U.S. April Employment - Suggests economy where Fed wants it, but can it persist?

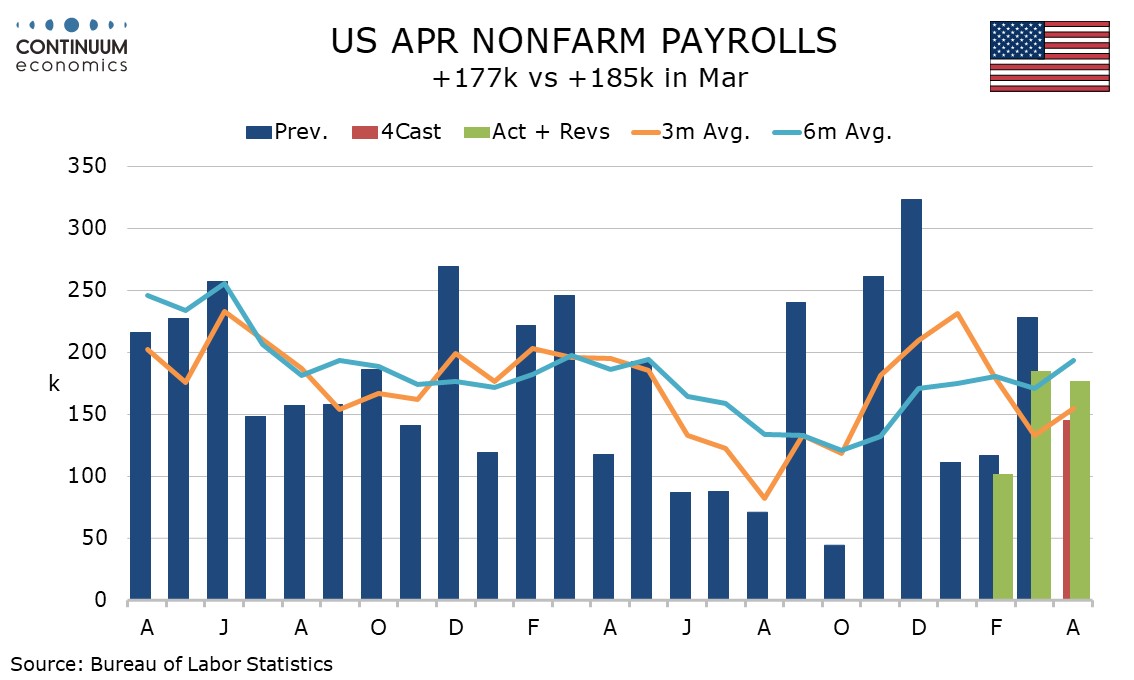

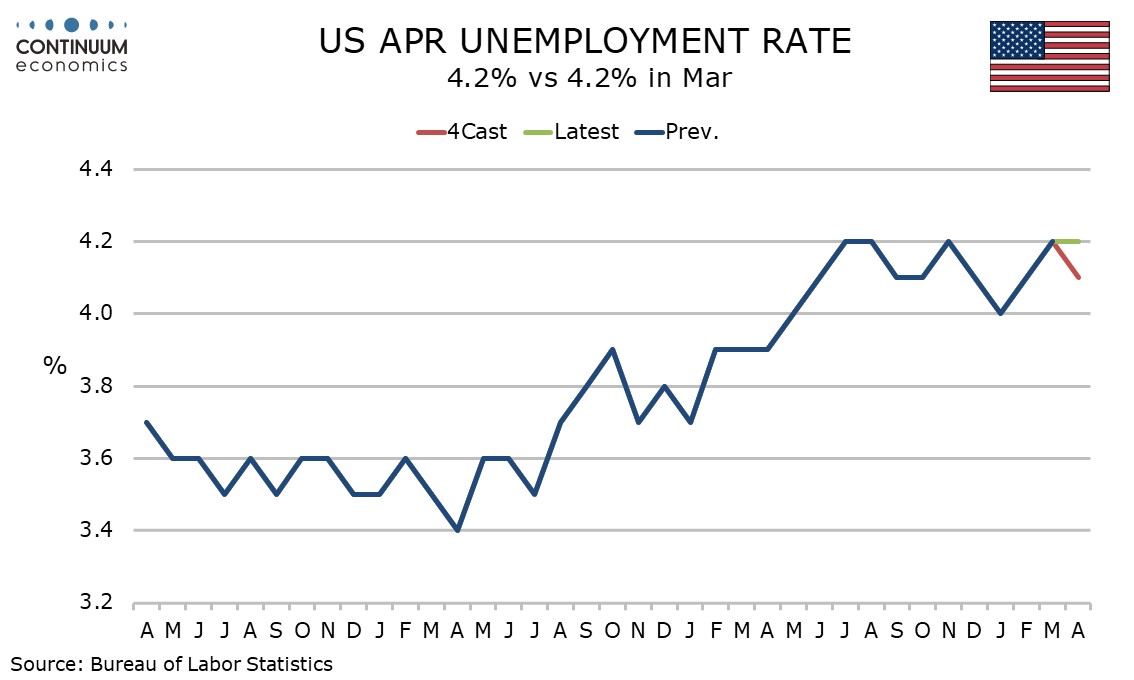

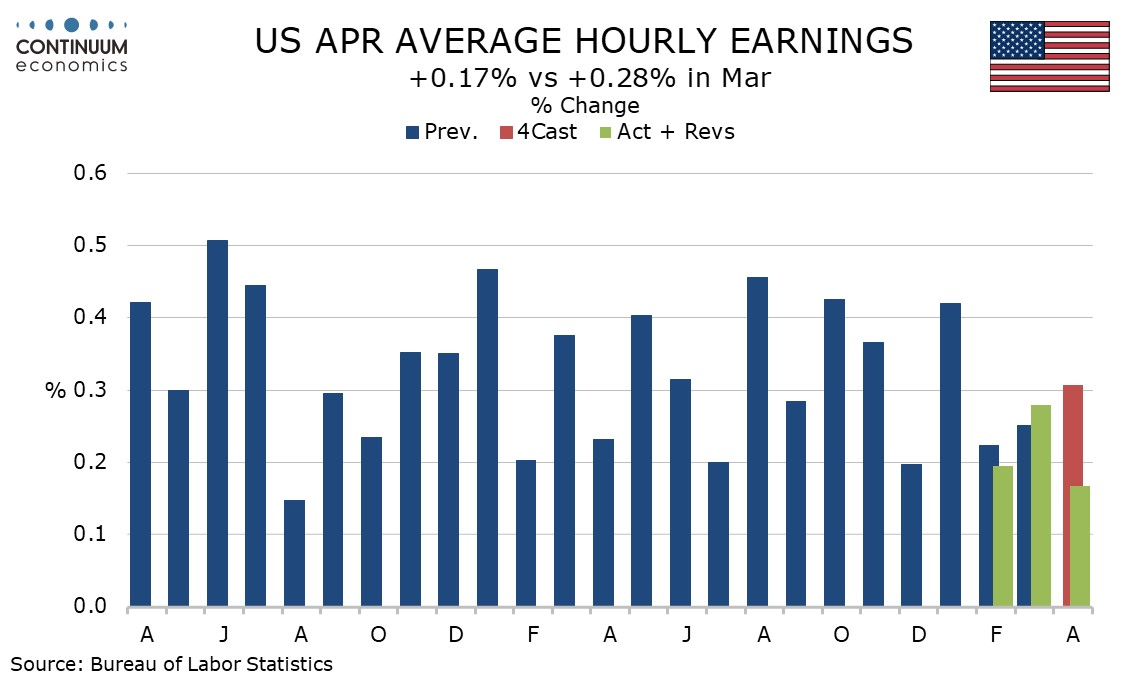

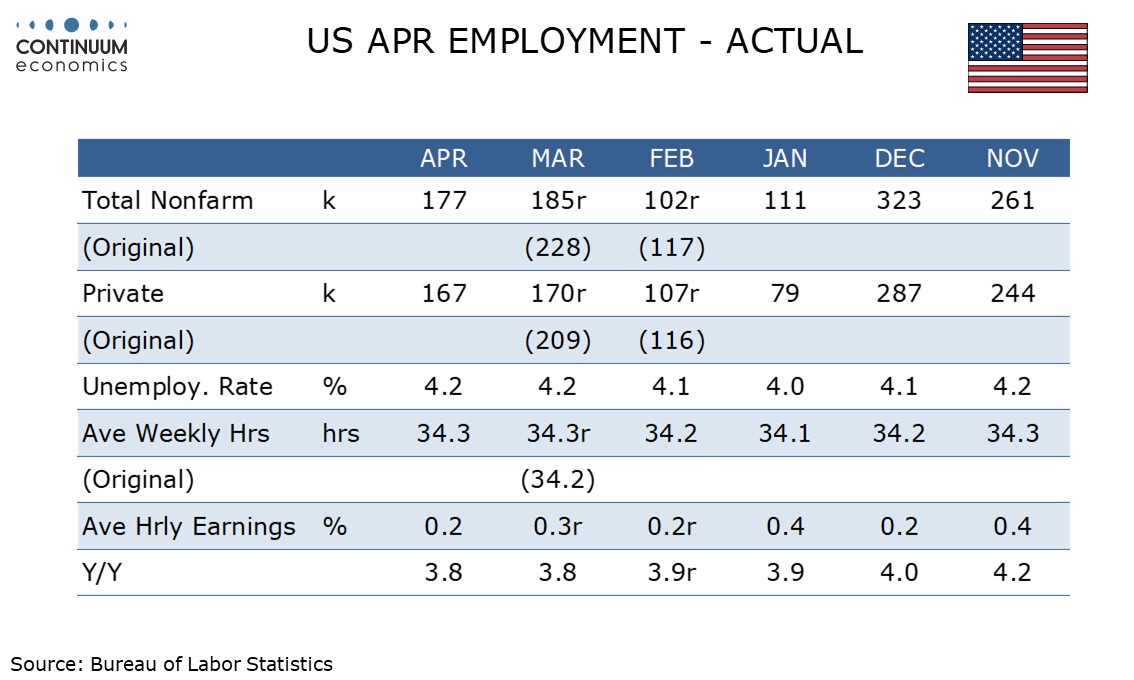

April’s non-farm payroll with a 177k increase is on the firm side of expectations and shows the labor market remained solid in early April, but the upside surprise is offset by 58k in net downward revisions. Unemployment was unchanged at 4.2% as expected but a below consensus 0.2% rise in average hourly earnings suggests some easing in inflationary pressure, at least before the tariffs kick in.

March’s payroll was revised to 185k from 228k while February was revised to 102k from 117k. March and April’s data were similar and stronger than February and January, both of which probably saw some restraint from bad weather.

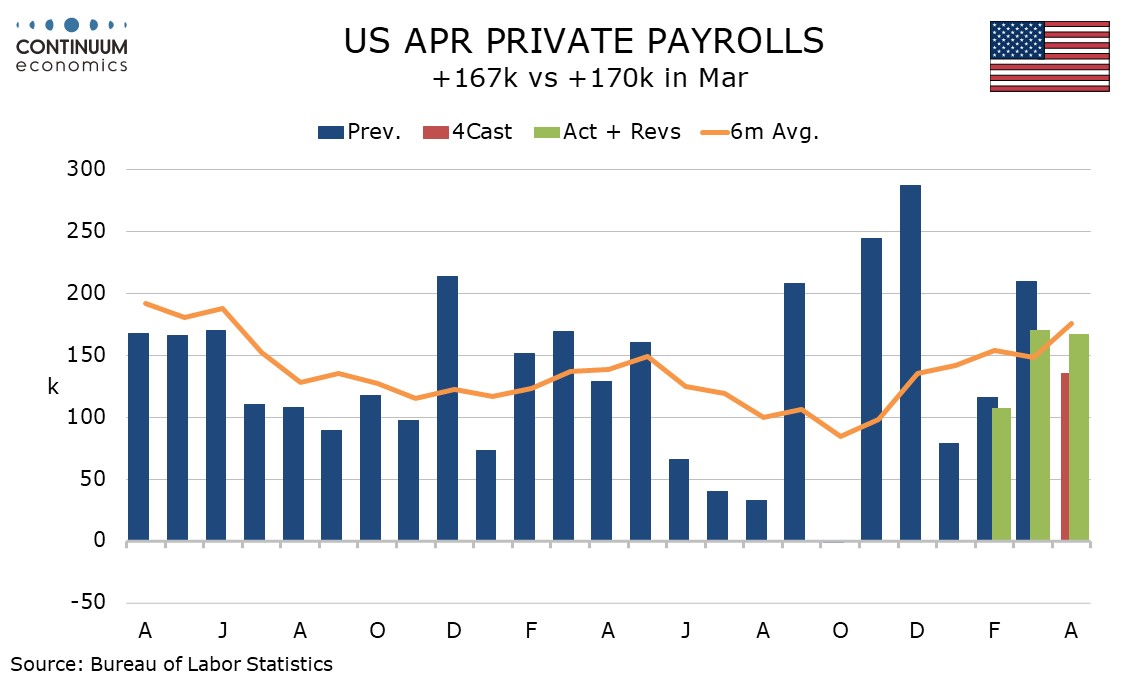

Private payrolls rose by 167k in April after a 170k rise in March, a 10k rise in government seeing a 10k decline in Federal workers outweighed by increases at the state and local level.

Private sector payroll growth continues to be led by health care and social assistance, up by 58k, contrasting a decline in the ADP estimate of the sector, but still below recent trend. Transportation and warehousing saw an above trend month at 29k. Construction saw a modest 11k rise while manufacturing slipped by a marginal 1k. There were no areas of marked weakness.

The household survey that calculates the unemployment rate was surprisingly strong in its detail, with employment much stronger than the payroll with a rise of 436k but the labor force seeing an even stronger rose of 518k, surprising given the current climate towards immigration.

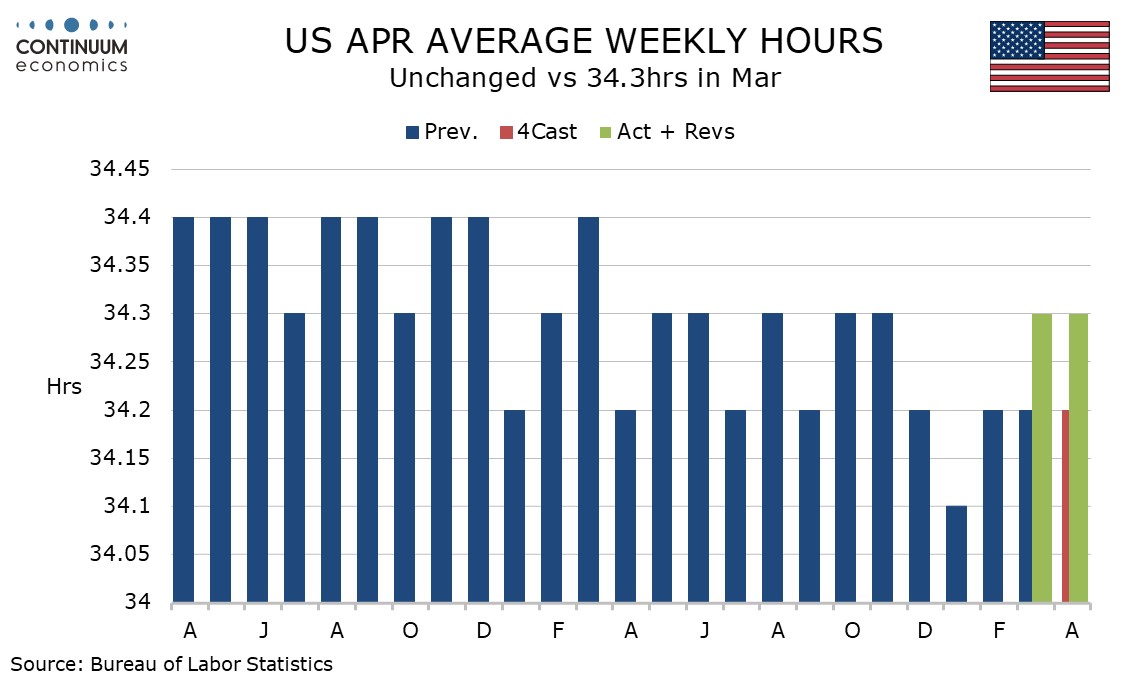

The workweek was firmer than expected at 34.3 hours, unchanged from an upwardly revised March, and that suggests the economy maintained some momentum when the survey was done in early April. It is however too soon to expect any significant adverse effects from the tariffs at this point.

The average hourly earnings rise at 0.17% before rounding is the slowest since August 2023 though the yr/yr pace is unchanged at 3.8%, still the lowest since July 2024. Easing in wage inflation will provide some offset to the likely lift to inflation coming from tariffs.

This employment report probably reflects a pre-tariff picture that may change significantly in the coming months. However the data suggests that before the recent dramatic policy changes, the economy was close to where the Fed wanted it to be. It remains to be seen how much that will change.