was subdued at 0.4% but intellectual property was solid at 4.1%. Housing investment rose by a modest 1.3%.

With so many special factors the Q1 detail does not tell us much about Q2. Imports will surely correct sharply lower but the Q1 gains in business investment and inventories will probably do so too. That Q1 consumer spending was restrained by weather, underperforming real disposable income, suggests the consumer still has some underlying momentum, but if employment growth slows and inflation rises in Q2 the consumer fundamentals could deteriorate quickly. That will be key for Q2.

Even before the tariffs fully kick in, Q1 saw disappointing price data, with overall PCE prices at 3.6% exceeding the 3.4% core, and the overall GDP price index stronger still at 3.7%. Employment Costs are not leading inflationary risk, but Q1 data maintained trend with a 0.9% increase. Wages and salaries saw a modest slowing to 0.8%, but benefits accelerated to a 1.2% pace.