The U.S. Slowdown Question Key for Markets

• Though financial markets are debating the effects of the U.S. budget deficit trajectory on yields and how much global investors will reduce overweight U.S. exposure long-term, the critical question remains the scale of the economic slowdown and what it means for tactical asset allocation in H2 2025. Our baseline view remains for a slowdown rather than a hard landing, which will likely mean choppy Treasuries and U.S. equities but a weaker USD. A U.S. hard landing would hurt equities and the USD, but see Treasury yields decline.

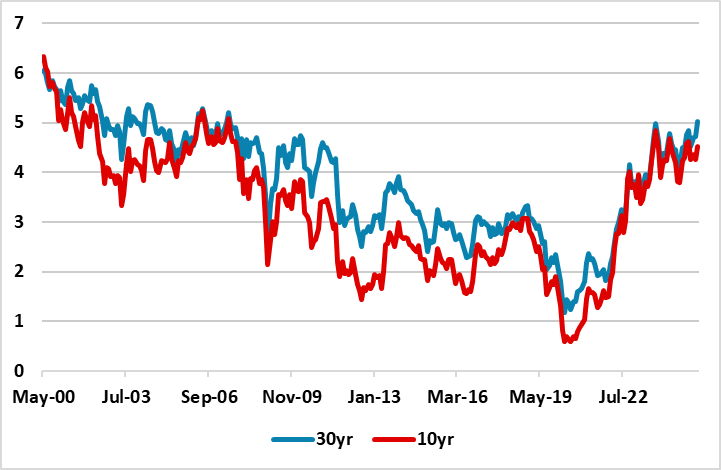

Figure 1: 10 and 30yr U.S. Treasury Yields (%)  Source: Datastream

Source: Datastream

Global markets have had to cope with the erratic tariff decisions and threats from the Trump administration and the 10yr budget bill passing through the House. However, the most critical issue remains the scale of the slowdown of the U.S. economy in the coming months. The size and composition of the 10yr budget bill has raised some further questions about appropriate risk premia for U.S. Treasuries, but 10 and 30yr U.S. Treasury yields have settled down into this week trading (Figure 1). Attention now switches to the Senate on the budget bill, but the May economic releases will be in more focus for the markets. The June 6 May employment report and June 11 CPI number for May will attract a lot of attention. May should see some signs of supply disruption from China when penal tariffs curtailed new trade, while the new 30% fentanyl and reciprocal tariffs still threaten to hurt supply and imports. However, economists remain uncertain about how big an adverse impact will be seen to supplies and prices, given the buildup in import inventories earlier in the year. Some businesses held off implementing price rises. Meanwhile, the current average tariff of around 13% will likely dampen the impact. Nevertheless, trade policy uncertainty takes time to recede, despite partial U turns on reciprocal and then China tariffs. Trump’s bias for tariffs also means that threats of new or extra tariffs (e.g. EU (here)) will be part of the negotiating landscape and prolong uncertainty.

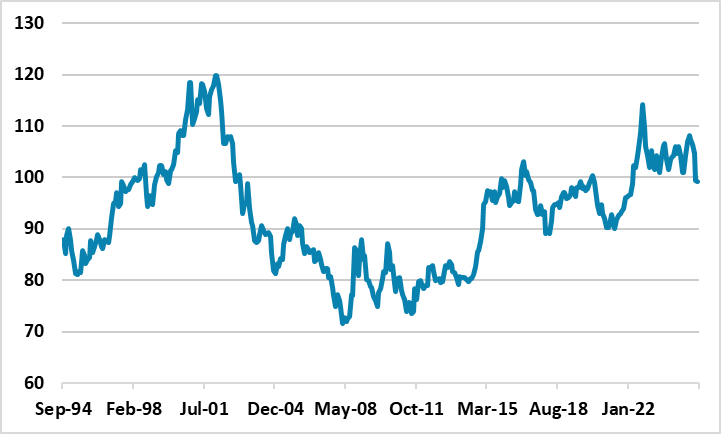

Figure 2: DXY USD Index

Source: Datastream

Our baseline view is for a slowing economy but not a hard landing (here), which would likely keep 10yr yields centered around the 4.00-4.50% area. However, this could still be enough to cause a pullback into mid-year for U.S. equities. Meanwhile, non U.S. investors feel more strongly than U.S. investors that the era of U.S. exceptionalism has peaked and that they are overexposed to U.S. assets. Though this has been expressed in 10 and 30yr nominal and real yield premia, global investors feel that long-term they need to reduce the scale of overweight positions in U.S. equities and the USD. Currency hedging and some asset sales have kept the USD on the defensive (Figure 2), despite the current yield levels at the long-end of the curve. Our forecast remains for 1.20 on EUR/USD by end 2025 (here). Our alternative view would be a harder landing that brings the U.S. economy to a borderline recession, with a 20% probability (here). This would likely prompt a fall in 10yr yields below 4.0%, as the market moves to anticipate aggressive Fed easing. However, overvaluation leaves U.S. equities and the USD vulnerable in this scenario. We will watch incoming data closely in the coming weeks to see what economic picture is developing for the U.S.