Preview: Due August 1 - U.S. July Employment (Non-Farm Payrolls) - Slower overall, but stronger in the private sector

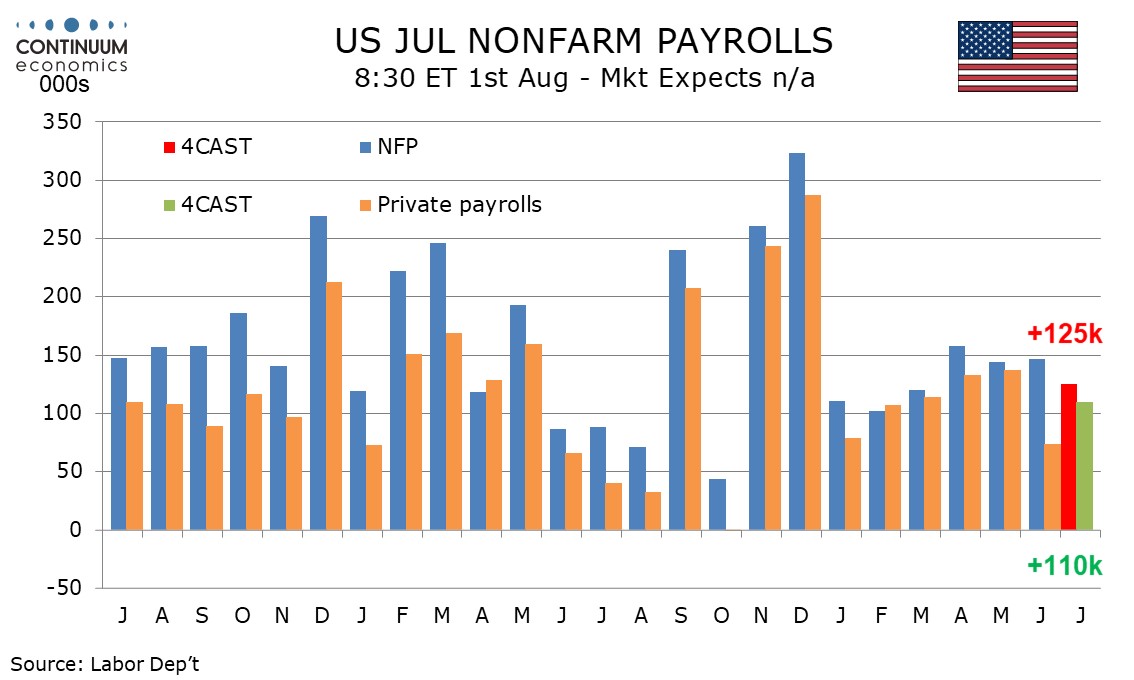

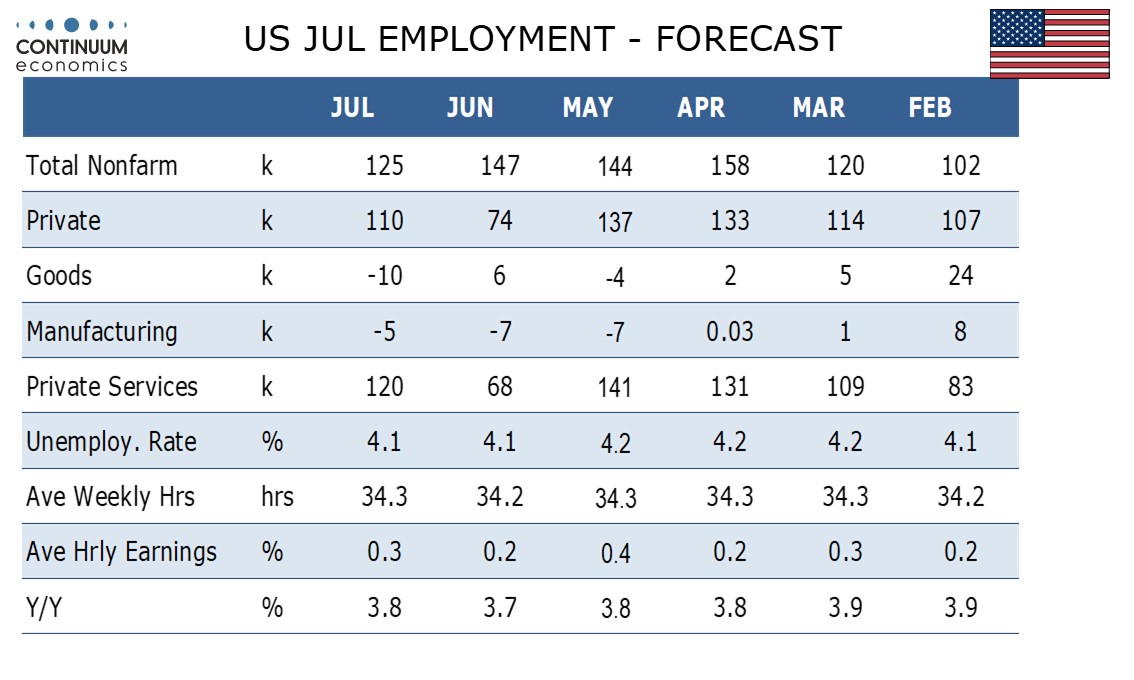

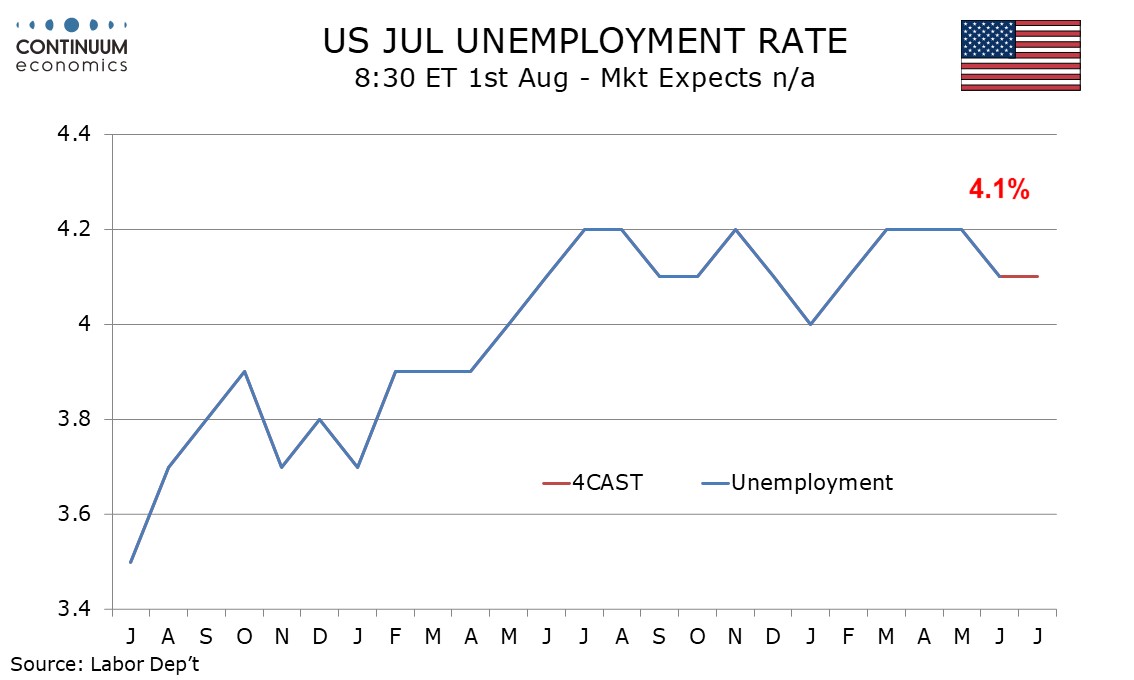

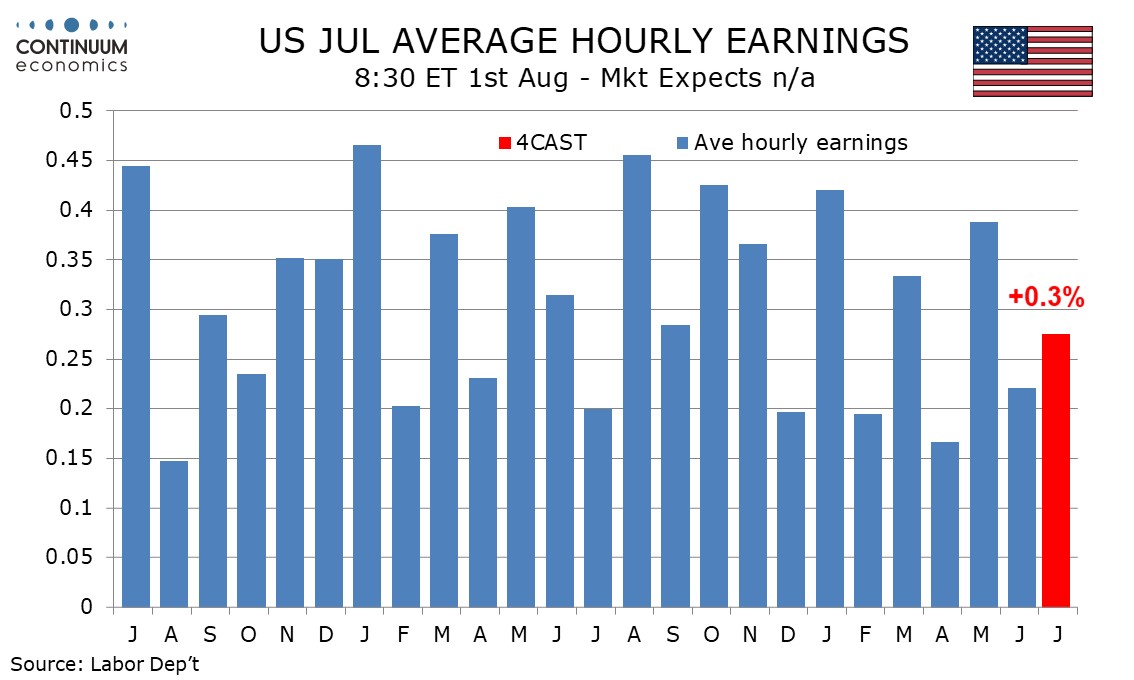

We expect a 125k increase in July’s non-farm payroll, slightly slower than in each month of Q2 but slightly stronger than in each month of Q1. We expect a 110k rise in private sector payrolls, up from 74k in June but slower than in April and May. An unchanged unemployment rate of 4.1% and a 0.3% rise in average hourly earnings will complete a mostly healthy picture.

A rising trend in initial claims into early June has lost some momentum, and this may reflect tariff worries easing after the shock of the April 2 announcement. Fresh tariff measures pose risks going forward, but we expect July payrolls to reflect at least a temporary easing of risk.

Government surged by 73k in June led by state and local education employment which looks like a one-time bounce, though unlikely to be quickly reversed. Seasonal adjustments assume declines in education employment in July. We expect July to see a more typical 15k rise in government, with gains at the state and local level outweighing a sixth straight decline at the Federal.

We expect goods employment to slip by 10k after a 6k increase in June with a 15k June rise in construction unlikely to be repeated. However we expect private sector services to bounce by 120k after a 68k June increase that was the slowest since a hurricane-influenced October 2024.

We expect employment to rise at a faster pace than the labor force in July, though the unemployment rate is still likely to round to 4.1%, while falling to 4.08% from 4.12% before rounding.

Trend in average hourly earnings is probably a little below 0.3% per month, but June’s 0.22% increase was below trend, correcting an above trend 0.39% in May. We expect July to see a 0.28% increase before rounding, though this would see yr/yr growth edging up to 3.8%, reversing June’s dip to 3.7%.

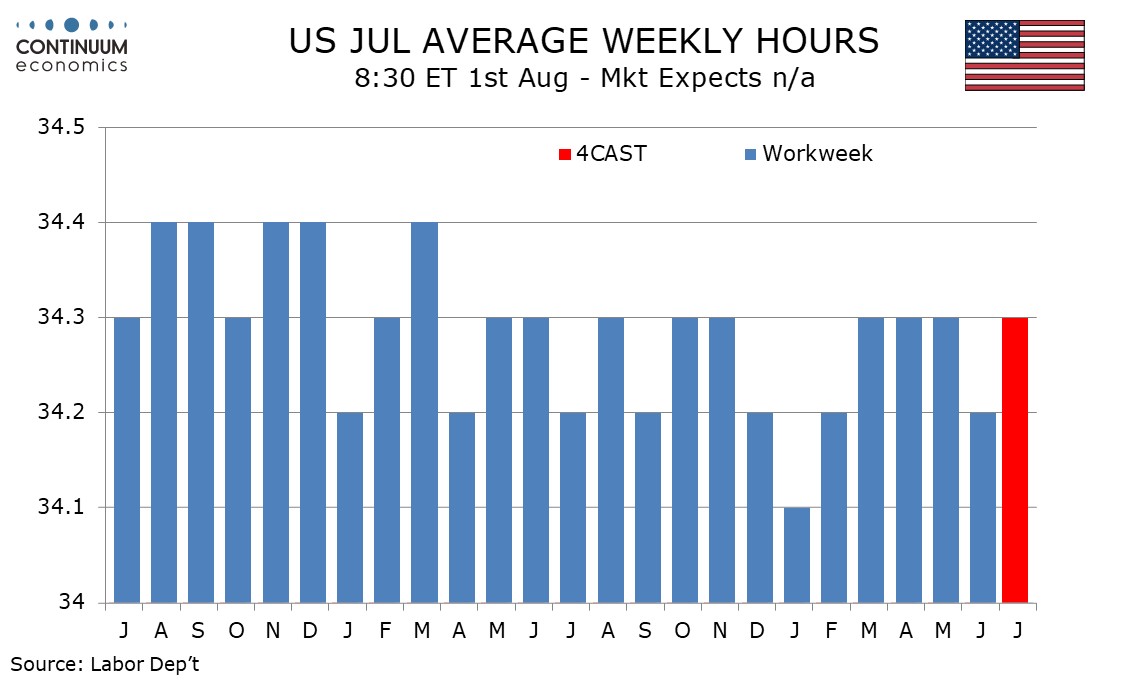

The June workweek at 33.2 hours was also on the low side of trend after three straight months at 34.3, and we expect a return to 34.3 in July. This is a close call between 34.2 and 34.3, but a slightly stronger underlying picture in July has us leaning towards 34.3.