FOMC leaves rates unchanged, sees increased risk on both sides of mandate

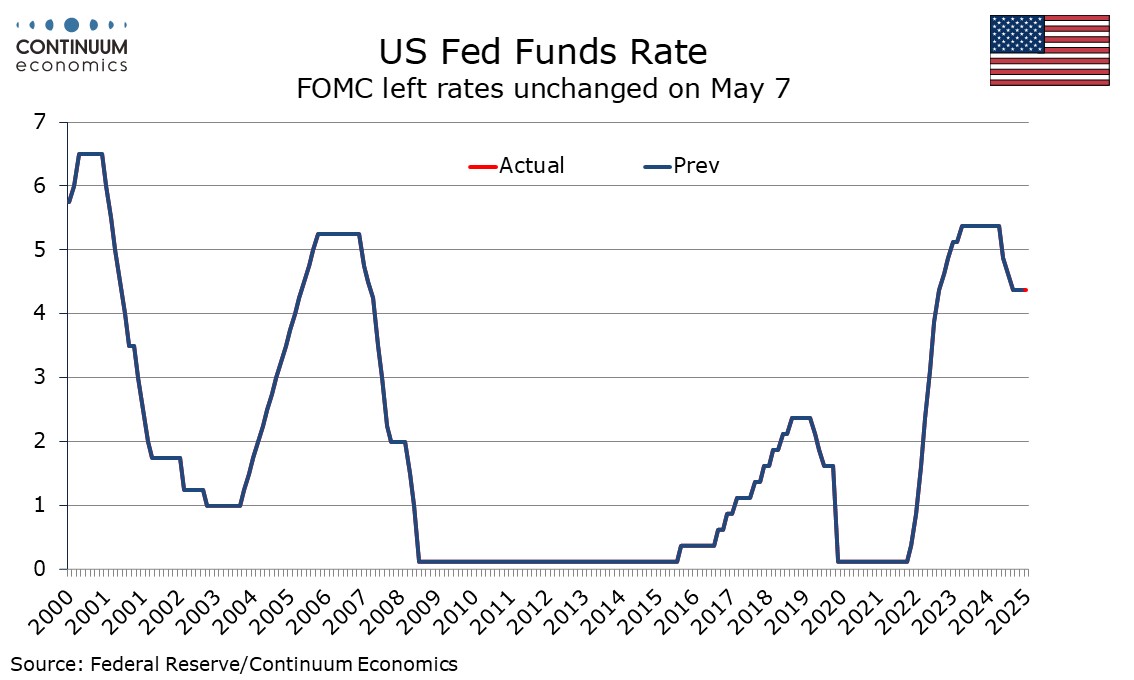

The FOMC has left rates unchanged at 4.25-4.5% as expected. The main change in the statement is to note that the risks of higher unemployment and higher inflation have both risen, which gives little insight on any policy bias though suggests that the Fed could be responsive to data going forward.

The assessment of the economy has not changed much from the last statement on March 19, repeating that recent indicators suggest economic activity has continued to expand at a solid pace, with the opening caveat that swings in net exports have affected the data both acknowledging and downplaying the fact Q1 GDP marginally declined. The views on unemployment, stabilized at a low level, and inflation, somewhat elevated, are unchanged.

Uncertainty is seen as having increased further and risks on both sides have increased. Wording on quantitative tightening has changed but only because a change in policy was announced on March 19. No changes were announced in this statement. There were no dissenting votes at this meeting.