U.S. May CPI - Little tariff pass-through, with inflationary pressures elsewhere fading

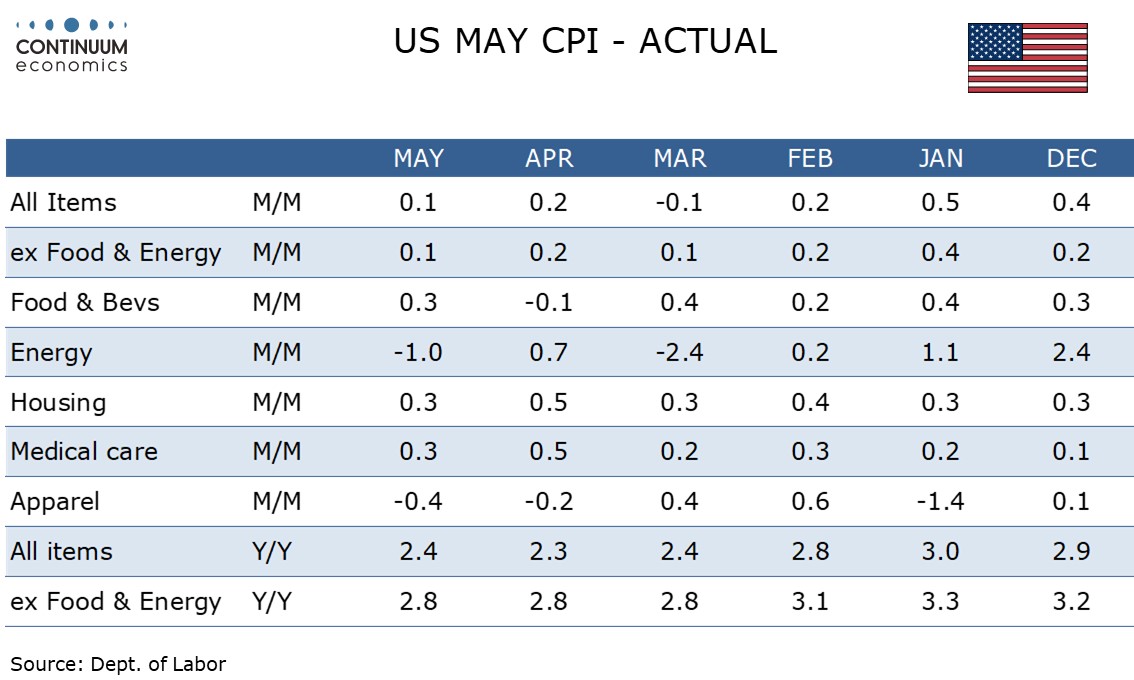

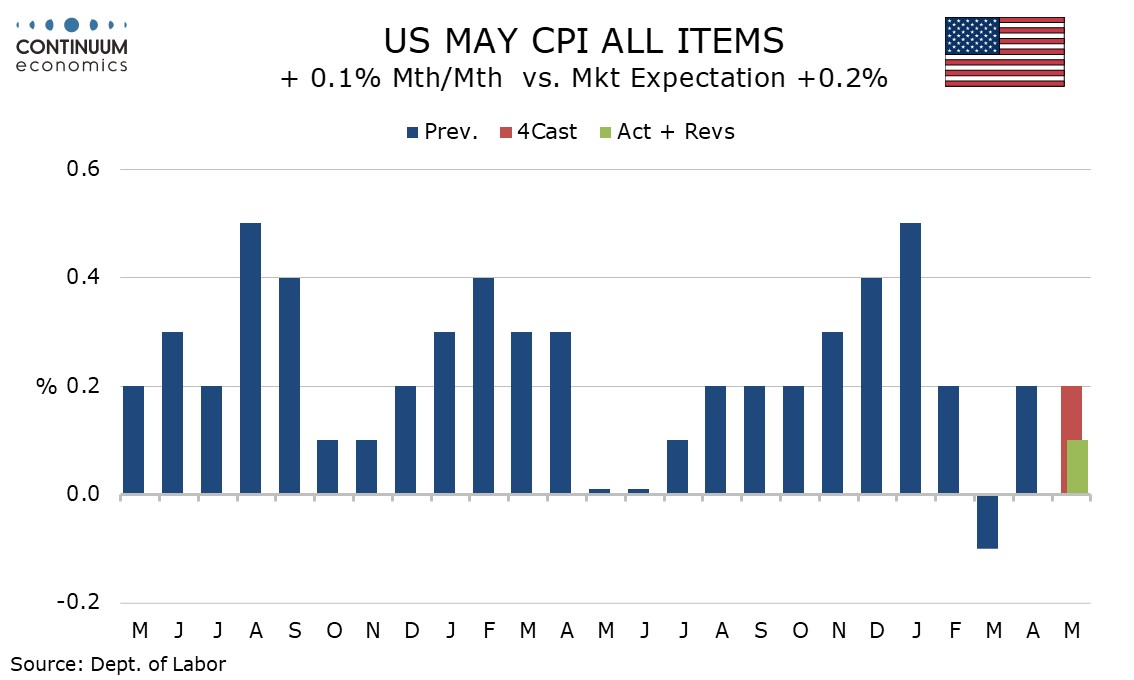

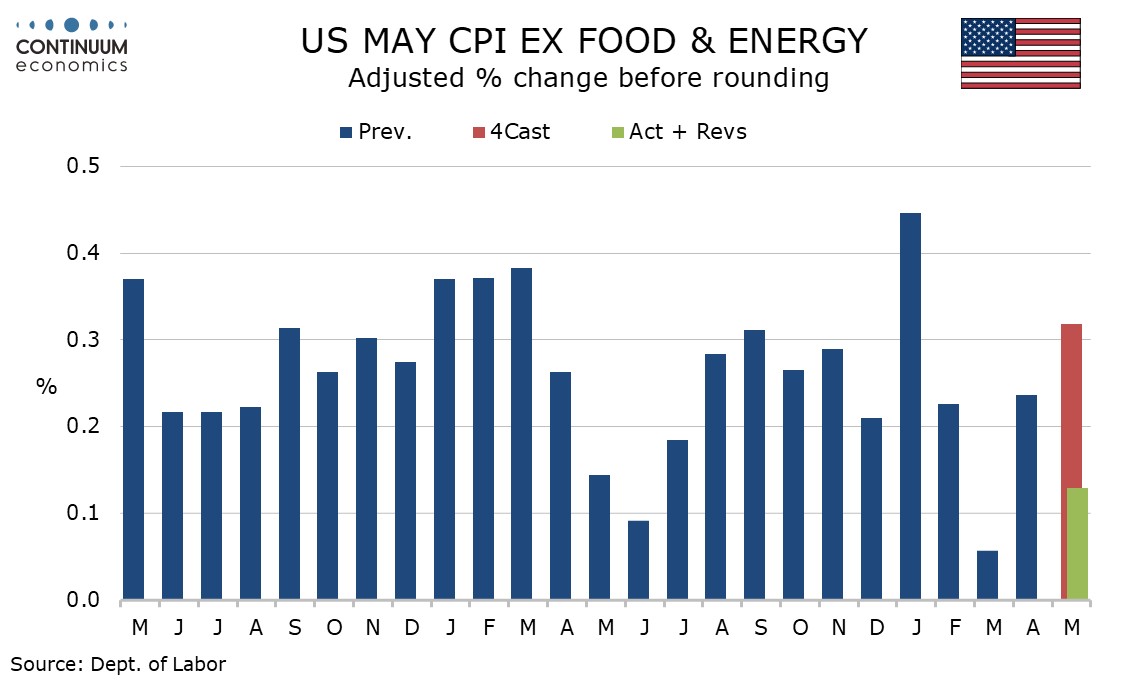

May CPI has surprised significantly to the downside, up only 0.1% both headline and core, with the respective gains before rounding being 0.08% and 0.13%. The data is subdued across the board, with commodities ex food and energy unchanged despite tariffs and services ex energy on the low side of trend at 0.2%.

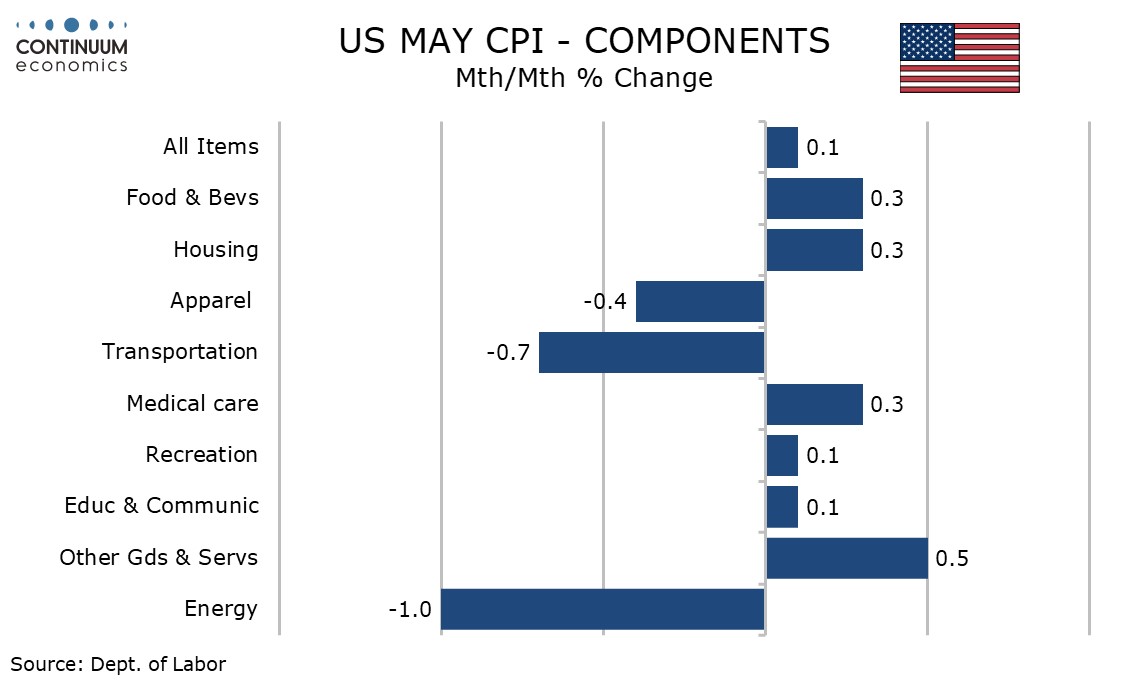

Food was slightly above trend with a 0.3% increase after a 0.1% decline in April despite eggs continuing to move off recent highs, albeit less steeply than in April. However the gain in food was outweighed by a 1.0% fall in energy, ked by a 2.6% fall in gasoline.

The components that restrained core commodities in April did so again in May. Apparel, despite being susceptible to tariffs, fell by 0.4% after a 0.2% fall in April. Used autos saw a third straight fall, by 0.5%, while new vehicles fell by 0.3%, the first fall since February.

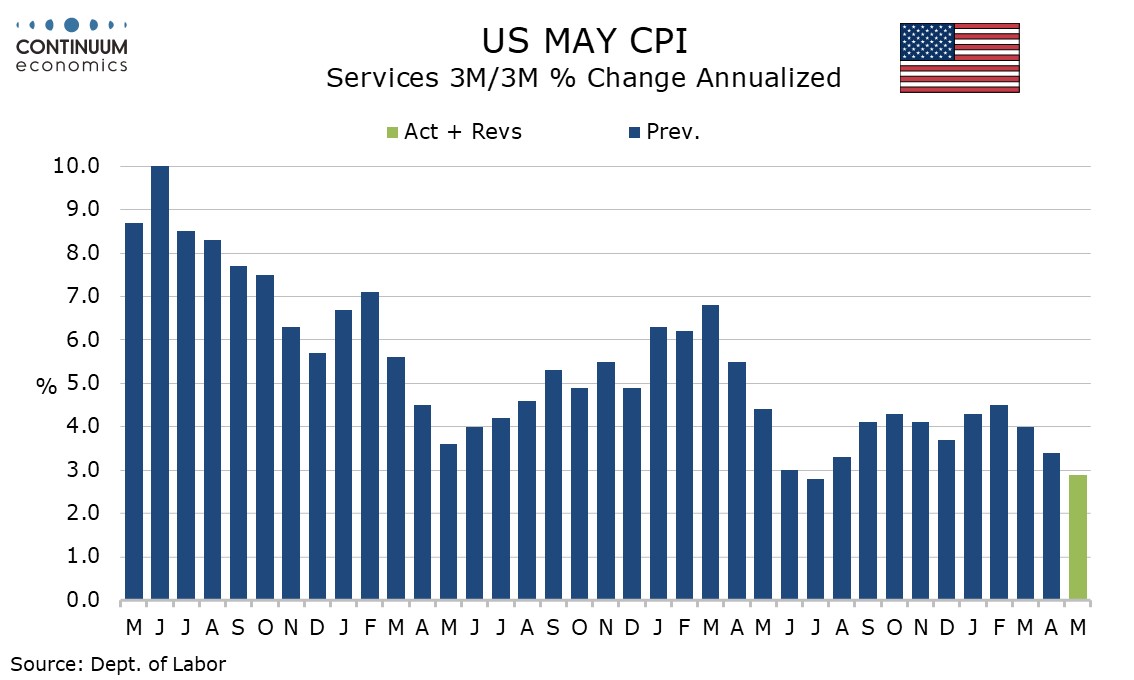

Transportation services fell by 0.2%, led by continued weakness in air fares at -2.7%. Lodging away from home fell by 0.1% for a second straight month to follow a 3.5% plunge in March. These sectors have taken a hit on reduced tourist arrivals from abroad. The heavily weighted owners’ equivalent rent rose by 0.3% after two straight gains of 0.4%.

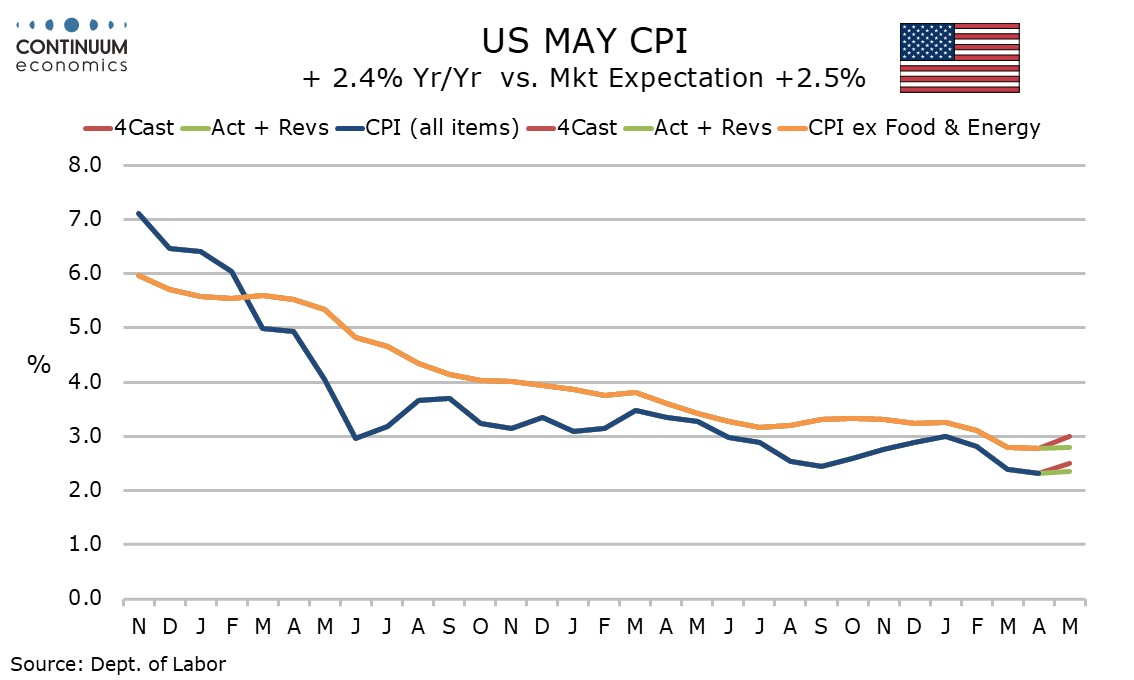

Subdued year ago data meant that overall CPI edged up to 2.4% from 2.3% while the ex food and energy rate was unchanged at 2.8% for a third straight month, these being the weakest since March 2021.

Some questions have been raised about the accuracy of the CPI data with staff cuts meaning more estimations than usual were seen in the April report, though the concern is reduced accuracy rather than bias. Tariffs are not yet feeding through to prices.

It is too early to say tariffs will not feed through to prices given a large Q1 inventory build up and uncertainly as to how long tariffs will persist, though the Fed will note that Q2 data so far is looking encouraging. Excluding tariffs, inflationary pressures appear to be falling and tariffs have had surprisingly little impact so far.