U.S. Outlook: Slowdown but not Recession, Cautious Fed Easing

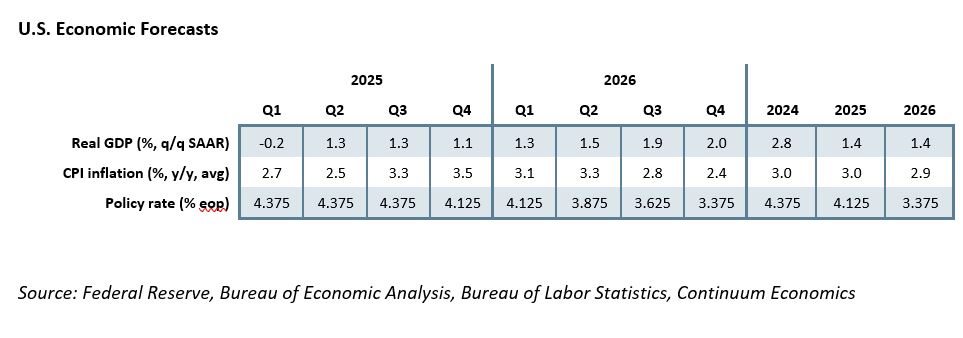

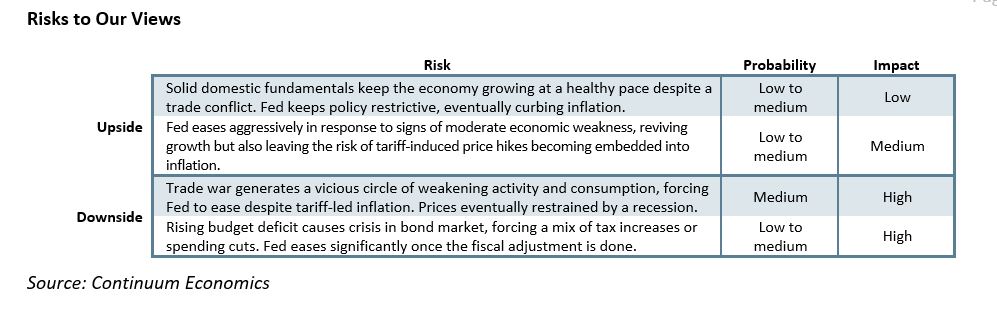

• Policy uncertainty remains high and final details of the tariffs will depend on the decisions of the courts as well as those of President Trump. However the magnitude of the tariffs is becoming easier to predict than the detail. Trump looks set to insist on a minimum average tariff of at least 10%, but will not go dramatically above that out of fear of provoking a sharp slide in the markets. We expect an average rate of 13-15%, which will lift inflation and restrain growth, but is unlikely to cause a recession. We expect subdued GDP growth of 1.4% in both 2025 and 2026, with sub-potential growth through mid-2026, before returning to near 2.0% in H2 2026, assisted by Fed easing as a tariff-induced boost to inflation fades. We expect tariffs to lift CPI inflation to 3.5% in Q4 2025 before a slowing to 2.4% in Q4 2026. Fiscal policy may also provide some support to growth in 2026, but this will be limited by likely upward pressure on bond yields due to budget deficits near 7% of GDP.

• The FOMC has scope to ease should the economy be threatened with recession, though with recession now looking unlikely we expect the FOMC to be cautious over easing until a boost to inflation from tariffs shows signs of peaking. We expect one 25bps easing in Q4 2025 and three 25bps moves in 2026, in Q2, Q3 and Q4. This would leave the Fed Funds target at 3.25-3.50% at the end of 2026, above the current 3.0% FOMC estimate of where neutral is, but in a less globalized world the neutral rate has probably increased.

• Forecast changes: Our GDP forecasts have been revised lower, 2025 to 1.4% from 2.1%, and 2026, to 1.4% from 1.6%. The revisions however are largest in H1 2025 due to a weaker than expected Q1 and our now seeing a smaller bounce in Q2 than was the case in March. Beyond that the downward revision reflects a more aggressive tariff stance, though multiple Trump climbdowns mean the difference is now modest relative to our March expectation. Our inflation forecasts have seen only marginal adjustments for the years as a whole, with 2025 CPI revised down to 3.0% from 3.2% but 2026 unrevised at 2.9%. However, we now expect the boost to inflation from tariffs to come mostly in H2 of 2025 after previously expecting a sharp spike in Q2. We now see CPI at 3.5% in Q4 2025 rather than 3.3% before falling to 2.4% in Q4 2026 which we had previously seen at 2.7%. We continue to expect only one FOMC easing in 2025, by 25bps in Q4, but now expect three moves in 2025, in Q2, Q3 and Q4, rather than two, seeing the Fed Funds rate ending 2026 at 3.25-3.5% rather than 3.5-3.75%.

Trade and fiscal policy suggest weaker growth, but not a recession

Policy uncertainty remains exceptionally high, both on trade and fiscal policy, but the actual outcome of the eventual policy mix looks increasingly likely to be one of moderate damage done, avoiding worst case scenarios. We now expect a protracted period of below potential growth, slightly above 1.0%, extending through the first half of 2026, before the economy returns to a near 2.0% pace in the second half of 2026.

President Trump had already acted more aggressively than expected on tariffs in Q1 of 2025. The “Liberation Day” announcement on April 2 was more aggressive still. However, Trump had already backed off his most extreme positions towards Canada and Mexico announced in Q1, and quickly delivered a three month reduction in the “Liberation Day” tariffs and a cycle of retaliation with China was also largely reversed. The tariffs are also facing a legal challenge that adds to uncertainty. The fine details of the tariff regime that eventually materializes are impossible to predict with high confidence. However despite his repeated climbdowns Trump’s conviction in the benefits of tariffs appears unshakeable. Even if he receives a major defeat in the courts, Trump would be likely to offset that by means that will remain at his disposal (here), as he did when doubling tariffs on steel and aluminum after his initial defeat in the courts. While 10% looks like a clear floor, Trump has enough fear of the markets to prevent him going sharply above that, other than in specific sectors such as autos, steel, and probably pharmaceuticals. We are comfortable in assuming an average tariff of 13-15%. This will be slightly more damaging than appeared to be the case in March, but not dramatically.

Fiscal policy is also highly uncertain, as the Republican Party struggles to reconcile concerns over the size of the budget deficit with a desire to cut taxes and protect its working class base from spending cuts, Medicaid in particular. The “Big Beautiful Bill” passed by the House has front loaded tax cuts and back loaded spending cuts, which may help growth to pick up through 2026. However, after a modest decline to near 6% in in the fiscal year ending in September 2025, over the subsequent three years deficits are likely to be around 7% of GDP, and that will put upward pressure on bond yields, limiting the support to GDP growth. Failure to raise the debt ceiling, which will be required by August, is a low probability but high damage scenario.

We have revised our 2025 GDP forecast down significantly, to 1.4% from 2.1%, and now see 2026 also at 1.4% rather than 1.6%. However, most of the revision comes from a negative Q1 underperforming our expectations, and that we now expect less of a rebound in Q2 than was previously the case. The decline in Q1 was more than fully explained by net exports which look set to be a substantial positive in Q2 as imports plunge from inflated pre-tariff levels, but we also expect a sharp slowing in inventories and business investment from Q1 strength in Q2 with uncertainty likely to weigh on the latter. That Gross Domestic Income fell by 0.2% annualized in Q1 suggests that the matching GDP decline was an accurate measure. While extreme volatility in net exports adds to the uncertainty in Q2, our view of below trend growth in H2 2025 and H1 2026, has been only modestly downgraded from our March view. Uncertainty will continue to weigh on investment and a gradual slowing in employment, combined with a gradual slowing in wages and a rise in inflation, will weigh on consumer spending. The risks for a modest hit to growth turning into a negative spiral, in which slowing employment growth feeds further into personal income and back into employment is real, though if such a scenario starts to threaten recession the Fed would be likely to respond.

Unless the economy faces recession, FOMC easing will be cautious

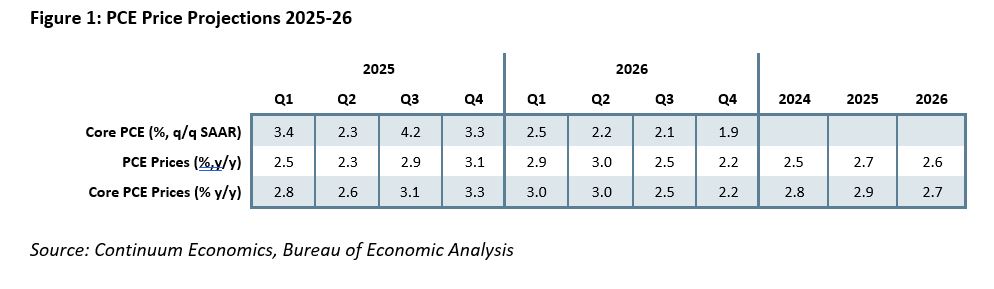

Our forecast for inflation has not changed much since March for 2025 and 2026 as a whole, with CPI now seen as 3.0% in 2025 rather than 3.2%, and 2026 still seen at 2.9%, though Q2 inflation has not yet seen the sharp lift from tariffs that we had expected in March. Price pressures are building in goods, but uncertainty over how long the tariffs will persist as well as a strong inventory build-up in Q1 has discouraged the passing on of cost increases. Service Inflation has eased, air fares and hotels in particular being restrained by a reduction in foreign tourist arrivals. Wages are a limited and slowly fading source of inflationary pressure, and if that persists second round inflationary effects from the tariffs are likely to be limited. However, we expect increased pass through of tariffs to lift goods inflation in the second half of this year while services are unlikely to slow much further. While we expect similar growth near 3.0% in CPI for 2024, 2025 and 2026, we expect a peak at 3.5% in Q4 2025 before a slowing to 2.4% in Q4 2026. For core PCE prices we expect quarterly annualized growth to rise to 4.2% in Q3 2025 before slowing to 1.9% in Q4 2026. We expect yr/yr core PCE prices to rise to 3.3% in Q4 2025 before slowing to 2.2% in Q4 2026. The slowing in 2026 assumes the tariff regime that emerges through 2025 will not change much in 2026, as Trump attempts to consolidate trade deals that he is likely to achieve in 2025, but a further escalation in tariffs is not to be ruled out.

Fed rhetoric still shows no urgency to ease with the eventual pass-through of tariffs to inflation uncertain and the economy showing few warning signals for recession, even if sub-potential growth appears likely. We expect no easing until Q4 2025, by when GDP growth will have been subdued for four straight quarters but inflation will have accelerated from current levels. Slower growth in the labor force will keep gains in unemployment modest, with 5.0% unlikely to be threatened. We believe that in the absence of recession, the Fed will wait until the inflationary impact of tariffs is peaking, and easing will remain cautious until annualized core PCE prices get close to the 2% target. After a solitary move in Q4 2025, we expect the Fed to pause in Q1 2026 before delivering 25bps moves in Q2, Q3 and Q4. That would leave the upper bound of the Fed Funds target range at 3.5% at the end of 2026, still slightly above the 3.0% that the Fed currently sees as neutral. We suspect that in a less globalized word, the long-term neutral rate will edge slightly above 3.0%.

We are forecasting easing to accelerate around the time Fed Chairman’s Powell’s term expires in May 2026, and it appears all but certain that he will not be reappointed by President Trump. However our Fed view is based on our economic forecast rather than an expected change of Chairman. Trump is unlikely to get a subservient Fed Chairman approved by the Senate, and even if he does, the existing FOMC voters will ensure that policy independence persists.

A key event for 2026 will be the Midterm elections. Under a view that the economy will look less than satisfactory, the Democrats look likely to overturn the current narrow Republican majority in the House, but the economy would probably need to enter recession to see the Democrats taking control of the Senate. Even if the Democrats take only the House, that would restrict Trump’s options in many areas of policy, though whether this will include tariffs is in the hands of the courts.