U.S. May Employment - Resilient picture suggests no urgency for Fed easing

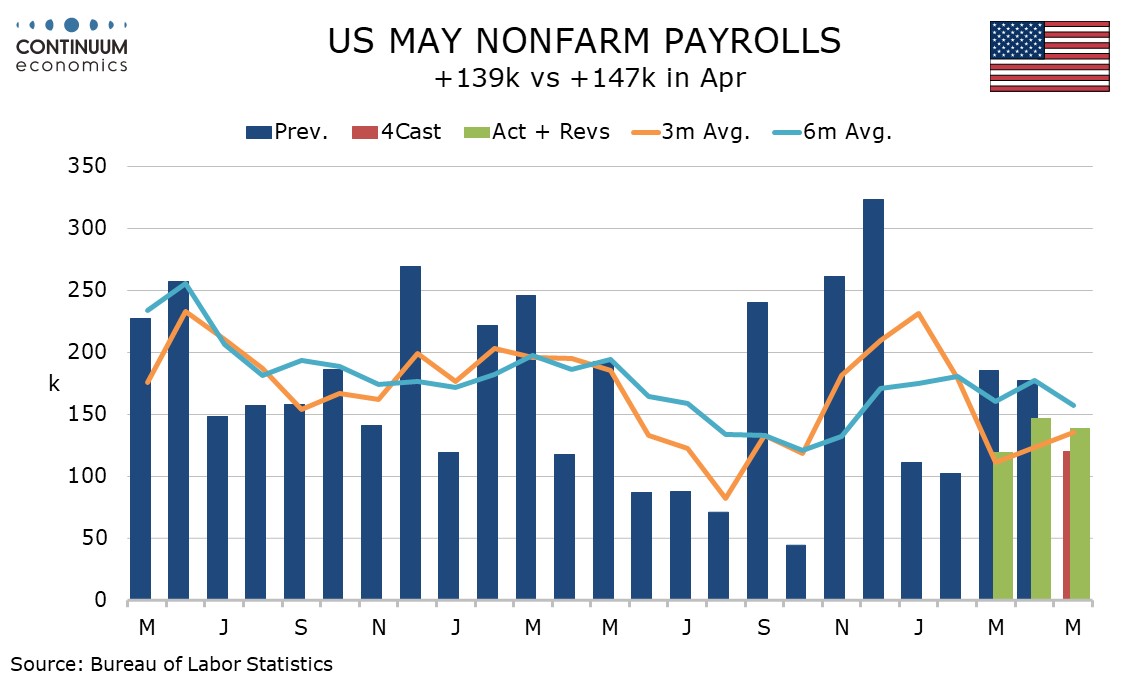

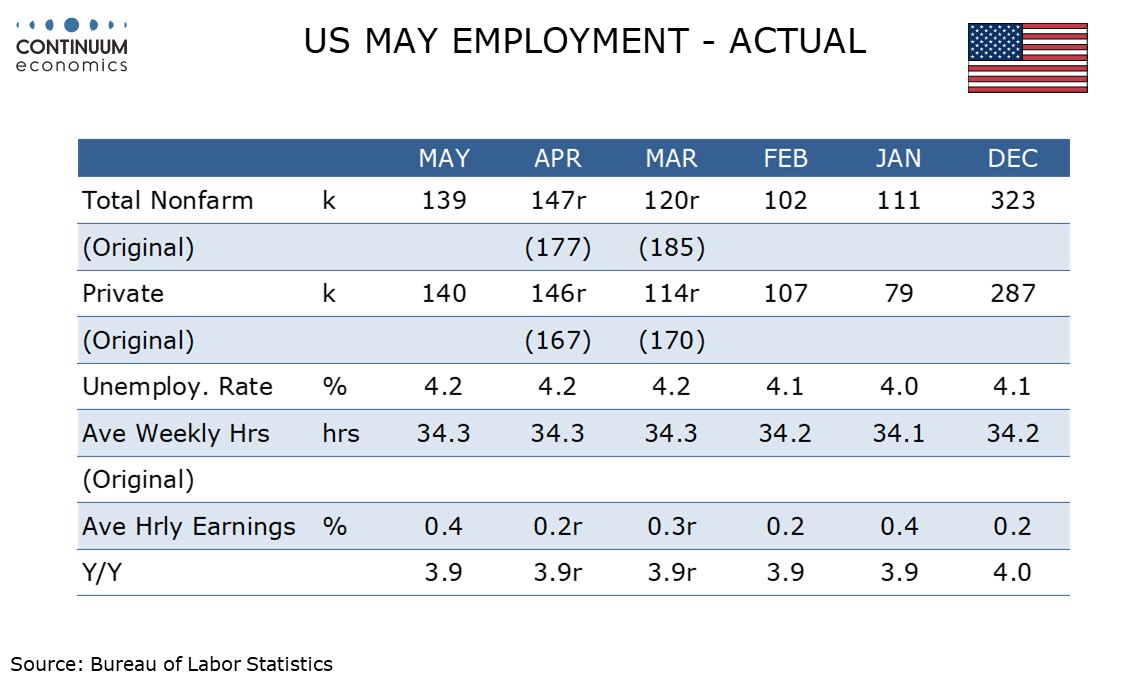

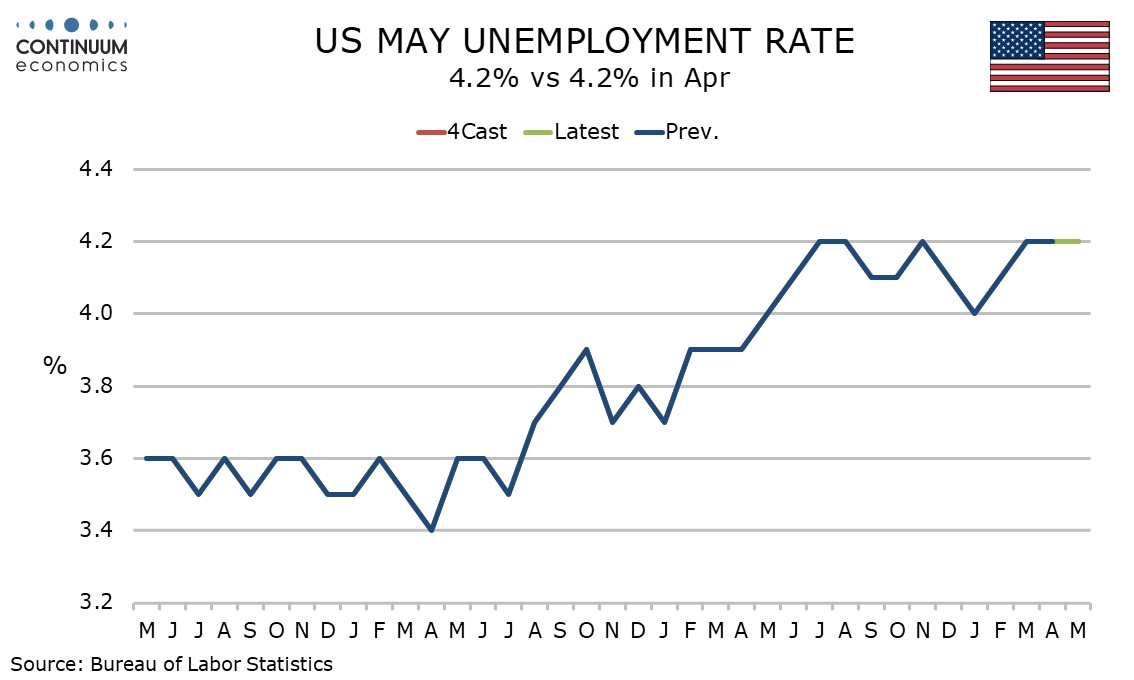

May’s non-farm payroll with a 139k increase, is on the firm side of expectations, particularly after the ADP report, and suggests the economy is not on the cusp of recession yet. Revisions were negative at 95k but leave a stable-looking picture, while average hourly earnings were above trend with a rise of 0.4%. The unemployment rate of 4.2% and the workweek at 34.3 hours are stable.

Revisions saw March revised to 120k from 185k and April to 147k from 177k though these revised numbers are similar to the May outcome. This suggests a broadly stable picture consistent with moderate underlying growth, the marginal decline in Q1 GDP as imports surged not illustrative of the underlying picture. This is not data that suggests any need for the Fed to ease. Still, gains in initial claims in the two weeks since May’s payroll was surveyed are a warning sign for June.

The job gains come entirely in private sector services, with government down by 1k due a 22k drop in Federal employees, and a fall of 8k in manufacturing outweighing a 4k increase in construction.

Payroll growth continues to be led by education and health, up 87k, contrasting a decline in the sector in the ADP report, with health contributing 78k. Also strong was leisure and hospitality, up by a surprising 48k, reduced foreign tourist arrivals apparently not doing much damage. Retail was soft at -6.5k while temporary help, often seen as a leading indicator, fell by 20k.

While the unemployment rate was stable at 4.2% the details were less supportive, with the labor force plunging by 625k and the household survey’s estimate of employment down by 696k, though these need to be seen alongside gains of 518k and 436k respectively in April.

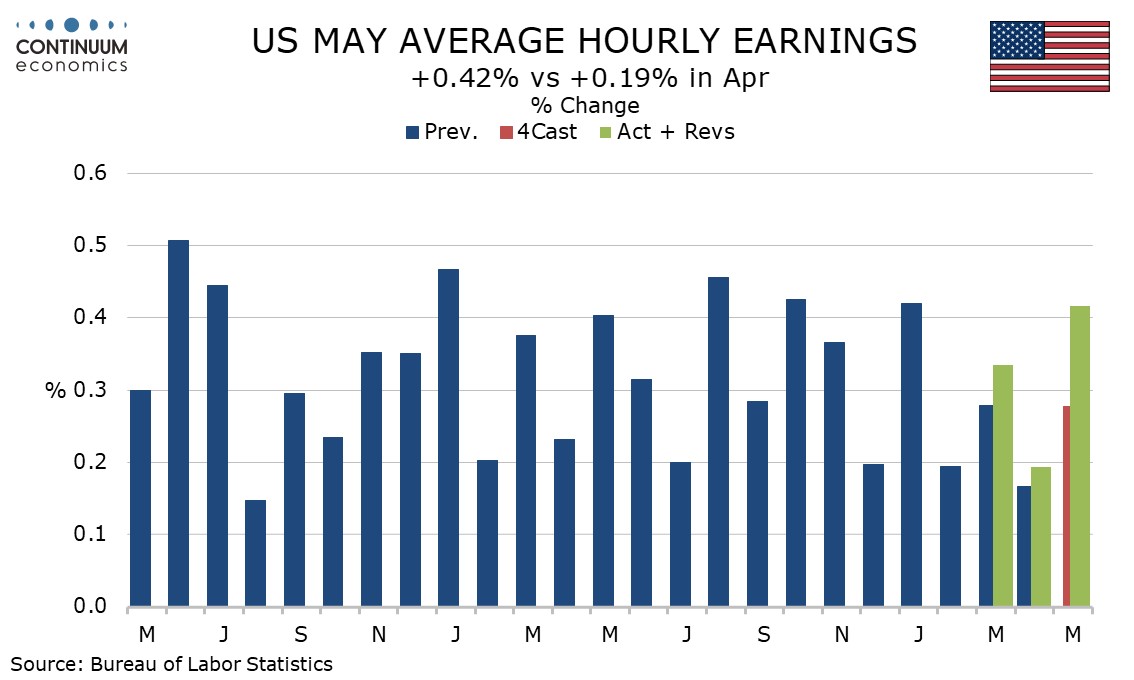

Average hourly earnings rose by 0.42% before rounding, an above trend gain to follow a below trend 0.19% in April. Yr/yr growth has been at 3.9% for five straight months, with April revised up from 3.8%.

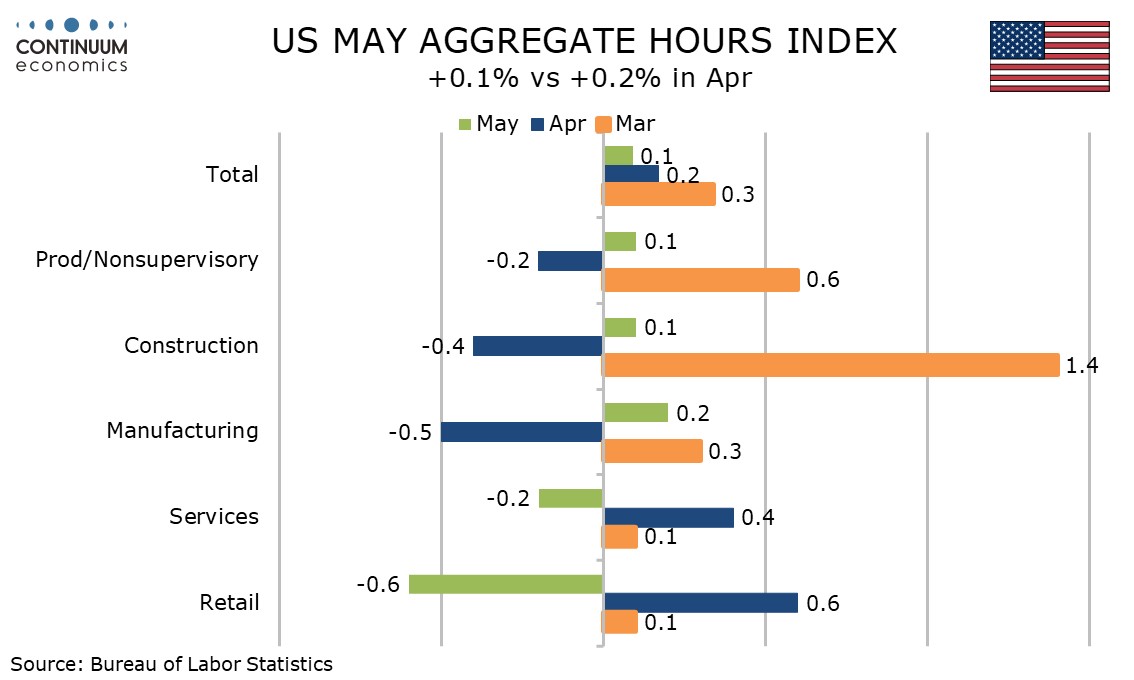

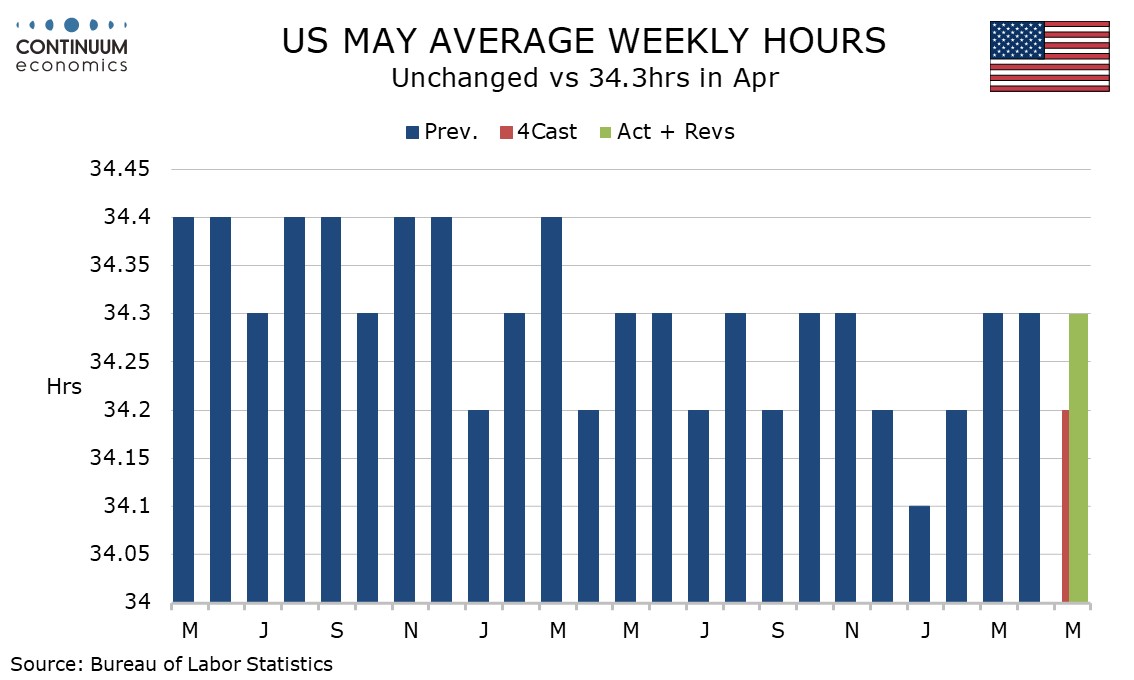

There are no signs of slowing in the workweek which at 34.3 hours for the third straight month stands above levels seen in December, January and February. The monthly rise in aggregate hours worked however is modest at 0.1%. Manufacturing and construction saw marginal gains but private services fell by 0.2%. Within the private services breakdown retail was weak but leisure and hospitality strong.