Preview: Due May 13 - U.S. April CPI - Upside risk after a below trend March

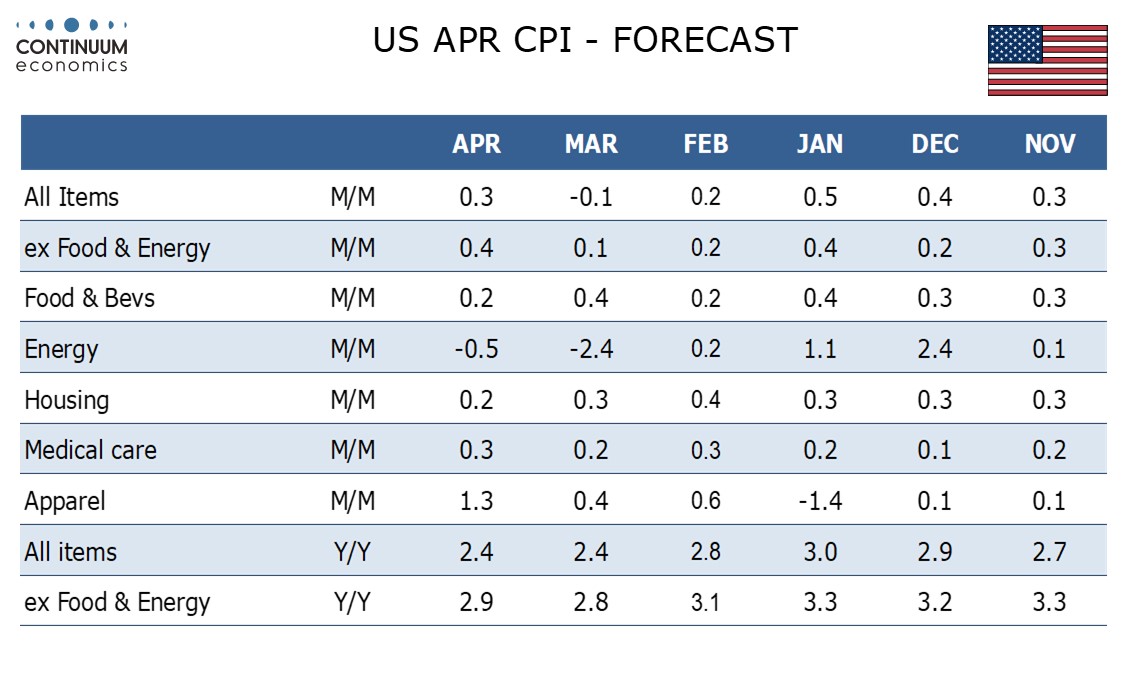

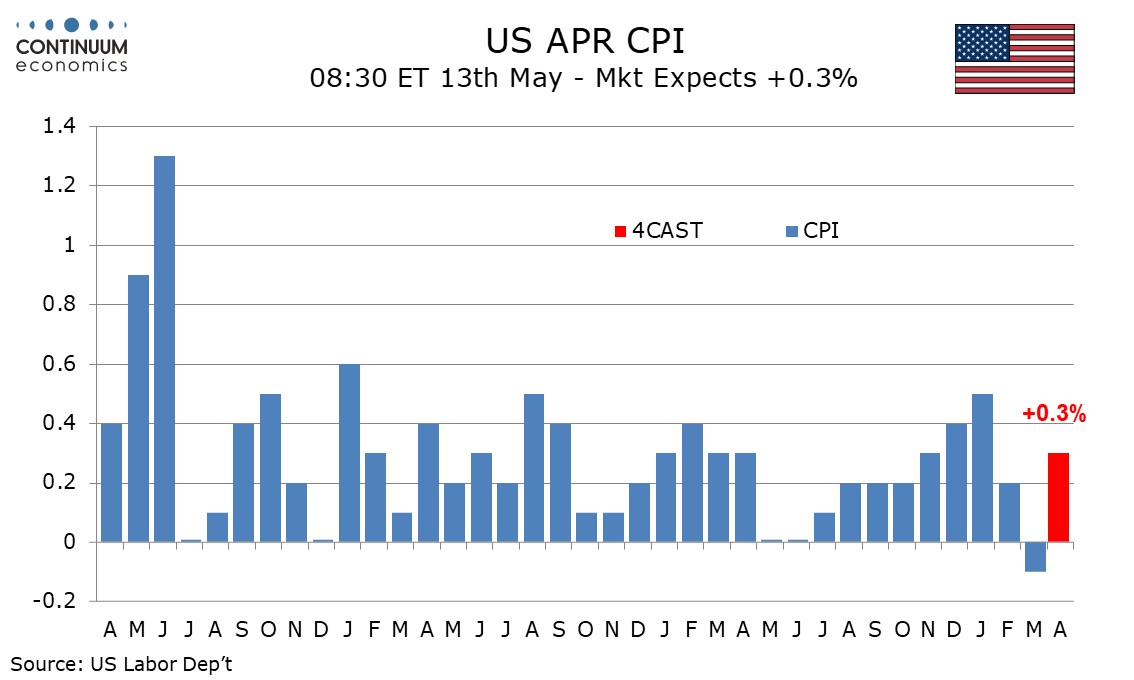

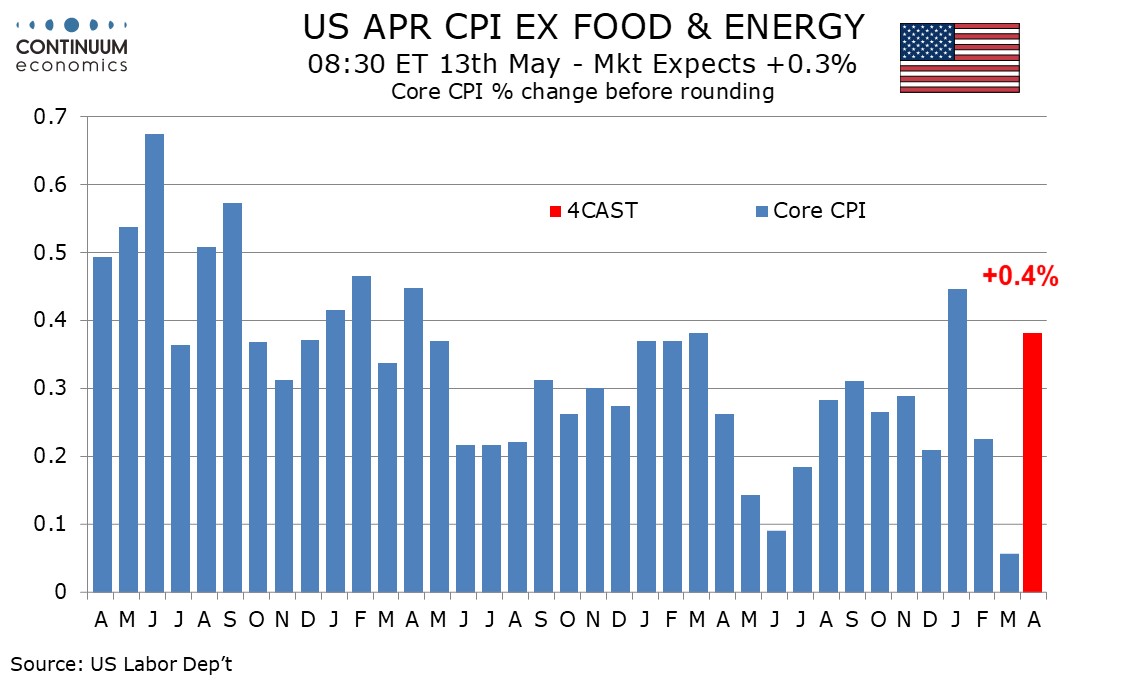

We expect April CPI to increase by 0.3% overall and by 0.4% ex food and energy, the core rate reflecting a rebound from a below trend March as well as some impact from tariffs, though the extent of the tariff impact is highly uncertain. We see the core rate at 0.38% before rounding.

March CPI fell by 0.1% overall and rose by only 0.1% ex food and energy, with the rise in the latter being only 0.057% before rounding. However the Cleveland Fed’s Median CPI rose by 4.2% annualized in March, its strongest since April 2024, showing the CPI weakness was due to a few sharp falls in volatile components, notably air fares and hotels, suggesting risk of a bounce in April.

With the eventual size of the tariffs uncertain, and significant inventory built up in Q1, it appears that most retailers have not been immediately passing on the cost of tariffs to consumers. However, some pass through is a risk, particularly in sectors such as apparel which are dominated by imports. Upside risk is concentrated in goods, with services less sensitive to tariffs, but a sharp spike in prices is not to be ruled out. It was in April that the inflation surge of 2021 first became apparent, with a 0.9% rise in the core rate (later revised to 0.8%), catching markets by surprise. The consensus was only 0.3%. That rise was led by autos. An index of used auto prices from Manheim has bounced this April, though less steeply than was the case in April 2021.

Gasoline prices have seen a marginal dip in April after a steeper drop in March, while we expect household energy prices to correct from two straight gains, leaving energy prices down by 0.6%. We expect a modest 0.2% rise in food as recent strength in eggs starts to fade, leaving overall CPI at 0.3%, below a 0.4% core rate. Yr/yr growth would then remain unchanged at 2.4% overall, but edge up to 2.9% from 2.8% ex food and energy. March’s core rate showed the slowest yr/yr gain since March 2021, just before the April 2021 surge.