Preview: Due July 15 - U.S. June CPI - A little more from tariffs

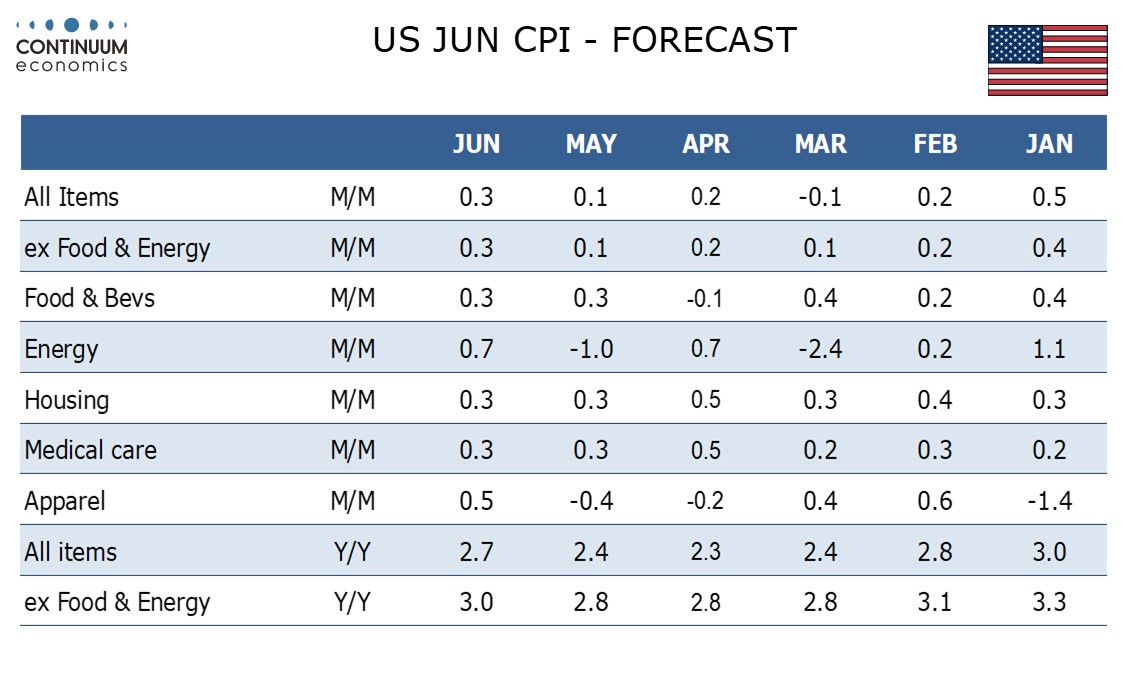

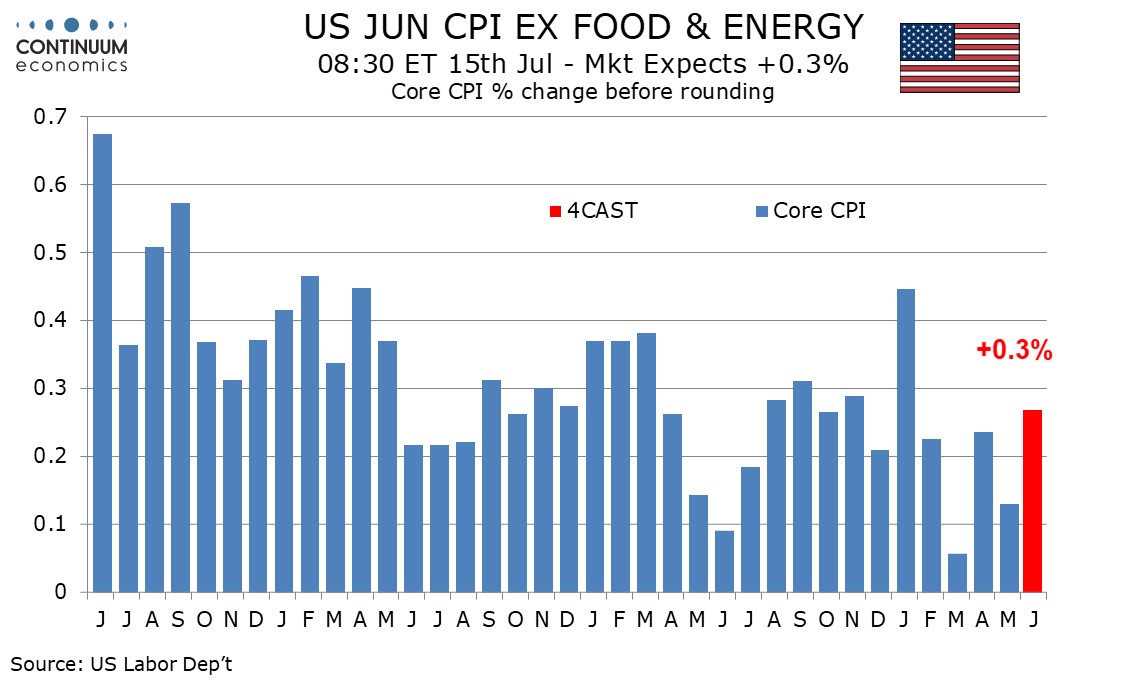

We expect June CPI to increase by 0.3% overall and by 0.3% ex food and energy, with the overall pace close to 0.3% before rounding but the core rate rounded up from 0.27%. This would still be the strongest core rate since January and reflect tariffs starting to feed through, something expected by Fed Chairman Powell.

With the acceleration likely to be largely from tariffs, we expect it to be led by goods. Particularly likely to bounce are autos and apparel, which were negative in both April and May, restraining commodities ex food and energy to gains of 0.2% band 0.1% respectively despite some hints of acceleration elsewhere.

Gasoline prices saw a modest lift during the Israel-Iran conflict and are likely to see a modest seasonally adjusted rise on the month despite being little changed unadjusted. We also expect food to see some impact from tariffs, rising by 0.3% for a second straight month. Service prices less energy are likely to remain subdued, with a rise similar to May’s 0.2%, which followed gains of 0.3% in April and 0.1% in March.

Our forecasts would see yr/yr growth rising to 2.7% overall from 2.4% and to 3.0% ex food and energy after three straight months at 2.8%, which were the weakest since February 2021. Weak data from June 2024 will be dropping out, helping to lift yr/yr data. Some further acceleration is likely in Q3 as tariffs feed through, though the data dropping out will not be as weak as that for June 2024.