FOMC Likely to Remain Cautious Unless Economy Falls into Recession

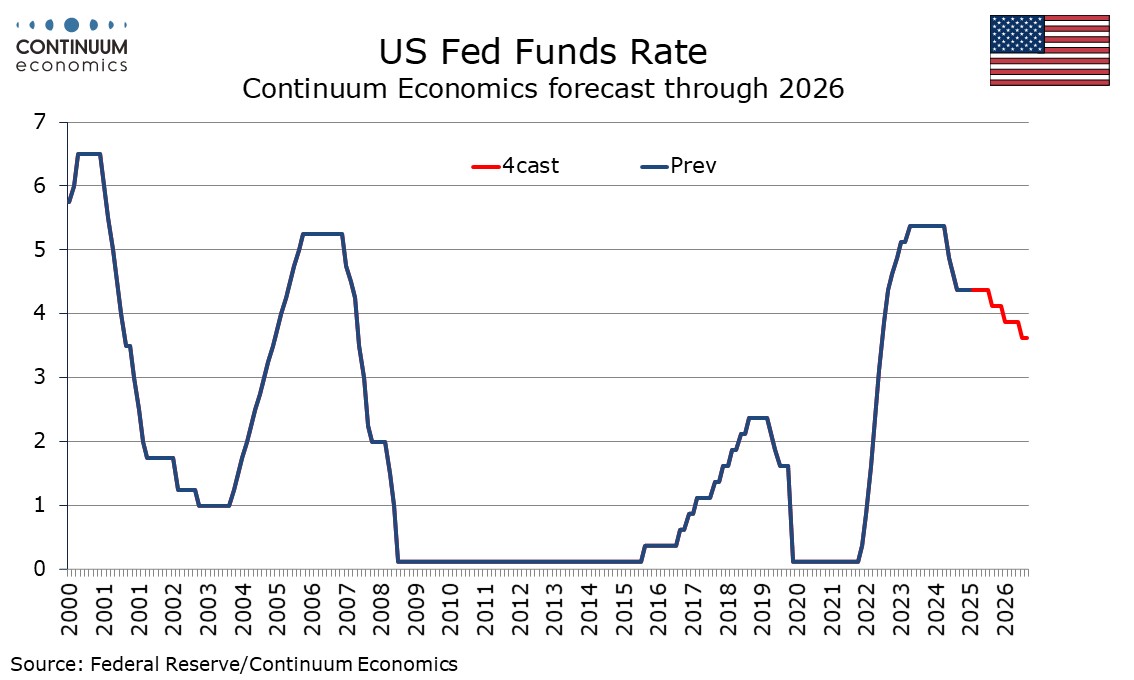

Fed’s Powell made clear that with high uncertainty the Fed is in no position to move rates at this point, though how long that will persist is unclear. We see no reason to adjust our existing Fed call of only one easing in 2025, by 25bps in December, and two more in 2026. This would take the Fed Funds rate to 3.50-3.75% at the end of 2026, remaining above where the FOMC currently sees as neutral. Should the economy fall into recession however, the Fed would need to ease by more than we expect.

The main change in the statement from the last one on March 19 was to note that the risks of higher unemployment and higher inflation have both risen. This reflects the Liberation Day tariff announcement on April 2, as well as subsequent policy shifts. The assessment of the economy has not changed much from the last statement on March 19, repeating that recent indicators suggest economic activity has continued to expand at a solid pace, with the opening caveat that swings in net exports have affected the data both acknowledging and downplaying the fact Q1 GDP marginally declined. The views on unemployment, stabilized at a low level, and inflation, somewhat elevated, are unchanged. Chairman Jerome Powell opened his press conference by stating the economy is still in a solid position.

Uncertainty remains extremely high. Our FOMC call assumes that the economy will slow, but not into recession, while reduced immigration will keep the rise in unemployment moderate. We expect tariffs to postpone further progress in inflation towards target rather that bringing a sharp acceleration. Should the economy fall into recession, easing would be more rapid than we expect. That appears to be a greater risk than inflation accelerating while the economy remains resilient, a scenario that could cause tightening. Looking into 2026, Trump’s underlying enthusiasm for tariffs suggests sustained inflationary risk, but willingness to make tactical retreats reduces downside risk to growth. Still, the risk that Trump could miscalculate and deliver a recession is the biggest risk to our view.

A lot can happen before the next FOMC meeting on June 18. The April and May CPIs will be particularly important, as well as May’s non-farm payroll. However, with the 90-day pause in tariffs still set to be ongoing, uncertainty is likely to remain high. Easing as soon as June would probably require weakness in May’s non-farm payroll, relief at the April and May CPIs, and significant progress in achieving trade deals that reduce the tariff risk. That is quite a lot to bet on. Even if near term inflationary data provides some relief, it should be treated cautiously as some companies may be delaying pricing decisions in the hope that tariff uncertainty will be resolved at the end of the 90-day period. Given Trump’s unpredictability, that may also prove to be too much to hope for. Price hikes will not be postponed indefinitely, particularly if shortages start to appear.