Tax Foreigners Assets: How To Lose Friends

Increasing taxes on dividends on U.S. equities and corporate bond coupons would alarm foreign investors and hurt the USD and U.S. equities, as it would amplifies foreign investors concerns that they are overweight U.S. assets and the USD. Starting a capital war with investors into the U.S. is a terrible idea. For now it is an issue to watch as the Trump administration is sensitivity to market selloffs and may not introduce such a tax if it survives the budget reconciliation with the Senate.

The U.S. House bill includes a section that would allow the U.S. to increase taxes on foreign investors holdings in the U.S.

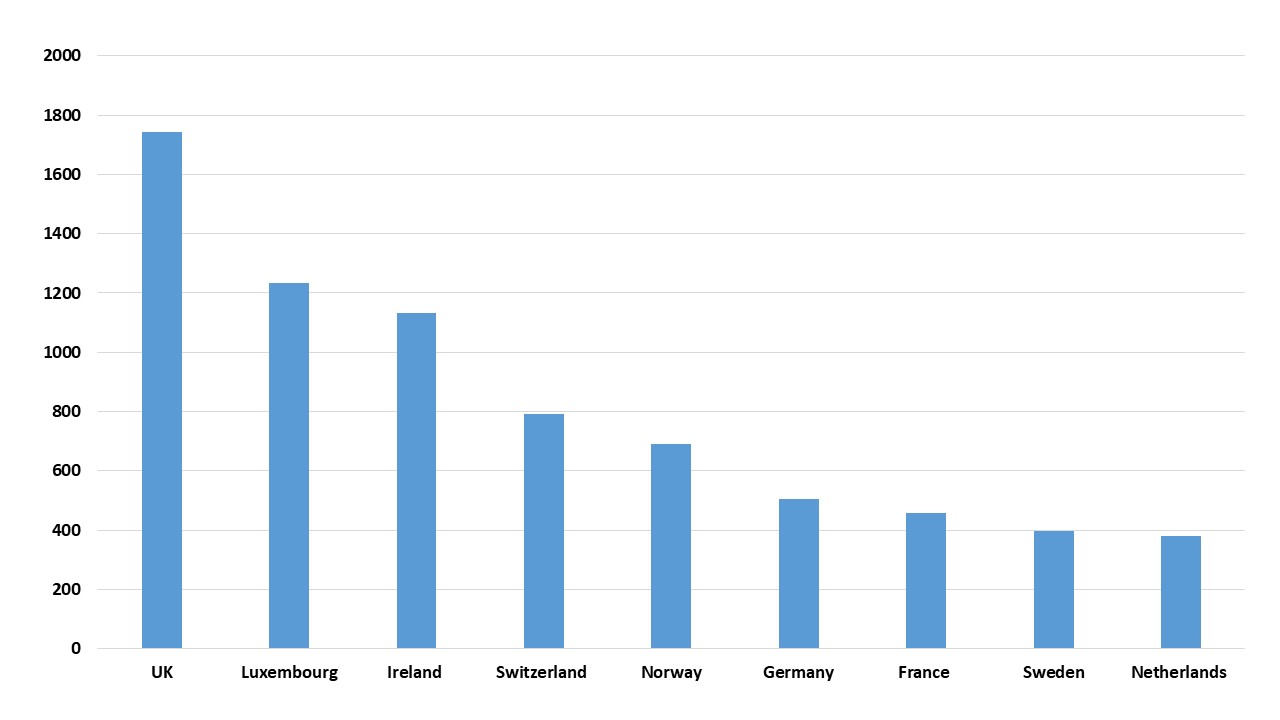

Figure 1: European Holdings of U.S. Equities End June 2024 (Blns)

Source: BEA Tics

The 10yr House bill includes section 899, which allows the U.S. to increase taxes on dividends on equities and coupons on some corporate bonds by 5% per annum to a maximum of 20% for foreign investors. This section has caused alarm among foreign investors into the U.S., with reports of widespread concerns among pension funds/insurance companies and sovereign wealth funds outside the U.S.

The context is also interesting as section 899 references unfair foreign trade practices including digital services taxes by a number of DM economies on U.S. companies. If this section survives the budget reconciliation process, then it would give the U.S. the ability to threaten or actually implement higher taxes on some income from U.S. assets. The initial interpretation is that this would not change the tax exempt status of U.S. Treasuries for foreign investors.

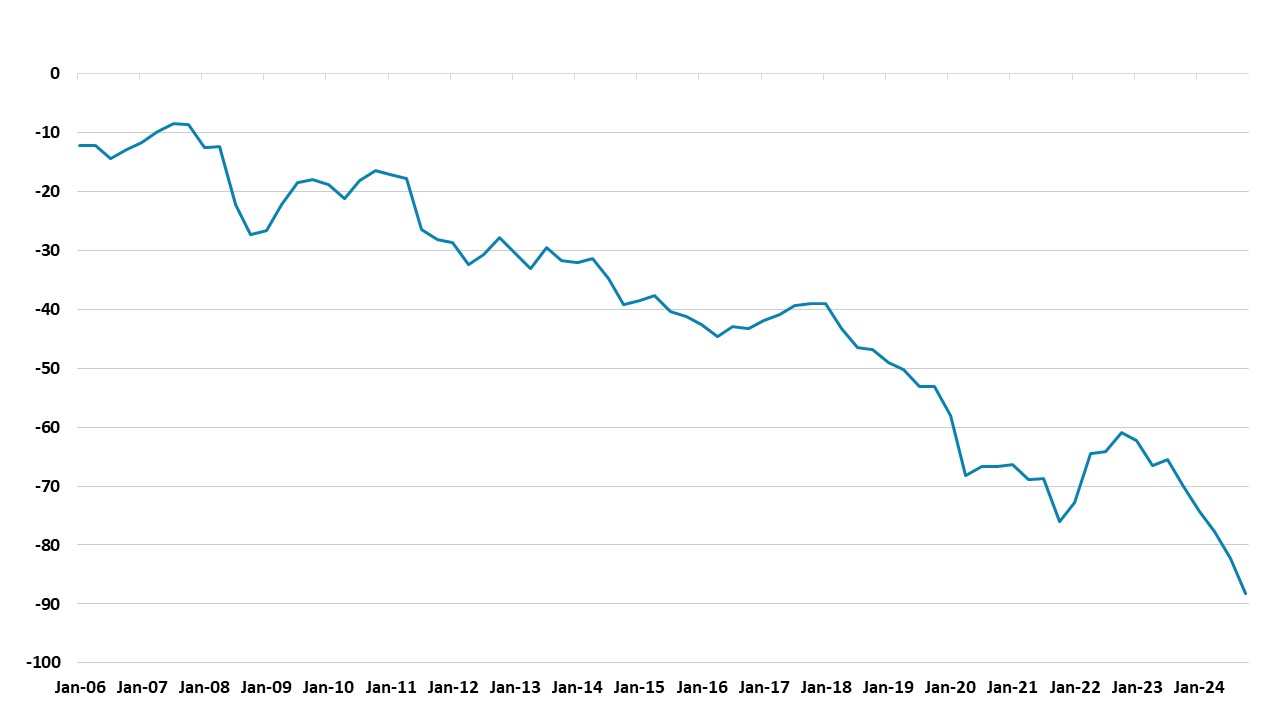

Though some in the Trump administration would regard this as a retaliation tool against countries with large trade surpluses with the U.S., it could be toxic to new portfolio investment in the U.S. Foreign investors already feel that they are overweight U.S. assets and that U.S. equities and the USD are still overvalued. This is prompting a view that net inflows into the U.S. will likely be lower than the exceptional years and that some investors could see a net reduction in their U.S. holdings, as they diversify globally. Foreign holdings are large with USD17.1trn in U.S. equities, with European investors alone holdings USD8.1trn (Figure 1). Overall portfolio holdings also includes USD8.9trn of U.S. Treasuries and USD4.4trn of agency/corporate and ABS bonds. Overall, the U.S. net international investment position (NIIP) has deteriorated sharply since 2006 (Figure 2) to the point that it could become a concern – countries with 80% plus NIIP positions have seen buyers strikes in the past. Starting a capital war with investors into the U.S. is a terrible idea.

For now it is an issue to watch, as the Trump administration is sensitivity to market selloffs and may not introduce such a tax if it survives the budget reconciliation with the Senate. U.S. Treasury secretary Bessant is sure to tell Trump that introducing such a tax provision would hurt foreign interest in U.S. assets and is not a good idea. However, while Bessant has Trump ear recently, Trump volatile nature means that this could change. Additionally, Trump is very upset with the court ruling against his reciprocal and fentanyl tariffs and may have to search for other options to pressure other countries to do trade deals with the U.S. (here).

Figure 2: Net International Investment Deficit/GDP (%)

Source: St Louis Fed