U.S. Q2 GDP to see only a modest rebound from a decline in Q1

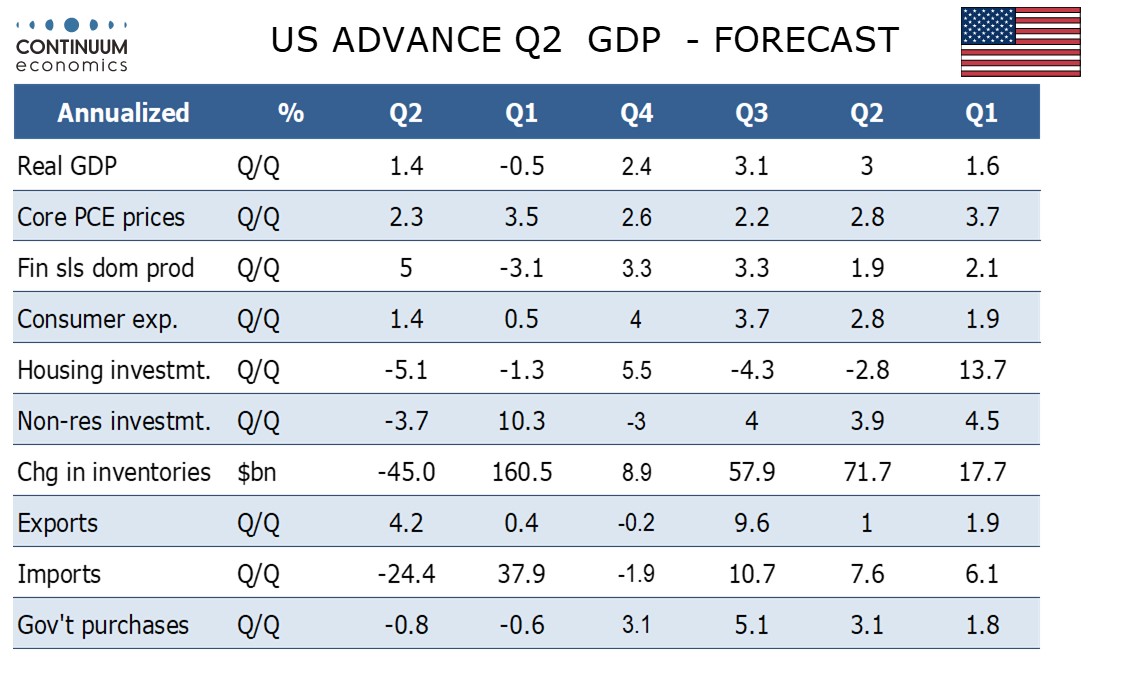

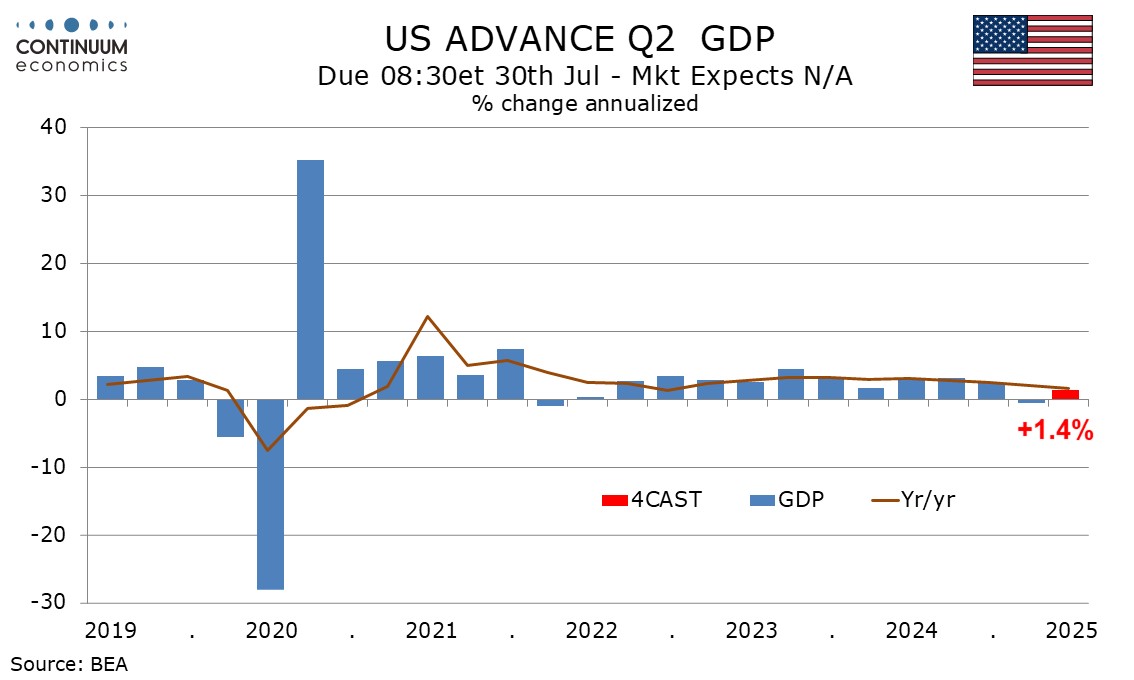

The release of advance May trade and inventory data, plus May consumer spending, provides us with clearer signals on Q2 GDP, even if we have not yet seen any data for June. We currently expect a modest annualized gain of 1.4%, following a 0.5% decline in Q1, leaving a subdued first half of the year.

We expect final sales to domestic buyers (GDP less inventories and net exports) to rise by only 0.2% after a 1.5% increase in Q1. Assuming a modest 0.1% increase in June in real terms, we expect consumer spending to rise by 1.4% after a 0.5% increase in Q1. We expect durables to rebound by 4.4% after a 3.7% Q1 decline but auto sales have already slipped from a strong April. We expect non-durables and services to be subdued with respective gains of 1.2% and 1.0%.

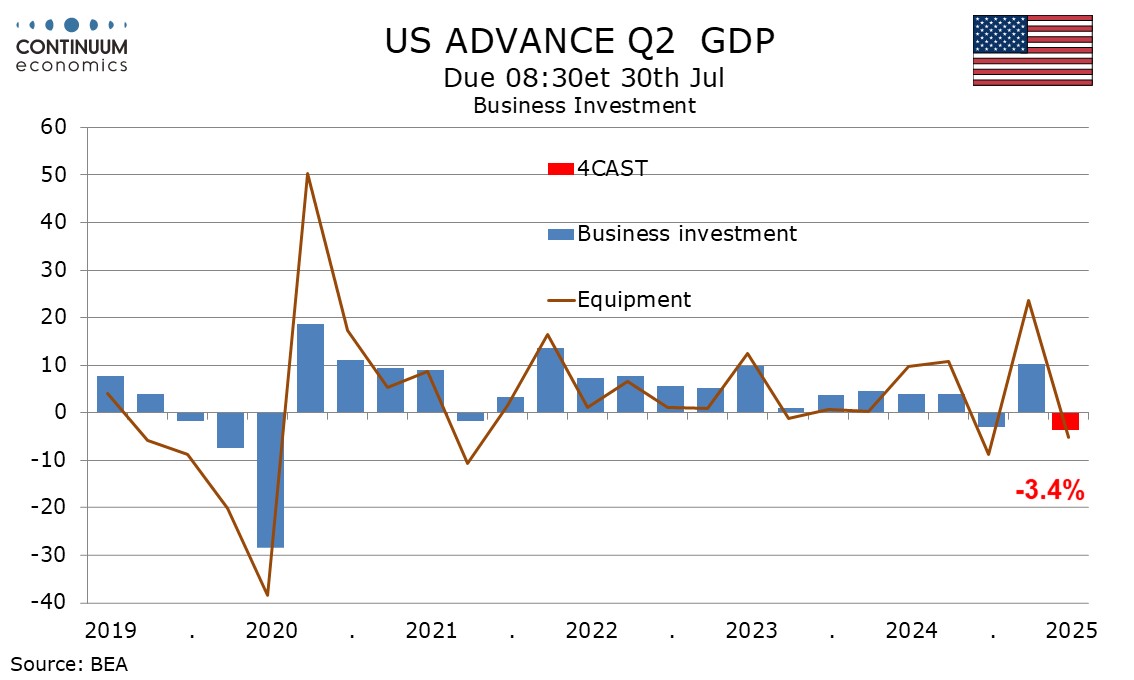

Business investment was very strong in Q1 with a 10.3% rise which appears to reflect pre-tariff front loading. We expect a 3.7% decline in Q2. Non-residential structures are likely to extend a 2.4% dip seen in Q1, we expect by 5.4%, but corrections in equipment, falling by 5.1%, and intellectual property, by 2.4%, are likely to be moderate compared to respective Q1 gains of 23.7% and 6.0%.

Construction appears to be slowing generally, and this is likely to see increased weakness in residential investment, falling by 5.1% after a 1.3% Q1 decline, and government, falling by 0.8% after a Q1 decline of 0.6%. The fall will again be led by Federal government but state and local spending is also likely to slow.

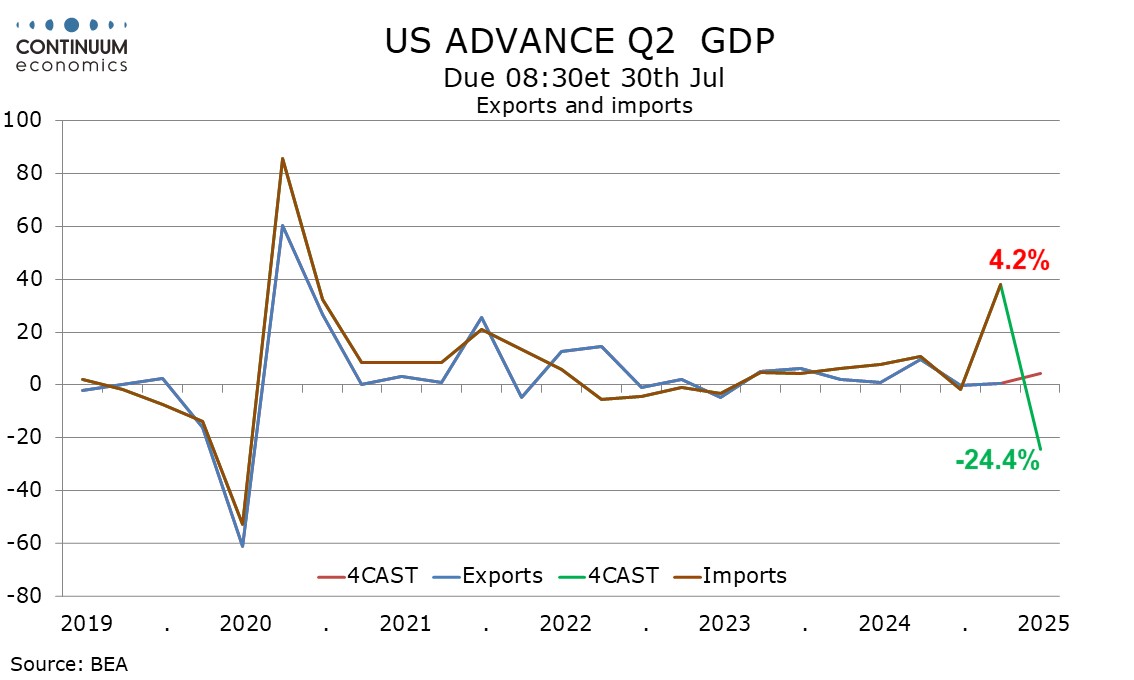

We expect net exports to add 4.8% to Q2 GDP after taking off 4.6% in Q1. We expect a 4.2% rise in exports after a gain of only 0.4% in Q1, the acceleration due to a rebound in services from a weak Q1. We expect Imports to plunge by 24.4%, though a full reversal of Q1’s pre-tariff surge of 37.9% is looking less likely after May’s trade data.

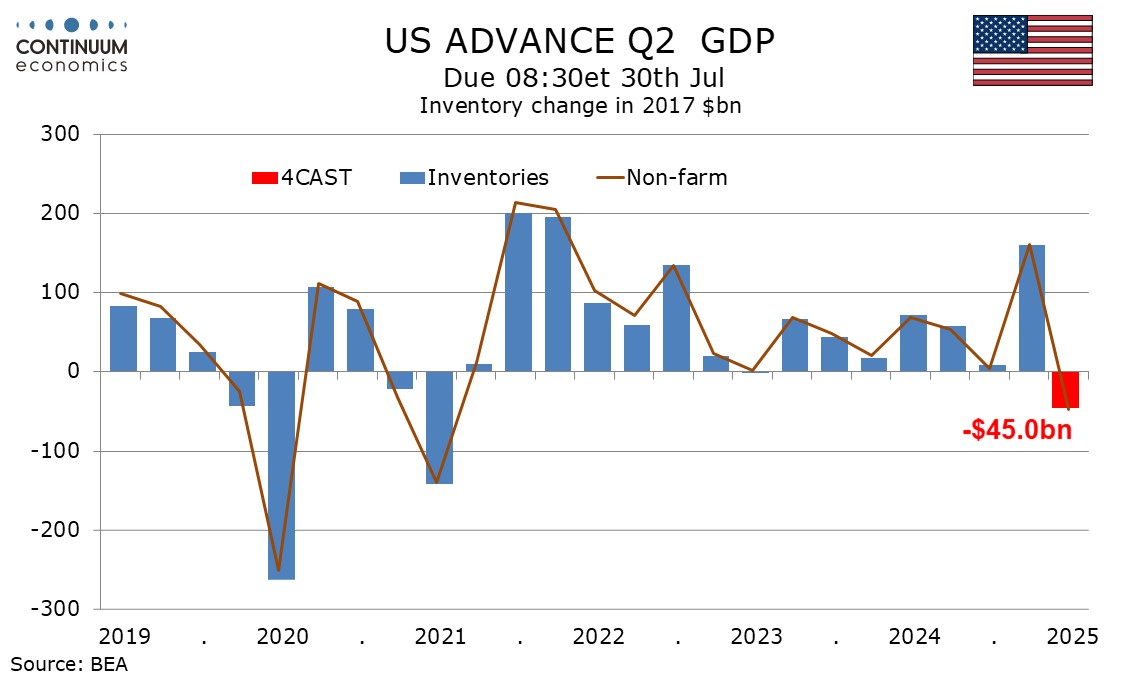

We expect final sales (GDP less inventories) to rise by 5.0% after a 3.1% decline in Q1. Inventories look set to see a significant correction, but not a full reversal, from a strong Q1 build up. The Q1 surge in imports appears to have gone mostly into business investment and inventories, which will correct lower as imports do, offsetting some of the boost to GDP coming from net exports.

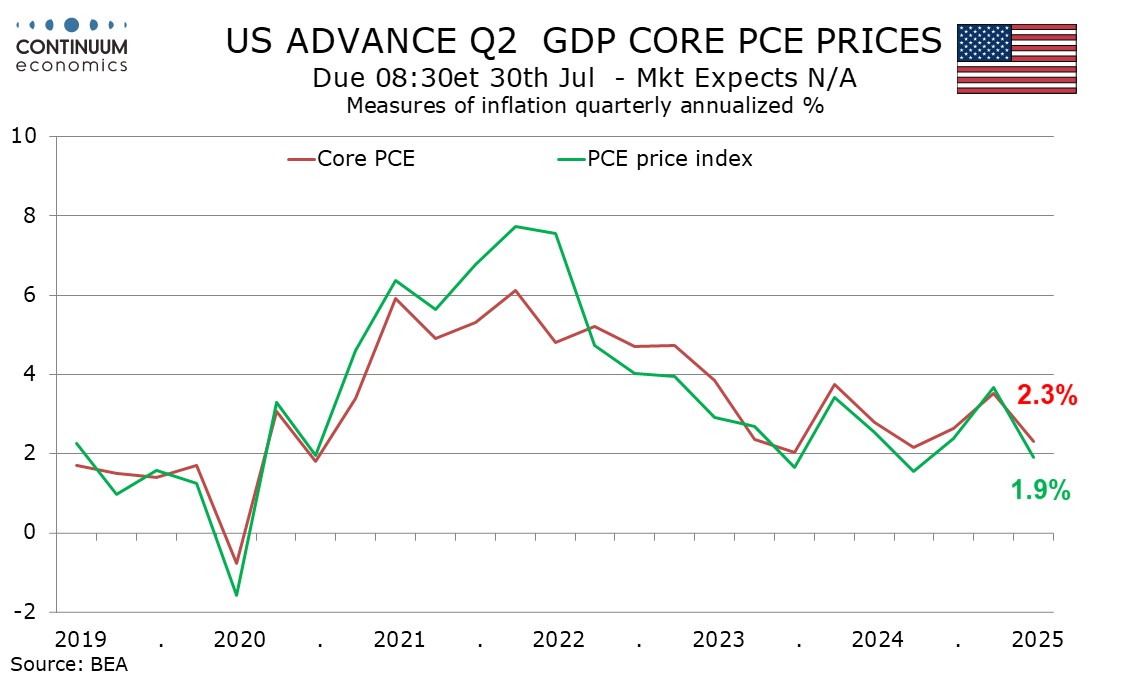

We assume a 0.3% increase in June PCE prices with a 0.25% rise in the core PCE, with tariffs beginning to feed through. This would leave annualized gains of 1.9% for overall PCE prices and 2.3% for the core rate in Q2, close to the 2.0% target but with the core rate not quite there. We expect Q3 data to be stronger as tariff-feed through picks up